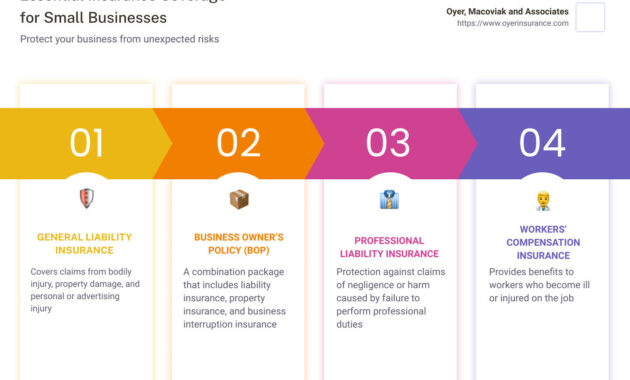

General Liability Insurance

- Covers common business risks such as bodily injury, property damage, and legal expenses.

Professional Liability Insurance (Errors & Omissions)

- Protects professionals and service providers against claims of negligence or errors in their work.

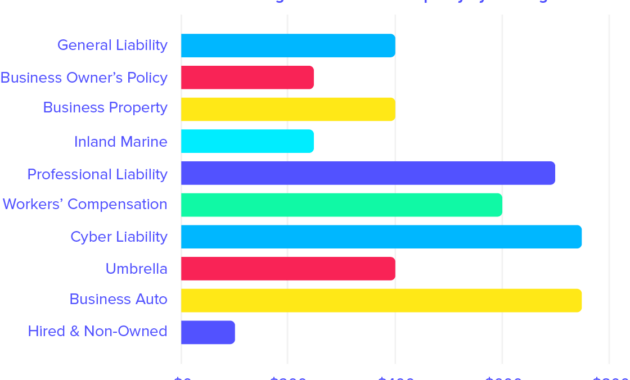

Cyber Liability Insurance

- Covers losses related to data breaches, cyberattacks, and online privacy issues.

Commercial Property Insurance

- Covers the physical assets of your business, including building, equipment, and inventory.

Business Owners Policy (BOP)

- Combines general liability, property, and business interruption insurance into one convenient package.

Other Types of Liability Insurance

- Product Liability Insurance: Protects manufacturers and distributors against claims arising from defective products.

- Vehicle Liability Insurance: Covers accidents and damage caused by company-owned or rented vehicles.

- Directors & Officers Liability Insurance: Protects business leaders from personal financial liability for decisions made in their roles.

Factors to Consider When Choosing Liability Insurance

- Business size and industry

- Level of risk exposure

- Potential for lawsuits

- Cost and coverage limits

It’s crucial to consult with an insurance professional to determine the best liability insurance coverage for your specific small business.

What is the Best Liability Insurance for Small Business?

When it comes to protecting your small business, liability insurance is a must-have. This type of insurance can help protect you from financial ruin if you’re sued for injuries, property damage, or other losses caused to third parties. But with so many different liability insurance policies on the market, it can be difficult to know which one is right for your business.

To help you make the best decision, we’ve put together this guide to liability insurance for small businesses. We’ll cover everything you need to know, from what liability insurance is to how much coverage you need. We’ll also provide tips on how to find the best policy for your business.

If you’re a small business owner, you need to make sure you have the right liability insurance in place. This type of insurance can protect you from financial ruin if you’re sued for injuries, property damage, or other losses caused to third parties. But with so many different liability insurance policies on the market, it can be difficult to know which one is right for your business.

To help you make the best decision, we’ve put together this guide to liability insurance for small businesses. We’ll cover everything you need to know, from what liability insurance is to how much coverage you need. We’ll also provide tips on how to find the best policy for your business.

What is Liability Insurance for Small Business?

Liability insurance is a type of insurance that protects businesses from financial liability for injuries, property damage, or other losses caused to third parties. This type of insurance can be essential for small businesses, as it can help protect them from financial ruin if they’re sued.

There are many different types of liability insurance, but the most common types include:

- General liability insurance: This type of insurance covers a wide range of liability risks, including bodily injury, property damage, and personal injury. It’s the most common type of liability insurance for small businesses.

- Professional liability insurance: This type of insurance covers businesses for errors and omissions that they make in the course of their professional services. It’s important for businesses that provide professional services, such as accountants, lawyers, and doctors.

- Product liability insurance: This type of insurance covers businesses for injuries or damages that are caused by their products. It’s important for businesses that manufacture or sell products.

The amount of liability insurance you need will vary depending on the size and type of your business. However, it’s important to make sure you have enough coverage to protect yourself from financial ruin in the event of a lawsuit.

How Much Liability Insurance Do I Need?

The amount of liability insurance you need will vary depending on the size and type of your business. However, there are a few factors you can consider to help you determine how much coverage you need:

- The size of your business: The larger your business, the more likely you are to be sued. Therefore, you’ll need more liability insurance coverage.

- The type of business you have: Some businesses are more likely to be sued than others. For example, businesses that provide professional services or manufacture products are more likely to be sued than businesses that sell retail products.

- Your financial situation: If you don’t have a lot of assets, you’ll need more liability insurance coverage to protect yourself from financial ruin.

A good rule of thumb is to purchase enough liability insurance to cover your business’s assets. This will help ensure that you’re protected in the event of a lawsuit.

How to Find the Best Liability Insurance for Your Business

There are many different liability insurance companies on the market, so it’s important to shop around to find the best policy for your business. Here are a few tips to help you find the best policy:

- Get quotes from multiple insurance companies: This will help you compare prices and coverage options.

- Read the policy carefully: Make sure you understand what’s covered and what’s not.

- Ask your insurance agent questions: They can help you understand your coverage options and make sure you’re getting the best policy for your business.

Liability insurance is an important part of protecting your small business. By following these tips, you can find the best policy for your business and protect yourself from financial ruin.

The Best Liability Insurance for Your Small Business: A Comprehensive Guide

As a small business owner, you’re keenly aware of the risks involved in your day-to-day operations. From customer injuries to property damage, there’s a lot that could potentially go wrong. That’s why having the right liability insurance is crucial for protecting your business and your livelihood. But with so many different types of liability coverage available, it can be tough to know where to start.

That’s where we come in. In this article, we’ll break down the different types of liability insurance available for small businesses and help you choose the right one for your needs. We’ll also provide some tips on how to get the most out of your policy.

Types of Liability Insurance for Small Business

The best liability insurance for your small business will depend on the specific risks you face. However, there are a few common types of liability coverage that most businesses need, including general liability, commercial auto insurance, product liability, and professional liability.

General Liability Insurance

General liability insurance is the most basic type of liability coverage for small businesses. It protects you from claims of bodily injury, property damage, and personal injury caused by your business operations. For example, if a customer slips and falls in your store, general liability insurance could help cover their medical expenses. Or, if you accidentally damage a customer’s property, general liability insurance could help cover the cost of repairs.

General liability insurance is typically required by most commercial leases and contracts, so if you’re renting or leasing space, you’ll likely need to have it. You should check with your landlord or other contracting parties to find out if they require you to carry a general liability insurance policy and for how much.

Commercial Auto Insurance

If you use a vehicle for business purposes, you’ll need commercial auto insurance. This coverage protects you from claims of bodily injury, property damage, and personal injury caused by your business-related driving. For example, if you’re driving to a client meeting and you’re involved in an accident, commercial auto insurance could help cover the cost of damages to the other vehicle and any injuries sustained by the other driver or passengers.

Commercial auto insurance is typically required by most states if you use your vehicle for business purposes. The coverage can be added to your personal auto insurance policy or you can purchase a separate commercial auto insurance policy. Working with an experienced agent can help you understand the nuances of commercial vs personal auto policies, so they can ensure that your business is adequately protected.

Product Liability Insurance

Product liability insurance protects you from claims of bodily injury or property damage caused by products you sell or distribute. For example, if you sell a product that causes a customer to get sick, product liability insurance could help cover the cost of their medical expenses and any other damages they suffered.

Product liability insurance is especially important for businesses that sell products online or that manufacture their own products. If you’re not sure whether or not you need product liability insurance, it’s best to err on the side of caution and get covered.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, protects you from claims of negligence, breach of contract, or other errors or omissions in your professional services. For example, if you’re a consultant and you give a client advice that turns out to be wrong, professional liability insurance could help cover the cost of the client’s losses.

Professional liability insurance is especially important for businesses that provide professional services, such as consultants, accountants, lawyers, and doctors. If you’re not sure whether or not you need professional liability insurance, it’s best to talk to an insurance professional.

When choosing a liability insurance policy, it’s important to consider the specific risks your business faces. The right policy will provide you with the coverage you need to protect your business from financial ruin.

Here are some tips for getting the most out of your liability insurance policy:

- Make sure you understand the coverage in your policy. Don’t be afraid to ask your insurance agent questions about what is and isn’t covered.

- Get the right amount of coverage. Don’t underinsure your business, but don’t overpay for coverage you don’t need.

- Keep your insurance information up to date. Notify your insurance company of any changes to your business, such as new employees or new locations.

- File claims promptly. If you have a claim, file it as soon as possible. The sooner you file your claim, the sooner you’ll get your money.

Liability insurance is an important part of protecting your small business. By understanding the different types of coverage available and choosing the right policy for your needs, you can help protect your business from financial ruin.

What’s the Best Liability Insurance for Small Businesses?

Every small business owner knows that accidents can happen, which is why liability insurance is indispensable. But with so many options out there, finding the right one can feel like a daunting task. This article will guide you through the key considerations to make when choosing liability insurance, ensuring you have the coverage you need to protect your business.

Factors to Consider When Choosing Liability Insurance

What factors should you keep in mind when selecting liability insurance? Consider the following:

-

Size of the Business: The number of employees, revenue, and assets all impact your potential liability. Larger businesses typically need more coverage than smaller ones.

-

Industry of the Business: Some industries, like construction or manufacturing, pose higher risks than others. The nature of your business operations will influence the type and amount of insurance you require.

-

Number of Employees: The more employees you have, the greater the likelihood of accidents or incidents. Businesses with a larger workforce need to account for increased potential liability.

-

Potential Risks: Evaluate the specific risks your business faces. Consider factors like customer traffic, equipment usage, and environmental hazards. Identifying these risks will help you determine the appropriate level of coverage.

-

Legal Requirements: Some states or industries may have specific liability insurance requirements. Make sure you comply with these regulations to avoid penalties or legal issues.

Comprehensive Coverage for Your Business

General liability insurance is the foundation of a solid insurance plan. It covers bodily injury, property damage, and legal defense costs resulting from accidents on your business premises or during business operations. Here are the key types of general liability coverage:

-

Bodily Injury: This covers injuries sustained by customers, employees, or others due to your business activities.

-

Property Damage: This protects against damage to property owned by others, such as customer vehicles or rented equipment.

-

Medical Payments: This provides immediate medical coverage for minor injuries that occur on your premises, regardless of fault.

-

Legal Defense Costs: This covers the expenses of defending against lawsuits, even if you’re not ultimately found liable.

Beyond the Basics: Tailoring Your Coverage

Depending on your business’s unique needs, you may consider additional types of liability insurance:

-

Professional Liability Insurance: This covers errors or omissions in your professional services, protecting you from claims of negligence or breach of duty.

-

Commercial Auto Insurance: This covers accidents involving company-owned vehicles, protecting against bodily injury, property damage, and financial loss.

-

Employment Practices Liability Insurance: This protects against lawsuits related to employment practices, such as discrimination, wrongful termination, or harassment.

-

Product Liability Insurance: This covers claims arising from the sale or use of defective products, protecting you from potential lawsuits from customers.

The Bottom Line: Protecting Your Business

liability insurance serves as a crucial safety net for small businesses. By carefully considering the factors discussed above, you can tailor an insurance plan that meets the specific needs of your enterprise. Remember, it’s not just about protecting your assets; it’s about ensuring the well-being of your customers, employees, and the long-term success of your business.

What’s the Best Liability Insurance for Small Businesses?

As a small business owner, you’re constantly juggling a million tasks. But one thing you can’t afford to overlook is liability insurance. It’s an essential safeguard that can protect your business from financial ruin in the event of a lawsuit.

Benefits of Having Liability Insurance

Liability insurance is like a financial airbag for your business. It provides a buffer against claims of negligence, bodily injury, and property damage. Here are just a few of the benefits:

- Peace of mind: Knowing that you have liability insurance is a huge weight off your shoulders. You can rest easy knowing that you’re protected against unexpected financial losses.

- Asset protection: A lawsuit can quickly drain your business’s assets. Liability insurance can help you protect your hard-earned savings, equipment, and inventory from being seized.

- Compliance: Many states require businesses to carry liability insurance. It’s simply a smart business decision to stay in compliance with the law.

Types of Liability Insurance

There are different types of liability insurance, each designed to cover specific risks. Here’s a breakdown of the most common types:

General liability insurance: This is the most basic type of liability insurance and covers a wide range of risks, including bodily injury, property damage, and personal injury.

Professional liability insurance: This type of insurance is designed for businesses that provide professional services, such as accountants, lawyers, and doctors. It covers claims of negligence or errors and omissions.

Product liability insurance: This type of insurance protects businesses that sell products from claims of injury or damage caused by their products.

Cyber liability insurance: This type of insurance is essential for businesses that operate online. It covers claims of data breaches, cyberattacks, and other online threats.

Choosing the Right Liability Insurance

Choosing the right liability insurance for your small business is essential. Here are a few factors to consider:

- The size of your business: The larger your business, the more exposure you have to risk. You’ll need to purchase more coverage to adequately protect your assets.

- The type of business you operate: Some businesses are more risky than others. For example, a construction company faces a higher risk of bodily injury claims than a retail store. You’ll need to choose a policy that covers the specific risks associated with your business.

- Your budget: Liability insurance can be expensive, but it’s worth every penny. Shop around and compare quotes from different insurance companies to find the best coverage at the best price.

Conclusion

Liability insurance is an indispensable part of any small business. It provides peace of mind, protects your assets, and helps you stay compliant with the law. By choosing the right policy, you can ensure that your business is protected from the unexpected.

Additional Resources

- The Ultimate Guide to Liability Insurance for Small Businesses

- How to Choose the Right Liability Insurance for Your Small Business

- 5 Tips for Getting the Most Out of Your Liability Insurance

What Is the Best Liability Insurance for Small Business?

For small business owners, liability insurance is like a superhero’s cape – it protects them from financial ruin in case of lawsuits. But with so many insurance providers and policies out there, finding the right one can feel like navigating a maze blindfolded. Fear not, dear reader! This comprehensive guide will equip you with the knowledge and strategies to identify the best liability insurance for your small business.

Why Liability Insurance Matters:

Imagine this: A disgruntled customer slips on a wet floor in your store and breaks a leg. Or a faulty product you sold causes an injury. Without liability insurance, you’d be left holding the bag for medical bills, legal fees, and potential settlements. Liability insurance acts as a safety net, shielding your assets and preventing your business from crumbling under the weight of unexpected claims.

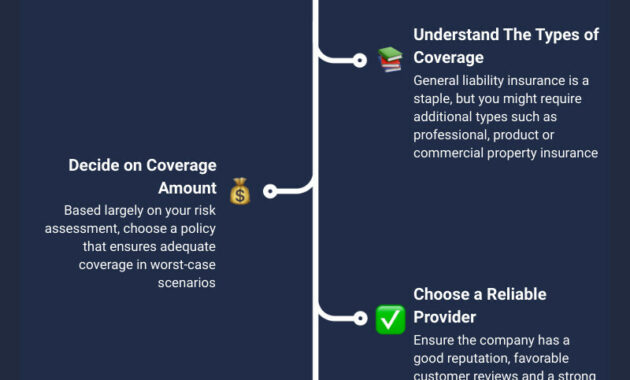

How to Find the Right Liability Insurance for Small Business

1. Assess Your Risks:

Before you start comparing policies, take a moment to identify the potential risks your business faces. Consider the nature of your operations, your location, and any specific industry hazards. This will help you determine the types and limits of coverage you need.

2. Online Research:

The internet is your friend when it comes to researching liability insurance providers. Visit their websites, read reviews, and compare their offerings. Don’t just focus on the big players; smaller regional insurers may offer competitive rates and tailored policies for your business.

3. Get Quotes:

Once you have a shortlist of potential providers, it’s time to get quotes. Be prepared to provide information about your business, including its size, industry, and claims history. Compare the quotes carefully, paying attention to both the coverage provided and the premiums charged.

4. Consult an Insurance Agent:

Insurance agents can be invaluable resources when it comes to finding the right liability insurance. They have expertise in the field and can guide you through the different policies and options available. A good agent will help you understand the coverage, ensure you have adequate limits, and negotiate competitive rates.

5. Tailor Your Policy to Your Needs:

Liability insurance is not a one-size-fits-all solution. Take the time to tailor your policy to your specific needs. Consider the following:

- Coverage Limits: Determine the maximum amount the insurance will cover for each claim and for the policy period as a whole.

- Deductible: This is the amount you pay out of pocket before the insurance kicks in. Higher deductibles typically result in lower premiums.

- Exclusions: Pay attention to any exclusions or limitations in the policy. These could include specific risks or activities that are not covered.

- Additional Coverage: Consider adding optional coverages, such as product liability, errors and omissions, or cyber liability, to enhance your protection.

Finding the right liability insurance for your small business doesn’t have to be a daunting task. By following these steps, you can identify the coverage you need, compare quotes, and choose a policy that will protect your business and give you peace of mind. Just remember, liability insurance is not simply a cost of doing business – it’s an investment in your company’s future.

-