Credit card processing fees are the fees that businesses pay to credit card companies for the privilege of accepting credit cards as payment. These fees can vary depending on a number of factors, including the type of credit card, the amount of the transaction, and the business’s processing volume.

Typical credit card processing fees

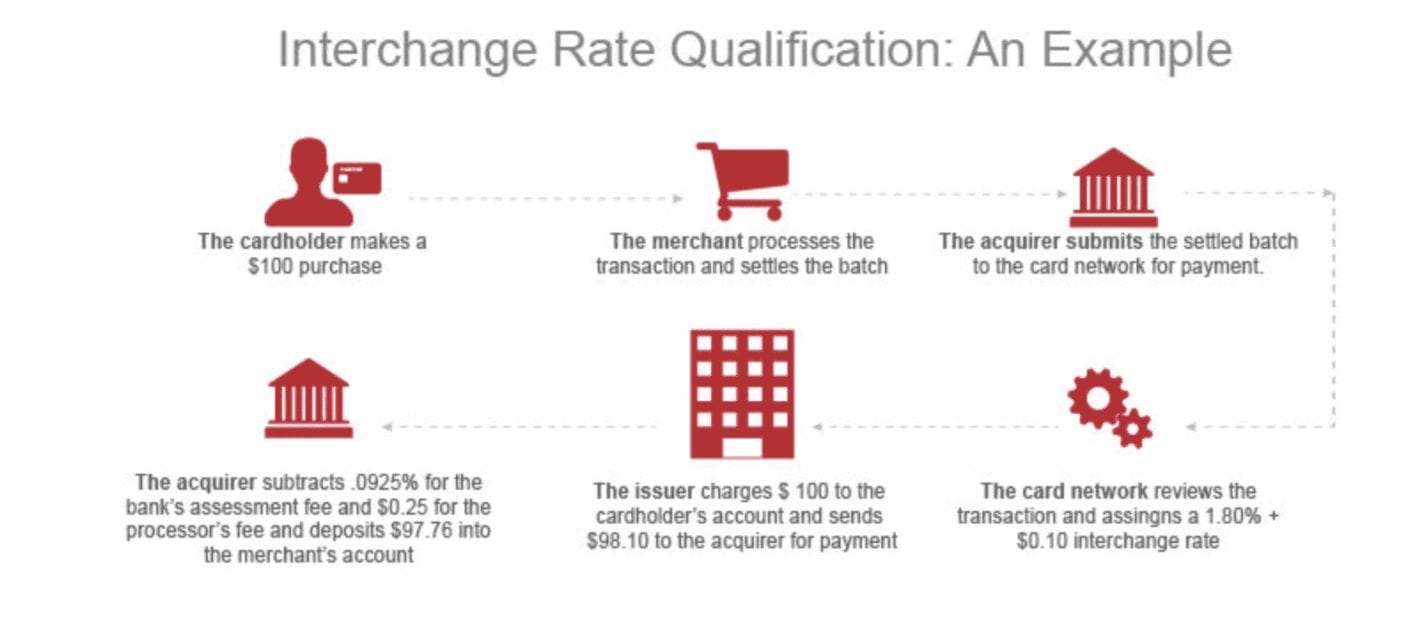

- Interchange fees: These fees are paid to the issuing bank (the bank that issued the credit card to the customer). The interchange fee is a percentage of the transaction amount, and it varies depending on the type of card and the cardholder’s country of residence.

- Merchant fees: These fees are paid to the acquiring bank (the bank that processes the transaction for the business). Merchant fees typically include a per-transaction fee and a monthly fee.

- Payment gateway fees: These fees are paid to the payment gateway provider, which is the company that connects the business’s website or point-of-sale system to the credit card network. Payment gateway fees typically include a monthly fee and a per-transaction fee.

How to reduce credit card processing fees

There are a number of ways that businesses can reduce their credit card processing fees. These include:

- Negotiating with your acquiring bank: You can try to negotiate lower merchant fees with your acquiring bank.

- Using a payment gateway: A payment gateway can help you to reduce your processing fees by consolidating your transactions with multiple credit card companies.

- Accepting electronic payments: Electronic payments, such as ACH transfers and PayPal, typically have lower processing fees than credit cards.

- Offering discounts for cash payments: You can encourage customers to pay with cash by offering a discount for cash payments.

Conclusion

Credit card processing fees can be a significant expense for businesses. However, by understanding the different types of fees and how to reduce them, businesses can save money on their processing costs.