Truist Bank Investment Services

Truist Bank, the sixth-largest bank in the United States, has a rich history dating back to 1872. Today, Truist offers a comprehensive suite of investment services to help its clients achieve their financial goals. These services include investment management, financial planning, and trust and estate services. Whether you’re a seasoned investor or just starting out, Truist has a tailored solution to meet your needs.

Investment Management

Truist’s investment management services are designed to help you grow and preserve your wealth. The bank’s team of experienced investment professionals will work with you to create a customized investment portfolio that aligns with your risk tolerance, investment objectives, and time horizon. Truist offers a wide range of investment options, including stocks, bonds, mutual funds, and exchange-traded funds. The bank also provides access to alternative investments, such as private equity and hedge funds, for qualified investors.

Truist’s investment management services are available in a variety of formats. You can choose from discretionary management, where Truist makes all investment decisions on your behalf, or you can opt for advisory services, where you retain control over your investment decisions while receiving guidance from a Truist advisor. Truist also offers self-directed brokerage services for experienced investors who prefer to manage their own investments.

Truist’s investment management fees are competitive with other major banks. The bank typically charges an annual management fee based on the size of your investment portfolio. The fee is typically around 1% of assets under management, but may be lower for larger portfolios.

Financial Planning

Truist’s financial planning services are designed to help you make informed financial decisions throughout your life. The bank’s team of certified financial planners will work with you to develop a comprehensive financial plan that addresses your short-term and long-term financial goals. Truist’s financial planning services include:

- Retirement planning

- Education planning

- Estate planning

- Tax planning

- Insurance planning

Truist’s financial planning fees are based on the complexity of your plan and the services you require. The bank typically charges an hourly fee for financial planning services, but may also offer fixed-fee packages for certain services.

Trust and Estate Services

Truist’s trust and estate services are designed to help you protect and preserve your assets for future generations. The bank’s team of experienced trust officers will work with you to create a customized estate plan that meets your specific needs. Truist’s trust and estate services include:

- Revocable living trusts

- Irrevocable living trusts

- Testamentary trusts

- Charitable trusts

- Estate administration

Truist’s trust and estate fees are based on the size and complexity of your estate. The bank typically charges an annual fee for trust administration, which is typically around 1% of assets under management. The bank may also charge additional fees for other services, such as estate planning and estate administration.

Conclusion

Truist Bank offers a comprehensive range of investment services to help you achieve your financial goals. The bank’s team of experienced professionals will work with you to create a customized financial solution that meets your specific needs. Whether you’re looking to grow your wealth, plan for retirement, or protect your assets for future generations, Truist has a solution for you.

Truist Bank Investment Services: A Comprehensive Guide to Financial Empowerment

Truist Bank, renowned for its comprehensive financial services, offers an array of investment services tailored to empower investors of all levels. Whether you’re a seasoned pro or just starting your financial journey, Truist Bank has solutions to help you achieve your monetary aspirations.

Financial Planning

Laying the groundwork for financial success begins with a well-defined plan. Truist Bank’s financial planning services provide clients with a roadmap to navigate the complexities of managing their finances. They work closely with you to understand your individual goals, risk tolerance, and time horizon, crafting a personalized plan designed to optimize your financial well-being. Their team of experienced advisors can assist with a wide range of financial planning matters, including budgeting, cash flow analysis, debt management, retirement planning, and investment strategies.

Investing

Truist Bank offers a diverse range of investment options to meet the unique needs of every investor. From stocks and bonds to mutual funds and ETFs, their investment portfolio is designed to help you achieve your financial objectives. Whether your focus is on growth, income, or a combination of both, Truist Bank’s investment specialists will work with you to develop a tailored portfolio that aligns with your risk appetite and long-term aspirations.

Retirement Planning

Retirement may seem like a distant dream, but Truist Bank believes in the power of early preparation. Their retirement planning services are designed to help you create a secure financial foundation for your golden years. They offer a variety of retirement savings plans, including IRAs, 401(k)s, and annuities, tailored to different income levels and retirement goals. Their financial advisors can provide guidance on investment strategies, tax implications, and other factors to ensure you have a comfortable retirement.

Wealth Management

For individuals with substantial assets, Truist Bank offers specialized wealth management services. Their team of dedicated wealth managers takes a holistic approach to managing your finances, considering all aspects of your financial situation. They provide customized solutions for investment management, estate planning, risk management, and philanthropic endeavors. Whether you’re looking to grow your wealth, preserve your assets, or pass on your legacy, Truist Bank’s wealth management services can help you achieve your financial goals.

Services for Businesses

Truist Bank also caters to the financial needs of businesses of all sizes. Their business banking services include commercial lending, cash management, treasury management, and investment solutions. They understand the challenges faced by businesses and are committed to providing tailored financial solutions that help businesses grow and thrive.

Conclusion

Truist Bank’s comprehensive financial services encompass a wide range of investment services designed to meet the unique needs of every individual and business. Whether you’re just starting your financial journey or looking to enhance your investment portfolio, Truist Bank has the expertise and resources to help you achieve your financial goals. Their commitment to personalized service and tailored financial solutions sets them apart as a trusted partner for financial empowerment.

Truist Bank Investment Services: A Comprehensive Guide

Navigating the complex world of finance can be a daunting task, especially for those seeking guidance in managing their investments. Truist Bank, a leading financial institution, offers a comprehensive suite of investment services tailored to meet the diverse needs of investors. Whether you’re a seasoned investor or just starting out, Truist Bank can help you pursue your financial goals.

Wealth Management

Truist Bank’s wealth management services are designed to provide tailored investment strategies and advice to high-net-worth individuals and families. Their team of experienced wealth managers works closely with clients to understand their unique financial objectives and risk tolerance. By leveraging their deep market knowledge and expertise, they craft personalized investment portfolios that align with clients’ specific needs.

Among the core services offered by Truist Bank’s wealth management division are:

- Investment planning: Comprehensive analysis of clients’ financial situation, goals, and risk tolerance to create personalized investment strategies.

- Portfolio management: Ongoing monitoring and adjustment of investment portfolios to ensure alignment with clients’ objectives and changing market conditions.

- Tax planning: Proactive tax strategies to help clients minimize their tax burden and maximize their wealth.

- Trust and estate planning: Guidance on estate planning, trust administration, and other strategies to preserve and transfer wealth across generations.

- Charitable giving: Assistance in establishing and managing charitable trusts and foundations to support clients’ philanthropic goals.

Retirement Planning

Retirement planning is a crucial aspect of financial well-being. Truist Bank offers a range of retirement planning services to help individuals prepare for a secure financial future. Their experienced advisors provide personalized advice on:

- Retirement income planning: Developing strategies to generate sufficient income during retirement, considering factors such as savings, investments, and Social Security benefits.

- Investment selection: Guidance on selecting retirement-focused investment options that align with clients’ risk tolerance and time horizon.

- Tax-advantaged accounts: Maximizing the benefits of tax-advantaged retirement accounts, such as 401(k)s and IRAs, to minimize taxes and grow savings faster.

- Social Security planning: Optimizing Social Security claiming strategies to maximize retirement income.

- Estate planning: Ensuring that retirement assets are distributed according to clients’ wishes and minimizing estate taxes.

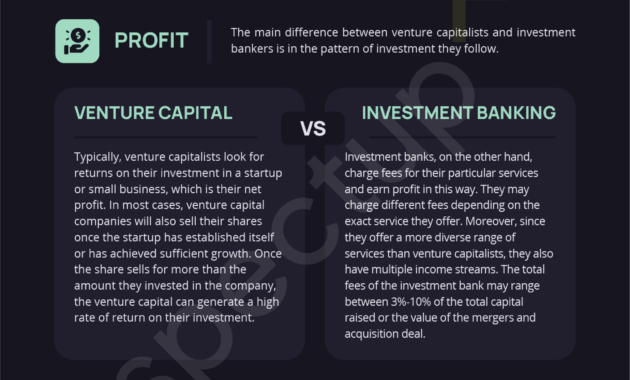

Investment Banking

Truist Bank’s investment banking division provides a full range of services to corporate clients, including:

- Mergers and acquisitions: Advisory services related to mergers, acquisitions, and divestitures, helping clients navigate complex transactions and maximize value.

- Capital markets advisory: Guidance on debt and equity financing, including underwriting, debt syndication, and private placements.

- Financial restructuring: Assistance with corporate restructurings, including workouts, recapitalizations, and bankruptcies.

- Private equity and venture capital: Providing capital and advisory services to private equity funds and venture capital firms.

- Loan syndications: Arranging and managing syndicated loans for large-scale projects and corporate financings.

Commercial Banking

Truist Bank’s commercial banking division offers a comprehensive suite of financial services to businesses of all sizes. Their experienced commercial bankers provide tailored solutions for:

- Business lending: Flexible financing options for working capital, equipment acquisition, and real estate purchases.

- Treasury management: A range of services to optimize cash flow, manage risk, and enhance liquidity.

- International banking: Expertise in cross-border transactions, foreign exchange, and specialized services for international businesses.

- Equipment financing: Customized financing solutions for the acquisition of equipment and machinery.

- Commercial real estate: Comprehensive services for commercial real estate purchases, refinancing, and development.

Truist Bank’s commitment to delivering exceptional investment services is evident in their track record of success. With a long history of serving clients’ financial needs, Truist Bank has consistently earned industry recognition for its innovative products, personalized advice, and unwavering dedication to client satisfaction. Whether you’re looking to build wealth, plan for retirement, or manage your business’s finances, Truist Bank is a trusted partner that can guide you towards achieving your financial goals.

Truist Bank Investment Services: A Comprehensive Guide

If you’re considering investing your hard-earned money, you’ll want to partner with a reputable financial institution that offers a comprehensive range of investment services. Look no further than Truist Bank, a leading provider of banking and financial services in the United States. With Truist Bank investment services, you can access a wide array of tools and resources to help you achieve your financial goals.

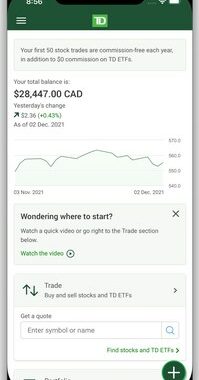

Brokerage Services

Truist Bank’s brokerage services empower clients with the ability to trade stocks, bonds, mutual funds, and other investments. The bank offers various account types to suit different investment needs, including individual accounts, joint accounts, and retirement accounts. With online and mobile trading platforms, you can seamlessly manage your investments from the comfort of your home or on the go.

Investment Management

For those seeking professional guidance, Truist Bank provides investment management services tailored to individual needs. Whether you prefer traditional portfolio management or modern robo-advisory platforms, the bank offers tailored solutions to help you achieve your long-term financial objectives. Experienced investment professionals will work closely with you to develop a personalized portfolio that aligns with your risk tolerance and investment goals.

Financial Planning

Truist Bank goes beyond investment management by offering comprehensive financial planning services. Their team of certified financial planners can assist you with a wide range of financial matters, including retirement planning, estate planning, and tax planning. Whether you’re planning for a secure retirement or navigating complex financial decisions, Truist Bank’s financial planners can provide invaluable guidance and support.

Trust and Estate Services

Truist Bank’s trust and estate services are designed to help individuals and families protect and manage their assets through various life stages. They offer a range of services, including trust administration, estate planning, and probate administration. By partnering with Truist Bank, you can ensure the smooth transfer of your wealth to your loved ones and minimize potential legal complications.

Private Banking

For high-net-worth individuals and families, Truist Bank offers exclusive private banking services. These services include customized wealth management, investment advisory, and other personalized financial solutions. With a dedicated team of private bankers, clients receive tailored attention and guidance to meet their complex financial needs and preserve their legacy for generations to come.