Services Provided by Investment Banks: A Comprehensive Guide

Investment banks are financial institutions that provide a wide range of services to corporations, governments, and high-net-worth individuals. These services include capital raising, mergers and acquisitions, financial advisory, and sales and trading.

Capital Raising

One of the most important services provided by investment banks is capital raising. Companies and governments often need to raise capital to fund their operations, expand their businesses, or make acquisitions. Investment banks help them do this by issuing debt and equity securities.

Debt Financing

Debt financing involves borrowing money from investors. Investment banks underwrite debt offerings, which means they guarantee to buy the debt from the issuer if it cannot be sold to investors. They also provide advice on the terms of the debt offering, such as the interest rate and maturity date.

Equity Financing

Equity financing involves selling ownership stakes in a company to investors. Investment banks underwrite equity offerings, which means they guarantee to buy the shares from the issuer if they cannot be sold to investors. They also provide advice on the terms of the equity offering, such as the number of shares to be sold and the price per share.

Mergers and Acquisitions

Investment banks also provide advice on mergers and acquisitions (M&A). They help companies identify potential targets for acquisition, negotiate the terms of the deal, and execute the transaction. Investment banks also provide fairness opinions to ensure that the terms of the deal are fair to both parties.

Financial Advisory

Investment banks also provide financial advisory services. They help companies with a variety of financial matters, such as developing business plans, raising capital, and managing their finances. Investment banks also provide research and analysis on the financial markets.

Sales and Trading

Investment banks also provide sales and trading services. They buy and sell securities for their clients, and they provide research and analysis on the financial markets. Investment banks also make markets in a variety of securities, which means they stand ready to buy or sell securities at a quoted price.

Conclusion

Investment banks play a vital role in the financial system. They provide a wide range of services that help companies and governments raise capital, acquire other businesses, and manage their finances.

Investment Banking: A Diverse Array of Services for Financial Markets

The world of finance is a vast and complex arena, where businesses and individuals navigate the intricate landscape of investments, transactions, and financial strategies. To steer through these waters effectively, many turn to the expertise of investment banks, financial institutions that provide a comprehensive range of services tailored to meet the diverse needs of their clients.

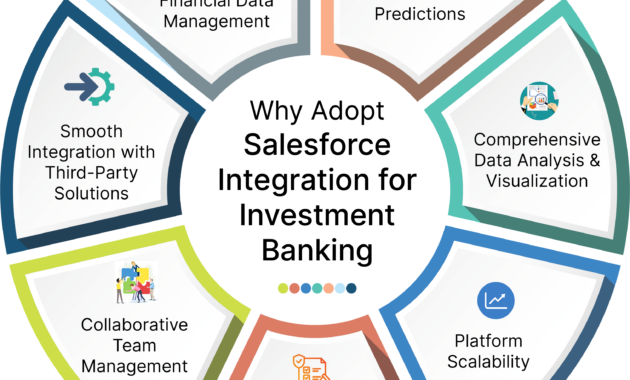

Investment banks act as financial advisors, providing expert guidance and execution of complex transactions. These services encompass a wide spectrum of activities, including:

- Mergers and acquisitions

- Capital raising

- Underwriting

- Restructuring

- Derivatives trading

- Wealth management

Each of these services plays a crucial role in the functioning of financial markets, facilitating the flow of capital, enabling businesses to expand and innovate, and helping individuals achieve their financial goals.

Mergers and Acquisitions

In the realm of mergers and acquisitions (M&A), investment banks serve as trusted advisors to companies contemplating strategic transactions. They provide invaluable counsel throughout these complex processes, drawing upon their deep understanding of market conditions, industry dynamics, and regulatory frameworks.

Investment banks assist clients in identifying potential acquisition targets, evaluating their financial performance and strategic fit, and negotiating the terms of the transaction. They also oversee the due diligence process, ensuring that all aspects of the target company are thoroughly examined before the deal is finalized.

Beyond M&A advisory, investment banks also play a pivotal role in the execution of these transactions. They act as financial intermediaries, facilitating the exchange of funds and securities between the acquiring and target companies. By leveraging their extensive relationships with lenders, investors, and other financial institutions, investment banks ensure that the transaction is completed smoothly and efficiently.

In the competitive world of business, mergers and acquisitions can be game-changing events, reshaping industries and creating new opportunities. With the guidance of experienced investment bankers, companies can navigate these transactions with confidence, maximizing their potential for success.

Capital Raising

Access to capital is the lifeblood of businesses, fueling their growth and innovation. Investment banks serve as gatekeepers to the capital markets, helping companies raise funds to meet their diverse needs. Through a range of services, they connect businesses with investors, enabling them to tap into the vast pool of capital available in the financial markets.

Investment banks assist companies in structuring and executing debt and equity offerings. They provide expert advice on the appropriate financing strategy, considering factors such as the company’s financial condition, industry outlook, and investor demand. By leveraging their deep relationships with institutional investors, investment banks ensure that companies can access capital on favorable terms.

Beyond traditional debt and equity offerings, investment banks also provide innovative financing solutions, such as structured finance and private placements. These tailored approaches enable companies to raise capital in a manner that meets their specific needs and risk tolerance.

In today’s dynamic business environment, access to capital is more critical than ever. Investment banks play a vital role in facilitating the flow of capital, empowering businesses to seize opportunities and drive their growth trajectory.

Underwriting

Underwriting is a fundamental service provided by investment banks, bridging the gap between companies seeking to raise capital and investors looking to acquire new securities. Investment banks act as intermediaries, assuming the risk of purchasing a new issue of securities from the issuing company and then selling those securities to investors.

To assess the viability of an underwriting offering, investment banks conduct thorough due diligence on the issuing company. They evaluate the company’s financial health, industry prospects, and management team to determine its creditworthiness and the potential attractiveness of the offering to investors.

Once the underwriting agreement is in place, investment banks launch marketing campaigns to generate interest among potential investors. They distribute offering materials, host roadshows, and engage in one-on-one meetings with investors to provide detailed information about the offering.

Through the underwriting process, investment banks play a pivotal role in ensuring that companies can access capital while providing investors with access to a diverse range of investment opportunities. They act as gatekeepers to the capital markets, filtering new issues and presenting them to investors in a structured and transparent manner.

Restructuring

Financial distress can be a significant challenge for businesses, threatening their survival and the livelihoods of employees. Investment banks provide restructuring services to help companies overcome financial difficulties and emerge from distress stronger than before.

Investment bankers work closely with distressed companies to develop and implement comprehensive restructuring plans. These plans may involve debt restructuring, equity infusions, or asset sales, tailored to the specific needs and circumstances of each company.

In addition to financial restructuring, investment banks also provide operational restructuring services. They analyze a company’s operations, identify areas for improvement, and implement changes to enhance efficiency, profitability, and long-term viability.

Through their restructuring services, investment banks help companies navigate the complexities of financial distress, preserving value for stakeholders and safeguarding the interests of creditors and equity holders. They provide invaluable guidance and support during these challenging times, helping businesses to rebuild and emerge from adversity.

Derivatives Trading

The derivatives market is a complex and sophisticated arena where investment banks play a central role as market makers and brokers. Derivatives are financial instruments that derive their value from an underlying asset, such as stocks, bonds, currencies, or commodities.

Investment banks engage in derivatives trading to provide liquidity to the market, facilitate hedging strategies, and enable investors to speculate on the future direction of asset prices. They offer a wide range of derivative products, including futures, options, swaps, and credit default swaps.

By providing access to the derivatives market, investment banks empower investors and corporations to manage risk, protect against price volatility, and pursue sophisticated investment strategies. They act as intermediaries, connecting buyers and sellers of derivatives and ensuring that the market functions smoothly and efficiently.

Wealth Management

Beyond their services to corporations and institutions, investment banks also provide wealth management services to high-net-worth individuals and families. These services encompass a comprehensive range of financial planning, investment management, and advisory services tailored to the unique needs of affluent clients.

Wealth managers from investment banks work closely with clients to develop customized financial plans that align with their individual goals and objectives. They provide expert advice on asset allocation, investment strategies, estate planning, and tax minimization.

By leveraging their deep understanding of financial markets and their extensive network of resources, wealth managers from investment banks help high-net-worth clients preserve and grow their wealth, ensuring financial security and peace of mind for themselves and future generations.

Services Provided by Investment Banks: A Comprehensive Guide

When it comes to the financial world, investment banks play a pivotal role. These institutions offer a wide array of services, enabling businesses and individuals to navigate the intricacies of capital markets. From underwriting securities and advising on mergers and acquisitions to providing research and trading solutions, investment banks are the go-to partners for a range of financial needs. In this comprehensive guide, we’ll delve into the essential services provided by investment banks, empowering you to make informed decisions when seeking financial expertise.

Capital Raising

Investment banks act as intermediaries between companies seeking capital and investors looking to invest. They underwrite securities, such as stocks and bonds, which involves guaranteeing the sale of a specific amount of securities at a predetermined price. This service enables companies to raise funds for expansion, acquisitions, or other strategic initiatives.

Mergers and Acquisitions (M&A)

Investment banks provide expert advisory services to companies considering mergers or acquisitions. They assist in evaluating potential targets, conducting due diligence, negotiating terms, and structuring transactions. Their deep understanding of the financial landscape and deal-making processes helps clients make informed decisions and achieve optimal outcomes.

Research

Investment banks offer comprehensive research on industries, companies, and securities, providing valuable insights to clients. Their analysts monitor market trends, analyze financial data, and make investment recommendations. This research empowers investors with the knowledge they need to make informed investment decisions and identify promising opportunities.

Sales and Trading

Investment banks facilitate the buying and selling of securities on behalf of clients. Their trading desks execute trades for institutions and individuals, providing liquidity and ensuring efficient market operations. By leveraging their extensive networks and market knowledge, investment banks offer competitive pricing and timely execution of trades.

Asset Management

Some investment banks also offer asset management services, providing clients with tailored investment solutions. They manage portfolios, allocate assets, and monitor performance to help clients achieve their financial goals. Whether it’s a long-term retirement plan or a short-term investment strategy, investment banks offer expertise in managing a wide range of assets.

Financial Restructuring

Investment banks play a crucial role in assisting companies facing financial difficulties. They provide advice on debt restructuring, equity financing, and other financial strategies to help companies navigate challenging times. Their expertise in financial analysis and deal-making enables them to find innovative solutions and maximize value for all stakeholders.

Conclusion

Investment banks remain indispensable players in the financial landscape. Their comprehensive suite of services, from capital raising to financial restructuring, empowers businesses and investors alike to make informed decisions and achieve their financial objectives. By leveraging their deep market knowledge, deal-making expertise, and research capabilities, investment banks continue to be trusted partners in the world of finance.