Investment Banking: A Comprehensive Guide to Its Services

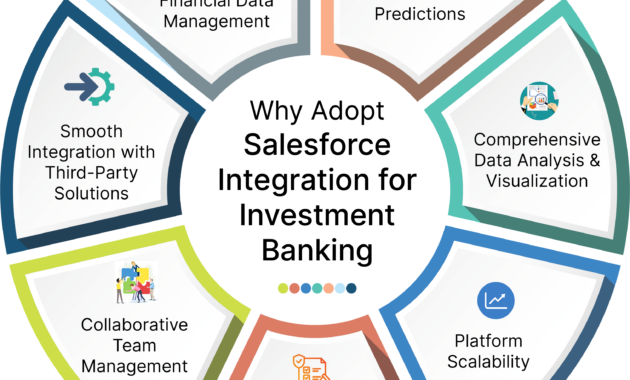

Investment banking is a multifaceted industry that offers a wide range of services to businesses and individuals seeking financial advice and capital raising solutions. From underwriting new securities to providing mergers and acquisitions expertise, investment banks play a crucial role in the financial markets. In this article, we’ll delve into the key services offered by investment banks, providing a comprehensive overview for readers seeking to understand this complex and dynamic field.

Underwriting Services

Underwriting is a fundamental service provided by investment banks. In this role, investment banks act as intermediaries between companies issuing new securities and investors seeking to purchase them. The underwriting process involves evaluating the financial health of the issuing company, determining the type and amount of securities to be issued, pricing the securities, and marketing them to potential investors. Successful underwriting ensures that companies can raise the necessary capital to fund their operations, while investors have access to a diverse range of investment opportunities.

Mergers and Acquisitions Advisory

Mergers and acquisitions (M&A) are transformative events that can significantly impact the business landscape. Investment banks provide comprehensive advisory services to companies seeking to engage in M&A transactions. This includes assessing strategic options, identifying potential targets or acquirers, negotiating transaction terms, and managing the regulatory processes involved. Investment banks leverage their extensive industry knowledge and relationships to guide clients through complex M&A transactions, maximizing value creation and minimizing risk.

Capital Raising Solutions

Companies seeking to raise capital for growth, expansion, or other strategic initiatives may turn to investment banks for assistance. Investment banks provide a range of capital raising solutions tailored to each client’s specific needs. These solutions include equity offerings, where companies issue new shares to raise capital, and debt offerings, where companies borrow funds from investors through the sale of bonds. Investment banks also offer private placements, which involve raising capital from a limited number of sophisticated investors without the need for a public offering.

Trading Services

Investment banks are also active participants in the securities markets, trading a wide range of financial instruments for their own account or on behalf of their clients. This includes trading stocks, bonds, currencies, commodities, and derivatives. Investment banks provide liquidity to the markets, facilitating the buying and selling of securities, and they act as market makers, standing ready to buy or sell securities at specified prices. Trading services offered by investment banks include:

-

Equity Trading: This involves buying and selling shares of publicly traded companies. Investment banks provide liquidity to the equity markets, enabling investors to buy or sell stocks at fair prices.

-

Fixed Income Trading: This encompasses trading in bonds, which are debt securities issued by governments and corporations. Investment banks facilitate the issuance of new bonds and trade existing bonds in the secondary markets.

-

Currency Trading: Investment banks are major players in the foreign exchange market, trading currencies for their own account or on behalf of their clients. They provide liquidity to the currency markets, enabling businesses and individuals to exchange currencies for various purposes.

-

Commodities Trading: Investment banks trade physical commodities like oil, gas, and metals, as well as futures contracts and options on commodities. They provide access to these markets for producers, consumers, and investors seeking to hedge against risk or speculate on price movements.

-

Derivatives Trading: Investment banks are active in the derivatives markets, trading a wide range of financial instruments such as options, futures, and swaps. These instruments allow investors to manage risk, speculate on market movements, and enhance returns.

-

Structured Products: Investment banks create and trade complex financial products that tailor to specific investment objectives and risk profiles of their clients. These products combine different types of underlying assets and financial instruments to provide unique investment opportunities.

Through their trading activities, investment banks provide critical liquidity to the financial markets, facilitating the flow of capital and supporting economic growth. They also offer a range of investment opportunities to investors, enabling them to diversify their portfolios and achieve their financial goals.

In conclusion, investment banks offer a comprehensive suite of services that cater to the complex financial needs of businesses and individuals. From underwriting new securities to providing M&A advisory, raising capital, and facilitating trading, investment banks play a vital role in the financial markets and contribute to economic prosperity. Understanding the services offered by investment banks empowers investors, businesses, and policymakers to make informed decisions and navigate the intricacies of the financial landscape.