Overview of Investment Banking Services

Imagine navigating the complex world of finance like a seasoned captain at the helm of a ship. Investment banking serves as your trusted guide, offering a comprehensive suite of services to help businesses set sail toward their financial goals. From raising capital to managing risks, investment banks are the architects of financial success, empowering companies to thrive in the ever-evolving economic landscape.

Raising Capital: The Lifeblood of Business

At the heart of investment banking lies the ability to unlock the lifeblood of business: capital. Investment bankers act as financial matchmakers, connecting companies seeking funds with investors eager to put their money to work. Through a variety of methods, including initial public offerings (IPOs), secondary offerings, and private placements, investment banks help businesses raise the capital they need to grow, expand, and innovate. IPOs, in particular, represent a transformative moment for companies, allowing them to tap into the vast pool of public investors and gain access to significant capital. Investment bankers meticulously guide companies through the IPO process, ensuring a successful launch and maximizing the value raised. They serve as expert advisors, providing strategic counsel and navigating the intricate regulatory landscape to ensure a smooth and successful offering.

Beyond IPOs, investment banks offer a spectrum of financing options tailored to the unique needs of each business. Secondary offerings allow companies to raise additional capital after their initial public offering, providing them with the flexibility to seize new opportunities or fund ongoing operations. Private placements, on the other hand, offer a more discreet and targeted approach to raising capital from a select group of investors. Investment bankers carefully assess the financial situation and objectives of each client, tailoring financing solutions that align with their long-term growth aspirations.

Mergers and Acquisitions: Reshaping the Business Landscape

In the dynamic world of business, mergers and acquisitions (M&A) serve as powerful tools for growth and transformation. Investment banks play a pivotal role in these complex transactions, acting as trusted advisors to both buyers and sellers. They provide expert guidance throughout the entire M&A process, from identifying potential targets to negotiating the final terms of the deal. Investment bankers meticulously assess the strategic fit and financial implications of potential transactions, ensuring that their clients make informed decisions that align with their long-term objectives. Their deep industry knowledge and extensive network of relationships enable them to identify and pursue the most promising opportunities for growth and consolidation.

For companies seeking to expand their reach or enter new markets, acquisitions can be a strategic move to gain market share, acquire valuable assets, or access specialized expertise. Investment banks serve as expert advisors, providing due diligence services to assess the target’s financial health, operations, and legal compliance. They negotiate the terms of the acquisition, ensuring that their clients secure the best possible deal while mitigating potential risks. Investment bankers also assist in post-acquisition integration, helping companies merge their operations seamlessly and maximize the value of the transaction.

On the other side of the equation, investment banks provide invaluable advice to companies contemplating a sale or merger. They evaluate the company’s financial position and strategic options, advising management on the best course of action to maximize shareholder value. Investment bankers prepare companies for the sale process, ensuring they are well-positioned to attract potential buyers and negotiate favorable terms. Their expertise in deal structuring and negotiation ensures that their clients achieve their financial goals and emerge from the transaction in a strong position.

Risk Management: Navigating Financial Headwinds

In the ever-changing financial landscape, risk management is paramount for businesses seeking to protect their assets and ensure long-term stability. Investment banks provide a range of risk management services, empowering companies to identify, assess, and mitigate financial risks. They employ sophisticated analytical tools and models to evaluate a company’s exposure to various risks, including market risk, credit risk, operational risk, and liquidity risk. Investment bankers develop customized risk management strategies that align with each client’s unique risk tolerance and financial objectives.

Investment banks play a crucial role in managing market risk, which arises from fluctuations in the value of financial instruments and assets. They utilize hedging techniques, such as forward contracts, options, and swaps, to mitigate potential losses and protect clients from adverse market movements. Investment bankers also assist companies in managing credit risk, which stems from the possibility of a borrower defaulting on their financial obligations. They perform thorough credit analysis, evaluate a borrower’s financial health, and advise clients on the appropriate level of risk exposure. Through these risk management services, investment banks help companies safeguard their financial well-being and navigate the complexities of the financial markets.

Advisory Services: Guiding Clients Through Uncertain Waters

Beyond capital raising, M&A, and risk management, investment banks offer a comprehensive suite of advisory services to guide clients through complex financial decisions and strategic challenges. They provide expert advice on a wide range of issues, including financial restructuring, debt and equity financing, and strategic planning. Investment bankers work closely with companies to assess their financial situation, develop customized solutions, and navigate the complexities of the financial markets.

For companies facing financial distress, investment banks provide invaluable guidance on financial restructuring. They assist in developing and implementing strategies to reduce debt, improve cash flow, and restore financial stability. Investment bankers negotiate with creditors and other stakeholders to find workable solutions that preserve the long-term viability of the business. They bring their deep understanding of financial restructuring laws and regulations to the table, ensuring that clients navigate the process effectively and emerge with a solid financial foundation.

Investment banks also offer expert advice on debt and equity financing. They help companies assess their funding needs, evaluate different financing options, and execute successful debt or equity offerings. Investment bankers provide objective counsel, ensuring that clients make informed decisions that align with their long-term financial goals. They leverage their extensive network of investors and financial institutions to secure the most favorable terms for their clients.

In addition to financial restructuring and financing, investment banks offer strategic planning services to help companies define their long-term goals, develop growth strategies, and navigate the ever-changing business landscape. Investment bankers work closely with management teams to assess their current position, identify potential opportunities and challenges, and develop actionable plans to achieve their strategic objectives. They provide objective and evidence-based advice, helping companies make informed decisions that drive growth and enhance shareholder value.

Conclusion: The Powerhouse of Financial Success

In the competitive world of business, investment banks stand as the architects of financial success. They provide a comprehensive suite of services, ranging from capital raising and M&A advisory to risk management and strategic planning. Investment bankers are the trusted advisors to corporations, governments, and institutions, guiding them through complex financial transactions and helping them achieve their long-term financial goals. Their expertise, network, and unwavering commitment to client success make them an invaluable asset in the ever-changing landscape of finance.

Services of Investment Banking

Investment banking is a highly specialized industry that provides a wide range of financial services to corporations, governments, and high-net-worth individuals. Investment banks play a critical role in the capital markets, facilitating the flow of funds between investors and businesses. Their services encompass a diverse array of activities, including capital raising, mergers and acquisitions (M&A), financial advisory, and trading.

Capital Raising Services

Capital raising is a core service offered by investment banks. They assist businesses in issuing and selling securities, such as stocks, bonds, and derivatives, to raise capital for various purposes, such as funding growth initiatives, expanding operations, or acquiring other companies. Investment banks act as intermediaries between issuers and investors, providing expertise in structuring and pricing securities to attract capital at favorable terms.

The process of capital raising involves several key steps. First, the investment bank conducts a thorough analysis of the issuer’s financial health, business prospects, and industry landscape. Based on this analysis, the bank develops a tailored capital raising strategy that outlines the type of securities to be issued, the target investor base, and the pricing parameters.

Next, the investment bank prepares a prospectus or offering memorandum, a legal document that provides detailed information about the issuer and the securities being offered. This document is distributed to potential investors, who evaluate the investment opportunity and decide whether to subscribe to the securities.

The investment bank plays a crucial role in marketing and distributing the securities to investors. They leverage their extensive network of relationships with institutional investors, such as pension funds, mutual funds, and hedge funds, to generate interest in the offering. They also work closely with retail investors, such as individual investors and financial advisors, to ensure a broad distribution of the securities.

The success of a capital raising transaction depends on the investment bank’s ability to effectively assess the issuer’s needs, structure an attractive offering, and execute a successful marketing and distribution strategy. Investment banks with a strong track record and deep industry expertise are highly sought after by companies seeking to raise capital.

Mergers and Acquisitions (M&A) Advisory

Mergers and acquisitions (M&A) are complex transactions that involve the combination or sale of businesses. Investment banks play a vital role in advising clients on all aspects of M&A, from strategic planning to deal execution.

Investment banks provide a comprehensive suite of M&A services, including financial analysis, valuation, due diligence, negotiation, and transaction structuring. They help clients identify potential targets or acquirers, assess the financial and strategic implications of a transaction, and negotiate favorable terms.

The M&A process typically begins with a strategic review of the client’s business objectives and growth aspirations. The investment bank conducts an in-depth analysis of the client’s financial performance, industry dynamics, and competitive landscape to identify potential opportunities for growth through M&A.

Once a potential target or acquirer has been identified, the investment bank conducts a thorough due diligence investigation to assess the financial health, legal compliance, and operational efficiency of the target. This involves reviewing financial statements, legal documents, and other relevant information to identify any potential risks or issues.

The investment bank then advises the client on the negotiation and structuring of the transaction. They work closely with the client’s legal counsel to draft and negotiate the transaction documents, ensuring that the client’s interests are protected and the transaction complies with all applicable laws and regulations.

Investment banks also play a key role in executing the transaction. They coordinate with the various parties involved, including the target or acquirer, legal counsel, and regulatory authorities, to ensure a smooth and timely closing.

The success of an M&A transaction depends on the investment bank’s ability to provide sound strategic advice, conduct thorough due diligence, negotiate favorable terms, and execute the transaction efficiently. Investment banks with a strong track record and deep industry expertise are highly sought after by companies seeking to engage in M&A.

Investment Banking Services: A Comprehensive Overview

The realm of investment banking encompasses a vast array of services, each designed to cater to the unique financial needs of corporations, governments, and individuals alike. From orchestrating mergers and acquisitions to underwriting debt and equity offerings, investment banks play a pivotal role in shaping the global financial landscape.

Mergers and Acquisitions (M&A)

When companies seek to expand their operations, diversify their portfolio, or consolidate their industry dominance, they often turn to the expertise of investment banks. These institutions provide comprehensive advisory services, guiding clients through every stage of the M&A process, from initial assessment to deal execution.

Investment bankers possess the financial acumen and industry knowledge to identify potential acquisition targets, evaluate their strategic fit, and negotiate favorable terms. They serve as trusted advisors, providing objective analysis and ensuring that clients make well-informed decisions.

The M&A landscape is a complex one, fraught with intricate regulations and potential pitfalls. Investment banks act as skilled navigators, helping clients navigate the regulatory maze, manage stakeholder expectations, and mitigate transaction risks. Their expertise extends to both domestic and cross-border transactions, ensuring seamless execution regardless of geographic boundaries.

Investment banks not only provide advisory services but also facilitate the actual transaction process. They work closely with the acquiring and target companies, coordinating due diligence, drafting legal agreements, and ensuring a smooth closing.

Debt and Equity Underwriting

Corporations and governments frequently seek external financing to fund their operations, growth initiatives, and infrastructure projects. Investment banks play a crucial role in this process through debt and equity underwriting.

Underwriting involves assessing the creditworthiness of an issuer, structuring and pricing securities, and distributing them to investors. Investment banks leverage their extensive investor networks and deep understanding of capital markets to ensure successful placements.

For debt offerings, investment banks determine the appropriate financing structure, interest rates, and maturity dates. They then syndicate the debt to a group of institutional investors, ensuring that the issuer secures the necessary funds at favorable terms.

Equity underwriting involves distributing shares of a company’s stock to investors. Investment banks determine the offering size, pricing, and distribution strategy, aiming to maximize the capital raised while minimizing dilution for the existing shareholders.

Restructuring and Advisory

Companies facing financial distress or seeking to optimize their operations often engage investment banks for restructuring and advisory services. These services encompass a wide range of expertise, including financial restructuring, debt refinancing, and operational turnaround.

Investment banks provide independent assessments of a company’s financial health, identifying areas for improvement and developing strategic plans to enhance performance. They negotiate with creditors and other stakeholders to restructure debt obligations and improve financial flexibility.

Additionally, investment banks offer advisory services on mergers, acquisitions, and divestitures, providing objective analysis and guidance to help clients make informed decisions about their strategic direction. They also assist with capital raising, investor relations, and corporate governance, ensuring that companies maintain strong financial footing and transparency.

Other Services

The services offered by investment banks extend far beyond mergers and acquisitions, debt and equity underwriting, and restructuring. They provide a comprehensive suite of financial solutions tailored to the unique needs of their clients.

- Capital markets advisory: Investment banks advise governments and corporations on accessing capital markets to fund their growth plans or manage their debt. They assist in developing innovative financing structures, managing investor roadshows, and ensuring compliance with regulatory requirements.

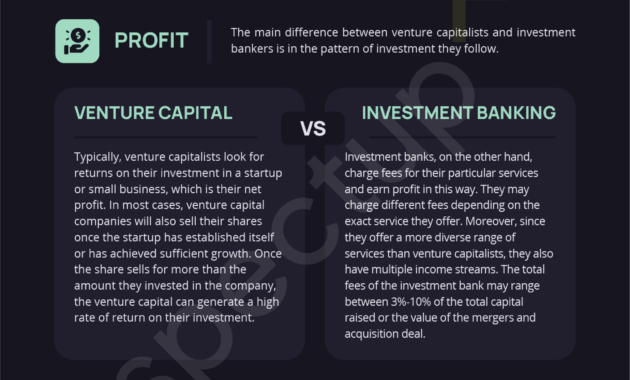

- Private equity: Investment banks play a significant role in the private equity industry, providing advisory services, capital raising, and transaction support to private equity funds and their portfolio companies.

- Venture capital: Investment banks provide advisory and fundraising services to venture capital firms and emerging growth companies, helping them secure funding and navigate the complexities of the venture capital market.

- Asset management: Investment banks offer asset management services to institutional investors, managing their portfolios and providing investment advice. They leverage their expertise in various asset classes, including equities, bonds, and alternative investments.

- Principal investments: Investment banks may make principal investments in companies or projects on behalf of their clients or their own proprietary accounts. These investments range from private equity to hedge funds and real estate.

Conclusion

Investment banks are indispensable players in the global financial landscape, providing a wide array of services that fuel corporate growth, facilitate capital markets transactions, and support financial stability. Their expertise, industry knowledge, and extensive networks empower them to deliver tailored solutions that meet the diverse needs of their clients.

Services of Investment Banking

Investment banks are financial institutions that offer a wide range of sophisticated and essential services specifically tailored to assist companies in achieving their financial goals and navigating the complexities of capital markets. These services are not limited to, but encompass, underwriting, mergers and acquisitions, capital raising, and financial restructuring. Investment banks serve as intermediaries between companies and investors, facilitating the flow of capital and enabling businesses to access funding for their ventures.

Underwriting

Underwriting is a crucial service provided by investment banks, wherein they assume the risk of purchasing a company’s securities, such as stocks or bonds, directly from the issuing company. This process involves assessing the company’s financial health, evaluating market conditions, and determining the appropriate pricing for the securities. Investment banks act as intermediaries between the issuer and the investing public, ensuring the successful distribution of securities to investors.

Mergers and Acquisitions (M&A)

Investment banks play a pivotal role in facilitating mergers and acquisitions, which involve the combination or consolidation of two or more companies. They provide advisory services to both buyers and sellers, assisting in the evaluation of potential targets, due diligence, negotiation of terms, and execution of transactions. Investment banks leverage their expertise in industry analysis, financial modeling, and regulatory compliance to ensure seamless and successful M&A outcomes.

Capital Raising

Investment banks assist companies in raising capital through various channels, including private placements, public offerings, and debt financing. They provide guidance on the most appropriate capital structure, identify potential investors, and structure transactions that meet the specific funding needs of their clients. Investment banks leverage their extensive network of relationships with institutional investors and high-net-worth individuals to secure favorable terms and ensure efficient execution of capital-raising initiatives.

Financial Restructuring

Investment banks provide expert guidance and assistance to companies facing financial challenges or seeking to restructure their debt and equity. They assess the company’s financial situation, develop restructuring plans, negotiate with creditors, and facilitate the implementation of solutions that preserve value, enhance financial stability, and position the company for future growth. Investment banks bring a deep understanding of bankruptcy laws, restructuring techniques, and negotiation strategies to help companies navigate the complexities of financial distress and emerge stronger.

In financial restructuring, investment banks employ various strategies to address a company’s financial woes. One common approach is debt restructuring, which involves modifying the terms of existing debt obligations, such as reducing interest rates, extending maturities, or converting debt into equity. This strategy aims to reduce the burden of debt and improve the company’s cash flow. Another strategy is equity restructuring, which involves raising new equity capital or reorganizing the company’s ownership structure. By bringing in new investors or adjusting ownership stakes, equity restructuring can strengthen the company’s financial position and provide a fresh start.

Investment banks also assist companies in negotiating with creditors, such as banks and bondholders. They leverage their expertise in bankruptcy law and negotiation tactics to advocate for the company’s interests and reach agreements that are fair and equitable. By facilitating constructive dialogue and finding common ground, investment banks help companies avoid costly and protracted legal battles and preserve value for all stakeholders.

Financial restructuring is a complex and challenging process, but investment banks play a vital role in guiding companies through this difficult period. Their expertise, experience, and relationships with creditors and investors enable them to develop and implement restructuring solutions that maximize value and position companies for future success.

Unraveling the Symphony of Investment Banking Services

Picture this: you’re an ambitious entrepreneur with a brilliant business plan, brimming with potential but lacking the financial know-how to turn your dreams into reality. Enter the world of investment banking, a veritable maestro that orchestrates a symphony of services, each tailored to guide you through the labyrinth of financial markets. Let’s embark on a journey to discover the multifaceted offerings that investment banks bring to the table.

Advisory Services: Guiding Your Financial Odyssey

Think of investment banks as your financial compass, providing expert advice and insights to navigate the ever-shifting waters of the financial world. From strategic planning to capital structure optimization, they offer a comprehensive suite of consulting services to help you steer your business towards success.

Mergers and Acquisitions: Orchestrating Corporate Unions

Envision investment banks as matchmakers for the business world, facilitating mergers and acquisitions that forge new corporate giants or reshape industry landscapes. They serve as trusted advisors, meticulously assessing potential targets, managing negotiations, and ensuring a smooth transaction process from start to finish.

Capital Markets: Tapping into the Financial Lifeline

Investment banks are the gatekeepers to capital markets, providing companies access to the funds they need to grow and thrive. They offer a full spectrum of services, underwriting new debt and equity offerings, acting as market makers to facilitate trading, and providing liquidity to investors.

Debt and Equity Underwriting: Raising Capital with Confidence

Think of underwriters as financial architects, designing and executing bespoke debt and equity offerings that meet the unique needs of each client. They assume the risk of buying the securities from the issuer and then sell them to investors, ensuring a successful capital raise.

Sales and Trading: The Pulse of the Market

Imagine investment banks as the heart of the financial system, facilitating the buying and selling of securities in real time. Their sales and trading desks are the epicenter of market activity, providing liquidity to investors and executing trades with precision and speed.

Research: Illuminating the Financial Landscape

Investment banks employ armies of analysts who meticulously dissect companies and industries, providing investors with invaluable insights into market trends, financial performance, and potential investment opportunities. Their research reports are highly sought after by investors seeking an edge in the competitive financial arena.

Asset Management: Stewarding Your Wealth

Investment banks are also entrusted with the stewardship of vast pools of assets, offering a range of asset management services to meet the diverse needs of clients. They construct and manage portfolios tailored to specific risk profiles and financial goals, ensuring that investments are aligned with long-term objectives.

Private Equity: Fueling Innovation and Growth

Think of private equity as the turbocharged engine that propels emerging businesses and innovative startups towards success. Investment banks act as intermediaries, connecting private equity funds with promising companies, providing the capital and expertise needed to scale and transform industries.

Real Estate: Shaping the Urban Landscape

Investment banks play a pivotal role in the real estate market, advising on acquisitions, financing, and development projects. They provide expert insights into market trends, identify undervalued opportunities, and structure complex financing arrangements tailored to the unique requirements of the real estate sector.

Conclusion: A Symphony of Expertise

Investment banks are the maestros of the financial world, conducting a symphony of services that empower businesses to reach their full potential. From advisory services that guide strategic decisions to capital markets that provide access to funding, each offering is meticulously orchestrated to meet the evolving needs of clients in an ever-changing financial landscape.

Services of Investment Banking

Investment banking services encompass various specialized financial functions that aid corporations, governments, and other institutions in managing their capital needs and pursuing strategic initiatives. These services, often referred to as the “tools of the trade” for investment bankers, constitute the core of their daily operations. Investment bankers, the individuals who provide these services, act as intermediaries between entities seeking capital and investors looking to allocate funds.

The comprehensive range of investment banking services entails:

- Mergers and acquisitions (M&A)

- Equity and debt underwriting

- Financial advisory

- Restructuring

- Sales and trading

- Private equity

li>Capital markets

Mergers and Acquisitions (M&A)

Mergers and acquisitions (M&A) involve the consolidation of two or more companies into a single entity, or the acquisition of one company by another. Investment bankers serve as advisors throughout the M&A process, providing expertise in valuation, negotiation, and deal structuring. They assist clients in determining the strategic rationale for mergers and acquisitions, identifying potential targets, and executing transactions that maximize shareholder value.

Equity and Debt Underwriting

Equity and debt underwriting involves raising capital for corporations and governments by issuing and selling securities in the public markets. Investment bankers act as intermediaries between issuers and investors, managing the entire process from pricing and structuring the offering to distributing the securities to investors. They provide expert guidance on market conditions and help issuers access the most favorable terms for their capital raisings.

Financial Advisory

Financial advisory services provide strategic counsel and guidance to clients on a wide range of complex financial matters. Investment bankers assist companies with financial modeling, valuation, and strategic planning, helping them make informed decisions about capital structure, cost of capital, and growth strategies. They also advise clients on risk management, capital raising, and mergers and acquisitions.

Restructuring

Restructuring services assist companies facing financial distress or undergoing significant change. Investment bankers work with management teams to develop and implement restructuring plans, including debt restructuring, asset sales, and operational improvements. Their expertise in financial analysis and negotiation helps clients navigate complex situations and preserve value.

Capital Markets

Capital markets services involve managing the issuance and trading of debt and equity securities in the primary and secondary markets. Investment bankers act as market makers, providing liquidity and facilitating transactions for investors. They also provide research and analysis to clients on market trends and specific securities.

Sales and Trading

Sales and trading services involve the execution of trades and the provision of liquidity in the markets for stocks, bonds, and other financial instruments. Investment bankers work with clients to develop trading strategies, manage risk, and access the best prices for their transactions. They also provide ongoing market commentary and analysis.

Private Equity

Private equity services involve investing in privately held companies with the goal of generating long-term capital appreciation. Investment bankers assist private equity firms with deal sourcing, due diligence, and portfolio management. They also provide advisory services to companies seeking private equity investment.

Conclusion

Investment banking services play a crucial role in the functioning of the capital markets and the overall financial system. From facilitating mergers and acquisitions to underwriting securities and providing financial advisory, investment bankers assist corporations, governments, and institutions in navigating complex financial transactions and achieving their strategic objectives. Their expertise and guidance are essential for the efficient allocation of capital and the long-term growth of the economy.