Introduction

Managing your hard-earned money can be a daunting task, especially in today’s volatile financial landscape. That’s where PNC Bank comes in, offering a comprehensive suite of investment services designed to meet the unique needs of every investor, from seasoned veterans to those just starting their financial journey. With PNC, you can harness the power of personalized advice, innovative platforms, and tailored investment strategies to achieve your financial goals.

Whether you’re seeking to save for a comfortable retirement, finance your children’s education, or simply grow your wealth, PNC Bank has the expertise and resources to guide you every step of the way. Their investment services encompass a wide range of options, from traditional brokerage accounts to sophisticated wealth management strategies, ensuring that you have the tools you need to navigate the complexities of the financial markets and make informed decisions about your financial future.

In this comprehensive guide, we will delve into the intricacies of PNC Bank’s investment services, exploring the various offerings, benefits, and strategies available to investors. Whether you’re a seasoned professional or a novice just starting out, this guide will provide you with the insights and knowledge you need to make informed investment decisions and unlock your financial potential.

Understanding Your Investment Needs

The first step in any successful investment strategy is understanding your unique financial needs and goals. What are your short-term and long-term financial aspirations? Are you saving for a specific purpose, such as a down payment on a house or your children’s education? Or are you simply looking to grow your wealth over time?

Once you have a clear understanding of your goals, you can begin to assess your risk tolerance. How comfortable are you with the potential for fluctuations in your investment value? Remember, higher returns often come with higher risks, so it’s crucial to find a balance that aligns with your personal circumstances and financial fortitude.

Consider your investment horizon as well. Are you planning to invest for a short period, such as a few years, or for the long haul? The length of time you have to invest will influence the types of investments that are most appropriate for you. Short-term investments typically involve lower risks and lower potential returns, while long-term investments offer the potential for higher returns but come with greater volatility.

Choosing the Right Investment Account

Once you have a firm grasp of your investment needs and goals, it’s time to choose the right investment account. PNC Bank offers a variety of account types to suit different investment strategies and financial objectives.

Individual Brokerage Accounts (IBAs) are designed for investors who want to manage their own investments. These accounts provide access to a wide range of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). IBAs offer flexibility and control over your investment decisions, but they also require more active management on your part.

If you prefer a more hands-off approach, Managed Accounts may be a better option. With Managed Accounts, PNC Bank’s experienced investment professionals will handle the day-to-day management of your investments, making decisions based on your specific goals and risk tolerance. Managed Accounts offer a convenient and hassle-free way to invest, but they typically come with higher fees than IBAs.

Retirement Accounts, such as IRAs and 401(k)s, are designed to help you save for the future while taking advantage of tax benefits. These accounts offer tax-deferred growth, meaning that you won’t pay taxes on your investment earnings until you withdraw them in retirement. Roth IRAs and Roth 401(k)s offer tax-free withdrawals in retirement, but they come with income limits and contribution limits.

Trust Accounts are designed to manage assets for beneficiaries, such as children or grandchildren. These accounts offer a way to transfer wealth and manage assets over time, and they can be used for a variety of purposes, such as education funding or estate planning.

Investment Strategies and Planning

With your investment account in place, it’s time to develop an investment strategy that aligns

PNC Bank Investment Services: A Comprehensive Guide

Welcome, dear reader, to the ultimate guide to PNC Bank’s extensive investment services. Whether you’re a seasoned investor or just starting out on your financial journey, PNC has a wealth of options tailored to your unique needs. So, let’s dive right in and explore the world of PNC Bank investment services together!

Investment Management

At PNC Bank, you’ll find a dedicated team of financial advisors waiting to assist you with crafting a customized investment strategy and managing your portfolio. With their expertise, they’ll guide you through the complexities of the market, helping you navigate the ups and downs along the way.

Personalized Investment Strategies

Your PNC advisor will work closely with you to understand your financial goals, risk tolerance, and time horizon. Based on this in-depth assessment, they’ll develop a tailored investment strategy that aligns perfectly with your aspirations. No two strategies are the same, because PNC recognizes that every investor is unique.

Portfolio Management

PNC’s experienced advisors will meticulously manage your portfolio, keeping a watchful eye on market trends and adjusting your investments as needed. They’ll proactively identify opportunities for growth and diversification, ensuring that your portfolio stays on track towards meeting your long-term financial objectives.

Wealth Management

For those seeking a more comprehensive approach to their finances, PNC offers a range of wealth management services. These services extend beyond investment management to encompass a holistic view of your financial life.

Tax Planning and Strategies

PNC’s wealth managers will work with you to develop tax-efficient strategies that can help you minimize your tax burden and maximize your investment returns. They’ll stay abreast of the latest tax laws and regulations, ensuring that your financial decisions are always in line with your tax goals.

Estate Planning and Administration

PNC’s estate planning experts can guide you in creating a will or trust that protects your assets and ensures that your wishes are carried out after you’re gone. They’ll help you navigate the complexities of estate administration, ensuring a smooth and efficient transition of your wealth to your beneficiaries.

Trust and Custody Services

PNC offers a range of trust and custody services to safeguard your assets and ensure that they’re managed according to your instructions. Whether you’re establishing a trust for your children or holding assets for a business, PNC’s experienced professionals will provide the peace of mind you need.

PNC Bank Investment Services: Guiding Your Financial Path

PNC Bank stands tall as a pillar of financial prowess, offering a comprehensive suite of investment services designed to empower individuals and businesses alike. From retirement planning to wealth management, PNC’s team of experts provides tailored solutions to help clients navigate the complexities of the financial landscape. In this exhaustive guide, we’ll delve into the intricacies of PNC Bank investment services, providing indispensable insights into their offerings and their ability to shape your financial future.

Retirement Planning

Retirement, a time when dreams and aspirations intertwine, demands meticulous planning to ensure a secure and fulfilling future. PNC Bank recognizes this and offers a comprehensive range of retirement planning services to help individuals lay a solid foundation for their golden years. IRAs, with their tax-advantaged growth potential, serve as a cornerstone of PNC’s retirement offerings. Whether you seek a traditional IRA or a Roth IRA, the bank’s experts will guide you through the nuances of each option, helping you select the path that best aligns with your financial goals.

401(k) plans, a mainstay of workplace retirement savings, also fall under the purview of PNC’s retirement planning services. The bank’s team of dedicated professionals can assist you in maximizing your 401(k) contributions, taking full advantage of employer matching programs, and making informed investment decisions. Every step of the way, PNC’s experts are there to provide personalized guidance, ensuring that your retirement savings are optimized to meet your unique needs.

Beyond IRAs and 401(k)s, PNC Bank offers a diverse array of retirement accounts tailored to specific circumstances. Whether you’re self-employed, nearing retirement, or seeking tax-efficient investment options, the bank’s comprehensive suite of retirement services has you covered. With PNC Bank as your financial navigator, you can chart a course toward a secure and prosperous retirement, ensuring that your golden years are filled with financial peace of mind.

PNC Bank Investment Services: Unlocking Financial Empowerment

In the ever-evolving realm of finance, PNC Bank stands as a beacon of stability and innovation. With a deep understanding of their clients’ aspirations, PNC has curated a comprehensive suite of investment services tailored to empower you on your financial journey. From wealth management to retirement planning, PNC’s team of dedicated professionals is equipped to guide you through every financial milestone.

PNC’s unwavering commitment to excellence has earned them a stellar reputation within the industry. Their client-centric approach shines through in every interaction, ensuring that your financial goals take center stage. Whether you’re navigating the complexities of the stock market or planning for a secure retirement, PNC’s investment services are designed to help you achieve your financial dreams.

Trust and Estate Services

Estate planning is not just about distributing assets; it’s about preserving legacies and ensuring that your wishes are honored. PNC’s trust and estate services provide a comprehensive framework for safeguarding your wealth and guiding its transfer to future generations. Their experienced team of estate attorneys and financial advisors will work closely with you to craft a personalized plan that meets your unique needs and goals.

PNC offers a full spectrum of trust management services, including revocable and irrevocable trusts, charitable trusts, and special needs trusts. These trusts can serve various purposes, such as reducing estate taxes, protecting assets from creditors, and providing for loved ones with special needs. PNC’s team of experts will guide you through the complexities of trust law, ensuring that your assets are managed in accordance with your wishes.

In addition to trust management, PNC also provides estate planning services such as will preparation, durable powers of attorney, and healthcare directives. These documents help ensure that your wishes are known and respected in the event of incapacity or death. PNC’s attorneys will work with you to create a comprehensive estate plan that addresses all aspects of your estate, from asset distribution to end-of-life care.

Retirement Planning: A Path to Financial Security

Retirement should be a time to enjoy the fruits of your labor, free from financial worries. PNC’s retirement planning services are designed to help you achieve financial independence and peace of mind as you transition into this new chapter of life. Their team of financial advisors will work with you to create a customized retirement plan that aligns with your unique circumstances and goals.

PNC offers a wide range of retirement planning services, including investment management, income planning, and tax optimization. Their investment professionals will develop a diversified portfolio that aligns with your risk tolerance and investment objectives. PNC also provides income planning services to help ensure that you have a steady stream of income throughout your retirement years. Additionally, their tax optimization strategies can help minimize your tax burden and maximize your retirement savings.

PNC’s retirement planning services go beyond financial management. They also offer educational resources, workshops, and seminars to help you stay informed about retirement planning strategies. Their goal is to empower you with the knowledge and confidence to make informed decisions about your retirement future.

Unleashing Your Financial Potential: PNC’s Investment Services

PNC’s investment services provide a comprehensive suite of solutions designed to help you reach your financial aspirations. Their team of experienced investment professionals will work with you to create a tailored investment plan that aligns with your risk tolerance, investment goals, and time horizon. PNC offers a wide range of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

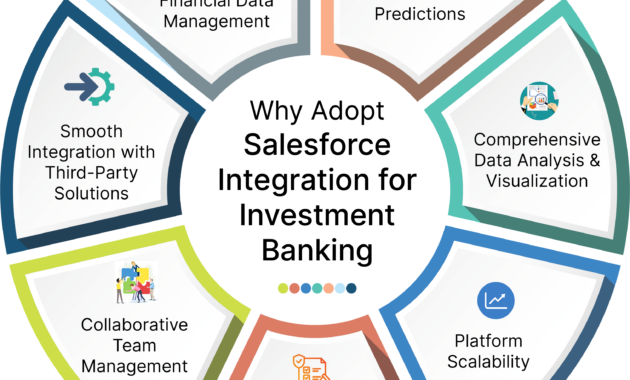

PNC’s investment platform provides you with access to real-time market data, research reports, and portfolio tracking tools. This empowers you to stay informed about your investments and make informed decisions. PNC also offers personalized investment advice and guidance to help you navigate the complexities of the financial markets.

Whether you’re a seasoned investor or just starting out, PNC’s investment services are designed to meet your unique needs. Their team of experts will guide you through every step of the investment process, from asset allocation to portfolio management. With PNC, you can rest assured that your investments are in good hands.

Conclusion

In the vast landscape of financial services, PNC Bank stands as a beacon of trust, expertise, and innovation. Their comprehensive investment services are designed to empower you on your financial journey, providing you with the tools and guidance you need to achieve your financial goals. From trust and estate planning to retirement planning and investment management, PNC has the expertise to help you unlock your financial potential and secure a prosperous future for yourself and your loved ones.

PNC Bank Investment Services: A Comprehensive Overview

In today’s bustling financial landscape, investing wisely is more crucial than ever. PNC Bank stands out as a trusted partner for individuals and businesses seeking to cultivate their financial well-being. With their comprehensive suite of investment services, PNC empowers their clients to navigate market complexities and achieve their long-term financial goals.

Investment Expertise at Your Fingertips

PNC Bank’s investment professionals boast a wealth of knowledge and experience, providing invaluable guidance to their clients. They work closely with individuals to understand their unique financial needs and tailor investment strategies that align with their risk tolerance and aspirations.

A Comprehensive Array of Investment Options

PNC Bank offers a diverse portfolio of investment options to suit every financial objective. Whether you seek growth-oriented stocks, income-generating bonds, or a balanced approach with mutual funds, there’s something to cater to your needs. Their experienced advisors can help you navigate the complexities of the market and select investments that align with your financial goals.

Personalized Investment Management

For those who prefer a more hands-off approach, PNC Bank offers personalized investment management services. Their experienced team takes care of the day-to-day decision-making, freeing you up to focus on the things that matter most to you.

Online and Mobile Access

PNC’s user-friendly online and mobile platforms allow clients to conveniently monitor their investments and make informed decisions. With real-time account updates and market insights at your fingertips, you can stay on top of your investments from anywhere, at any time.

Financial Planning and Advice

Beyond investment services, PNC Bank offers comprehensive financial planning and advice. Their team of experts can guide you through major life events, such as retirement planning, wealth management, and estate planning. By taking a holistic approach to your financial life, PNC Bank empowers you to make informed decisions and secure your financial future.

Building Your Financial Legacy

Investing with PNC Bank is not just about maximizing returns. It’s about building a financial legacy that will benefit you and your loved ones for generations to come. Their investment services are designed to help you achieve your financial goals, whatever they may be.

Conclusion

PNC Bank’s investment services offer a comprehensive and personalized solution to managing your financial future. With their experienced professionals, diverse investment options, and cutting-edge technology, PNC empowers you to navigate market complexities and achieve your financial aspirations. As you embark on your financial journey, consider partnering with PNC Bank to unlock the power of well-managed investments and secure your financial well-being.

PNC Bank Investment Services: A Comprehensive Guide for Investors

In the ever-evolving world of finance, finding a reliable and comprehensive investment partner is paramount. PNC Bank, with its robust investment services, stands out as a beacon of guidance for investors seeking to navigate the complexities of the market. This article delves into the multifaceted offerings of PNC Bank’s investment services, providing a comprehensive guide to help you make informed decisions about your financial future.

Investment Management

PNC Bank’s investment management services are tailored to meet the unique needs of each client. Whether you’re a seasoned investor or just starting your journey, the bank’s experienced financial advisors provide personalized guidance and tailored investment strategies. They work closely with you to understand your financial goals, risk tolerance, and time horizon, crafting a portfolio that aligns perfectly with your aspirations.

PNC Bank offers a wide range of investment options to suit every risk appetite, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). The bank’s investment philosophy emphasizes diversification, spreading your assets across different asset classes and sectors to mitigate risk and enhance potential returns.

Investment Education

Empowered investors make better decisions. Recognizing this, PNC Bank provides a wealth of educational resources, including:

- Webinars and seminars hosted by financial experts

- Online tools and interactive learning modules

- In-person workshops and one-on-one consultations

These resources cover a broad spectrum of investment topics, from basic financial literacy to advanced investment strategies. Whether you’re a seasoned investor or just starting out, PNC Bank’s educational offerings empower you with the knowledge and confidence to navigate the financial markets.

Retirement Planning

Retirement planning is a critical component of financial well-being. PNC Bank offers comprehensive retirement planning services to help you plan for a secure and comfortable retirement. The bank’s financial advisors can help you:

- Estimate your retirement income needs

- Create a personalized retirement savings plan

- Choose appropriate retirement investment vehicles

- Navigate the complexities of Social Security and Medicare

With PNC Bank’s expert guidance, you can gain peace of mind knowing that your retirement is on track.

Estate Planning

Estate planning is essential for preserving and distributing your wealth according to your wishes. PNC Bank’s estate planning services can help you:

- Create a will or trust

- Minimize estate taxes

- Plan for the distribution of your assets

- Protect your loved ones from financial hardship

PNC Bank’s experienced estate planning attorneys can guide you through the complexities of estate planning, ensuring that your legacy is preserved and your wishes are carried out.

Private Banking

PNC Bank’s private banking services are designed for high-net-worth individuals and families. These services provide a comprehensive suite of financial solutions, including:

- Investment management

- Retirement planning

- Estate planning

- Lending and credit

- Wealth management

With PNC Bank’s private banking services, you benefit from a dedicated team of financial experts who provide tailored advice and personalized solutions to meet your unique financial needs.

Conclusion

PNC Bank’s investment services offer a comprehensive and tailored approach to financial planning. Whether you’re an individual investor, a family, or a high-net-worth individual, PNC Bank has the expertise and resources to help you achieve your financial goals. With its commitment to investment education, personalized investment management, and comprehensive retirement, estate, and private banking services, PNC Bank is your trusted partner for a secure financial future.