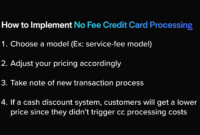

No Monthly Fee Credit Card Processing: A Guide Ready to wave goodbye to the monthly drain of credit card processing fees? No monthly fee credit card processing is the answer you’ve been looking for! This comprehensive guide will take you on a deep dive into the world of fee-free processing, uncovering its advantages and guiding you through the key factors to consider. Get ready to streamline your payments and boost your business’s bottom line. What’s the Deal with No Monthly Fee Credit Card Processing? In the realm of credit card processing, there’s a standard practice: businesses pay a monthly fee […]

BUSINESS

QuickBooks Online Credit Card Processing Fees

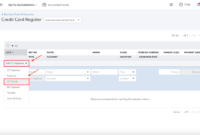

Introduction As a small business owner, you can breathe a sigh of relief knowing that you don’t have to go through the hassle of managing your finances manually. With the advent of cloud-based accounting software like QuickBooks Online (QBO), keeping track of your financial transactions has become a breeze. But what about those all-important credit card processing fees? They can be a real pain in the neck, can’t they? Don’t worry, we’ll delve into everything you need to know about QuickBooks Online’s credit card processing fees, so you can make informed decisions about your business’s financial strategy. QBO Credit Card […]

qbo credit card processing fee

QBO Credit Card Processing Fees: A Comprehensive Guide for Businesses In the digital age, credit card payments have become an indispensable part of business transactions. QuickBooks Online (QBO), a popular accounting software, offers businesses a convenient way to process credit card payments. However, it’s essential to understand the associated fees to make informed decisions. This article delves into QBO’s credit card processing fees, providing a comprehensive overview of what businesses can expect when using this platform. QBO Credit Card Processing Fees: What to Expect QBO’s credit card processing fees depend on several factors, including the chosen plan and the type […]

How Much Are Credit Card Processing Fees?

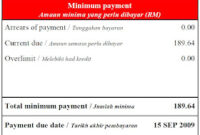

Introduction In today’s fast-paced business world, accepting credit card payments has become a necessity. Whether you’re a small mom-and-pop shop or a large corporation, offering customers the convenience of paying with plastic is essential for driving sales and staying competitive. However, with the convenience of credit card payments comes a cost: processing fees. Credit card processing fees are the charges that businesses pay to the financial institutions that handle their credit card transactions. These fees can vary widely depending on a number of factors, including the type of card being used, the transaction amount, and the business’s payment processor. So, […]

Is GoDaddy’s Payment Processing Worth It? Fees & Alternatives Explored

GoDaddy Credit Card Processing Fees: A Comprehensive Guide In today’s business landscape, accepting credit cards is essential, and finding a payment processor with competitive fees can help your business thrive. One such provider is GoDaddy. With its range of payment processing options tailored to businesses of all sizes, GoDaddy offers competitive rates to help you keep more of your hard-earned profits. Whether you’re a bustling enterprise or a budding entrepreneur, understanding credit card processing fees and how they impact your bottom line is crucial. Let’s delve deeper into the world of GoDaddy credit card processing fees. By the end of […]

How much is a Credit Card Processing Fee?

Introduction Whenever you swipe your credit card, there’s a behind-the-scenes dance of data and dollars that can leave you wondering, “How much is the credit card processing fee, and who’s taking a cut?” The answer to “who” is typically banks and payment processors, who charge fees to merchants for the convenience of accepting plastic. But the “how much” part can get complicated, involving a blend of fixed fees, percentage-based charges, and even interchange fees. Let’s dive into the world of credit card processing fees, exploring who pays them, how they’re calculated, and what merchants can do to navigate this financial […]

Bank of America Credit Card Processing Fees: Everything You Need to Know

Bank of America Credit Card Processing Fees If you’re a business owner, you know processing fees are a cost of doing business. But what exactly are Bank of America credit card processing fees, and how much will they cost you? Bank of America offers a variety of credit card processing options, so the fees you’ll pay will vary depending on the type of card you accept and the type of transaction. For example, Bank of America charges a 2.65% fee for swiped Visa and Mastercard transactions. That means that if you process $100 worth of Visa or Mastercard transactions, you’ll […]

Zero Processing Fee Credit Cards: Understanding the Benefits and Drawbacks

Zero Processing Fee Credit Cards There’s a ton of credit cards out there that will charge you a fee to process your transactions. But what if you could find a credit card that doesn’t charge a processing fee? That would be like finding a unicorn, right? Well, you’re in luck! There are actually a few credit cards out there that don’t charge a processing fee. One of them is the **[Insert Credit Card Name]** This card has no annual fee, and it doesn’t charge a processing fee on purchases. So, you can use it to make purchases anywhere, and you […]

Waive Credit Card Processing Fees

Wave Credit Card Processing Fees Whoa there! Are you looking for the lowdown on Wave credit card processing fees? You’ve come to the right place, pal. We’re going to dive deep into the numbers and give you the straight scoop on what you can expect when you use Wave to process your credit card payments. Let’s start with the basics. Wave offers two main pricing plans for credit card processing: the Starter plan and the Professional plan. The Starter plan is free to use, but it comes with a higher per-transaction fee of 2.9% + 30¢. The Professional plan costs […]