Credit card processing fees are the fees that businesses pay to credit card companies for the privilege of accepting credit cards as payment. These fees can vary depending on a number of factors, including the type of credit card, the amount of the transaction, and the business’s processing volume. Typical credit card processing fees Interchange fees: These fees are paid to the issuing bank (the bank that issued the credit card to the customer). The interchange fee is a percentage of the transaction amount, and it varies depending on the type of card and the cardholder’s country of residence. Merchant […]

BUSINESS

No Monthly Fee Credit Card Processing for Small Businesses

Credit Card Processing for Small Business: No Monthly Fee, No Problem In today’s competitive business landscape, every penny counts for small businesses. That’s why finding cost-effective solutions for essential services like credit card processing is crucial. Credit card processors with no monthly fee offer a lifeline to small businesses looking to streamline their payment processing without breaking the bank. But before you dive in, it’s essential to equip yourself with the knowledge to make an informed decision. What to Look for in a Credit Card Processor with No Monthly Fee Choosing the right credit card processor with no monthly fee […]

Lowest Credit Card Processing Fees for Small Businesses

The Lowest Credit Card Processing Fees for Small Businesses Small businesses seeking to minimize their payment processing expenses should prioritize selecting the appropriate credit card processor. With numerous providers offering a wide range of fee structures, navigating this landscape can be challenging. This comprehensive guide will provide valuable insights into the lowest credit card processing fees available, empowering small businesses to make informed decisions that optimize their financial performance. Factors Influencing Credit Card Processing Fees Several factors influence the fees associated with credit card processing, including: Transaction Volume: Processors often offer tiered pricing based on the number of transactions processed […]

elavon credit card processing fees

Elavo Credit Card Processing Fees Navigating the ever-evolving realm of credit card processing can be a daunting task, especially when grappling with the elusive quest to understand Elavo’s fee structure. These fees, like a chameleon, adapt subtly to a myriad of factors, leaving merchants scratching their heads. But fear not, intrepid explorers, for this comprehensive guide will illuminate the labyrinthine world of Elavo’s credit card processing fees, empowering you to make informed decisions that align with your business aspirations. Factors Affecting Fees Delving into the heart of Elavo’s fee structure, one discovers a constellation of variables that exert a profound […]

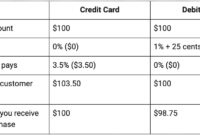

Credit Cards with Processing Fees: Making Sense of the Costs

Understanding Credit Cards with Processing Fees In today’s fast-paced world, credit cards have become an indispensable tool for financial transactions. They offer unparalleled convenience, allowing you to make purchases, pay bills, and access cash with a swipe or a tap. However, beneath this layer of convenience lies a hidden cost that many consumers are unaware of: processing fees. These fees, charged by banks and credit card companies, can add up over time, potentially eroding the benefits of using a credit card. Processing fees occur when merchants accept credit card payments. These fees cover the costs associated with processing the transaction, […]

lowest credit card processing fee

Introduction In today’s competitive market, businesses are constantly looking for ways to save money. One area where businesses can save a significant amount of money is on credit card processing fees. By finding the lowest credit card processing fees, businesses can keep more of their hard-earned profits. The average credit card processing fee is around 2.9%, but some processors charge as much as 4%. This means that for every $1,000 in sales, a business could be paying up to $40 in processing fees. Over time, these fees can add up to a significant amount of money. Finding the lowest credit […]

Heartland Credit Card Processing Fees: A Comprehensive Guide

Overview Heartland Payment Systems, a renowned provider of payment processing solutions, offers a vast array of services tailored to the unique needs of businesses. Among its suite of offerings, Heartland’s credit card processing stands out with its robust features and a flexible fee structure. This article delves into the intricacies of Heartland’s credit card processing fees, providing a comprehensive guide to help businesses make informed decisions about their payment processing needs. Heartland’s credit card processing fees encompass various components, each meticulously designed to align with the specific requirements of different businesses. Understanding these fees is paramount for businesses seeking to […]

Small Business Credit Card Processing Fees

Small businesses often rely on credit card payments to process customer transactions. However, there are fees associated with credit card processing that can eat into your profits. Understanding these fees is essential for managing your cash flow and ensuring your business remains profitable. Types of Credit Card Processing Fees Transaction Fees: Per-transaction fees are charged by the credit card network (e.g., Visa, Mastercard) and the payment processor. They typically range from 1.5% to 3.5% of the transaction amount. Interchange Fees: These fees are charged by the card-issuing bank to the merchant’s acquiring bank. Interchange fees vary depending on the card […]

Understanding QuickBooks Online Credit Card Processing Fees

QBO Credit Card Processing Fees: A Comprehensive Guide If you’re a business owner accepting credit cards, you’re probably familiar with the term "processing fees." These fees are charged by payment processors to cover the costs of authorizing, processing, and settling credit card transactions. QBO, a popular accounting software for small businesses and freelancers, also offers credit card processing services. But how do QBO’s fees compare to those of other payment processors? QBO Credit Card Processing Fees QBO’s credit card processing fees vary depending on the plan you choose. The Basic plan, which costs $30 per month, includes a 2.9% + […]