Merchant Cash Advance Overview

For business owners seeking immediate financial assistance, merchant cash advances have emerged as a popular financing tool. Provided by specialized lenders known as merchant cash advance providers, these short-term loans offer a lifeline to businesses in need of swift access to funds. In exchange for a percentage of their future sales, businesses can secure a lump-sum advance, typically ranging from $2,000 to $250,000. This flexibility has made merchant cash advances an attractive option for businesses of all sizes, particularly those with limited access to traditional bank loans.

Unlike traditional loans, merchant cash advances do not require collateral or a lengthy application process. Instead, lenders assess the business’s financial health by reviewing its bank statements and sales data. This expedited process allows businesses to access funding within a matter of days, making merchant cash advances a viable solution for time-sensitive situations. Additionally, there are no fixed repayment terms, as the advance is automatically deducted from the business’s future sales. This eliminates the need for monthly payments and provides businesses with flexibility in managing their cash flow.

However, it’s important to note that merchant cash advances come with higher interest rates compared to traditional loans. This increased cost should be carefully considered before taking out a merchant cash advance. It’s crucial for businesses to assess their financial situation and determine if the benefits of a merchant cash advance outweigh the costs.

Key Considerations for Merchant Cash Advances

Before pursuing a merchant cash advance, it’s essential for businesses to thoroughly understand the terms and conditions. The repayment structure, including the percentage of future sales to be deducted, should be clearly outlined in the agreement. Additionally, any fees associated with the advance, such as origination fees, should be factored into the cost analysis.

It’s equally important to assess the business’s financial health and ability to repay the advance. Merchant cash advances are best suited for businesses with a consistent and predictable stream of sales. Businesses with fluctuating sales or seasonal revenue patterns may encounter challenges in repaying the advance reliably.

Seeking advice from a qualified financial advisor can provide valuable guidance in navigating the complexities of merchant cash advances. They can assist businesses in evaluating their financial situation, determining the suitability of a merchant cash advance, and negotiating favorable terms with lenders.

Advantages and Disadvantages of Merchant Cash Advances

Merchant cash advances offer several advantages, including their quick and easy application process, minimal documentation requirements, and flexibility in repayment. These benefits make them an attractive option for businesses in need of immediate funding. However, it’s crucial to weigh these advantages against the potential drawbacks.

One of the main disadvantages of merchant cash advances is their higher interest rates compared to traditional loans. This increased cost should be carefully considered before taking out a merchant cash advance. It’s essential for businesses to assess their financial situation and determine if the benefits of a merchant cash advance outweigh the costs.

Another potential disadvantage of merchant cash advances is their impact on the business’s cash flow. The advance is deducted from the business’s future sales, which can strain cash flow, especially during slow periods. Businesses should ensure they have sufficient cash on hand to cover operating expenses and unexpected costs while repaying the advance.

Alternative Financing Options for Businesses

In addition to merchant cash advances, there are a variety of other financing options available to businesses. These include traditional bank loans, lines of credit, and equipment leasing. Each option has its own advantages and disadvantages, and the best choice depends on the specific needs of the business.

Traditional bank loans are typically long-term loans with fixed interest rates and monthly payments. The application process can be lengthy and requires extensive documentation, including financial statements and business plans. However, bank loans often offer lower interest rates compared to merchant cash advances.

Lines of credit provide businesses with access to a pool of funds that can be drawn upon as needed. This flexibility can be beneficial for businesses with fluctuating sales or seasonal revenue patterns. However, lines of credit may come with higher interest rates than bank loans.

Equipment leasing allows businesses to acquire equipment without making a large upfront purchase. Instead, businesses make monthly payments over the term of the lease. Equipment leasing can be a cost-effective way to acquire necessary equipment without straining cash flow.

Merchant Cash Advance Providers: A Lifeline for Businesses in Need

Merchant cash advance providers have become a lifeline for businesses in need of quick and easy access to capital. These providers offer short-term, high-risk loans to businesses that may not qualify for traditional bank loans. With a merchant cash advance, businesses can get the funding they need to cover unexpected expenses, purchase new equipment, or expand their operations.

Types of Merchant Cash Advance Providers

Traditional Merchant Cash Advance Providers

Traditional merchant cash advance providers are typically banks or other financial institutions that offer these loans as part of their suite of small business lending products. Traditional merchant cash advance providers typically have stricter lending criteria than alternative providers, and they may require businesses to have a good credit history and strong cash flow. However, traditional merchant cash advance providers often offer lower interest rates and more flexible repayment terms than alternative providers.

Alternative Merchant Cash Advance Providers

Alternative merchant cash advance providers are typically private companies that offer these loans to businesses that may not qualify for traditional bank loans. These providers offer short-term, high-risk loans to businesses with less-than-perfect credit. An alternative merchant cash advance provider will take a business’s monthly credit card sales and offer a lump sum advance ranging from $5,000 to $250,000 or more. The alternative merchant cash advance provider will then add a fixed markup to the outstanding balance. The business repays the loan by allowing the alternative merchant cash advance provider to debit their merchant account a daily or weekly percentage of the business’s credit card sales. The provider continues to debit the business’s merchant account until the advance and the markup are repaid in full

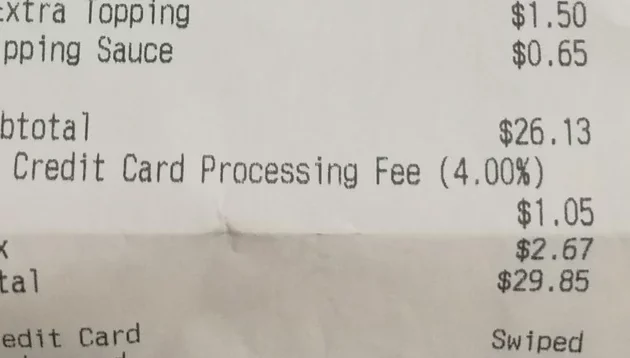

Alternative Merchant cash advance providers typically have less stringent lending criteria than traditional providers. The interest rates, fees and repayment terms for an alternative merchant cash advance are not subject to state usury laws, and vary widely among providers. Alternative merchant cash advance providers may charge higher interest rates than traditional providers. The interest rate of an alternative merchant cash advance is often disguised by the use of a “factor rate” or “discount rate”, which magnifies the actual cost of the advance, and can range from 1.14 – 1.50 for every dollar advanced. At a factor rate of 1.25, a business that receives an advance of $25,000 would repay $31,250 including a $6,250 fee

Merchant Cash Advance Providers

If you’re a business owner in need of quick cash, you may have considered a merchant cash advance. Merchant cash advances are short-term loans that are repaid as a percentage of your daily credit card sales. This type of financing can be a good option for businesses that need quick access to capital and don’t have the time or credit history to qualify for a traditional loan.

There are a number of merchant cash advance providers in the market, so it’s important to do your research before choosing one. Here are a few things to keep in mind when comparing merchant cash advance providers:

-

Rates and fees: Merchant cash advance rates and fees can vary significantly from one provider to another. Be sure to compare the rates and fees of several providers before making a decision.

-

Repayment terms: Merchant cash advances are typically repaid as a percentage of your daily credit card sales. The repayment term will vary depending on the provider and the amount of money you borrow.

-

Customer service: It’s important to choose a merchant cash advance provider that has good customer service. This will ensure that you can get help if you have any questions or problems with your loan.

Benefits of Using a Merchant Cash Advance

Merchant cash advances can provide a number of benefits for businesses, including:

Quick access to capital

Merchant cash advances can be a good option for businesses that need quick access to capital. The application process is typically quick and easy, and you can receive your funds within a few days.

No need for collateral

Merchant cash advances are unsecured loans, which means that you don’t need to put up any collateral. This can be a major advantage for businesses that don’t have any assets to use as collateral.

Flexible repayment terms

Merchant cash advances have flexible repayment terms that can be tailored to your business’s needs. This can make it easier to manage your cash flow and avoid defaulting on your loan.

Cons of Using a Merchant Cash Advance

Merchant cash advances can also have some drawbacks, including:

High interest rates

Merchant cash advances typically have high interest rates, which can make them an expensive form of financing.

Short repayment terms

Merchant cash advances typically have short repayment terms, which can make it difficult to manage your cash flow.

Can damage your credit

If you default on your merchant cash advance, it can damage your credit score. This can make it difficult to qualify for other forms of financing in the future.

Is a Merchant Cash Advance Right for Your Business?

Merchant cash advances can be a good option for businesses that need quick access to capital and don’t have the time or credit history to qualify for a traditional loan. However, it’s important to weigh the benefits and drawbacks of merchant cash advances before making a decision. If you’re not sure whether a merchant cash advance is right for your business, you should talk to a financial advisor.

Merchant Cash Advance Providers: A Lifeline for Businesses in Need

In today’s competitive business landscape, accessing quick and flexible financing can be a game-changer. That’s where merchant cash advance providers step in, offering a lifeline to businesses seeking financial support. These providers offer a unique financing solution that can help businesses overcome cash flow hurdles and unlock growth opportunities.

Considerations Before Getting a Merchant Cash Advance

Before taking the plunge and securing a merchant cash advance, businesses should carefully weigh several key considerations:

The Cost of the Advance

Merchant cash advances come with fees, including a factor rate that determines the total cost of financing. Evaluating these fees in advance is crucial, ensuring that businesses fully understand the financial implications of the advance.

The Repayment Terms

The repayment schedule should align with the business’s cash flow patterns. Repayments are typically made as a percentage of daily credit card sales, ensuring that businesses repay the advance at a pace that does not strain their operations.

The Impact on Cash Flow

While merchant cash advances provide immediate access to funds, it’s essential to assess their potential impact on cash flow. If repayments are not managed carefully, they can disrupt the business’s day-to-day operations. Therefore, businesses must have a clear understanding of how the advance will affect their ability to meet ongoing expenses.

Unpacking the Impact on Cash Flow: A Closer Look

The impact of a merchant cash advance on cash flow can be multifaceted. Here’s a detailed breakdown of what businesses should consider:

Immediate Cash Infusion vs. Long-Term Burden

A merchant cash advance can provide a much-needed cash injection, easing immediate financial pressures. However, it’s important to remember that the advance must be repaid over time, which can potentially create an ongoing financial burden. Businesses should ensure that the benefits of the advance outweigh the potential long-term costs.

Seasonality and Fluctuations in Sales

Seasonal businesses or those experiencing unpredictable sales fluctuations may face challenges in managing repayments. They should carefully consider how the advance will impact their cash flow during lean periods and ensure they have a contingency plan in place to avoid cash flow disruptions.

Repayment Flexibility vs. Fixed Obligations

Unlike traditional loans, merchant cash advances offer some flexibility in repayment. However, repayments are still tied to daily credit card sales, which can limit a business’s ability to make large purchases or invest in growth opportunities. Businesses should weigh the benefits of flexible repayments against the potential constraints.

Impact on Creditworthiness

While merchant cash advances typically do not affect a business’s credit score, they can have other implications for creditworthiness. If repayments are not made on time, it can damage the business’s reputation with lenders and make it more difficult to secure future financing.

Merchant Cash Advance Providers: A Lifeline for Businesses in Need

In today’s fast-paced business environment, accessing quick and flexible financing is often crucial for growth and success. For many small businesses, merchant cash advances (MCAs) have emerged as a popular solution. MCAs provide businesses with an advance on their future credit card sales, offering a much-needed cash infusion to cover expenses, expand operations, or seize new opportunities.

Merchant cash advance providers play a vital role in connecting businesses with this valuable source of funding. They assess a business’s creditworthiness and future sales potential to determine the amount and terms of the advance. However, it’s important to remember that MCAs come with higher interest rates and fees compared to traditional bank loans.

Alternatives to Merchant Cash Advances

While MCAs can be a quick and convenient financing option, it’s worth exploring alternative options that may better suit your business’s needs and financial状況. Here are some popular alternatives to consider:

Small Business Loans

Traditional bank loans offer businesses a more structured and long-term financing solution. Small business loans typically have lower interest rates than MCAs, but they also require a more stringent application process, including a thorough credit check and business plan.

Lines of Credit

A line of credit provides businesses with a flexible way to access funds on an as-needed basis. Lines of credit offer a fixed amount of money that businesses can draw from and repay over time, subject to interest and fees.

Invoice Factoring

Invoice factoring involves selling unpaid invoices to a factoring company in exchange for an immediate cash advance. This option can be especially beneficial for businesses with a high volume of invoices and long payment terms.

Choosing the Right Option

The best financing option for your business will depend on your specific circumstances and financial goals. Consider the following factors when evaluating your options:

- Amount of funding needed: How much money do you need to cover your expenses or fuel growth?

- Repayment terms: What is the length of time you need to repay the funds?

- Interest rates and fees: Carefully compare the interest rates and fees associated with different financing options.

- Eligibility requirements: Review the eligibility requirements and application process for each option to ensure you meet the criteria.

- Impact on credit: Some financing options may have a negative impact on your business’s credit score.

Conclusion

Merchant cash advance providers fill a critical gap in the financing market for small businesses. However, it’s essential to thoroughly research and consider alternative options that may offer a better fit for your business’s financial situation and long-term goals. By carefully weighing your options and choosing the right financing solution, you can position your business for success and growth.