Introduction

In the realm of business financing, merchant cash advances (MCAs) have emerged as a lifeline for countless enterprises seeking a quick and convenient infusion of capital. Unlike traditional loans, MCAs offer a unique approach to financing, providing businesses with a lump sum of cash in exchange for a percentage of their future sales. This innovative funding option has gained immense popularity among businesses of all sizes, particularly those with immediate cash flow needs.

To effectively manage the complexities of MCA financing, businesses require a robust customer relationship management (CRM) system tailored specifically to the nuances of this industry. A specialized merchant cash advance CRM, such as [CRM Name], empowers businesses to streamline their MCA operations, foster stronger relationships with clients, and maximize their return on investment.

Merchant Cash Advance vs. Traditional Loans: A Comparative Analysis

To fully appreciate the unique attributes of merchant cash advances, it is essential to draw a comparison with traditional loans. Unlike traditional loans, which are typically secured by collateral and involve a lengthy application process, MCAs offer a more flexible and accessible alternative. The approval process for MCAs is often less stringent, with a focus on the business’s cash flow potential rather than its credit history. This makes MCAs an attractive option for businesses with limited collateral or those seeking a faster funding solution.

Another key distinction between MCAs and traditional loans lies in their repayment structure. MCAs are repaid as a percentage of the business’s daily sales, providing a degree of flexibility that is not available with traditional loans. This structure allows businesses to align their repayment schedule with their revenue flow, ensuring that they do not face undue financial strain.

The Role of a Merchant Cash Advance CRM in Business Success

In the competitive landscape of today’s business world, leveraging the power of technology is paramount. A merchant cash advance CRM serves as an invaluable tool for businesses looking to optimize their MCA operations. This specialized software provides a centralized platform for managing all aspects of the MCA lifecycle, from lead generation and underwriting to ongoing account management and reporting.

With a merchant cash advance CRM, businesses can streamline their workflow, improve communication with clients, and gain valuable insights into their MCA performance. This comprehensive approach not only enhances operational efficiency but also empowers businesses to make informed decisions that drive long-term success.

Key Features of a Merchant Cash Advance CRM

When selecting a merchant cash advance CRM, it is crucial to consider the specific features that align with the unique needs of your business. Some of the key features to look for include:

- Lead management: A robust lead management module allows businesses to capture, track, and nurture leads throughout the sales pipeline.

- Underwriting automation: Automated underwriting tools streamline the approval process, enabling businesses to make quick and informed decisions.

- Client relationship management: A dedicated CRM module helps businesses build strong relationships with clients, providing a personalized experience.

- Reporting and analytics: Comprehensive reporting capabilities provide businesses with valuable insights into their MCA performance, allowing them to make data-driven decisions.

- Integration with other systems: The ability to integrate with other business systems, such as accounting software, ensures a seamless workflow.

The Benefits of Using a Merchant Cash Advance CRM

The implementation of a merchant cash advance CRM offers a multitude of benefits that can positively impact a business’s operations and financial performance. Some of the key benefits include:

- Increased efficiency: Streamlining the MCA lifecycle through a centralized platform enhances operational efficiency, freeing up time and resources.

- Improved client relationships: A dedicated CRM module fosters stronger client relationships, leading to increased customer satisfaction and loyalty.

- Data-driven decision-making: Robust reporting and analytics capabilities provide businesses with valuable insights into their MCA performance, enabling them to make informed decisions that drive growth.

- Competitive advantage: By leveraging the power of a specialized CRM, businesses gain a competitive edge by optimizing their MCA operations and enhancing their overall profitability.

Conclusion

In conclusion, merchant cash advances have revolutionized the business financing landscape, providing businesses with a flexible and accessible alternative to traditional loans. However, to fully harness the potential of MCAs, businesses must embrace the power of technology through specialized merchant cash advance CRMs. These tools empower businesses to streamline their operations, strengthen client relationships, and gain a competitive advantage. By investing in a robust CRM solution, businesses can unlock the full potential of merchant cash advances and drive their businesses towards lasting success.

Why MCAs Are Bad

Merchant cash advances, more affectionately known as MCAs, are a notorious type of business funding that has garnered a less-than-stellar reputation. Despite being deceptively marketed as a straightforward solution for businesses seeking quick access to capital, MCAs often come with a laundry list of hidden costs and predatory terms that can leave business owners drowning in debt. In this exposé, we’ll delve into the murky depths of MCAs, shedding light on their questionable practices and why they’re often considered the financial equivalent of a wolf in sheep’s clothing.

How MCAs Work

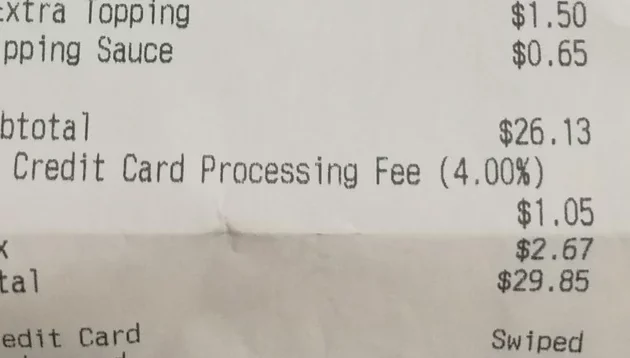

MCAs function like a cash advance secured against your business’s future revenue. Lenders typically advance you a lump sum of cash, which you’re expected to repay through a hefty percentage of your daily credit card sales – often ranging from 10% to 20% or even more. This repayment structure is where MCAs get their claws into you. Unlike traditional loans with fixed monthly payments, MCAs fluctuate with your sales. So, when your business is booming, so too are your MCA repayments. But when sales dip – as they inevitably do from time to time – you’re still on the hook for those hefty daily payments, which can quickly snowball into an unsustainable burden.

To put it into perspective, imagine you’re a small business owner with unpredictable cash flow. You take out an MCA for $20,000, and the lender demands a 15% daily repayment rate. On a good day, when sales are strong, you might repay $300-$400. But on a slow day, you could end up paying as little as $50. This wildly fluctuating repayment schedule makes it incredibly challenging to manage your cash flow and budget effectively, potentially leading to late payments and additional fees.

Furthermore, MCAs often come with sky-high interest rates and additional fees that can add thousands of dollars to your overall repayment costs. These fees can include origination fees, processing fees, late payment fees, and even termination fees if you decide to end the agreement early. It’s like getting hit with a barrage of hidden charges that can quickly drain your business’s financial reserves.

Merchant Cash Advance CRM: A Comprehensive Guide for Streamlining Your MCA Operations

In the fast-paced business world, securing access to capital is crucial for growth and success. Merchant cash advances (MCAs) have emerged as a popular financing option for businesses seeking quick and flexible funding. To maximize the potential of your MCA operations, leveraging a specialized merchant cash advance CRM can be an invaluable tool.

What is a Merchant Cash Advance CRM?

A merchant cash advance (MCA) CRM is a software solution designed specifically for businesses offering MCA services. It provides a centralized platform for managing all aspects of the MCA lifecycle, from lead generation and underwriting to repayment tracking and customer relationships.

Benefits of Merchant Cash Advance CRMs

Deploying a merchant cash advance CRM can revolutionize your MCA operations, delivering numerous benefits that can streamline processes, enhance efficiency, and drive revenue growth.

- Streamlined Lead Management: Manage leads effectively from initial contact to closure. Track lead sources, qualify prospects, and assign leads to appropriate team members for follow-up.

- Automated Underwriting: Accelerate the underwriting process with automated underwriting tools. Utilize pre-defined underwriting criteria to assess applicant eligibility, reducing manual effort and speeding up decision-making.

- Efficient Repayment Tracking: Keep track of repayments accurately and effortlessly. Automate payment processing, track payment status, and generate timely reports for easy reconciliation.

- Enhanced Customer Relationships: Build and maintain strong relationships with your MCA customers. Centralize customer information, track interactions, and provide personalized support to foster loyalty and repeat business.

Choosing the Right Merchant Cash Advance CRM

When selecting a merchant cash advance CRM, consider the following factors to ensure it meets the unique needs of your business:

- Features and Functionality: Assess the CRM’s features to ensure they align with your specific requirements. Consider lead management tools, underwriting capabilities, repayment tracking functionality, and customer relationship management features.

- Integration Capabilities: Choose a CRM that integrates seamlessly with your existing systems, such as accounting software, payment gateways, and other business applications. Seamless integration eliminates manual data entry and ensures data accuracy.

- Scalability and Flexibility: Select a CRM that can scale with your growing business. Look for solutions that offer flexible pricing plans, allow for customization, and support future expansion needs.

How a Merchant Cash Advance CRM Can Transform Your Business

Implementing a merchant cash advance CRM can transform your MCA operations by:

- Increasing Efficiency: Automating tasks and streamlining processes frees up your team to focus on more strategic initiatives.

- Improving Accuracy: Reduce errors associated with manual data entry and ensure accuracy across all aspects of your MCA operations.

- Enhancing Customer Service: Provide personalized and timely support to your customers, building stronger relationships and increasing customer satisfaction.

- Driving Revenue Growth: Streamlined operations and improved efficiency lead to increased sales and profitability.

Conclusion

By leveraging a merchant cash advance CRM, you empower your business with the tools necessary to streamline MCA operations, enhance efficiency, and drive revenue growth. Invest in the right CRM and watch your business soar to new heights.

How Merchant Cash Advance CRM Can Help You Overcome Challenges

Merchant cash advances (MCAs) can be a lifesaver for businesses that need a quick infusion of cash. They’re easy to get, and you can use the money for anything you want. However, MCAs can also come with some challenges, such as high interest rates and short repayment terms.

That’s where a merchant cash advance CRM can come in handy. These systems can help you manage your MCA repayments, track your progress, and avoid costly mistakes. Here’s how:

MCA CRM Can Help You Manage Repayments

One of the biggest challenges of MCAs is managing the repayments. The payments are often due on a daily or weekly basis, and they can be difficult to keep up with. A merchant cash advance CRM can help you automate your repayments, so you don’t have to worry about missing a payment.

The CRM will also help you track your progress on your MCA repayments. You can see how much you’ve paid off, how much you still owe, and when your next payment is due. This information can help you stay on track and avoid falling behind.

CRM Can Help You Avoid Costly Mistakes

Another challenge of MCAs is the potential for costly mistakes. If you’re not careful, you can end up paying more than you intended on your MCA. A merchant cash advance CRM can help you avoid these mistakes.

The CRM will help you track your MCA costs, so you can see how much you’re paying in interest and fees. This information can help you make informed decisions about your MCA, and avoid paying more than you have to.

CRM Can Help You Get the Most Out of Your MCA

A merchant cash advance CRM can also help you get the most out of your MCA. The CRM can help you track your sales and cash flow, so you can see how your MCA is impacting your business.

This information can help you make adjustments to your MCA, so you can get the most out of it. For example, if you see that your MCA is helping you increase your sales, you may want to consider increasing your MCA amount.

Challenges of MCAs

MCAs can be a great way to get quick cash for your business. However, they can also come with some challenges, such as:

- High interest rates

- Short repayment terms

- Potential for costly mistakes

If you’re considering an MCA, it’s important to weigh the benefits and challenges carefully. A merchant cash advance CRM can help you overcome these challenges and get the most out of your MCA.

Conclusion

Merchant cash advances can be a great way to get quick cash for your business. However, they can also come with some challenges. A merchant cash advance CRM can help you overcome these challenges and get the most out of your MCA.

If you’re considering an MCA, be sure to do your research and talk to a qualified financial advisor. A CRM can help you manage your MCA repayments, track your progress, and avoid costly mistakes.

Merchant Cash Advance CRM: The Secret Weapon for Business Growth

Managing your merchant cash advance business just got a whole lot easier with the latest merchant cash advance CRM software. These cutting-edge solutions streamline your operations, automate tasks, and empower you with critical data to make well-informed decisions. But what if you don’t know where to start? Not to worry, this in-depth guide will navigate you through the world of merchant cash advance CRMs, highlighting their benefits, key features, and how to choose the perfect one for your business.

Merchant cash advances (MCAs) have become increasingly popular among small businesses seeking quick and flexible funding. Unlike traditional bank loans, MCAs provide access to cash based on your future sales, offering a lifeline for businesses facing challenges accessing traditional financing. However, managing an MCA portfolio can be a complex task, requiring you to juggle multiple contracts, track payments, and monitor performance.

Enter merchant cash advance CRM software. These specialized CRMs are designed to streamline every aspect of your MCA business, from lead generation to underwriting and servicing. They automate repetitive tasks, centralize data, and provide real-time insights, empowering you to manage your portfolio efficiently and grow your business.

Key Features to Look for in a Merchant Cash Advance CRM

When choosing a merchant cash advance CRM, there are several key features to consider:

- Lead management: Track leads, qualify them, and nurture relationships through automated workflows.

- Underwriting and approval: Streamline the underwriting process, automate risk assessments, and make informed decisions.

- Portfolio management: Centralize all your MCA contracts, track payments, and manage delinquencies.

- Reporting and analytics: Generate custom reports, analyze performance trends, and identify growth opportunities.

- Customer relationship management: Manage customer interactions, provide support, and build lasting relationships.

Benefits of Using a Merchant Cash Advance CRM

A merchant cash advance CRM can unlock a treasure trove of benefits for your business:

- Increased efficiency: Automate tasks, streamline processes, and save time.

- Improved accuracy: Reduce errors and ensure data integrity throughout your operations.

- Enhanced visibility: Get a real-time view of your portfolio, performance, and customer interactions.

- Better decision-making: Make informed decisions based on data-driven insights.

- Increased revenue: Identify new opportunities and grow your MCA portfolio.

How to Choose the Right Merchant Cash Advance CRM for Your Business

Selecting the right merchant cash advance CRM is crucial for maximizing its benefits. Here are some factors to consider:

- Your business size and needs: Choose a CRM that aligns with your current and future business requirements.

- Features and functionality: Identify the specific features you need to streamline your operations.

- Ease of use: Opt for a CRM with a user-friendly interface and intuitive navigation.

- Integration with other systems: Ensure the CRM integrates seamlessly with your existing software.

- Price and support: Factor in the cost and level of support offered by the vendor.

Alternatives to MCAs

If MCAs are not the right fit for your business, there are a number of other financing options available, such as:

- Traditional bank loans: Provide long-term financing with fixed interest rates, but may require collateral and a strong credit history.

- SBA loans: Government-backed loans with favorable terms, but can be time-consuming to obtain.

- Equity financing: Involves selling a portion of your business to investors in exchange for capital, but can dilute your ownership.

- Invoice factoring: Provides immediate cash advances based on your outstanding invoices, but can be expensive.

- Business lines of credit: Offer flexible access to funds as needed, but may require personal guarantees.

Ultimately, the best financing option for your business depends on your individual circumstances and financial goals. Carefully consider each option and consult with a financial advisor to make the right choice.

Conclusion

Merchant cash advance CRMs are powerful tools that can revolutionize the way you manage your MCA business. By automating tasks, centralizing data, and providing valuable insights, these CRMs empower you to streamline operations, make informed decisions, and grow your revenue. By carefully considering your business needs and selecting the right CRM, you can unlock the full potential of your MCA portfolio and achieve long-term success.

Merchant Cash Advance CRM: A Lifeline for Small Businesses

In today’s fast-paced business environment, small businesses are facing unprecedented challenges. From rising costs to increased competition, it can be tough to keep up. That’s where merchant cash advance (MCA) providers step in. These companies offer short-term loans to businesses, helping them bridge the gap between expenses and revenue. But with so many MCA providers to choose from, it can be hard to know where to start. That’s where our comprehensive merchant cash advance CRM comes in.

Our CRM is designed to help businesses find the right MCA provider for their needs. We compare interest rates, repayment terms, and fees from multiple providers, so you can make an informed decision. We also provide valuable insights into the MCA industry, helping you avoid costly mistakes. With our CRM, you can streamline the MCA application process and get the funding you need, fast. It’s the perfect tool for small businesses looking to take their business to the next level.

Choosing the Right MCA Provider

Choosing the right MCA provider is essential for getting the best deal on your loan. Here are a few things to keep in mind when comparing providers:

- Interest rates: Interest rates on MCAs can vary significantly, so it’s important to compare rates from multiple providers before making a decision.

- Repayment terms: Repayment terms for MCAs can also vary, so you’ll need to choose a provider that offers terms that work for your business.

- Fees: MCA providers may charge a variety of fees, including origination fees, processing fees, and late payment fees. It’s important to compare fees from multiple providers to avoid getting hit with unexpected costs.

- Ease of use: The CRM should be easy to use, even for non-technical users.

- Features: The CRM should offer a variety of features, such as payment tracking, balance monitoring, and reporting.

- Integration: The CRM should integrate with your other business software, such as your accounting software and your payment processor.

- Cost: The CRM should be affordable for your business.

- Save time and money: A CRM can help you automate tasks, such as sending reminders and generating invoices. This can save you a lot of time and money.

- Improve customer service: A CRM can help you track customer interactions and provide better customer service.

- Increase sales: A CRM can help you identify opportunities to increase sales.

- Make better decisions: A CRM can provide you with valuable insights into your business, helping you make better decisions.

- Centralized Platform: An MCA CRM serves as a central hub for managing all your MCA activities. You can store loan details, track repayments, and monitor performance all in one place.

- Streamlined Applications: No more juggling multiple loan applications. With an MCA CRM, you can easily compare different offers and apply for financing with just a few clicks.

- Automated Repayments: An MCA CRM automates your loan repayments, ensuring you never miss a payment and avoid late fees.

- Real-time Tracking: Monitor the status of your loan applications, track repayments, and stay informed about any pending actions in real time.

- Enhanced Reporting: Generate detailed reports on your MCA activities, including loan performance, repayment schedules, and financial statements.

- Improved Customer Service: An MCA CRM provides a secure platform for communication with your lenders, ensuring prompt support and quick resolution of any issues.

- Features: Make sure the CRM offers the features you need, such as loan management, automated repayments, and reporting.

- Integration: Choose a CRM that integrates with your existing business systems, such as accounting software and payment gateways.

- Security: Ensure the CRM meets industry-standard security protocols to protect your sensitive financial data.

- Cost: Consider the cost of the CRM and choose one that aligns with your budget.

- Support: Look for a CRM provider that offers reliable support and can help you maximize the benefits of the software.

- Choose the right CRM: Conduct thorough research and choose an MCA CRM that meets your specific needs.

- Onboard your team: Get your team on board with the CRM and provide training on its features and functionality.

- Integrate with your systems: Integrate the CRM with your existing business systems to ensure seamless data flow.

- Set up automation: Automate repetitive tasks, such as loan applications and repayments, to streamline your workflows.

- Monitor and adjust: Regularly monitor the performance of your CRM and adjust settings as needed to optimize its effectiveness.

Finding the Best MCA CRM

Once you’ve chosen an MCA provider, you’ll need to find a CRM that can help you manage your MCA account. A good MCA CRM will allow you to track your payments, monitor your balance, and generate reports. It can also help you automate tasks, such as sending reminders and generating invoices.

When choosing an MCA CRM, it’s important to consider the following factors:

Merchant Cash Advance: A Game-Changer for Small Businesses

Merchant cash advances can be a game-changer for small businesses. They provide quick and easy access to capital, without the hassle of a traditional bank loan. However, it’s important to choose the right MCA provider and CRM to get the best deal on your loan. With our comprehensive merchant cash advance CRM, you can compare interest rates, repayment terms, and fees from multiple providers, so you can make an informed decision. We also provide valuable insights into the MCA industry, helping you avoid costly mistakes. With our CRM, you can streamline the MCA application process and get the funding you need, fast. It’s the perfect tool for small businesses looking to take their business to the next level.

Benefits of Using Merchant Cash Advance CRM

There are many benefits to using a merchant cash advance CRM. These benefits include:

Conclusion

Merchant cash advances can be a valuable tool for small businesses. However, it’s important to choose the right MCA provider and CRM to get the best deal on your loan. Our comprehensive merchant cash advance CRM can help you compare interest rates, repayment terms, and fees from multiple providers, so you can make an informed decision. We also provide valuable insights into the MCA industry, helping you avoid costly mistakes. With our CRM, you can streamline the MCA application process and get the funding you need, fast. It’s the perfect tool for small businesses looking to take their business to the next level.

Merchant Cash Advance CRM: The Ultimate Guide for Businesses Seeking Fast Funding

In today’s fast-paced business environment, every minute counts. When you’re facing an urgent need for capital, a merchant cash advance (MCA) can be a lifesaver. These short-term loans are designed to provide businesses with quick access to cash in exchange for a percentage of future sales. But navigating the complex world of MCAs can be tricky. That’s where a merchant cash advance CRM comes in handy.

An MCA CRM streamlines the entire MCA process, from initial application to post-funding support. With a comprehensive CRM in place, you can manage multiple MCA providers, track loan details, monitor repayments, and stay organized throughout the lifecycle of each loan.

So, if you’re considering an MCA to fuel your business growth, don’t go it alone. Invest in an MCA CRM and reap the countless benefits it offers. Trust us, it’s an investment that will pay dividends down the road.

Benefits of Using a Merchant Cash Advance CRM

The benefits of using a merchant cash advance CRM are numerous. Here’s a closer look at some of the key advantages:

Choosing the Right Merchant Cash Advance CRM

Not all MCA CRMs are created equal. When choosing one for your business, consider the following factors:

How to Implement a Merchant Cash Advance CRM

Implementing an MCA CRM is a straightforward process. Here are the steps you should follow:

Conclusion

Merchant cash advances can be a valuable financing option for businesses looking for quick access to capital. However, it is important to weigh the benefits and challenges of MCAs before making a decision. By investing in a merchant cash advance CRM, you can streamline the entire MCA process, minimize risks, and maximize the benefits.

So, if you’re ready to take your business to the next level with an MCA, make sure to choose the right CRM to support your journey.