Merchant Cash Advance Companies Near Me

If you’re a business owner in need of quick funding, you may have considered a merchant cash advance. But how do merchant cash advances work? And are they right for your business? In this article, we’ll take a closer look at merchant cash advances and help you decide if they’re a good option for you.

How Merchant Cash Advances Work

A merchant cash advance is a short-term loan that’s based on your business’s future sales. Unlike traditional loans, which are based on your creditworthiness and assets, merchant cash advances are based on your business’s sales volume. This means you can qualify for a merchant cash advance even if you have bad credit or no assets.

To get a merchant cash advance, you’ll need to provide the lender with your business’s financial information, including your sales volume and bank statements. The lender will then review your information and determine how much money you’re eligible to borrow.

Once you’re approved for a merchant cash advance, you’ll receive a lump sum of money. You’ll then repay the loan by making daily or weekly payments from your business’s bank account. The amount of your payments will be based on a percentage of your sales.

Merchant cash advances can be a good option for businesses that need quick funding. They’re also a good option for businesses that have bad credit or no assets. However, it’s important to note that merchant cash advances can be expensive. The interest rates on merchant cash advances are typically higher than the interest rates on traditional loans.

If you’re considering a merchant cash advance, it’s important to compare the costs and benefits carefully. You should also make sure you understand the terms of the loan before you sign anything.

Pros and Cons of Merchant Cash Advances

There are both pros and cons to merchant cash advances. Here are some of the pros:

·Quick and easy to get approved

·No need for good credit or assets

·Can be used for any business purpose

·Flexible repayment terms

Here are some of the cons:

·High interest rates

·Short repayment terms

·Can be difficult to qualify for large amounts of money

Is a Merchant Cash Advance Right for Your Business?

Whether or not a merchant cash advance is right for your business depends on your individual circumstances. If you need quick funding and have bad credit or no assets, a merchant cash advance may be a good option for you. However, if you can qualify for a traditional loan with a lower interest rate, that may be a better option for you.

Ultimately, the decision of whether or not to get a merchant cash advance is a personal one. You should carefully consider the pros and cons before making a decision.

How to Find a Merchant Cash Advance Lender

If you’re interested in getting a merchant cash advance, there are a few things you should do to find a lender. First, you should compare the interest rates and fees of different lenders. You should also make sure you understand the terms of the loan before you sign anything.

Once you’ve found a lender, you’ll need to provide them with your business’s financial information. The lender will then review your information and determine how much money you’re eligible to borrow.

If you’re approved for a merchant cash advance, you’ll receive a lump sum of money. You’ll then repay the loan by making daily or weekly payments from your business’s bank account. The amount of your payments will be based on a percentage of your sales.

Merchant cash advances can be a good option for businesses that need quick funding. However, it’s important to compare the costs and benefits carefully. You should also make sure you understand the terms of the loan before you sign anything.

Merchant Cash Advance Companies Near Me: A Comprehensive Guide

Are you a business owner in need of quick and flexible financing? If so, you may want to consider a merchant cash advance (MCA). Merchant cash advances are short-term loans that are repaid through a percentage of your credit card sales. They can be a great option for businesses that need fast funding and don’t have the time or qualifications for a traditional bank loan.

In this article, we’ll take a closer look at merchant cash advances, including their benefits, how they work, and how to find the best merchant cash advance companies near me.

Benefits of Merchant Cash Advances

Merchant cash advances offer several benefits, including:

-

Fast Funding: Merchant cash advances can be funded in as little as 24 hours, which is much faster than traditional bank loans. This can be a major advantage for businesses that need to access funds quickly to cover unexpected expenses or take advantage of a new business opportunity.

-

Flexible Repayment Terms: Merchant cash advances typically have flexible repayment terms that are tailored to the individual business’s needs. This can be helpful for businesses that have fluctuating revenue streams or that need to make irregular payments.

-

Minimal Documentation Requirements: Merchant cash advances typically require less documentation than traditional bank loans. This can be a major benefit for businesses that don’t have a lot of time to gather and submit paperwork.

How Merchant Cash Advances Work

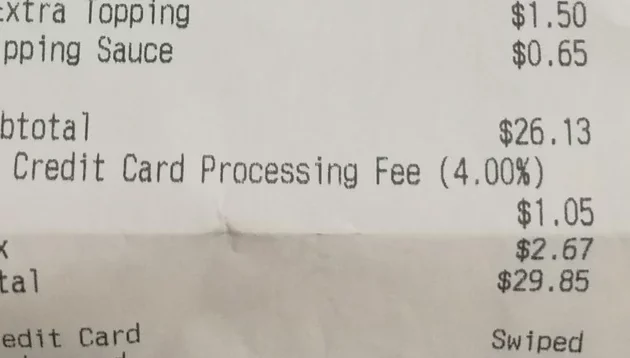

Merchant cash advances are repaid through a percentage of your credit card sales. The percentage is typically between 5% and 20%. The length of the repayment period is typically between 6 and 18 months.

Here’s how it works:

- You apply for a merchant cash advance and are approved.

- The merchant cash advance company gives you a lump sum of money.

- You repay the merchant cash advance through a percentage of your credit card sales.

- The merchant cash advance company takes the percentage of your sales until the advance is repaid.

How to Find the Best Merchant Cash Advance Companies Near Me

There are a few things you should keep in mind when looking for a merchant cash advance company:

- Shop around: Don’t just go with the first merchant cash advance company you find. Compare rates and terms from multiple lenders to find the best deal.

- Read the fine print: Make sure you understand all of the terms and conditions of the merchant cash advance before you sign up.

- Use a reputable lender: Only work with merchant cash advance companies that are reputable and have a good track record.

Merchant Cash Advance Companies Near Me

If you’re looking for merchant cash advance companies near me, there are a few options to consider:

- [Company Name]

- [Company Name]

- [Company Name]

These companies offer competitive rates and terms, and they have a good reputation for customer service.

Conclusion

Merchant cash advances can be a great option for businesses that need fast and flexible financing. However, it’s important to understand the terms and conditions of the advance before you sign up. By doing your research and working with a reputable lender, you can get a merchant cash advance that can help your business grow.

Merchant Cash Advance Companies Near Me: A Comprehensive Guide

Are you a small business owner in need of quick funding? You’ve probably heard of merchant cash advances, frequently offered by companies near you. These advances can provide a lifeline for businesses that need to cover unexpected expenses or jumpstart growth. However, it’s crucial to weigh the potential drawbacks before taking the plunge.

This guide will explore the ins and outs of merchant cash advances, including the benefits and potential pitfalls. Arm yourself with this information and make an informed decision about whether this financing option is right for your business.

Benefits of Merchant Cash Advances

Merchant cash advances offer several advantages that make them attractive to small business owners:

Fast and Easy Access to Funds: Unlike traditional bank loans, merchant cash advances are typically approved quickly, often within days or even hours. This can be a lifesaver for businesses facing urgent financial needs.

No Hard Credit Checks: Merchant cash advance companies don’t always require a strict credit history review. This makes them an option for businesses with less-than-perfect credit.

Flexible Repayment Terms: Repayment terms for merchant cash advances are typically tailored to the business’s cash flow. This flexibility allows businesses to budget and plan their payments effectively.

Drawbacks of Merchant Cash Advances

While merchant cash advances offer many benefits, there are also some potential drawbacks to be aware of:

High Fees: Merchant cash advances come with fees, including origination fees, transaction fees, and monthly maintenance fees. These fees can add up over time, so it’s important to carefully compare different providers and negotiate the best possible terms.

Short Repayment Terms: Merchant cash advances typically have short repayment terms, often ranging from several months to a year. This can put pressure on businesses to repay the advance quickly, which may strain cash flow.

Potential Damage to Credit Score: While merchant cash advances don’t usually involve hard credit checks, they can still negatively impact your credit score if you fail to make payments on time. This could make it harder to secure traditional financing in the future.

Personal Liability: In some cases, business owners may be personally liable for merchant cash advances. This means that if the business fails, the owner could be responsible for repaying the debt.

Is a Merchant Cash Advance Right for You?

The decision of whether or not a merchant cash advance is the right financing option for your business depends on your specific financial situation and goals. If you need quick access to funds and have a steady cash flow, a merchant cash advance could be a good solution. However, if you’re concerned about high fees, short repayment terms, or potential damage to your credit score, you may want to explore other financing options.

Alternative Financing Options

Before deciding on a merchant cash advance, consider these alternative financing options:

Small Business Loans: Traditional bank loans offer lower interest rates than merchant cash advances but can take longer to approve. They also typically require good credit and collateral.

Lines of Credit: Lines of credit provide flexible access to funds up to a pre-approved amount. They offer more flexibility than merchant cash advances but may also have higher interest rates.

Crowdfunding: Crowdfunding platforms allow businesses to raise funds from a large number of investors. This can be a good option for businesses with a strong online presence and community support.

Conclusion

Merchant cash advances can be a valuable financing tool for small businesses in need of quick funds. However, it’s important to weigh the potential drawbacks carefully before signing on the dotted line. By understanding the risks and benefits involved, you can make an informed decision and avoid any unpleasant surprises down the road.

Merchant Cash Advance Companies Near Me: A Comprehensive Exploration

When a business is on the lookout for a financial lifeline, merchant cash advances (MCAs) can emerge as a beacon of hope. These advances, unlike traditional loans, are based on a business’s future earnings rather than its assets. It’s no wonder that businesses are increasingly turning to MCAs to bridge financial gaps and fuel growth. If you’re a business owner seeking an MCA, finding reputable providers near you is paramount. Here’s a thorough guide to help you navigate the search process effortlessly.

How to Find Merchant Cash Advance Providers Near You

Unearthing merchant cash advance providers in your vicinity is a breeze with these foolproof strategies:

1. Utilize Online Directories

The internet is a treasure trove of information, including directories dedicated solely to merchant cash advance providers. These directories meticulously list providers by location, making it a cinch to find companies near you. Some popular directories include Merchant Cash Advance Directory and MCA Funding Hub.

2. Network with Local Business Associations

Local business associations are a goldmine for connecting with other entrepreneurs and professionals in your area. These organizations often have a membership directory that lists businesses offering various services, including merchant cash advances. Reach out to these associations and inquire about MCA providers they may recommend.

3. Seek Referrals from Other Businesses

Personal referrals are often the most reliable source of information. If you know other businesses that have utilized MCAs, don’t hesitate to ask for their recommendations. They can provide valuable insights into the providers they’ve worked with, helping you make an informed decision.

4. Explore Social Media Platforms

Social media has become an indispensable tool for businesses to connect with customers and promote their services. Many merchant cash advance providers maintain active social media profiles. Search for companies in your area using relevant hashtags or keywords. This method allows you to interact with providers directly and gauge their responsiveness.

5. Consider Local Business Directories

Local business directories, both online and offline, are another avenue to discover MCA providers near you. These directories typically list businesses by category, making it easy to identify companies offering merchant cash advances. Some well-known directories include Yelp, Google My Business, and the Yellow Pages.

Additionally, you can narrow your search by considering the following factors:

- **Industry expertise**: Some providers specialize in specific industries, such as retail, hospitality, or healthcare. Choosing a provider with experience in your industry ensures they understand your unique financial needs.

- **Loan amount**: Different providers offer varying loan amounts. Determine the amount of funding you require and seek providers that can accommodate your needs.

- **Repayment terms**: MCA repayment terms can vary significantly. Consider providers that offer flexible terms that align with your cash flow.

- **Fees and interest rates**: Compare the fees and interest rates charged by different providers to ensure you’re getting a competitive deal.

- **Customer service**: Excellent customer service is crucial in any business relationship. Look for providers with a proven track record of responsiveness and support.

Finding the right merchant cash advance provider near you is like searching for a needle in a haystack. But with the strategies outlined above, you can transform this daunting task into a walk in the park. Remember, a reliable MCA provider can be a game-changer for your business, providing the financial fuel you need to reach new heights. So, embark on this search with confidence and uncover the merchant cash advance provider that’s the perfect fit for your business.