Good Affordable Health Insurance Plans: Navigating the Maze of Options

In today’s uncertain healthcare landscape, finding affordable health insurance can feel like a daunting task. But fear not! With a little know-how and some savvy strategies, you can secure quality coverage without breaking the bank. Enter our comprehensive guide, where we’ll unravel the complexities of health insurance and empower you to make informed decisions.

Let’s start with the basics: what makes a health insurance plan “good” and “affordable”? Good health insurance should provide comprehensive coverage, including essential benefits like preventive care, maternity care, and prescription drug coverage. It should also have a network of quality providers and low out-of-pocket costs. Affordable health insurance, on the other hand, is one that fits your budget without sacrificing coverage. Keep these criteria in mind as we dive into the world of health insurance.

Decoding Health Insurance Premiums

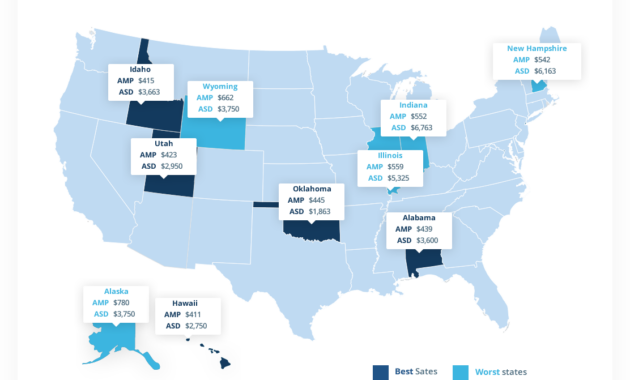

Health insurance premiums are the monthly payments you make to your insurance company. They can vary widely depending on several factors, including your age, location, health status, and the type of plan you choose. When comparing plans, it’s essential to consider not just the premium but also the deductible, copays, and coinsurance. These costs will determine how much you pay out of pocket for healthcare services.

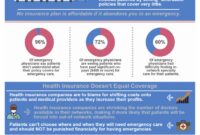

One common misconception is that high premiums always equate to better coverage. While it’s true that some higher-priced plans may offer more comprehensive benefits, it doesn’t always follow. It’s crucial to research and compare plans thoroughly to find one that strikes the right balance between cost and coverage.

Tips for Lowering Health Insurance Costs

Now, let’s get to the nitty-gritty: how can you lower health insurance costs without compromising on quality? Here’s a bag of tricks to help you save some green:

- Discounts, discounts, discounts! Take advantage of any discounts offered by your employer, health insurance marketplace, or insurance company. These may include group discounts, healthy lifestyle discounts, and discounts for non-smokers.

- Negotiate with your premium. Don’t be afraid to reach out to your insurance provider and negotiate your premium. You might be surprised at how much you can save by simply asking.

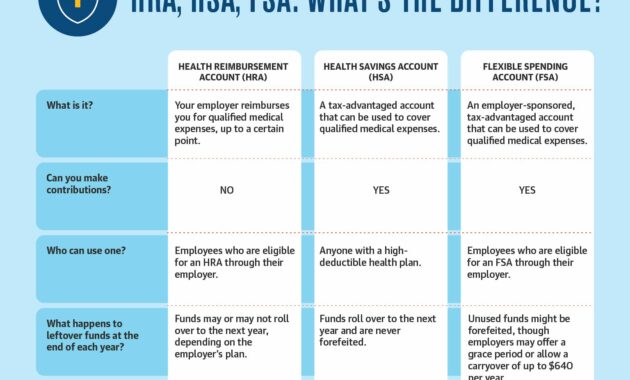

- Consider a high-deductible health plan (HDHP). HDHPs have lower premiums but higher deductibles, meaning you pay more out of pocket before your insurance kicks in. However, if you’re generally healthy and don’t anticipate significant medical expenses, an HDHP can save you money in the long run.

- Utilize health savings accounts (HSAs). If you have an HDHP, you can contribute to an HSA, which is a tax-advantaged savings account that you can use to pay for qualified medical expenses. HSAs are a great way to save money on medical costs and build up a nest egg for future healthcare needs.

- Live a healthy lifestyle. This one’s a no-brainer: the healthier you are, the lower your healthcare costs will be. So, eat healthy, exercise regularly, and get enough sleep. Your body and your wallet will thank you!

There you have it, folks! By following these tips, you can find good affordable health insurance plans that meet your needs and budget. Remember, health insurance is not a one-size-fits-all game. Take the time to research and compare plans thoroughly, and don’t hesitate to reach out to insurance providers for more information. With a little effort, you can secure quality coverage that protects your health and your finances.

Good Affordable Health Insurance Plans

Finding affordable health insurance doesn’t have to be a pain in the neck. There are several good and affordable health insurance plans. That are available to you. In this article, we’ll provide you with all the information you need to find the right plan for your needs and budget. We’ll cover everything from understanding the different types of health insurance plans to finding affordable options.

Types of Health Insurance Plans

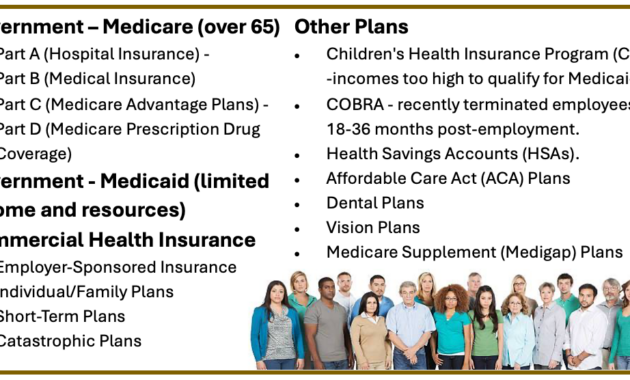

There are several different types of health insurance plans available. The most common type of plan is a Preferred Provider Organization (PPO). PPO plans allow you to see any doctor or hospital you want, but you’ll pay less if you see providers within the plan’s network. Another type of plan is a Health Maintenance Organization (HMO). HMO plans require you to see doctors within the plan’s network. However, HMO plans usually have lower premiums than PPO plans.

Finding Affordable Health Insurance

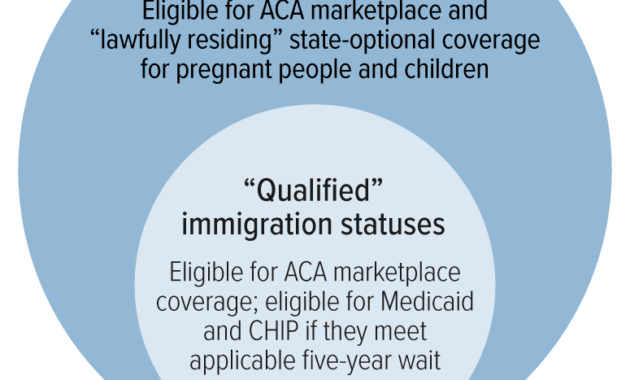

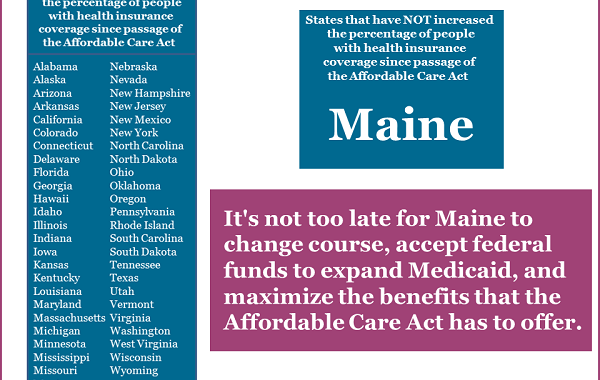

There are several ways to find affordable health insurance. One way is to shop around and compare prices from different insurance companies. You can also check with your employer to see if they offer health insurance. If you’re low-income, you may be eligible for Medicaid or CHIP. Medicaid is a government health insurance program for low-income individuals and families. CHIP is a government health insurance program for low-income children.

What to Look for in a Health Insurance Plan

When you’re shopping for health insurance, there are several things you should keep in mind. First, you’ll want to make sure the plan covers the services you need. Second, you’ll want to compare the premiums and deductibles of different plans. The premium is the monthly payment you make for your health insurance. The deductible is the amount you have to pay out-of-pocket before your insurance starts to cover costs.

Understanding Health Insurance Terminology

When you’re shopping for health insurance, you’ll come across a lot of unfamiliar terms. Here are a few of the most common terms:

- Premium: The monthly payment you make for your health insurance.

- Deductible: The amount you have to pay out-of-pocket before your insurance starts to cover costs.

- Copay: A fixed amount you pay for a covered service, such as a doctor’s visit or prescription drug.

- Coinsurance: A percentage of the cost of a covered service that you have to pay, such as 20%.

- Out-of-pocket maximum: The most you have to pay for covered services in a year.

Conclusion

Finding good and affordable health insurance is crucial for health and financial well-being. By following the tips in this article, you can find the right plan for your needs and budget. Don’t put off getting health insurance! The sooner you get covered, the sooner you can start protecting your health and your finances.