Fees for Credit Card Processing

If your business accepts credit or debit cards, you must be familiar with the fees associated with their processing. These fees can eat into your profits, so it’s important to grapple with the different types and how they may impact your business. This article will demystify the complexities of credit card processing fees, providing you with a clear understanding of what they are, how they’re calculated, and strategies for minimizing their impact on your bottom line.

Understanding the Anatomy of Processing Fees

When a customer swipes their credit card or enters their information online, a complex web of transactions occurs behind the scenes. These involve a series of players, including the merchant, the payment processor, the issuing bank, and the acquiring bank. Each of these players takes a cut, resulting in the fees merchants incur.

-

Interchange Fees: These fees are charged by the issuing bank to the acquiring bank. They cover the costs associated with processing the transaction, including fraud prevention and network security. Interchange fees vary based on the card type, transaction amount, and industry. MasterCard, Visa, American Express, and Discover all set their own interchange fee schedules.

-

Network Fees: These fees are charged by the card networks, such as Visa and Mastercard, to the payment processor. They cover the costs of maintaining and operating the payment network. Network fees are typically a flat fee per transaction.

-

Payment Gateway Fees: These fees are charged by the payment gateway, which is the software that connects the merchant’s website or POS system to the payment processor. Payment gateway fees can vary based on the provider and the volume of transactions processed.

-

PCI Compliance Fees: These fees are charged by the acquiring bank to ensure that the merchant is compliant with the Payment Card Industry Data Security Standard (PCI DSS). PCI DSS is a set of security standards designed to protect cardholder data. Merchants can incur PCI compliance fees for non-compliance, which can range from monthly fees to fines.

-

-

Assessment Fees: These fees are charged by the card brands, such as Visa and Mastercard, to the acquiring bank. They cover the costs of operating the card payment system and providing various benefits to cardholders, such as rewards programs and fraud protection. Assessment fees are typically a percentage of the transaction amount.

-

Processor Fees: These fees are charged by the payment processor to the merchant. They cover the costs of processing the transaction, including fraud screening, authorization, and settlement. Processor fees can vary based on the provider and the volume of transactions processed.

-

Acquirer Fees: These fees are charged by the acquiring bank to the merchant. They cover the costs of managing the merchant’s account, processing transactions, and providing customer support. Acquirer fees can vary based on the bank and the volume of transactions processed.

Fees for Credit Card Processing: A Comprehensive Guide

In the digital age, where seamless transactions reign supreme, credit card processing has become an indispensable tool for businesses of all sizes. However, understanding the fees associated with this service can be akin to navigating a labyrinth. This article aims to demystify the intricacies of credit card processing fees, empowering you with the knowledge to make informed decisions for your business.

Interchange Fees: The Heart of the Matter

Interchange fees, charged by credit card networks like Visa and Mastercard, form the core of credit card processing costs. These fees are essentially a transaction tax levied on merchants for each credit card transaction. The rate varies depending on the type of card (Visa, Mastercard, etc.), the cardholder’s region, and the type of transaction (in-person, online, etc.).

Processor Fees: The Middlemen’s Margins

Credit card processors, the intermediaries between merchants and credit card networks, also charge fees for their services. These fees, typically a percentage of the transaction amount, cover the costs of authorization, settlement, and customer support.

Additional Fees: Hidden Costs

Some processors may also charge additional fees, such as:

- Chargeback fees: Assessed when a customer disputes a transaction and requests a refund.

- PCI compliance fees: Required for businesses to maintain security standards for handling cardholder data.

- Gateway fees: For merchants using payment gateways to connect to credit card networks.

Flat vs. Tiered Pricing: Which Fits Your Business?

Credit card processors offer different pricing models: flat and tiered. Flat pricing charges a fixed percentage for all transactions, regardless of the card type. Tiered pricing, on the other hand, divides transactions into different tiers based on card type and transaction volume, with lower fees for debit cards and higher fees for premium credit cards.

Choosing the Right Processor: A Delicate Balancing Act

Selecting a credit card processor is not a one-size-fits-all endeavor. Consider your business’s transaction volume, average transaction size, and the types of cards you accept. Weigh the processor’s fees against their features, customer support, and reputation. Remember, the processor you choose can significantly impact your bottom line.

How to Negotiate Lower Fees: The Art of Diplomacy

Negotiating lower fees with credit card processors is a skill that can save your business money. Be prepared to provide data on your transaction volume and card mix. Emphasize your loyalty and long-term commitment to the processor. Remember to approach negotiations with a cooperative spirit, seeking a mutually beneficial outcome.

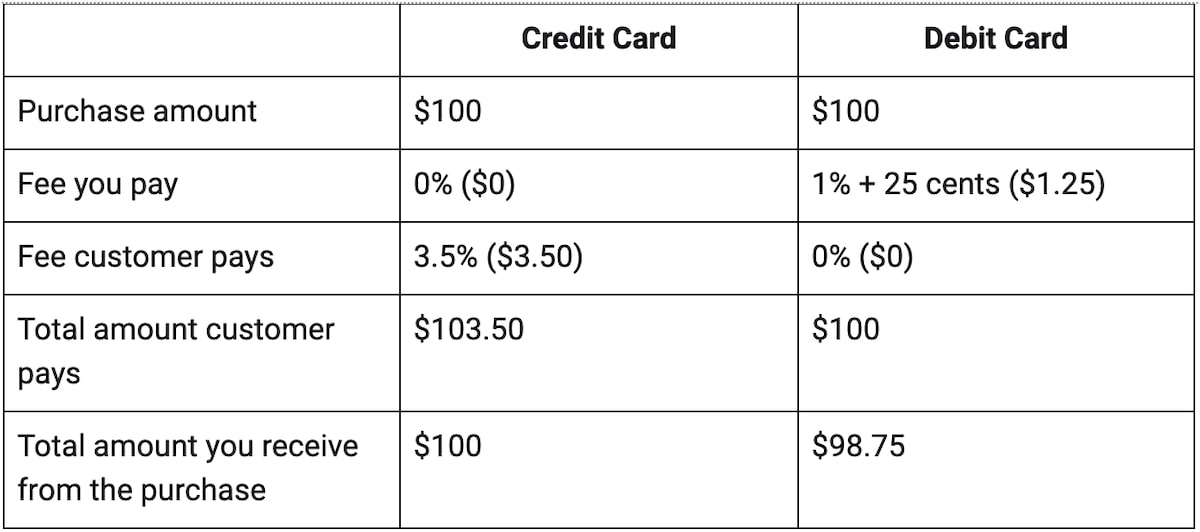

Understanding Interchange Optimization: Minimizing Your Costs

Interchange optimization is the art of reducing interchange fees by optimizing your transaction mix and implementing smart payment strategies. Consider using surcharge programs, offering discounts for debit card usage, and partnering with payment processors that offer competitive interchange rates. Every cent saved on interchange fees goes straight to your business’s bottom line.