Understanding Credit Cards with Processing Fees

In today’s fast-paced world, credit cards have become an indispensable tool for financial transactions. They offer unparalleled convenience, allowing you to make purchases, pay bills, and access cash with a swipe or a tap. However, beneath this layer of convenience lies a hidden cost that many consumers are unaware of: processing fees. These fees, charged by banks and credit card companies, can add up over time, potentially eroding the benefits of using a credit card.

Processing fees occur when merchants accept credit card payments. These fees cover the costs associated with processing the transaction, including authorization, verification, and settlement. The fees are typically a percentage of the transaction amount, ranging from 1% to 3%. While they may seem like a small amount, they can accumulate quickly, especially for businesses that process a high volume of transactions.

For consumers, processing fees can be passed on as surcharges, which are added to the purchase price when paying with a credit card. Surcharges are typically prohibited by credit card networks, but some businesses may still find ways to implement them, either by charging a flat fee or by increasing the price of the item itself. These surcharges can add to the cost of your purchases, making it essential to be aware of them before making a transaction.

In addition to surcharges, processing fees can also affect your credit card rewards. Many credit cards offer rewards programs that allow you to earn points or cash back on your purchases. However, processing fees are often excluded from these rewards, meaning you will not earn rewards on the fees you pay.

Processing fees can also impact your credit score. Late or missed payments on your credit card bill can negatively affect your score, but processing fees are not typically reported to credit bureaus. This means that they will not directly impact your credit score, but they can still contribute to late or missed payments if you do not account for them in your budget.

Credit Cards With Processing Fees: A Comprehensive Guide

Many credit cards come with processing fees, which are charged to merchants when customers use their cards to make purchases. These fees can vary depending on the type of card, the payment method, and the transaction amount. For businesses, understanding these fees is crucial to managing their costs and pricing their products or services accordingly. In this article, we will explore the different types of processing fees and provide tips for minimizing their impact on your business.

Types of Processing Fees

There are several types of processing fees that merchants may encounter. The most common include:

- Interchange fees: These are fees charged by the card-issuing bank to the merchant’s bank. Interchange fees vary depending on the card type, with premium cards like Visa Signature and Mastercard World Elite typically carrying higher fees than standard cards.

- Assessment fees: These are fees charged by the card network (e.g., Visa, Mastercard, American Express) to the merchant’s bank. Assessment fees are typically a fixed percentage of the transaction amount.

- Gateway fees: These are fees charged by the payment gateway, which is the technology that processes the transaction. Gateway fees can vary depending on the provider and the type of transaction.

- PCI compliance fees: These are fees charged by companies that help businesses comply with the Payment Card Industry Data Security Standard (PCI DSS). PCI compliance is required for businesses that process credit card payments.

In addition to these standard fees, there may also be additional fees for certain types of transactions, such as international transactions, high-risk transactions, or chargebacks. It’s important for businesses to carefully review the fee schedule of their payment processor to understand all the potential costs associated with processing credit card payments.

Factors Affecting Processing Fees

Several factors can affect the processing fees that a business pays, including:

- Card type: Premium cards like Visa Signature and Mastercard World Elite typically have higher processing fees than standard cards.

- Payment method: In-person transactions typically have lower processing fees than online or phone transactions.

- Transaction amount: Processing fees are often a percentage of the transaction amount, so larger transactions will result in higher fees.

- Merchant category: Some types of businesses, such as those in the travel or healthcare industries, may pay higher processing fees due to the higher risk of fraud associated with these industries.

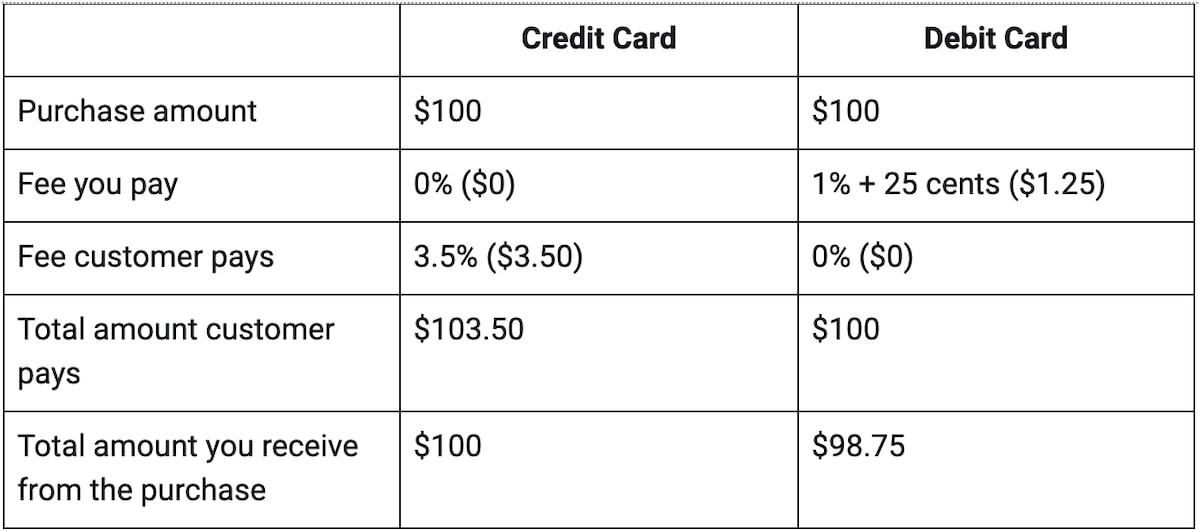

By understanding the factors that affect processing fees, businesses can take steps to minimize their impact. For example, they can encourage customers to use lower-cost payment methods, such as debit cards or cash, or they can negotiate with their payment processor for lower rates.

Minimizing Processing Fees

There are several strategies that businesses can use to minimize the processing fees they pay. These include:

- Negotiating with your payment processor: Payment processors often have some flexibility in their pricing. Businesses can negotiate with their processor for lower rates or more favorable terms.

- Encouraging customers to use lower-cost payment methods: Businesses can offer discounts or incentives to customers who use lower-cost payment methods, such as debit cards or cash.

- Bundling products or services: Businesses can bundle products or services to increase the average transaction size. This can result in lower processing fees, as fees are typically a percentage of the transaction amount.

- Outsourcing payment processing: Some businesses may choose to outsource their payment processing to a third-party provider. This can save businesses time and money, as they will not need to invest in their own payment processing infrastructure.

By following these tips, businesses can minimize the processing fees they pay and keep more of their hard-earned revenue.

Credit Cards: Unpacking the Impact of Processing Fees

In the ever-evolving tapestry of financial transactions, credit cards have woven their way to the forefront, offering unparalleled convenience and accessibility. However, beneath the façade of seamless swipes and taps lies a hidden cost that can silently erode business profits: processing fees.

Delving into Processing Fees

Processing fees are the charges levied by credit card companies each time a card is used for a purchase. These fees can vary depending on the type of card, the network it belongs to, and the transaction amount. Typically, fees hover around 1-3% of the transaction value, but can occasionally reach higher percentages for premium cards or international transactions.

Impact of Processing Fees on Businesses

For businesses, processing fees are a crucial factor to consider, as they can significantly impact profitability. Every transaction processed via credit card incurs a fee, which adds up over time and can eat into profit margins. To mitigate this impact, businesses often adjust their pricing to absorb these costs, which can lead to higher prices for consumers.

Unraveling the Effects

Beyond the immediate financial implications, processing fees can also have indirect consequences for businesses. They can create a barrier to entry for small businesses and startups that operate on thin margins. Additionally, businesses may find themselves locked into contracts with credit card companies, limiting their ability to negotiate more favorable terms.

Strategies for Managing Processing Fees

Navigating the complexities of processing fees requires a thoughtful approach. Businesses can explore the following strategies to minimize their impact:

-

Negotiate with Credit Card Companies: Engaging in negotiations with credit card companies can yield lower fees or more favorable terms. Building a strong business history and maintaining a high transaction volume can strengthen your bargaining position.

-

Choose Cards with Lower Fees: Research and compare different credit cards to identify those with lower processing fees. This can involve considering business-specific cards or cards that offer rewards programs or other incentives.

-

Implement Surcharges: In some cases, businesses may choose to implement a surcharge for credit card transactions. This allows them to pass on the processing fees directly to the customer, but it’s important to weigh the potential impact on customer satisfaction.

-

Encourage Alternative Payment Methods: Offering alternative payment methods, such as debit cards or mobile payments, can reduce processing fees as these transactions often incur lower charges.

Conclusion

Processing fees are an inherent facet of credit card transactions that can have a tangible impact on businesses. Understanding the implications of these fees is essential for maintaining profitability and making informed financial decisions. By implementing effective strategies and seeking out opportunities to minimize these charges, businesses can harness the power of credit cards while protecting their bottom line.

Credit Cards with Processing Fees: A Comprehensive Guide

Credit cards are an indispensable financial tool, offering convenience, rewards, and purchase protection. However, it’s crucial to be aware of processing fees that can chip away at your earnings. These hidden costs can add up, especially for small businesses and high-volume transactions. So, buckle up as we delve into the world of credit cards with processing fees, providing you with invaluable information to navigate this financial minefield.

Understanding Processing Fees

When you use a credit card, the transaction doesn’t happen magically. Behind the scenes, a series of events occur involving multiple parties, and each has a stake in the game. The merchant, the credit card network (e.g., Visa, Mastercard), and the issuing bank all play a role, and they all want a piece of the pie. These fees cover the costs of processing the transaction, including fraud prevention, card security, and network maintenance.

Types of Processing Fees

There are several types of processing fees, each with its own quirks and consequences. Interchange fees are the most common, charged by the credit card network to the merchant’s bank. These fees vary based on factors like the transaction amount, card type, and industry. Assessment fees are levied by the credit card companies and go towards funding their operations and rewards programs. And lastly, gateway fees are paid to the payment gateway provider, which enables the merchant to accept credit card payments. Understanding these fees is the first step towards minimizing their impact.

Minimizing Processing Fees

Now that you’ve got a grip on the different types of processing fees, let’s explore some strategies to minimize their impact. Negotiating lower rates is a great way to save some dough. Reach out to your credit card processor and see if they’re willing to budge on their fees. It never hurts to ask, right? Using alternative payment methods is another option. Consider offering ACH payments or e-checks, which typically have lower processing fees than credit cards.

Choosing the right credit card processor is also critical. Look for a processor that offers competitive rates, transparent pricing, and a suite of features that meet your business needs. Remember, it’s not just about the lowest fees but also about finding a processor that aligns with your business strategy. By implementing these strategies, you can significantly reduce processing fees and keep more of your hard-earned profits.

Impact on Small Businesses

Processing fees can be a hefty burden for small businesses, especially those with low margins or high-volume transactions. Every cent counts for these businesses, and excessive fees can eat into their profits. That’s why it’s crucial for small businesses to carefully consider their options and explore strategies to minimize processing fees. By doing so, they can keep more money in their pockets and fuel their growth.

Impact on Consumers

While merchants bear the brunt of processing fees, consumers are not immune to their effects. These fees can be passed on to consumers in the form of higher prices or reduced rewards. Understanding the impact of processing fees can help consumers make informed decisions when using credit cards. By being mindful of fees and choosing credit cards with favorable terms, consumers can minimize their financial burden and maximize their purchasing power.

The Future of Processing Fees

The landscape of processing fees is constantly evolving. With the rise of new technologies and payment methods, we can expect changes in how these fees are structured and implemented. It’s essential to stay informed about these developments and adapt your strategies accordingly. By staying ahead of the curve, businesses and consumers can mitigate the impact of processing fees and harness the full potential of credit cards.

Credit Cards with Processing Fees: What You Need to Know

When you use a credit card to make a purchase, you may be charged a processing fee by the merchant. This fee is typically a percentage of the purchase amount, and it can add up over time. If you’re not careful, you could end up paying hundreds of dollars in processing fees each year. In this article, we’ll take a closer look at credit cards with processing fees, and we’ll provide some tips for avoiding them.

How Do Processing Fees Work?

Processing fees are charged by merchants to cover the cost of processing credit card transactions. These costs include things like the cost of the credit card network, the cost of fraud prevention, and the cost of customer service. Processing fees are typically a percentage of the purchase amount, but they can also be a flat fee. The amount of the processing fee will vary depending on the merchant and the type of credit card you use.

Why Are Processing Fees a Problem?

Processing fees can be a problem for consumers because they can add up over time. If you’re not careful, you could end up paying hundreds of dollars in processing fees each year. This can be a significant expense, especially if you use your credit card frequently. What’s more, processing fees can make it difficult to budget for your purchases. If you don’t know how much you’re going to be charged in processing fees, it can be difficult to plan your spending.

Tips for Avoiding Processing Fees

There are a few things you can do to avoid processing fees. One is to use a credit card that doesn’t charge processing fees. There are a number of credit cards on the market that offer this feature, so you should be able to find one that meets your needs. Another way to avoid processing fees is to use a debit card instead of a credit card. Debit cards don’t typically charge processing fees, so you can save money by using them whenever possible.

Considerations for Consumers

When using a credit card, it’s important to be aware of the processing fees that may be charged. These fees can add up over time, so it’s important to factor them into your budget. You should also be aware of the different ways to avoid processing fees, such as using a credit card that doesn’t charge them or using a debit card instead. By following these tips, you can save money on your credit card purchases.

1. Understand the Terms and Conditions

Before you sign up for a credit card, it’s important to read the terms and conditions carefully. This document will outline the processing fees that you will be charged. Make sure you understand these fees before you agree to the terms of the credit card.

2. Compare Credit Cards

Once you’ve read the terms and conditions of a few different credit cards, you can compare them to find the one that’s right for you. Be sure to compare the processing fees, as well as the other features and benefits of the cards.

3. Use Your Credit Card Wisely

Once you have a credit card, it’s important to use it wisely. This means avoiding unnecessary purchases and paying off your balance in full each month. This will help you avoid paying interest and processing fees.

4. Be Aware of Hidden Fees

In addition to processing fees, there are a number of other hidden fees that you may be charged when you use a credit card. These fees can include things like balance transfer fees, cash advance fees, and late payment fees. Be sure to be aware of these fees before you use your credit card.

5. Protect Yourself from Fraud

Credit card fraud is a serious problem, and it’s important to protect yourself from it. There are a number of things you can do to protect yourself, such as using a strong password, keeping your credit card information confidential, and reporting any unauthorized charges to your credit card company immediately. By following these tips, you can help protect yourself from credit card fraud and processing fees.

Credit Cards with Processing Fees: A Comprehensive Guide

Credit cards have become an indispensable tool in today’s world, offering convenience, security, and rewards. However, behind the scenes, there’s a hidden cost that businesses and consumers need to be aware of: processing fees. These fees, charged by credit card companies to process transactions, can have a significant impact on businesses’ profitability and consumers’ spending power. In this article, we’ll delve into the world of credit cards with processing fees, exploring their impact, pros and cons, and how to navigate them effectively.

Understanding Processing Fees

Processing fees are charges levied by credit card companies for handling transactions. These fees typically range from around 1% to 3% of the transaction amount, and they cover the costs of processing the transaction, including authorization, verification, and settlement. Businesses typically pay these fees to their payment processor or merchant account provider, who then passes them on to the credit card company.

Impact on Businesses

For businesses, processing fees can represent a significant expense. High processing fees can eat into profit margins, especially for businesses with high transaction volumes. Businesses may choose to pass these fees on to their customers in the form of higher prices or surcharges, or they may absorb the fees themselves. Ultimately, the impact of processing fees on businesses depends on factors such as their industry, transaction volume, and pricing strategy.

Impact on Consumers

While businesses bear the direct cost of processing fees, consumers may also be indirectly affected. Some businesses may pass on these fees to their customers, resulting in higher prices or surcharges. Additionally, some credit cards charge consumers additional fees for using them, such as foreign transaction fees or rewards program fees. Understanding these fees before using a particular credit card is crucial to avoid unexpected charges.

Pros and Cons of Credit Cards with Processing Fees

Like any financial instrument, credit cards with processing fees have their pros and cons. Let’s explore both sides of the equation:

Pros:

- Convenience: Credit cards offer unparalleled convenience, allowing for quick and easy transactions without the need for cash or checks.

- Security: Credit cards provide a secure way to make payments, reducing the risk of fraud and theft compared to cash.

- Rewards and benefits: Many credit cards offer rewards programs, cashback incentives, and other perks that can offset the cost of processing fees.

Cons:

- Processing fees: The main drawback of credit cards is the processing fees that businesses must pay, which can add up over time.

- Fees for consumers: Some credit cards charge additional fees to consumers, such as foreign transaction fees or rewards program fees.

- Potential for debt: Using credit cards irresponsibly can lead to debt and financial difficulties if not managed properly.

Navigating Credit Cards with Processing Fees

To navigate the world of credit cards with processing fees effectively, both businesses and consumers should consider the following tips:

Tips for Businesses:

- Compare processing fees: Before signing up with a payment processor, compare the processing fees charged by different providers to find the most competitive rates.

- Negotiate with vendors: Some credit card companies may be willing to negotiate lower processing fees for high-volume businesses.

- Consider surcharges: Surcharging allows businesses to pass on processing fees to customers, but it’s important to implement this strategy carefully to avoid alienating customers.

Tips for Consumers:

- Choose credit cards wisely: Consider the processing fees and other charges associated with different credit cards before choosing one.

- Understand the terms and conditions: Carefully read the terms and conditions of your credit card agreement to avoid unexpected fees or penalties.

- Use credit cards responsibly: Avoid using credit cards for unnecessary purchases or carrying excessive debt to minimize the impact of processing fees.

Conclusion

Credit cards with processing fees are a double-edged sword. They offer convenience, security, and rewards but also come with associated costs for both businesses and consumers. By understanding the impact and implications of processing fees, businesses and consumers can make informed decisions to minimize their financial impact and maximize the benefits of using credit cards.