Understanding Credit Card Processing Rates and Fees

In today’s digital age, credit cards have become an indispensable part of our financial lives. They offer convenience, security, and rewards, but they also come with a cost. Credit card processing rates and fees can vary widely depending on a number of factors, so it’s important to understand what you’re paying for before you sign up for a new card or payment processor. According to Nilson Report, the average merchant discount rate in the U.S. was 2.64% in 2022, but rates can range from 1.5% to 4% or more depending on the type of card, the size of the transaction, and the risk associated with the merchant. In addition to interchange fees, merchants may also be charged a variety of other fees, such as authorization fees, batch fees, and PCI compliance fees.

Interchange fees are the fees that banks charge merchants for each credit card transaction. These fees are used to cover the cost of processing the transaction, including the cost of fraud prevention and customer service. Interchange fees are typically a percentage of the transaction amount, but they can also be a flat fee. The interchange fee rate is determined by the type of card used, the size of the transaction, and the risk associated with the merchant. Merchants with high sales volumes and low fraud rates will typically pay lower interchange fees than merchants with low sales volumes and high fraud rates.

Authorization fees are charged by some credit card processors for each transaction that is authorized. These fees are typically a few cents per transaction, but they can add up over time. Batch fees are charged by some credit card processors for each batch of transactions that is processed. These fees are typically a few dollars per batch, but they can also add up over time. PCI compliance fees are charged by some credit card processors to merchants who are required to comply with the Payment Card Industry Data Security Standard (PCI DSS). These fees can range from a few hundred dollars to several thousand dollars per year.

In addition to these fees, merchants may also be charged a variety of other fees, such as chargeback fees, retrieval fees, and dispute fees. Chargeback fees are charged when a customer disputes a transaction and requests a refund. Retrieval fees are charged when a merchant requests a copy of a transaction receipt. Dispute fees are charged when a merchant disputes a chargeback.

Understanding credit card processing rates and fees can be a daunting task, but it’s important to do your research before you sign up for a new card or payment processor. By understanding the different types of fees and how they are calculated, you can make sure that you are getting the best possible deal.

Credit Card Processing Rates and Fees: A Comprehensive Guide

Credit cards have become an indispensable part of our lives, offering convenience and security in our financial transactions. However, behind the scenes, there lies a complex world of fees and charges that can impact businesses and consumers alike. In this article, we dive into the intricate web of credit card processing rates and fees, unraveling the different components that make up this enigmatic financial landscape.

Interchange Fees

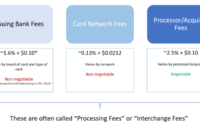

At the heart of credit card processing lies the interchange fee, a charge levied by the card-issuing bank to the acquiring bank that handles the transaction. This fee represents a major source of revenue for banks and is a key factor in determining the overall cost of credit card acceptance. Interchange fees are typically a percentage of the transaction amount, ranging from 1% to 3% or more. Factors such as the card type, transaction type, and merchant category code all influence the interchange fee structure.

The interchange fee system is complex and opaque, shrouded in a web of regulations and standards set by payment networks such as Visa and Mastercard. These networks negotiate interchange fees with card issuers and acquiring banks, creating a dynamic marketplace that can vary greatly from industry to industry and merchant to merchant. As a result, businesses need to be vigilant in understanding the interchange fees associated with their transactions to ensure they are not overpaying.

Other Processing Fees

Beyond interchange fees, merchants may encounter a range of other processing fees charged by their payment processor. These fees can include:

- Processor Fee: A flat fee or percentage-based charge for the services provided by the payment processor.

- Gateway Fee: A fee charged by a third-party gateway that facilitates the secure transmission of transaction data.

- Batch Fee: A fee charged each time a batch of transactions is settled.

- PCI Compliance Fee: A fee charged to cover the costs of maintaining compliance with the Payment Card Industry Data Security Standard (PCI DSS).

- Chargeback Fee: A fee charged when a customer disputes a transaction and requests a chargeback.

The specific processing fees and their associated costs can vary widely depending on the payment processor and the merchant’s specific needs. It’s important to carefully compare the fee structures of different processors to ensure you are getting the best deal.

Tips for Minimizing Fees

While credit card processing fees can be a significant expense for businesses, there are several strategies that can help minimize their impact:

- Negotiate Interchange Fees: Reach out to your bank or payment processor to negotiate a lower interchange fee rate.

- Surcharge for Credit Card Payments: Consider adding a small surcharge to credit card transactions to offset the processing fees.

- Optimize Transaction Volumes: Process as many transactions as possible through a single payment processor to qualify for volume discounts.

- Choose the Right Processor: Compare the fee structures of different payment processors to find the one that offers the most favorable rates.

- Monitor Transactions: Regularly review your transaction data to identify any unusual patterns or excessive fees.

By implementing these strategies, businesses can take control of their credit card processing costs and ensure that they are not overpaying for this essential service.

Credit Card Processing Rates and Fees: A Guide for Businesses

In today’s digital landscape, credit cards have become an indispensable part of doing business. But with the convenience they provide comes a cost, namely, the processing fees charged by payment processors. Understanding these fees and how they can impact your bottom line is crucial for any business that accepts cards.

Processing Fees

Processing fees are the backbone of a payment processor’s revenue stream. They encompass the various charges involved in facilitating card transactions, including authorization, settlement, and fraud detection. These fees can vary depending on the type of card used, the transaction volume, and the specific processor you work with.

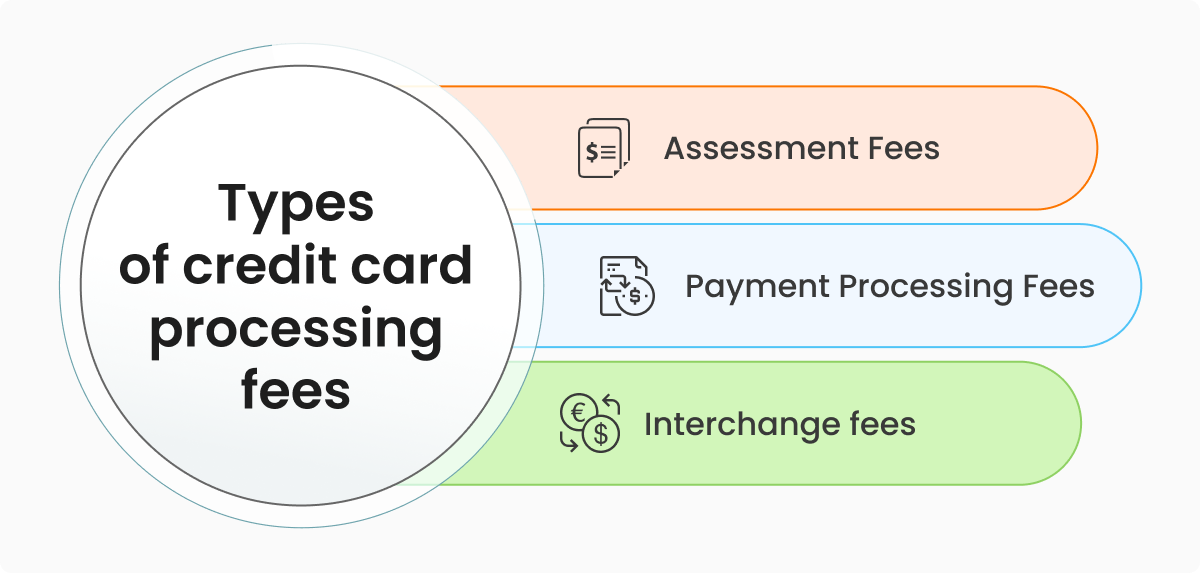

Types of Processing Fees

There are several types of processing fees businesses can encounter, each with its purpose and calculation method:

- Interchange Fees: These are fees levied by the card networks (e.g., Visa, Mastercard) to cover the cost of processing transactions on their systems.

- Assessment Fees: Fees assessed by the card brands (e.g., American Express, Discover) for the use of their networks.

- Gateway Fees: Charged by the gateway that connects your business to the payment processor.

- Processor Fees: Fees charged by the payment processor for providing the infrastructure and services to facilitate transactions.

- PCI Compliance Fees: Fees for compliance with Payment Card Industry (PCI) security standards.

- Fraud Detection and Prevention Fees: Charges for fraud monitoring and prevention services.

- Chargeback Fees: Fees charged when a customer disputes a transaction and requests a refund.

Factors Affecting Processing Fees

The processing fees you pay can be influenced by several factors, including:

- Card Type: Different card types (e.g., debit, credit, prepaid) carry varying interchange fees.

- Transaction Volume: Higher transaction volumes often qualify for lower fees due to volume discounts.

- Payment Processor: Each processor has its pricing structure and fee schedule.

- Business Size: Large businesses with substantial transaction volumes may negotiate lower fees.

- Industry: Certain industries, such as healthcare or travel, may be subject to higher fees.

How to Negotiate Lower Processing Fees

Negotiating lower processing fees is possible if you approach it strategically. Here are some tips:

- Shop Around: Compare fees from multiple processors to find the best deal.

- Negotiate Volume Discounts: High-volume businesses can leverage their transaction volume to secure lower rates.

- Package Deals: Bundling payment processing services (e.g., gateway, PCI compliance) can reduce overall costs.

- Review Your Statement: Check your monthly statements for any errors or inconsistencies in fees.

- Be Prepared to Switch: If you’re not satisfied with your current processor’s fees, don’t hesitate to move to a provider that offers better terms.

Conclusion

Understanding credit card processing rates and fees is essential for business owners who want to optimize their payment processing costs. By considering the types of fees, factors affecting them, and strategies for negotiating lower rates, businesses can minimize their expenses and maximize their profits.

Credit Card Processing Rates and Fees: A Comprehensive Guide

When it comes to accepting credit cards, businesses need to be aware of the processing rates and fees involved. These costs can vary depending on a number of factors, so it’s important to do your research and find the best option for your business. In this article, we’ll cover everything you need to know about credit card processing rates and fees, so you can make informed decisions about how to accept payments from your customers.

Let’s face it: credit card processing fees are like taxes – we all have to pay them. But just like taxes, there are ways to minimize the impact of these fees on your business. By being clued in about the different factors affecting processing rates, you can keep more money in your bank account.

Factors Affecting Processing Rates

The cost of processing a credit card transaction is determined by a number of factors, including:

- Card type. Different card types have different processing rates. Visa and Mastercard are typically the most expensive, followed by American Express and Discover.

- Transaction amount. The larger the transaction amount, the higher the processing rate. This is because the credit card companies charge a percentage of the transaction amount.

- Payment method. Credit cards are the most expensive payment method to process, followed by debit cards and ACH transfers.

- Merchant industry. Some industries have higher processing rates than others. For example, businesses that sell high-risk products or services may have to pay higher rates.

- Processing volume. Businesses that process a high volume of transactions may be able to negotiate lower processing rates.

- Contract terms. The terms of your contract with your credit card processor will also affect your processing rates. Be sure to read the fine print before you sign up for a service.

- Equipment costs. If you need to purchase equipment to accept credit cards, such as a POS system or a payment gateway, this will also increase your costs.

The processing rates and fees can vary significantly from one provider to another. It’s important to compare the rates and fees of several different providers before choosing one.