Introduction

Credit card processing fees can be a significant expense for businesses, so it’s important to compare different providers to find the best deal. But don’t just take our word for it – let the numbers speak for themselves. The average credit card processing fee in the U.S. is 2.9%, but fees can range from 1.5% to 4%. That means a business that processes $100,000 in credit card sales per year could pay anywhere from $1,500 to $4,000 in processing fees. To put it in perspective, that’s like paying an extra $125 to $333 per month just to accept credit cards. Ouch!

Thankfully, there are a number of ways to reduce your credit card processing fees. You can negotiate with your payment processor for a lower rate, or you can choose a provider that offers Interchange-plus pricing. Interchange-plus pricing is a more transparent pricing model that allows businesses to see exactly how much each transaction costs. This can help you avoid hidden fees and save money in the long run.

**Interchange Fees Explained**

Interchange fees are the fees that credit card companies charge banks and payment processors for each transaction. These fees are passed on to businesses in the form of processing fees. Interchange fees vary depending on the type of card used, the amount of the transaction, and the merchant’s location. For example, interchange fees for Visa and Mastercard transactions are typically higher than interchange fees for American Express transactions. Interchange fees also tend to be higher for online transactions than for in-person transactions.

Interchange fees are a major source of revenue for credit card companies. In 2022, credit card companies collected an estimated $137.8 billion in interchange fees. That’s a lot of money! And it’s one of the reasons why credit card processing fees are so high.

So, what’s a business to do? How can they reduce the impact of interchange fees on their bottom line? Here are a few tips:

Credit Card Processing Fees: A Comprehensive Guide

In today’s fast-paced business environment, understanding credit card processing fees is crucial for businesses looking to optimize their financial performance. Whether you’re a seasoned pro or just starting out, navigating the complexities of processing fees can be a daunting task. But fear not, for this comprehensive guide will delve into the intricacies of these fees, empowering you with the knowledge you need to make informed decisions and minimize their impact on your bottom line.

To help you get started, here’s a quick snapshot of credit card processing fees:

- Interchange Fees: Fees paid to the card-issuing bank.

- Assessment Fees: Fees paid to the card network (e.g., Visa, Mastercard).

- Processor Fees: Fees charged by the payment processor for handling the transaction.

Factors that Impact Credit Card Processing Fees

Now that you have a basic understanding of the types of fees involved, let’s explore some of the key factors that influence the rates you’ll pay:

- Card Type: Different card types (e.g., credit, debit, rewards) have different interchange fees.

- Processing Volume: Higher processing volumes often qualify for lower rates.

- Business Type and Industry: Some industries have higher risk profiles and may incur higher fees.

- Payment Channel: Fees vary depending on the payment method (e.g., in-store, online, mobile).

Strategies for Minimizing Credit Card Processing Fees

Armed with this knowledge, let’s dive into some practical strategies for minimizing your credit card processing fees:

- Negotiate with Your Processor: Don’t be afraid to negotiate lower rates, especially if you have a high processing volume.

- Choose the Right Processor: Compare quotes from multiple processors to find the best fit for your business.

- Optimize Payment Channels: Shift to lower-cost payment channels whenever possible (e.g., debit cards, ACH payments).

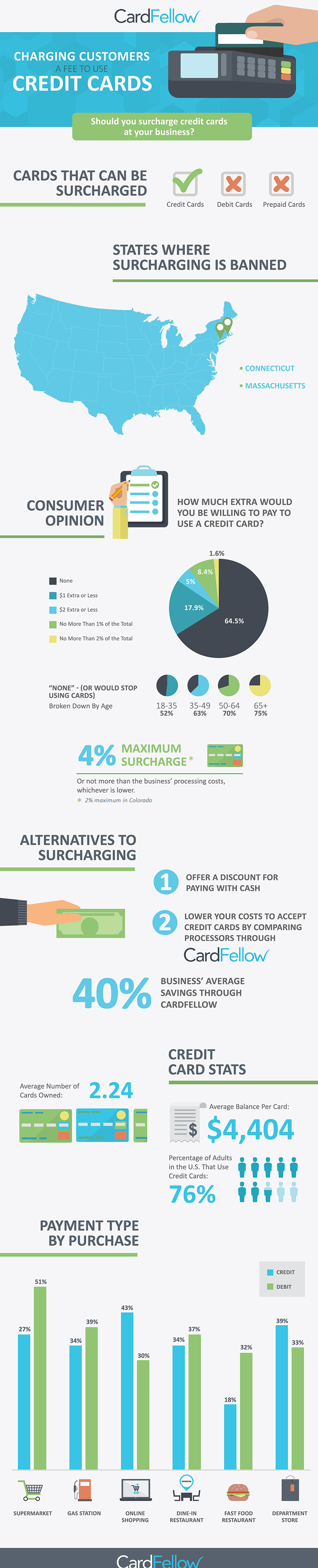

- Surcharge for Credit Cards: Consider adding a surcharge for credit card transactions to offset the fees.

Emerging Trends in Credit Card Processing

The world of credit card processing is constantly evolving. Here are a few trends that businesses should keep an eye on:

- Increased Use of Non-Traditional Payment Methods: Consumers are embracing digital wallets, mobile payments, and other alternative payment options.

- Focus on Security: With the rise of data breaches, payment processors are implementing stricter security measures.

- Data Analytics for Fee Optimization: Businesses are using data to analyze spending patterns and identify opportunities for fee reduction.

Conclusion

By understanding credit card processing fees, their influencing factors, and the strategies for minimizing them, businesses can effectively manage their processing costs. Remember, every penny saved on fees directly contributes to increased profitability. So, take the time to research, compare, and negotiate to ensure you’re getting the best deal on your credit card processing.