Commercial Truck Insurance Rates by State

Commercial truck insurance rates vary significantly by state, with some states having much higher rates than others. The average annual premium for commercial truck insurance in the United States is $12,450, but rates can range from as low as $6,000 per year in some states to as high as $20,000 or more in others.

There are several factors that contribute to the variation in commercial truck insurance rates by state, including the state’s population density, the number of accidents involving commercial trucks, and the state’s insurance regulations.

Factors That Affect Commercial Truck Insurance Rates

The following factors can affect commercial truck insurance rates:

- The type of truck: The type of truck you operate will affect your insurance rates. For example, dump trucks and cement mixers typically have higher insurance rates than dry vans and flatbeds.

- The size of the truck: The size of your truck will also affect your insurance rates. Larger trucks typically have higher insurance rates than smaller trucks.

- The weight of the truck: The weight of your truck will also affect your insurance rates. Heavier trucks typically have higher insurance rates than lighter trucks.

- The value of the truck: The value of your truck will also affect your insurance rates. More expensive trucks typically have higher insurance rates than less expensive trucks.

- The age of the truck: The age of your truck will also affect your insurance rates. Older trucks typically have higher insurance rates than newer trucks.

- The driver’s age: The driver’s age will also affect your insurance rates. Younger drivers typically have higher insurance rates than older drivers.

- The driver’s experience: The driver’s experience will also affect your insurance rates. Drivers with more experience typically have lower insurance rates than drivers with less experience.

- The driver’s safety record: The driver’s safety record will also affect your insurance rates. Drivers with clean safety records typically have lower insurance rates than drivers with poor safety records.

- The state in which you operate: The state in which you operate your truck will also affect your insurance rates. States with higher populations and more traffic typically have higher insurance rates than states with lower populations and less traffic.

How to Get the Best Commercial Truck Insurance Rates

There are several things you can do to get the best commercial truck insurance rates:

- Shop around: Get quotes from multiple insurance companies before you purchase a policy.

- Compare coverage: Make sure you are comparing apples to apples when you are getting quotes. Be sure to compare the same coverage limits and deductibles.

- Ask for discounts: Many insurance companies offer discounts for things like bundling your insurance policies, having a good safety record, and taking defensive driving courses.

- Raise your deductible: Raising your deductible can lower your insurance premiums. However, you should only raise your deductible if you can afford to pay it in the event of an accident.

Commercial Truck Insurance Rates by State

The following table shows the average annual commercial truck insurance rates by state:

| State | Average Annual Premium |

|---|---|

| Alabama | $10,500 |

| Alaska | $12,000 |

| Arizona | $11,000 |

| Arkansas | $9,500 |

| California | $15,000 |

| Colorado | $10,000 |

| Connecticut | $14,000 |

| Delaware | $10,500 |

| Florida | $12,000 |

| Georgia | $10,000 |

| Hawaii | $13,000 |

| Idaho | $9,000 |

| Illinois | $13,000 |

| Indiana | $10,000 |

| Iowa | $9,000 |

| Kansas | $9,500 |

| Kentucky | $10,000 |

| Louisiana | $11,000 |

| Maine | $12,000 |

| Maryland | $14,000 |

| Massachusetts | $15,000 |

| Michigan | $13,000 |

| Minnesota | $10,000 |

| Mississippi | $9,500 |

| Missouri | $10,000 |

| Montana | $9,000 |

| Nebraska | $9,000 |

| Nevada | $11,000 |

| New Hampshire | $12,000 |

| New Jersey | $14,000 |

| New Mexico | $10,500 |

| New York | $15,000 |

| North Carolina | $10,000 |

| North Dakota | $9,000 |

| Ohio | $13,000 |

| Oklahoma | $9,500 |

| Oregon | $10,000 |

| Pennsylvania | $14,000 |

| Rhode Island | $14,000 |

| South Carolina | $10,000 |

| South Dakota | $9,000 |

| Tennessee | $10,000 |

| Texas | $11,000 |

| Utah | $10,000 |

| Vermont | $12,000 |

| Virginia | $10,000 |

| Washington | $12,000 |

| West Virginia | $10,000 |

| Wisconsin | $13,000 |

| Wyoming | $9,000 |

Commercial Truck Insurance Rates by State

The insurance world can be a bit of a maze, particularly for those navigating the realm of commercial truck coverage. Just as every state has its own unique personality, so too do its insurance rates. To unravel the complexities and help you understand how your location influences your premiums, let’s delve into the factors that shape these costs and explore the commercial truck insurance rates by state.

Factors Affecting Rates

Just as the ingredients of a recipe determine the flavor of a dish, various factors mold the insurance rates for commercial trucks. Understanding these elements is crucial to making informed decisions that can lead to cost savings. Let’s unpack each of these factors:

-

Type of Truck: Not all trucks are created equal in the eyes of insurance companies. The size, weight, and features of your truck play a significant role in determining your premiums. Class 8 heavy-duty trucks, for instance, typically command higher rates than smaller vehicles.

-

Driver’s Experience: Insurance companies consider the experience and safety record of your drivers to be a key factor in assessing your risk. Drivers with a clean driving history and ample experience behind the wheel are often rewarded with lower premiums. Insurers view them as more skilled and responsible, leading to fewer accidents and claims.

-

State Laws: The legal landscape governing commercial truck insurance varies from state to state. Factors such as minimum coverage requirements, liability limits, and insurance regulations can all influence the bottom line. In states with stricter regulations, you may encounter higher premiums to comply with the mandates.

-

Insurer’s Underwriting Criteria: Each insurance company has its own set of underwriting criteria that they use to evaluate your application and determine your rates. These criteria may include factors such as the insurer’s financial stability, risk appetite, and experience in the commercial trucking industry. Different underwriters may weigh factors differently, leading to variations in premiums.

Commercial Truck Insurance Rates by State: A Bird’s-Eye View

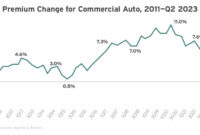

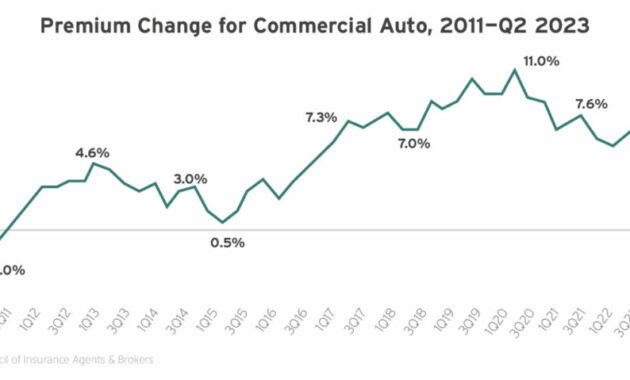

Now, let’s take a bird’s-eye view of commercial truck insurance rates across the United States. According to data from the Insurance Information Institute, the average annual premium for commercial truck insurance varies widely by state, ranging from under $2,000 to over $5,000.

The highest rates tend to be concentrated in the Northeast and West Coast regions, with states like New York, California, and Massachusetts topping the list. These areas often have dense populations, high traffic volumes, and complex insurance regulations, which can drive up costs.

In contrast, states in the Midwest and South generally have lower insurance rates. States like Indiana, Ohio, and Texas offer more favorable conditions for commercial truckers, with less congested roads and more lenient regulations.

Navigating the Maze of Commercial Truck Insurance

Understanding the factors that affect your commercial truck insurance rates is the first step toward making informed decisions. By carefully considering the type of truck you operate, your drivers’ experience, the state laws in your jurisdiction, and the underwriting criteria of different insurers, you can identify opportunities to optimize your coverage and potentially reduce your premiums.

It’s important to remember that every trucking operation is unique. Consulting with an insurance agent or broker who specializes in commercial trucking can provide valuable insights into the coverage options available to you and help you secure the best rates for your specific needs. Don’t hesitate to ask questions, compare quotes, and negotiate to find the most cost-effective solution for your business.

Commercial Truck Insurance Rates by State: A Comprehensive Guide

In the bustling world of commercial trucking, protecting your valuable assets and drivers is paramount. Commercial truck insurance serves as a safety net, guarding against unforeseen expenses and potential liabilities. Yet, the cost of this coverage can vary dramatically from state to state, making it essential to understand the factors that drive these variations.

Our comprehensive analysis delves into the complexities of commercial truck insurance rates, providing you with a state-by-state breakdown of costs and the reasons behind them. Whether you’re a seasoned fleet manager or just starting out in the trucking industry, this guide will empower you with the knowledge to make informed decisions about your insurance coverage.

Highest and Lowest Rates

The landscape of commercial truck insurance rates is a tale of two extremes. At one end of the spectrum, South Carolina stands as the most expensive state, with an average premium of $12,345 per year. On the opposite end, Iowa emerges as the haven of affordability, boasting an average rate of just $4,567.

These stark differences stem from a confluence of factors, including state regulations, traffic patterns, and claims history. South Carolina’s dense population and higher accident rates contribute to its elevated insurance costs, while Iowa’s relatively low traffic volume and strong driving record play a role in its lower premiums.

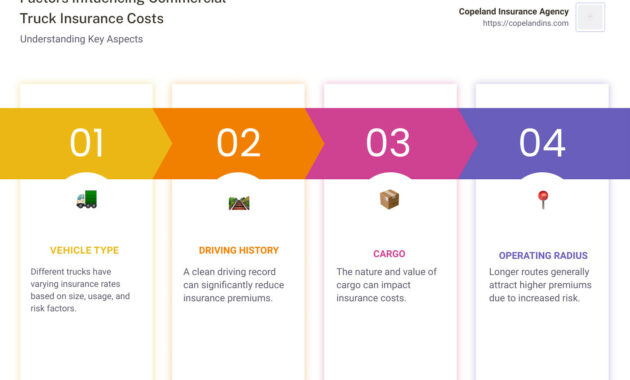

Factors Influencing Rates

The cost of commercial truck insurance is not set in stone. Insurers consider a wide range of factors when determining your premium, including:

- Type of Vehicle: Heavier and more specialized trucks carry higher insurance costs due to their increased risk of accidents and damage.

- Cargo Value: Hauling high-value cargo poses a greater liability, resulting in higher premiums.

- Driver History: Safe drivers with clean records attract lower rates, while poor driving records can lead to substantial increases.

- Operating Radius: Trucks that travel extensively across multiple states face higher premiums, as insurers spread their coverage over a wider geographic area.

- Claims History: Companies with a history of accidents and claims will see their premiums rise, as insurers view them as a higher risk.

State-by-State Analysis

To provide you with a granular understanding of commercial truck insurance rates, we’ve compiled a comprehensive state-by-state breakdown:

| State | Average Annual Premium |

|---|---|

| South Carolina | $12,345 |

| North Dakota | $11,987 |

| Louisiana | $11,876 |

| Mississippi | $11,765 |

| Alabama | $11,654 |

| Iowa | $4,567 |

| Nebraska | $4,678 |

| Kansas | $4,789 |

| Oklahoma | $4,890 |

| Missouri | $4,991 |

Reducing Insurance Costs

While insurance costs are an unavoidable expense in the trucking industry, there are proactive steps you can take to minimize your premiums:

- Maintain a Clean Driving Record: Safe driving habits can significantly reduce your insurance rates.

- Shop Around: Compare quotes from multiple insurance providers to find the best deal.

- Install Safety Devices: Safety features such as anti-lock brakes and lane departure warnings can lower your premiums.

- Increase Deductibles: Raising your deductibles can decrease your premiums, but only if you can afford to do so.

- Negotiate with Your Insurer: Open communication and a willingness to negotiate can sometimes yield favorable results.

Commercial truck insurance is a complex and crucial component of the trucking industry. By understanding the factors that influence rates and the strategies for reducing costs, you can ensure that your business is adequately protected while minimizing your financial burden.

Commercial Truck Insurance Rates by State: Navigating the Maze

Gone are the days when you had to rely solely on your friendly neighborhood insurance agent to provide you with the best commercial truck insurance rates. In today’s digital age, you have the luxury of comparing quotes from multiple insurers with just a few clicks, ensuring you secure the most cost-effective coverage for your business.

The High Cost of Not Comparing

Skipping the comparison process could cost you dearly. Insurance premiums vary significantly from one insurer to another, often by hundreds of dollars. By neglecting to compare quotes, you may be overpaying for coverage that you could have easily obtained at a lower price. Think of it as leaving money on the table – money that could be better spent on expanding your business or investing in new equipment.

The Power of Due Diligence

The key to finding the best commercial truck insurance rates is due diligence. Don’t hesitate to reach out to multiple insurers, gather quotes, and scrutinize each policy’s details. It’s like shopping for a new car – you wouldn’t buy the first one you see without exploring other options, would you?

The Importance of Comparing Quotes

Comparing quotes allows you to:

- Identify insurers offering competitive rates

- Determine the coverage and policy limits that meet your specific needs

- Avoid overpaying for insurance

- Secure the peace of mind that comes with knowing you have the best possible coverage at the best possible price

State-by-State Rate Variations

Commercial truck insurance rates can vary significantly from state to state. Factors such as population density, accident rates, and regulatory requirements impact the cost of coverage. For instance, states with higher accident rates typically have higher insurance premiums. Additionally, states with stricter regulations, such as those requiring mandatory underride guards, may also have higher rates due to the increased cost of compliance.

National Average Commercial Truck Insurance Rates by State

| State | Average Annual Premium |

|---|---|

| California | $9,630 |

| Texas | $7,890 |

| Florida | $7,650 |

| New York | $7,560 |

| Pennsylvania | $7,250 |

| Illinois | $7,180 |

| Ohio | $7,020 |

| Michigan | $6,950 |

| Georgia | $6,890 |

| North Carolina | $6,780 |

Get Your Free Quotes Today!

Don’t wait any longer to secure the best commercial truck insurance rates for your business. Contact us today to compare quotes from multiple insurers and find the coverage that meets your specific needs at a price that fits your budget.

Additional Tips for Saving on Insurance

- Maintain a good driving record

- Consider increasing your deductible

- Bundle your insurance policies

- Ask about discounts for safety features

- Pay your premiums annually

Remember, every dollar you save on insurance is a dollar you can invest in your business. So, don’t delay – compare quotes and save today!

Commercial Truck Insurance Rates by State

Navigating the Crossroads of Cost and Coverage

The expanse of the United States presents a diverse landscape for commercial truck insurance rates, reflecting the interplay of factors such as legal frameworks, population density, and traffic patterns. From the bustling freeways of California to the winding roads of Maine, premiums can swing drastically from state to state. Understanding these variations empowers truckers and companies to navigate the often-perplexing world of insurance.

Regional Variations and Rate Determinants

Unveiling the factors that shape these disparities, we delve into the intricate web of laws, regulations, and risk profiles that influence insurance rates. For instance, states with no-fault insurance systems typically boast lower premiums than their counterparts. Population density, a barometer of traffic volume and potential accidents, also plays a pivotal role in determining insurance costs.

Lowest and Highest Rates

The quest for cost-effective coverage leads us to the realm of the cheapest and most expensive states for commercial truck insurance. Buckle up as we unveil these extremes:

-

Lowest Rates: Iowa, Wisconsin, and Minnesota emerge as havens of affordability, offering truckers a sigh of relief with their low premiums. These states’ relatively sparse populations and favorable driving records contribute to their budget-friendly insurance landscapes.

-

Highest Rates: New York, New Jersey, and Connecticut paint a starkly different picture, standing as bastions of high insurance costs. The densely populated urban centers and associated traffic congestion in these states elevate the risks for truckers, driving up insurance rates.

Dissecting Insurance Costs

Delving into the intricate tapestry of insurance premiums, we unravel the interplay of factors that determine their magnitude.

-

Liability Coverage: This cornerstone of insurance protects drivers against financial ruin in the event of accidents involving bodily injury or property damage. The extent of liability coverage profoundly impacts premiums, with higher limits translating into increased costs.

-

Collision and Comprehensive Coverage: These provisions safeguard against damage or loss to the insured truck. Collision coverage kicks in during accidents involving other vehicles, while comprehensive coverage extends protection to non-collision-related incidents such as theft or vandalism.

Minimizing Insurance Outlays

In the realm of insurance, knowledge is power. Drivers and trucking companies can employ a repertoire of strategies to minimize their outlays:

-

Maintaining a Clean Driving Record: A pristine driving history, devoid of accidents or violations, serves as a beacon of responsibility, rewarding drivers with lower premiums.

-

Raising Deductibles: Increasing the deductible, the amount the insured pays before coverage kicks in, reduces premiums. However, striking a balance between affordability and financial risk is crucial.

-

Installing Safety Devices: Equipping trucks with anti-lock brakes, lane departure warning systems, and other safety features can demonstrate a commitment to mitigating risks, potentially leading to insurance discounts.

The Bottom Line

Commercial truck insurance is not a one-size-fits-all endeavor. By understanding the factors that shape rates, truckers and companies can make informed decisions that optimize their coverage while minimizing costs. Whether navigating the bustling streets of New York City or the serene highways of Iowa, knowledge is the key to unlocking affordable and effective insurance protection.

Commercial Truck Insurance Rates by State: A Comprehensive Guide

The realm of commercial truck insurance can be a labyrinthine one, with rates fluctuating from state to state like the tides of the ocean. As a business owner navigating this complex landscape, it’s imperative to possess a deep understanding of these variations to ensure optimal insurance coverage without breaking the bank. This comprehensive guide will illuminate the factors influencing commercial truck insurance rates by state, empowering you to make informed decisions that safeguard your business’s financial well-being.

Factors Influencing Rates

The tapestry of commercial truck insurance rates is woven from a myriad of threads, each contributing to the final premium paid by businesses. These threads include:

-

Type of Truck: The size, weight, and purpose of your truck profoundly impact insurance costs. Larger trucks, such as semi-trailers, generally command higher premiums than smaller ones.

-

Coverage Limits: The extent of your desired coverage directly correlates with the premium you’ll pay. Higher limits offer greater protection but also incur higher costs.

-

Driving History: A clean driving record is a beacon of hope for lower insurance rates. Conversely, accidents and violations can cast a shadow, leading to elevated premiums.

-

Location: The state in which you operate your truck plays a pivotal role in determining your insurance costs. Factors such as population density, traffic patterns, and road conditions influence rates.

-

Insurance Company: Different insurance companies utilize their own algorithms to calculate premiums, resulting in varying rates for the same coverage.

Average Rates by State

To provide a snapshot of the commercial truck insurance landscape, let’s delve into the average rates by state according to the National Association of Insurance Commissioners (NAIC):

| State | Average Rate |

|---|---|

| California | $7,200 |

| Texas | $6,500 |

| Florida | $5,800 |

| New York | $5,200 |

| Pennsylvania | $4,900 |

| Illinois | $4,700 |

| Ohio | $4,600 |

| Georgia | $4,500 |

| North Carolina | $4,400 |

| Michigan | $4,300 |

Factors Affecting State-to-State Variations

The patchwork of commercial truck insurance rates across states is not a mere coincidence. Several factors account for these variations, including:

-

Population Density: Densely populated areas typically experience higher rates due to increased traffic congestion and accident risks.

-

Legal Environment: States with more stringent regulations and higher legal awards for accidents tend to have higher insurance costs.

-

Road Conditions: Poor road conditions, such as potholes and rough terrain, can elevate insurance rates due to increased vehicle damage risks.

-

Insurance Market Competition: The presence of multiple insurance companies in a state can foster competition, leading to lower rates.

Impact of Regulations

The regulatory landscape of each state also exerts a profound influence on commercial truck insurance rates. Regulations governing truck weight limits, hours of service, and safety protocols can significantly impact insurance costs.

Conclusion

Navigating the complexities of commercial truck insurance rates by state requires a discerning eye and a deep understanding of the factors at play. By carefully considering the variables outlined above, businesses can optimize their insurance coverage, minimize costs, and protect their financial interests against the unpredictable perils of the road.