Commercial Truck Insurance Rates

Introduction

Navigating the labyrinthine world of commercial truck insurance can be a daunting task, especially when it comes to understanding the intricacies of insurance rates. Just like snowflakes, no two policies are exactly alike, and the premium you pay will vary depending on a myriad of factors. However, with a bit of research and the right guidance, you can decode the enigma of commercial truck insurance rates and secure coverage that fits your unique needs without breaking the bank.

This comprehensive guide will illuminate the key determinants of commercial truck insurance rates, empower you with insider knowledge, and arm you with the tools to negotiate like a seasoned pro. From understanding the underwriting process to deciphering the impact of your driving record, we’ve got you covered. So, buckle up and get ready to navigate the intricacies of commercial truck insurance rates with confidence.

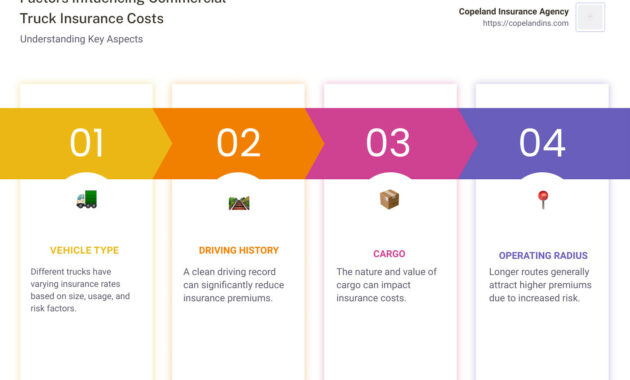

Factors Influencing Commercial Truck Insurance Rates

The cost of commercial truck insurance is not a one-size-fits-all proposition. Several factors converge to shape the premium you’ll pay, including:

1. Type of Truck and Usage

The type of truck you operate and its intended use play a significant role in determining your insurance rates. For instance, a heavy-duty semi-truck used for long-haul transportation will typically command a higher premium than a smaller pickup truck used for local deliveries. This is because larger trucks pose a greater potential risk due to their size and weight. Similarly, trucks used for hazardous materials transportation or specialized operations may incur higher rates due to the elevated risk involved.

2. Driving History

Your driving record is a crystal ball for insurance companies, providing them with a glimpse into your risk profile. A clean driving record with no accidents or violations is like a beacon of hope for insurers, leading to lower premiums. On the flip side, a checkered driving history with accidents, traffic violations, or DUI convictions can send your insurance rates soaring. Insurance companies view drivers with a history of risky behavior as more likely to file claims, hence the higher premiums.

3. Coverage Limits and Deductibles

The amount of coverage you choose and the deductibles you select also impact your insurance rates. Higher coverage limits provide more comprehensive protection in the event of an accident but come at a higher premium. Similarly, lower deductibles mean you’ll pay less out of pocket when filing a claim, but they also result in higher premiums. Finding the right balance between coverage, deductibles, and affordability is crucial.

4. Business Location and Claims History

The location of your business and its claims history can also influence your insurance rates. Areas with higher crime rates or a history of frequent accidents may lead to elevated premiums. Additionally, businesses with a history of frequent claims may be perceived as higher risk by insurance companies, resulting in higher rates.

5. Insurance Company

The insurance company you choose also plays a role in determining your rates. Different insurance companies have varying underwriting guidelines, claims handling procedures, and risk assessment models. Comparing quotes from multiple providers can help you secure the most competitive rates for your specific needs.

6. Discounts and Credits

Many insurance companies offer discounts and credits to policyholders who meet certain criteria, such as maintaining a clean driving record, installing safety devices on their trucks, or taking defensive driving courses. These discounts can significantly reduce your insurance premiums and make coverage more affordable.

Tips for Lowering Commercial Truck Insurance Rates

Navigating the world of commercial truck insurance rates can be a balancing act, but there are several strategies you can employ to lower your premiums without sacrificing coverage:

1. Maintain a Clean Driving Record

Your driving record is the single most influential factor in determining your insurance rates. Avoid accidents, traffic violations, and DUIs to keep your record pristine and your premiums low.

2. Increase Your Deductibles

Raising your deductible can significantly reduce your insurance premiums. However, it’s important to choose a deductible that you can comfortably afford to pay in the event of a claim.

3. Shop Around for Quotes

Comparing quotes from multiple insurance companies is essential for finding the most competitive rates. Different insurers have varying underwriting guidelines and risk assessment models, so getting multiple quotes can help you secure the best deal.

4. Take Advantage of Discounts

Many insurance companies offer discounts for policyholders who meet certain criteria, such as maintaining a clean driving record, installing safety devices on their trucks, or taking defensive driving courses. Take advantage of these discounts to lower your premiums.

5. Bundle Your Insurance

Bundling your commercial truck insurance with other business insurance policies, such as general liability or workers’ compensation, can often lead to discounts and lower overall insurance costs.

Conclusion

Understanding commercial truck insurance rates is a crucial aspect of managing your transportation expenses. By comprehending the factors that influence your premiums and employing strategies to lower your costs, you can secure coverage that meets your needs without breaking the bank. Remember, a clean driving record, smart deductible choices, shopping around for quotes, taking advantage of discounts, and bundling your insurance can all help you navigate the world of commercial truck insurance rates with confidence and affordability.

Introduction

Shopping for commercial truck insurance can be like navigating a treacherous road—filled with unexpected twists and turns that can leave you feeling lost and confused. But fear not, intrepid reader, for we’re here to guide you through the labyrinthine world of truck insurance rates, illuminating the path to finding the best coverage for your hard-earned dollars.

Just as a skilled mechanic meticulously examines every nook and cranny of your mighty rig, so too must you scrutinize the details of your insurance policy. The cost of this essential protection can fluctuate wildly, influenced by a myriad of factors that can make your head spin like a top. But don’t worry, we’ll break it down into bite-sized chunks, leaving no stone unturned in our quest for insurance enlightenment.

According to the American Trucking Associations, the average annual cost of commercial truck insurance in the United States hovers around $12,000. But hold your horses, buckaroo! This figure is merely a ballpark estimate. Your actual premium could be a lot higher or lower, depending on a smorgasbord of factors that we’ll explore shortly.

Factors Influencing Commercial Truck Insurance Rates

Buckle up, my friend, as we delve into the nitty-gritty of what makes commercial truck insurance rates dance like a marionette on strings.

1. Type of Truck and Usage

Just like your trusty pickup truck is different from a colossal 18-wheeler, the type of commercial truck you operate has a major impact on your insurance premium. The bigger and heavier your rig, the more it’s likely to cost to insure. Additionally, if you’re hauling hazardous materials or operating in high-risk areas, expect to pay a higher premium.

2. Driving History

Insurance companies aren’t fans of reckless drivers who treat the road like a demolition derby. A clean driving record, free of accidents and violations, can significantly lower your insurance costs. On the flip side, a checkered past behind the wheel can send your premium soaring through the roof like a homesick angel.

3. Location

Where you operate your commercial truck can also influence your insurance rates. If you’re based in a bustling metropolis with high traffic and accident rates, you’re likely to pay more than a trucker cruising the quiet roads of a sleepy town.

4. Coverage Limits

The amount of coverage you choose plays a crucial role in determining your insurance premium. Higher coverage limits mean more protection for your truck, but they also come with a higher price tag. Finding the right balance between coverage and affordability is key.

5. Deductible

The deductible is the amount you agree to pay out of pocket before your insurance kicks in. Choosing a higher deductible can lower your premium, but it also means you’ll have to shell out more cash in the event of a claim.

6. Insurance Company

Not all insurance companies are created equal. Some companies specialize in commercial truck insurance and offer competitive rates, while others may charge a premium for their services. It pays to shop around and compare quotes from multiple insurers before making a decision.

Commercial Truck Insurance Rates: Everything You Need to Know

When you’re behind the wheel of a commercial truck, you’re not just hauling cargo—you’re also responsible for protecting your livelihood. That’s why commercial truck insurance is essential. But how much does it cost? The answer depends on a number of factors, including the type of truck you drive, the weight of your loads, your mileage, your driver’s experience, and your company’s claims history. We’ll break down each of these factors and help you understand how they affect your premiums.

Factors Influencing Rates

The first step in understanding commercial truck insurance rates is to identify the factors that influence them. Here are some of the most important:

- Type of truck: The type of truck you drive has a big impact on your insurance rates. For example, dump trucks and flatbeds tend to be more expensive to insure than dry vans and refrigerated trailers.

- Weight of loads: The heavier your loads, the higher your insurance rates will be. This is because heavier loads increase the risk of damage to your truck and cargo.

- Mileage: The more miles you drive, the higher your insurance rates will be. This is because more miles on the road mean more opportunities for accidents.

- Driver’s experience: Drivers with more experience are less likely to get into accidents, so they typically have lower insurance rates.

- Claims history: If your company has a history of filing claims, your insurance rates will be higher. This is because insurance companies view companies with a history of claims as being more risky to insure.

Understanding Your Coverage

In addition to the factors listed above, there are a few other things you should keep in mind when purchasing commercial truck insurance. These include:

- Your deductible: The deductible is the amount of money you pay out of pocket before your insurance coverage kicks in. A higher deductible will lower your insurance premiums, but it will also mean that you’ll have to pay more out of pocket if you get into an accident.

- Your coverage limits: Your coverage limits are the maximum amount of money your insurance company will pay out in the event of an accident. You should choose coverage limits that are high enough to protect your business in the event of a worst-case scenario.

- Your riders: Riders are optional add-ons to your insurance policy that can provide additional coverage for specific risks. For example, you can purchase a rider to cover the cost of cargo theft or damage to your truck’s cab.

By understanding the factors that influence commercial truck insurance rates, you can make informed decisions about your coverage. This will help you protect your business and your livelihood.

Commercial Truck Insurance Rates: A Complete Guide for Savvy Business Owners

Owning and operating a commercial truck is an integral part of many businesses, but it also comes with a unique set of risks and responsibilities. That’s where commercial truck insurance comes in, providing a safety net to protect your business from unforeseen events and financial setbacks. Understanding the factors that influence commercial truck insurance rates is crucial for making informed decisions and securing the right coverage at the most competitive price.

Coverage Options

Commercial truck insurance policies offer a range of coverage options to tailor to the specific needs of your business. These options include:

- Liability insurance: Provides coverage for damages or injuries caused to others as a result of your truck’s operation.

- Physical damage insurance: Covers repairs or replacement of your truck in the event of an accident, theft, or vandalism.

- Cargo insurance: Protects the goods you’re transporting from damage or loss.

- Bobtail insurance: Extends coverage when your truck is not attached to a trailer.

- Non-trucking use insurance: Provides coverage when your truck is used for personal reasons, such as commuting to and from work.

Factors that Impact Commercial Truck Insurance Rates

A wide range of factors can influence the premiums you pay for commercial truck insurance. Understanding these factors can help you identify areas where you may be able to save money or improve your coverage:

- Type of truck: The size, weight, and type of truck you operate will impact your rates.

- Usage: The frequency and distance you drive your truck will affect your rates.

- Cargo: The type of cargo you transport can impact your rates, especially if it is high-value or hazardous.

- Driver history: Your driving record and experience can significantly impact your rates. Clean driving records typically result in lower premiums.

- Location: The location where your truck is based and where you operate it can affect your rates due to varying risk factors in different regions.

- Insurance history: Your claims history and previous insurance coverage can influence your rates.

- Deductibles: The deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Higher deductibles can lower your premiums but also increase your out-of-pocket expenses in the event of a claim.

Strategies for Lowering Commercial Truck Insurance Rates

There are several strategies you can employ to potentially lower your commercial truck insurance rates:

- Improve your driving record: Maintaining a clean driving record is one of the most effective ways to reduce your rates.

- Shop around: Compare quotes from multiple insurance providers to find the best rates and coverage options.

- Increase your deductible: Raising your deductible can lower your premiums. However, it’s important to choose a deductible that you can comfortably afford to pay in the event of a claim.

- Install safety features: Equipping your truck with safety features such as anti-lock brakes, lane departure warning systems, and dash cameras can demonstrate your commitment to safety and potentially lower your rates.

- Take driver safety courses: Completing driver safety courses can show insurers that you’re committed to improving your driving skills, which can lead to lower rates.

Conclusion

Commercial truck insurance is a critical component of protecting your business from the financial and legal risks associated with operating commercial vehicles. Understanding the coverage options, factors that influence rates, and strategies for lowering premiums is essential for making informed decisions about your insurance needs. By carefully considering these aspects, you can secure the right coverage at the most competitive prices, ensuring peace of mind and safeguarding your business against unforeseen events.

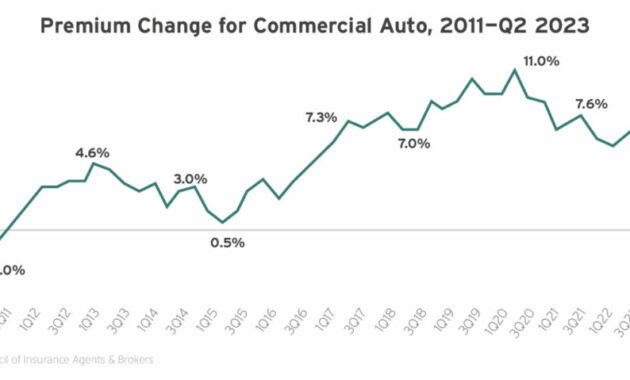

The Cost of Commercial Truck Insurance: Navigating the Maze

Commercial truck insurance can be a significant expense for businesses, especially in today’s volatile market. The average cost of commercial truck insurance in the United States varies widely depending on several factors, including the type of truck, the size of the fleet, the driving record of the drivers, and the state in which the truck is operated. However, businesses can expect to pay anywhere from a few thousand dollars to tens of thousands of dollars per year for commercial truck insurance.

Shopping for Insurance

With the high cost of commercial truck insurance, it’s more important than ever for businesses to shop around and compare quotes from multiple insurers. By doing so, businesses can find the best coverage at competitive prices. Here are a few tips for shopping for commercial truck insurance:

-

Get quotes from several different insurers. Don’t just go with the first insurer you find. Get quotes from at least three or four different insurers to compare coverage and prices.

-

Ask about discounts. Many insurers offer discounts for businesses that have a good driving record, install safety devices on their trucks, or have a large fleet of trucks. Ask about discounts when you’re getting quotes from insurers.

-

Read the policy carefully before you buy it. Make sure you understand what the policy covers and what the exclusions are. Don’t be afraid to ask questions if you don’t understand something.

Coverage Options

Commercial truck insurance policies typically include a variety of coverage options, including:

-

Liability coverage: This coverage protects businesses from financial liability if their truck is involved in an accident that causes injury or damage to others.

-

Collision coverage: This coverage pays for damage to the business’s truck if it is involved in an accident, regardless of who is at fault.

-

Comprehensive coverage: This coverage pays for damage to the business’s truck caused by non-collision events, such as theft, vandalism, or fire.

Businesses can choose which coverage options they want to purchase, depending on their individual needs and budget.

Exclusions

Commercial truck insurance policies typically have a number of exclusions, which are events or circumstances that are not covered by the policy. Some common exclusions include:

-

Acts of war

-

Nuclear explosions

-

Intentional acts

-

Criminal acts

Businesses should carefully review the exclusions in their policy to make sure they understand what is not covered.

Filing a Claim

If a business’s truck is involved in an accident, it is important to file a claim with the insurance company as soon as possible. The insurance company will investigate the claim and determine whether it is covered by the policy. If the claim is covered, the insurance company will pay for the damages up to the limits of the policy.

Filing a claim can be a stressful experience, but it is important to remember that the insurance company is there to help. The insurance company will work with the business to get its truck repaired or replaced and to get the business back on the road as quickly as possible.

Conclusion

Commercial truck insurance is an essential part of doing business for trucking companies. By shopping around and comparing quotes from multiple insurers, businesses can find the best coverage at competitive prices. Businesses should also carefully review the coverage options and exclusions in their policy to make sure they understand what is covered and what is not.

If a business’s truck is involved in an accident, it is important to file a claim with the insurance company as soon as possible. The insurance company will investigate the claim and determine whether it is covered by the policy. If the claim is covered, the insurance company will pay for the damages up to the limits of the policy.

Commercial Truck Insurance Rates: A Deep Dive into Premiums and Savings Strategies

Navigating the realm of commercial truck insurance can be a daunting task, with premiums often serving as a major financial burden for businesses. However, it’s crucial to understand that these rates are not set in stone – various factors can significantly impact the premiums you pay.

In this comprehensive guide, we’ll delve into the intricacies of commercial truck insurance, unraveling the factors that influence premiums and uncovering savvy savings strategies to help businesses keep their costs in check. Get ready to shift gears and gain a thorough understanding of this crucial aspect of truck fleet management.

Factors Determining Commercial Truck Insurance Rates

Understanding the determinants of commercial truck insurance premiums is the first step towards optimizing your coverage. Let’s lift the hood and examine the key elements that shape these rates:

1. Vehicle Type and Usage: The type of truck you operate – its size, weight, and intended use – plays a pivotal role in determining your premiums. Heavier vehicles, such as semi-trucks, typically command higher premiums compared to lighter trucks used for local deliveries.

2. Driving Record: Your drivers’ safety records are scrutinized by insurance companies as they gauge the risk associated with insuring your fleet. Accidents, traffic violations, and other driving-related incidents can elevate your premiums.

3. Annual Mileage: The number of miles your trucks accumulate each year directly influences your premiums. Higher mileage意味着 greater exposure to potential accidents, warranting a commensurate increase in insurance costs.

4. Cargo Value: The value of the cargo you transport heavily impacts your premiums. Hauling high-value goods attracts higher premiums as insurers seek to mitigate the financial liability associated with potential cargo losses.

5. Business Location: The geographical location of your business, including factors such as traffic congestion, crime rates, and weather patterns, can influence your insurance premiums.

6. Insurance Coverage Limits: The extent of coverage you choose – from liability insurance to comprehensive coverage – affects your premiums. Higher coverage limits provide broader protection but come at a higher cost.

Discounts and Savings

While commercial truck insurance premiums can be substantial, there are numerous ways to mitigate these costs and save money on your policy. Let’s explore the most effective strategies:

1. Driver Training: Investing in driver training programs can reap significant dividends in the form of reduced premiums. Insurers recognize the value of well-trained drivers and often offer discounts to businesses that prioritize safety.

2. Telematics: Equipping your trucks with telematics devices, which track vehicle performance and driver behavior, can provide insurers with valuable data. This data can be used to assess risk more accurately, potentially leading to lower premiums.

3. Good Safety Record: Maintaining a spotless driving record is a surefire way to keep your premiums in check. Accident-free fleets demonstrate a lower risk profile, earning them preferential treatment from insurance companies.

4. Bundling Policies: If your business operates multiple vehicles, consider bundling your insurance policies under a single provider. This can often result in savings on your overall premiums.

5. Loyalty Discounts: Staying with the same insurer for a specified period may qualify your business for loyalty discounts. Insurance companies appreciate long-term relationships and often reward them with reduced premiums.

6. Usage-Based Insurance (UBI): With UBI programs, premiums are directly tied to how much and how safely your trucks are driven. Businesses with low mileage and good driving habits can secure substantial savings under UBI policies.

Commercial Truck Insurance Rates: A Comprehensive Guide for Businesses

When it comes to running a successful trucking business, having adequate insurance coverage is paramount. Without it, you’re putting your company at risk of financial ruin in the event of an accident. But with so many different factors influencing commercial truck insurance rates, it can be difficult to know where to start.

In this article, we’ll take a deep dive into the world of commercial truck insurance rates, exploring the factors that impact them and providing tips on how to lower your premiums. By the end, you’ll have a comprehensive understanding of this crucial aspect of your business operations.

Factors Influencing Commercial Truck Insurance Rates

A multitude of elements come together to determine the cost of your commercial truck insurance. These factors can be broadly categorized into three main groups: driver-related, vehicle-related, and business-related.

Driver-Related Factors

- Age and driving experience: Younger drivers with less experience typically pay higher premiums than older, more seasoned professionals.

- Driving record: A clean driving record can significantly reduce your insurance costs. Avoidable accidents, traffic violations, and DUIs can all lead to higher premiums.

- Training and certifications: Drivers who have completed safety training programs or earned certifications may qualify for discounts on their insurance premiums.

Vehicle-Related Factors

- Type of truck: The type of truck you operate can also impact your insurance rates. For example, dump trucks and tow trucks typically cost more to insure than standard box trucks.

- Age and condition of the truck: Newer trucks with advanced safety features may qualify for lower insurance premiums than older trucks.

- Mileage and usage: The more miles you drive your truck, the higher your insurance premiums will be. Additionally, trucks used for hazardous materials or heavy hauling may incur higher rates.

Business-Related Factors

- Size of your fleet: The number of trucks in your fleet can also affect your insurance costs. Larger fleets may qualify for discounts, while smaller fleets may pay higher premiums.

- Location of your business: The location of your business can also impact your insurance rates. Areas with higher crime rates or accident rates may result in higher premiums.

- Claims history: Your business’s claims history is a major factor in determining your insurance rates. A higher number of claims can lead to higher premiums.

Types of Commercial Truck Insurance Coverage

There are various types of commercial truck insurance coverage available, each designed to protect different aspects of your business. The most common types of coverage include:

- Liability insurance: This coverage protects your business against claims of bodily injury or property damage caused to others as a result of your trucking operations.

- Collision insurance: This coverage protects your truck in the event of an accident, regardless of who is at fault.

- Comprehensive insurance: This coverage protects your truck against theft, vandalism, and other non-collision incidents.

- Cargo insurance: This coverage protects the goods you are transporting in the event of damage or loss.

How to Lower Your Commercial Truck Insurance Rates

Now that you have a better understanding of the factors that influence commercial truck insurance rates, let’s explore some strategies to help you lower your premiums:

- Maintain a good driving record: Avoid traffic violations and accidents to keep your driving record clean.

- Complete safety training programs: Take advantage of safety training programs and certifications to demonstrate your commitment to safe driving.

- Install safety features on your trucks: Equip your trucks with advanced safety features such as lane departure warnings and automatic emergency braking to reduce the risk of accidents.

- Shop around for insurance quotes: Don’t settle for the first insurance quote you receive. Compare offers from multiple insurance providers to find the best coverage at the lowest cost.

Conclusion

Understanding the factors that influence commercial truck insurance rates is essential for businesses to optimize their coverage and minimize costs. By carefully evaluating the factors discussed in this article and implementing strategies to lower your premiums, you can protect your business from financial risks while keeping your insurance costs under control. Remember, the right insurance coverage can provide peace of mind, allowing you to focus on running your business with confidence.