The Best Desktop Accounting Software For Small Businesses

Posted: 02 Apr 2025 on General

Introduction

In the realm of small businesses, where every penny counts, the choice of accounting software is paramount to ensuring financial well-being. While cloud-based options abound, desktop accounting software reigns supreme for its unmatched reliability, security, and customization capabilities. It’s the financial backbone of small businesses, empowering them to streamline processes, enhance accuracy, and ultimately thrive in a competitive landscape.

Advantages of Desktop Accounting Software

Desktop accounting software stands head and shoulders above its cloud-based counterparts, boasting a treasure trove of advantages that cater specifically to the needs of small businesses:

1. Unwavering Reliability: The Rock of Accounting Stability

In the whirlwind of business operations, reliability is an oasis of calm. Desktop accounting software, like a sturdy rock amidst turbulent waters, remains steadfast and dependable. Unlike cloud-based options, which are susceptible to internet outages and server glitches, desktop software operates independently, ensuring uninterrupted access to your financial data. It’s the unyielding companion that’s always there for you, rain or shine.

And that’s not all. With desktop accounting software, you’re not at the mercy of an internet connection. Whether you’re working from a remote cabin with spotty Wi-Fi or navigating the urban jungle with unreliable cellular service, desktop software empowers you to seamlessly manage your finances, giving you peace of mind knowing your business is in good hands.

Moreover, desktop software provides a comforting sense of control over your data. You’re not beholden to third-party servers or the whims of internet providers. Your financial information resides securely on your local computer, giving you the autonomy to safeguard it with multiple layers of security measures. It’s like having your own private financial fortress, impenetrable to outside threats.

2. Unparalleled Data Security: Guardian of Your Financial Sanctuary

In today’s digital age, data security is not a luxury but a necessity. Desktop accounting software stands as a vigilant sentinel, protecting your sensitive financial information from prying eyes and cyberattacks. Unlike cloud-based options, which store data on remote servers, desktop software keeps your information safely tucked away on your local computer.

This localized storage provides a crucial layer of defense against data breaches and cyber threats. By eliminating the risk of data being intercepted during transmission or compromised on remote servers, desktop software ensures your financial information remains confidential and secure. It’s like having a personal bodyguard for your financial data, constantly on the lookout for potential threats.

Moreover, desktop accounting software empowers you with complete control over access permissions. You decide who has the privilege of accessing your financial information, granting or revoking access as needed. This granular control ensures that only authorized individuals have the keys to your financial kingdom, minimizing the risk of unauthorized access and potential data breaches.

3. Tailored Customization: A Perfect Fit for Your Business’s Unique Needs

Every small business is a unique tapestry, with its own distinct needs and aspirations. Desktop accounting software understands this, offering a level of customization that cloud-based options simply can’t match. It’s like having a tailor-made suit that fits your business perfectly, enhancing efficiency and maximizing productivity.

With desktop accounting software, you can tailor the interface, menus, and even the accounting methods to align seamlessly with your business’s workflow. You can create custom reports that provide the exact insights you need, empowering you to make informed decisions and stay on top of your financial performance.

Furthermore, desktop accounting software allows you to integrate third-party applications and plugins, expanding its functionality to meet your specific requirements. Whether you need to streamline payroll processing, enhance inventory management, or connect with e-commerce platforms, desktop software’s open architecture empowers you to customize it to your heart’s content. It’s like having a Swiss Army knife for your finances, ready to tackle any challenge that comes your way.

Desktop Accounting Software: A Comprehensive Solution for Small Businesses

In the ever-evolving landscape of small business management, desktop accounting software has emerged as an indispensable tool. These feature-rich programs offer a comprehensive solution for streamlining financial operations, enhancing productivity, and ensuring compliance. Let’s delve into the benefits of desktop accounting software and uncover why it’s the go-to choice for businesses seeking financial clarity and efficiency.

Benefits of Desktop Accounting Software

**1. Robust Features and Customization Options**

Desktop accounting software boasts an array of robust features designed to cater to the diverse needs of small businesses. From tracking income and expenses with precision to generating financial reports with ease, these programs empower you to manage your finances with unparalleled accuracy. Moreover, the ability to customize the software to your specific workflow ensures that it seamlessly aligns with your business processes, saving you time and effort.

**2. Enhanced Security and Data Protection**

Protecting your sensitive financial data is paramount, and desktop accounting software takes this responsibility seriously. By storing data on your computer or local server, you gain complete control over your information, minimizing the risk of unauthorized access or data breaches. Desktop software also provides robust data encryption and backup features, ensuring that your financial records remain secure at all times.

**3. Offline Accessibility and Reliability**

Unlike cloud-based accounting software, desktop programs operate locally on your computer, providing you with the peace of mind that your data is always accessible, even without an internet connection. This offline capability is a lifesaver during power outages or technical glitches, ensuring that you can continue managing your finances seamlessly without any interruptions.

**4. Lower Cost of Investment**

Compared to cloud-based accounting software, desktop programs often require a one-time payment rather than ongoing subscription fees. This upfront investment can be a more budget-friendly option for small businesses with limited resources. Additionally, there are no recurring costs associated with updates or maintenance, further reducing your long-term expenses.

**5. Increased Efficiency and Productivity**

Desktop accounting software streamlines your financial processes by automating repetitive tasks, such as data entry and report generation. This frees up your valuable time to focus on core business operations, such as sales, customer service, and strategic planning. With a single, centralized platform for managing your finances, you’ll gain a comprehensive overview of your financial performance, enabling you to make informed decisions and drive growth.

**6. Improved Compliance and Reporting**

Desktop accounting software ensures that your business complies with accounting regulations and tax laws. By providing accurate and timely financial reports, you can streamline the tax filing process and avoid costly penalties. Moreover, the ability to generate custom reports tailored to your specific needs facilitates in-depth analysis and supports sound financial decision-making.

**7. Integration with Other Business Software**

Many desktop accounting software programs offer seamless integration with other business software, such as payroll systems, inventory management software, and customer relationship management (CRM) platforms. This integration eliminates the need for manual data entry, reducing errors and saving you time. By connecting your accounting software with other essential business applications, you create a robust and efficient ecosystem that empowers you to manage your business with greater efficiency.

Desktop Accounting Software for Small Businesses: A Comprehensive Guide

In the ever-evolving landscape of small business management, desktop accounting software has emerged as an indispensable tool. Designed to streamline financial operations and empower entrepreneurs with actionable insights, these software suites are a must-have for any business looking to succeed in today’s competitive market. Whether you’re managing a small retail shop or a burgeoning e-commerce empire, the right desktop accounting software can provide you with the foundation you need to grow and prosper.

One such software, [Software Name], stands out as a prime example of how desktop accounting can elevate small businesses. With a user-friendly interface, customizable features, and robust reporting capabilities, [Software Name] makes it easy for entrepreneurs to track income, expenses, and invoices while ensuring compliance with financial regulations.

Choosing the Right Software

When selecting desktop accounting software, it’s crucial to consider your business’s unique needs and objectives. Here are some key factors to keep in mind:

- **Business Size:** The size of your business will impact the complexity and functionality required in your accounting software. Smaller businesses may benefit from basic software, while larger businesses will need more robust solutions.

- **Industry:** Different industries have specific accounting needs. For example, retail businesses require software that can track inventory, while service-based businesses need software that can handle project billing.

- **Budget:** Desktop accounting software can vary in price, so it’s essential to set a budget before you start shopping. Consider the features you need and the cost of ongoing support.

Features to Look for

With a myriad of options available, narrowing down the best desktop accounting software for your business can be daunting. Here are some key features to look for:

- **Income Tracking:** Track and categorize all sources of income, including sales, fees, and interest.

- **Expense Tracking:** Easily record and organize business expenses, such as rent, utilities, and supplies.

- **Invoicing and Billing:** Create and send professional invoices to customers, track payments, and manage outstanding balances.

- **Financial Reporting:** Generate essential financial reports, such as balance sheets, income statements, and cash flow statements.

- **Inventory Management (Optional):** Track inventory levels, manage stock, and generate reports for better inventory control.

Benefits of Desktop Accounting Software

Investing in desktop accounting software for your small business offers a plethora of benefits:

- **Time Savings:** Automated processes and centralized data save time spent on manual accounting tasks, allowing you to focus on more strategic pursuits.

- **Improved Accuracy:** Automated calculations and data validation minimize errors and enhance the accuracy of financial reporting.

- **Enhanced Cash Flow Management:** Real-time insights into income and expenses enable informed decisions for better cash flow management.

- **Tax Compliance:** Built-in compliance features and reporting capabilities streamline tax preparation and ensure compliance with regulations.

- **Financial Insights:** Comprehensive financial reports and dashboards provide valuable insights into your business’s performance and help you make informed decisions.

Conclusion

Choosing the right desktop accounting software for your small business is a critical investment that can empower you with the tools and insights you need to drive growth and success. By considering your business’s unique needs, evaluating software features, and understanding the benefits, you can make an informed decision that will streamline your financial operations and propel your business forward.

Remember, accounting software is like the financial compass for your business, guiding you toward profitability and success. Invest in the right software, and it will pay for itself many times over.

Desktop Accounting Software: A Vital Tool for Small Business Success

In the competitive landscape of today’s business world, small enterprises face a plethora of challenges. One such challenge is managing finances effectively. Desktop accounting software emerges as a savior, empowering small businesses to stay on top of their financial game. With its user-friendly interfaces and robust features, desktop accounting software simplifies complex accounting tasks, allowing small businesses to streamline operations and make informed decisions.

Popular Desktop Accounting Software Options

The market boasts a vast array of desktop accounting software tailored to the needs of small businesses. Some of the top contenders include:

- QuickBooks: The industry leader, QuickBooks has captured the hearts of small businesses with its user-friendly interface, comprehensive features, and seamless integration with other business applications.

- Sage 50cloud: Sage 50cloud stands as a formidable competitor to QuickBooks, offering a wide range of accounting capabilities, including inventory management, payroll processing, and project costing.

- NetSuite: A cloud-based accounting solution, NetSuite provides a comprehensive suite of business management tools, including accounting, customer relationship management (CRM), and e-commerce.

Essential Features for Effective Accounting

Selecting the right desktop accounting software for your small business hinges on identifying the essential features that align with your unique requirements. These core features include:

- Invoicing and billing: Effortlessly create and send professional invoices, track payments, and manage customer accounts.

- Accounts payable and receivable: Keep meticulous records of your business’s financial transactions, ensuring timely payments and accurate billing.

- Financial reporting: Generate comprehensive financial reports, including balance sheets, income statements, and cash flow statements, to gain deep insights into your business performance.

- Payroll processing: Manage payroll efficiently, calculate taxes accurately, and generate paychecks with ease.

- Inventory management: Track inventory levels, manage stock, and optimize reordering to prevent stockouts and minimize waste.

- Integration: Seamlessly integrate your accounting software with other business applications, such as CRM, point-of-sale (POS) systems, and e-commerce platforms, to streamline data flow and enhance efficiency.

Benefits of Desktop Accounting Software

Adopting desktop accounting software for your small business offers a plethora of benefits:

- Enhanced accuracy: Automation minimizes errors and improves the accuracy of financial data.

- Time savings: Streamlined processes free up valuable time that can be dedicated to core business activities.

- Cost savings: Desktop accounting software can reduce the need for manual accounting, minimizing labor costs.

- Improved decision-making: Timely and accurate financial reports provide invaluable insights for informed decision-making.

- Enhanced compliance: Stay compliant with regulatory requirements by maintaining accurate financial records.

Choosing the Right Software for Your Small Business

The key to finding the perfect accounting software for your small business lies in evaluating your unique needs and budget. Consider the following factors:

- Business size and industry: Different industries and business sizes have varying accounting requirements.

- Features and functionality: Assess the specific features and modules required for your business operations.

- Ease of use: Opt for user-friendly software that simplifies accounting tasks for both accountants and non-accountants alike.

- Cost: Determine the software’s upfront cost and ongoing subscription fees to ensure it aligns with your budget.

- Support: Reliable customer support is crucial for troubleshooting and resolving technical issues.

In conclusion, desktop accounting software serves as an indispensable tool for small businesses seeking to streamline financial operations, enhance accuracy, and make informed decisions. By carefully evaluating your needs and selecting the right software, you can empower your small business to reach new heights of success.

Desktop Accounting Software for Small Business: A Comprehensive Guide

In the competitive landscape of today’s small businesses, having the right tools to manage finances efficiently is paramount. Desktop accounting software emerges as a powerful ally for small business owners, offering a streamlined approach to tracking financial transactions, generating reports, and making informed decisions. This comprehensive guide will delve into the intricacies of selecting and implementing desktop accounting software, empowering you to make an informed choice that aligns with the unique needs of your small business.

When choosing desktop accounting software, consider factors such as the number of transactions you process, the complexity of your financial operations, and your budget. QuickBooks, NetSuite, and Sage 50cloud are reputable options that cater to the diverse needs of small businesses. These solutions offer a range of features including invoicing, expense tracking, financial reporting, and inventory management.

Benefits of Desktop Accounting Software

Embracing desktop accounting software brings a plethora of benefits to small businesses. Streamlined financial management, simplified tax preparation, and enhanced decision-making capabilities are just a few of the advantages you can reap. With automated calculations and report generation, you can free up valuable time to focus on growing your business.

Moreover, desktop accounting software serves as a central repository for all your financial data, providing a comprehensive view of your business’s financial health. Say goodbye to the hassles of manual data entry and embrace the efficiency of digital record-keeping. Making informed decisions becomes a breeze with real-time access to accurate financial information.

Implementation and Training

Proper implementation and training are the cornerstones of successful desktop accounting software adoption. A well-executed implementation process ensures seamless integration into your business operations and minimizes disruptions. Seek professional assistance if necessary to guarantee a smooth transition.

Training your staff on the software’s functionality is equally important. Comprehensive training empowers your team to leverage the software’s capabilities effectively and derive maximum value from it. Consider conducting hands-on workshops and providing ongoing support to ensure your staff is well-equipped to navigate the software confidently.

Selecting Desktop Accounting Software: Key Considerations

Choosing the right desktop accounting software is a critical step towards efficient financial management. Before making a decision, evaluate your business’s specific needs and the features offered by different software solutions. Consider the number of transactions you process, the complexity of your financial operations, and your budget.

Don’t be afraid to consult with industry experts or seek recommendations from other small business owners. Their insights can provide valuable perspectives on software capabilities and user experiences. Invest time in researching and comparing different software options to make an informed choice that aligns with your business’s unique requirements.

Maximizing the Benefits of Desktop Accounting Software

To fully harness the benefits of desktop accounting software, embrace best practices and explore advanced features. Regular data backups ensure your financial information is safeguarded against unexpected events. Utilize the reporting capabilities to gain insights into your business’s financial performance and identify areas for improvement.

Stay abreast of software updates and new features to enhance your user experience and access the latest advancements. Consider integrating your software with other business applications to streamline processes and improve efficiency. By embracing these strategies, you can maximize the software’s potential and drive the growth of your small business.

Conclusion

In the ever-evolving landscape of small business management, desktop accounting software has become an indispensable tool for success. By streamlining financial processes, simplifying tax preparation, and providing valuable insights, desktop accounting software empowers small businesses to make informed decisions and achieve their financial goals. Embrace the power of technology and invest in desktop accounting software to unlock the potential of your small business.

Desktop Accounting Software for Small Business

Small business owners are often overwhelmed with the task of managing their finances. With so many things to keep track of, it can be difficult to know where to start. Fortunately, there are a number of desktop accounting software programs available that can make the process much easier. These programs can help you track your income and expenses, create invoices and reports, and manage your payroll.

When choosing a desktop accounting software program, there are a few things you’ll need to consider. First, you’ll need to decide what features are important to you. Some programs offer a wide range of features, while others are more basic. Second, you’ll need to consider the cost of the program. Some programs are free, while others can cost hundreds of dollars.

One of the best desktop accounting software programs for small businesses is QuickBooks. QuickBooks is a comprehensive program that offers a wide range of features, including invoicing, expense tracking, and payroll management. QuickBooks is also relatively easy to use, making it a good choice for small business owners who are not familiar with accounting software.

Another popular desktop accounting software program is Xero. Xero is a cloud-based program that offers many of the same features as QuickBooks. Xero is also very easy to use, making it a good choice for small business owners who are new to accounting software.

Features to Consider

When choosing a desktop accounting software program, there are a few key features you’ll want to consider. These features include:

- Invoicing: The ability to create and send invoices is essential for any small business. Make sure the software you choose offers invoicing features that meet your needs.

- Expense tracking: Keeping track of your expenses is essential for managing your cash flow. Make sure the software you choose offers expense tracking features that meet your needs.

- Payroll management: If you have employees, you’ll need to find a software program that can help you manage payroll. Make sure the software you choose offers payroll features that meet your needs.

- Reporting: The ability to generate reports is essential for understanding your financial performance. Make sure the software you choose offers reporting features that meet your needs.

- Ease of use: If you’re not familiar with accounting software, you’ll want to choose a program that is easy to use. Make sure the software you choose has a user-friendly interface and offers good customer support.

Cost

The cost of desktop accounting software programs can vary widely. Some programs are free, while others can cost hundreds of dollars. The cost of the program will depend on the features you need and the number of users.

If you’re on a budget, there are a number of free desktop accounting software programs available. These programs offer basic features that may be sufficient for your needs. If you need more advanced features, you’ll need to purchase a paid program.

Maintenance and Support

Regular software updates and ongoing support are essential for maintaining the software’s functionality and security. Make sure the software you choose offers regular updates and ongoing support.

Some software programs offer free updates and support, while others charge a fee. The cost of updates and support will vary depending on the program.

It’s important to make sure you understand the software’s update and support policies before you purchase it. This will help you avoid any unexpected costs down the road.

Here are some additional things to consider when choosing a desktop accounting software program:

- The size of your business: The size of your business will determine the features you need in an accounting software program. If you have a small business, you may not need a program with a lot of advanced features.

- Your industry: The industry you’re in may also affect the features you need in an accounting software program. For example, if you’re in the retail industry, you may need a program that can track inventory.

- Your budget: The cost of the software is an important factor to consider. Make sure you choose a program that fits your budget.

- Your comfort level with technology: If you’re not comfortable with technology, you’ll want to choose a program that is easy to use. Make sure the program you choose has a user-friendly interface and offers good customer support.

Choosing the right desktop accounting software program can make a big difference in the efficiency of your small business. By taking the time to consider your needs and budget, you can choose a program that will help you manage your finances and grow your business.

Desktop Accounting Software: Empowering Small Businesses with Financial Management

Accounting software is indispensable for businesses of all sizes, but it becomes even more critical for small businesses. With limited budgets and resources, small businesses need accounting solutions that are affordable, easy to use, and tailored to their specific needs. Desktop accounting software fits the bill perfectly, empowering small businesses to manage their finances with precision and efficiency. In this article, we will delve into the world of desktop accounting software, exploring its features, benefits, and top options available for small businesses.

Understanding Desktop Accounting Software

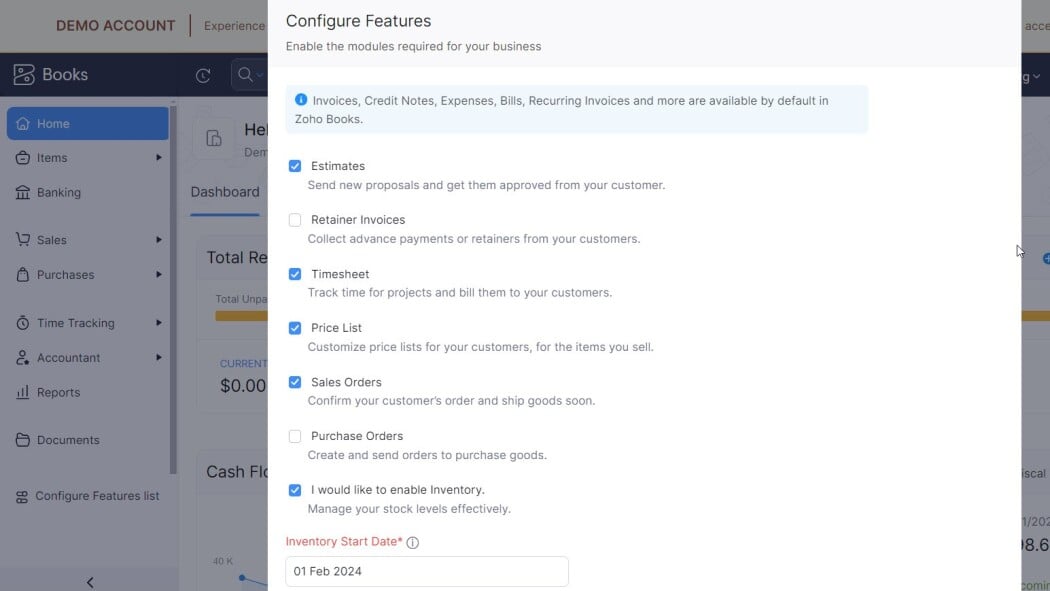

Desktop accounting software, as the name suggests, is installed on a local computer rather than accessed through the cloud. This local installation offers several advantages, including greater control over data, enhanced security, and offline accessibility. Desktop accounting software typically consists of a suite of modules that handle various accounting functions, such as invoicing, expense tracking, financial reporting, and inventory management.

Benefits of Desktop Accounting Software for Small Businesses

For small businesses, desktop accounting software offers a plethora of benefits:

- Cost-effectiveness: Desktop accounting software is generally more affordable than cloud-based solutions, making it an excellent choice for businesses with limited budgets.

- Customizability: Desktop accounting software allows for extensive customization, enabling businesses to tailor the software to their specific requirements.

- Control and privacy: With desktop accounting software, businesses have complete control over their financial data, which is stored locally on their computers, ensuring data privacy and security.

- Offline accessibility: Unlike cloud-based software, desktop accounting software can be accessed offline, providing businesses with the flexibility to work anytime, anywhere.

Key Features of Desktop Accounting Software

When choosing desktop accounting software, it is important to consider the following key features:

- Invoicing and billing: The software should allow businesses to create professional invoices, track payments, and manage customer accounts.

- Expense tracking: Businesses need to be able to record and categorize expenses accurately, and the software should provide robust expense tracking capabilities.

- Financial reporting: Comprehensive financial reporting is essential for understanding the financial health of a business. The software should generate a variety of reports, including profit and loss statements, balance sheets, and cash flow statements.

- Inventory management: For businesses that deal with physical products, inventory management is crucial. The software should enable businesses to track inventory levels, set reorder points, and manage stock adjustments.

- Integration with other software: The ability to integrate with other software, such as payroll software or e-commerce platforms, can streamline business processes and save time.

Top Desktop Accounting Software Options for Small Businesses

Choosing the right desktop accounting software is essential for maximizing its benefits. Here are some of the top options available for small businesses:

- QuickBooks Desktop: QuickBooks Desktop is a popular choice for small businesses, offering a user-friendly interface, comprehensive features, and affordable pricing.

- Sage 50cloud Accounting: Sage 50cloud Accounting is another excellent option for small businesses, providing a wide range of features, including inventory management and project tracking.

- NetSuite ERP: NetSuite ERP is a more comprehensive solution designed for small to mid-sized businesses, offering advanced features such as CRM, inventory management, and financial planning.

Conclusion

Small businesses can level up their financial management game with desktop accounting software. With their affordability, customizability, control, and offline accessibility, desktop accounting software empowers small businesses to manage their finances effectively and efficiently. From invoicing and billing to expense tracking and financial reporting, desktop accounting software is the cornerstone of financial success for small businesses. So, if you’re a small business owner looking to take control of your finances, it’s high time to consider investing in desktop accounting software.