Square Credit Card Processing Fees

Posted: 02 Apr 2025 on General

Square Credit Card Processing Fees

If you’re a small business owner, you know that every penny counts. That’s why it’s important to find a credit card processing company that offers competitive rates and fees. Square is one of the most popular credit card processing companies on the market, and they offer a variety of pricing plans to fit your business’s needs.

Square’s Pricing Plans

Square offers three different pricing plans for their credit card processing services:

Which Plan Is Right for You?

The best plan for your business will depend on your specific needs. If you process a small number of transactions each month, the Square Free plan may be a good option for you. If you need more features, such as the ability to track sales or manage inventory, the Square Plus or Square Premium plans may be a better fit.

Square’s Fees

In addition to the monthly fee, Square also charges a per-transaction fee. The per-transaction fee varies depending on the pricing plan you choose. The Square Free plan charges a flat rate of 2.6% + 10¢ per transaction. The Square Plus plan charges a flat rate of 2.5% + 10¢ per transaction. The Square Premium plan charges a flat rate of 2.4% + 10¢ per transaction.

Other Fees

In addition to the monthly fee and per-transaction fee, Square also charges a few other fees. These fees include:

Is Square Right for You?

Square may be a good option for you if you’re a small business that needs a simple and affordable credit card processing solution. However, if you’re a high-volume business, you may want to consider a different credit card processing company that offers lower rates.

Square Credit Card Processing Fees: A Comprehensive Guide

For many businesses, Square is a go-to option for payment processing. With its competitive rates and ease of use, it’s a no-brainer for handling credit and debit transactions. If you’re considering using Square, you’ll want to understand its fee structure before signing up.

Fixed-Rate Fees

With Square’s fixed-rate plans, you pay a flat rate for each transaction, regardless of the amount. This can be a great option for businesses that process a high volume of transactions or those that regularly process larger amounts. Square offers two fixed-rate options:

2.5% per Transaction

This is Square’s standard fixed rate, and it’s applicable to all types of cards, including credit cards, debit cards, and prepaid cards. So, if you process a $100 transaction, you’ll pay a fee of $2.50.

2.6% + 10¢ per Transaction

This variation on the fixed-rate plan is ideal for businesses that process a lot of transactions under $100. While the percentage fee is slightly higher than the standard rate, the 10¢ flat fee makes it a more cost-effective option for smaller transactions. For instance, if you process a $50 transaction, your fee will be $1.30.

As you can see, Square’s fixed-rate fees are quite competitive. In fact, they’re typically lower than the rates charged by traditional payment processors. This makes Square an attractive option for businesses of all sizes.

The Intricate Maze of Square Credit Card Processing Fees

Square, a venerated name in the financial technology arena, has carved a niche for itself with its user-friendly payment processing solutions. However, unraveling the complexities of its fees can be akin to navigating a labyrinthine puzzle. To empower merchants with the knowledge they need to make informed decisions, let’s delve into the nuances of Square’s credit card processing fees, dissecting the variable-rate fees that can fluctuate like the tides.

Variable-Rate Fees

Under the variable-rate fee structure, the processing charges levied upon merchants are not set in stone. Instead, they morph depending on the transaction amount and the type of card employed for the purchase. This dynamic pricing model can be likened to a chameleon, adapting to the circumstances at hand.

Transaction Amount

The transaction amount serves as a pivotal factor in determining the variable-rate fee. As the value of the transaction escalates, so too does the processing fee. This is akin to a graduated tax system, where higher earners are subject to a more substantial burden.

Card Type

The type of card utilized for the transaction also plays a pivotal role in the calculation of the variable-rate fee. Credit cards, debit cards, and prepaid cards all incur different processing fees. Credit cards typically command the highest fees, followed by debit cards. Prepaid cards, on the other hand, often carry the most modest fees.

Example

To illustrate how variable-rate fees work, let’s consider the following scenario:

- A small business processes a $100 transaction using a credit card.

- Square charges a variable-rate fee of 2.9% + 30 cents.

- The processing fee for this transaction would be $3.20 (2.9% of $100 + 30 cents).

Unveiling the Nuances

The intricacies of Square’s variable-rate fees extend beyond the aforementioned factors. Additional variables that can influence the processing charges include:

- Interchange fees

- Assessment fees

- Network fees

- PCI compliance fees

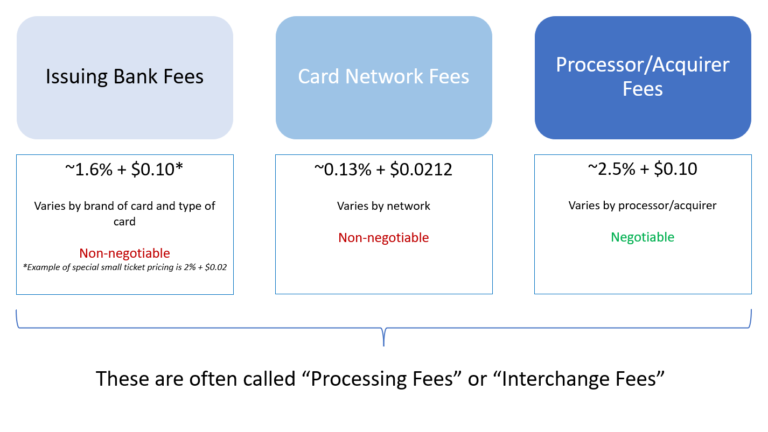

Interchange fees are levied by the card-issuing bank and are passed on to the merchant. Assessment fees are charged by the payment networks (e.g., Visa, Mastercard). Network fees are incurred when a transaction is processed through a specific payment network. PCI compliance fees are imposed to ensure that merchants adhere to industry-standard security protocols.

Navigating the Maze

Comprehending the intricacies of Square’s variable-rate fees is akin to charting a course through a labyrinth. However, by arming yourself with the knowledge provided in this article, you can navigate this complex landscape with confidence. Remember, the key to unlocking the full potential of Square’s payment processing solutions lies in understanding the fees associated with each transaction.

Square Credit Card Processing Fees: A Comprehensive Guide for Merchants

Square, the popular payment processing platform, offers businesses a convenient and cost-effective way to accept credit card payments. However, understanding its fee structure is crucial to ensure you’re not overpaying for this essential service. Here’s a detailed breakdown of Square’s credit card processing fees:

Interchange Fees

Interchange fees, set by the credit card networks (e.g., Visa, Mastercard), are the fees that a merchant pays to the card issuer (e.g., the bank that issued the customer’s credit card) every time a credit card is used. These fees vary based on factors such as card type, transaction size, and business industry. Interchange fees are typically around 2-3% of the transaction amount.

Square Processing Fees

In addition to interchange fees, Square charges its own processing fees for each transaction. These fees are typically a percentage of the transaction amount, ranging from 2.6% to 3.5%, depending on the payment method and the subscription plan chosen. Square’s processing fees are competitive with other payment processors and offer merchants a transparent pricing model.

Markup Fees

Square also charges a markup fee on top of interchange and processing fees for certain transactions, such as keyed-in transactions (where the card information is manually entered) or transactions processed through Square Invoices. The markup fee typically adds an additional 0.5% to 1% to the overall processing cost.

Other Fees

There are a few other fees to consider when using Square for credit card processing:

- Monthly Subscription Fee: Square offers two subscription plans: Plus ($29/month) and Premium ($79/month). The Plus plan includes advanced features such as custom invoices and inventory tracking, while the Premium plan offers additional features like customer loyalty programs and employee management.

- Chargeback Fees: If a customer disputes a transaction and successfully initiates a chargeback, Square charges a fee of $15 to cover administrative costs.

- PCI Compliance Fees: Square provides merchants with PCI compliance tools and resources, but additional fees may apply if a business requires additional support or validation.

Additional Considerations

When choosing a payment processor, it’s important to consider your business’s specific needs and transaction volume. Square’s fee structure is designed to be affordable for businesses of all sizes but may not be the best option for high-volume merchants. It’s also worth noting that Square may offer promotions or discounts on fees, especially for new customers. Before signing up for any payment processing service, it’s advisable to compare fees and features of multiple providers to find the best fit for your business.

Overall, Square’s credit card processing fees are transparent and competitive with other payment processors. By understanding the different types of fees involved, you can make informed decisions about your payment processing needs and budget.

Square Credit Card Processing Fees

Square offers a range of credit card processing fees, from 2.6% + 10¢ per transaction for in-person payments to 3.5% + 15¢ per transaction for online payments. In addition, Square charges a monthly fee of $20 for its basic plan and $60 for its premium plan. For businesses that process a high volume of transactions, Square offers custom pricing.

Square’s fees are competitive with other payment processors, such as PayPal and Stripe. However, it’s important to compare the fees of different processors before choosing one. You should also consider the features that each processor offers, such as mobile payments, online invoicing, and customer support.

PCI Compliance

PCI compliance is a set of security standards that merchants must meet in order to process credit cards. PCI compliance is designed to protect cardholder data from being stolen or compromised. To be PCI compliant, merchants must implement a variety of security measures, including:

PCI compliance can be a challenge for small businesses, but it’s essential for protecting customer data. Businesses that fail to comply with PCI standards could face fines, penalties, and even legal action.

5 Ways to Reduce Credit Card Processing Fees

There are a number of ways to reduce credit card processing fees. Here are five tips:

By following these tips, you can reduce your credit card processing fees and save money on your business expenses.

Conclusion

Credit card processing fees can be a significant expense for businesses. However, there are a number of ways to reduce these fees. By following the tips in this article, you can save money on your business expenses and improve your bottom line.

Square Credit Card Processing Fees

Square, the popular mobile payment processing company, offers a variety of pricing plans for businesses of all sizes. The fees associated with these plans can vary depending on the type of business, the volume of transactions, and the payment methods accepted. In this article, we will take a closer look at Square’s credit card processing fees and provide a breakdown of the different costs involved.

Transaction Fees

Square’s transaction fees are some of the most competitive in the industry. For card-present transactions (i.e., those made in person using a physical credit or debit card), the standard processing rate is 2.6% + 10 cents per transaction. For card-not-present transactions (i.e., those made online or over the phone), the processing rate is slightly higher at 3.5% + 15 cents per transaction.

Monthly Fees

In addition to per-transaction fees, Square also offers a monthly subscription plan for businesses that process high volumes of transactions. The monthly fee for this plan varies depending on the number of transactions processed and the type of payment methods accepted. For businesses that process less than $250,000 in annual sales, the monthly fee is $20. For businesses that process more than $250,000 in annual sales, the monthly fee is $75.

Chargeback Fees

Chargebacks occur when a customer disputes a transaction and requests a refund. When a chargeback occurs, Square will charge the business a fee of $15. This fee is in addition to the cost of the original transaction. Businesses can reduce the risk of chargebacks by implementing clear and concise refund policies and by providing excellent customer service.

Other Fees

There may be additional fees, such as monthly fees or fees for additional services, depending on your processing plan. It is important to carefully review the terms and conditions of your Square account to ensure that you are aware of all applicable fees.

How to Choose the Right Square Plan

The best Square plan for your business will depend on your specific needs and budget. If you process a high volume of transactions, a monthly subscription plan may be a good option. If you process a low volume of transactions, a pay-as-you-go plan may be more cost-effective. Square also offers a variety of add-on services, such as gift cards and loyalty programs, which can help you grow your business.

Conclusion

Square offers a variety of credit card processing plans to fit the needs of businesses of all sizes. The fees associated with these plans can vary depending on the type of business, the volume of transactions, and the payment methods accepted. It is important to carefully review the terms and conditions of your Square account to ensure that you are aware of all applicable fees.