Small Business Accounting Software With Payroll

Posted: 02 Apr 2025 on General

Introduction

Navigating the financial complexities of running a small business can be like trying to decipher an ancient hieroglyphic text without the Rosetta Stone. That’s where small business accounting software with payroll capabilities comes in – it’s the Swiss Army knife of your financial management arsenal.

These indispensable tools streamline your financial transactions, automate payroll processing, and provide valuable insights into the fiscal health of your business. It’s like having a trusty sidekick who’s always crunching numbers, keeping track of employee compensation, and whispering sage financial advice in your ear.

In this comprehensive guide, we’ll delve into the nitty-gritty of small business accounting software with payroll capabilities. We’ll explore the key features, benefits, and potential pitfalls to help you make an informed decision when it comes to choosing the perfect software for your business.

Features of Small Business Accounting Software with Payroll

The features of small business accounting software with payroll are as diverse as the businesses they serve. However, there are some core capabilities that are essential for any business:

- General ledger: This is the heart of your accounting system, where all financial transactions are recorded and organized. It provides a complete picture of your business’s financial health.

- Accounts payable and receivable: These modules track money owed to and by your business. They help you stay on top of your cash flow and avoid costly late payments.

- Payroll processing: This feature automates the often-tedious task of calculating employee paychecks, withholding taxes, and filing payroll reports.

- Financial reporting: These tools generate reports that provide insights into your business’s performance. They can help you identify trends, make informed decisions, and impress potential investors.

- Integration with other software: The ability to integrate with other software, such as customer relationship management (CRM) or e-commerce platforms, can streamline your business processes and save you time.

Additional features that may be beneficial for some businesses include inventory management, project tracking, and time tracking.

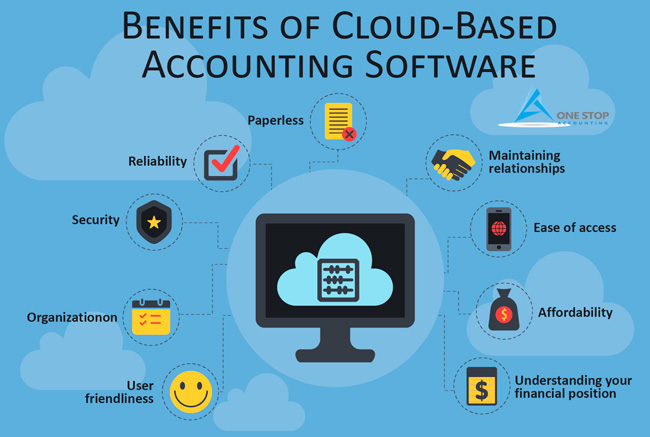

Benefits of Small Business Accounting Software with Payroll

Investing in small business accounting software with payroll capabilities can bring a wealth of benefits to your business, including:

- Time savings: Automating tasks such as payroll processing and financial reporting can free up your time to focus on more strategic aspects of your business.

- Improved accuracy: Software eliminates the risk of human error in financial calculations, ensuring that your financial records are always accurate.

- Enhanced efficiency: Streamlining your financial processes can improve your overall efficiency and productivity.

- Better decision-making: Financial reports generated by accounting software provide valuable insights into your business’s performance, enabling you to make informed decisions.

- Increased profitability: By improving your financial management, you can identify areas where you can reduce costs and increase profitability.

Overall, small business accounting software with payroll capabilities can be a game-changer for your business, helping you save time, improve accuracy, and make better decisions.

Considerations When Choosing Small Business Accounting Software with Payroll

When choosing small business accounting software with payroll capabilities, there are several factors to consider:

- Your business size and needs: The size and complexity of your business will determine the features and capabilities you need in accounting software.

- Your budget: Accounting software can range in price from free to thousands of dollars per month. Choose a software that fits within your budget.

- Your technical expertise: If you’re not comfortable with technology, choose software that is easy to use and has good customer support.

- Integration with other software: If you use other software, such as CRM or e-commerce platforms, make sure the accounting software you choose can integrate with them.

- Scalability: If you expect your business to grow, choose software that can scale with your needs.

It’s also a good idea to read reviews from other small businesses before making a decision.

Potential Pitfalls of Small Business Accounting Software with Payroll

While small business accounting software with payroll capabilities can be a valuable tool, there are some potential pitfalls to be aware of:

- Cost: Some accounting software can be expensive, especially for small businesses with limited budgets.

- Complexity: Some accounting software can be complex and difficult to use, especially for non-technical users.

- Data security: Accounting software contains sensitive financial data, so it’s important to choose software that has strong security measures.

- Lack of support: Some accounting software providers offer limited customer support, which can be frustrating if you encounter problems.

It’s important to carefully consider the potential pitfalls before investing in small business accounting software with payroll capabilities.

Conclusion

Small business accounting software with payroll capabilities can be a powerful tool for managing your finances and growing your business. By automating tasks, improving accuracy, and providing valuable insights, accounting software can free up your time, improve your decision-making, and increase your profitability. However, it’s important to choose software that is right for your business’s size, needs, and budget.

Consider the features, benefits, and potential pitfalls of different accounting software before making a decision. With the right software in place, you can streamline your financial processes and take your business to the next level.

Small Business Accounting Software with Payroll: Streamlining Your Operations

If you’re the owner of a small business, you know the importance of efficient accounting and payroll management. With the right software, you can streamline your financial processes, save time and money, and ensure compliance with regulations. In this article, we’ll dive into the must-have features you should consider when choosing small business accounting software with payroll capabilities.

Features to Look For

When selecting an accounting software solution for your small business, there are several key features to keep an eye out for.

1. Invoicing and Payment Processing

A robust accounting system should make it easy for you to create and send professional-looking invoices to your clients. Look for software that allows you to customize templates, track payments, and handle recurring invoicing. Seamless payment processing integration is also essential to streamline your cash flow management.

2. Expense Tracking and Management

Keeping track of your business expenses is crucial both for financial control and tax purposes. Choose software that provides comprehensive expense tracking features. You should be able to easily categorize expenses, attach receipts, and generate expense reports. Advanced features like mobile expense tracking and mileage logging can save you a lot of time and hassle.

Features to Consider in Expense Tracking

a. Automatic Categorization:

Say goodbye to tedious manual entries! Opt for software that automatically categorizes your expenses based on predefined rules. This feature can save you hours of work and ensure accuracy.

b. Receipt Capture and Storage:

No more stacks of paper receipts cluttering your desk. Look for software that allows you to scan or upload receipts directly into the system. This digital storage makes expense tracking a breeze.

c. Cross-Platform Compatibility:

Track your expenses on the go with software that offers mobile apps. Keep an eye on your expenses, snap receipts, and stay organized, no matter where you are.

d. Mileage Tracking:

If your business involves driving, find software that simplifies mileage tracking. Automatic GPS logging or manual entry options can help you calculate mileage deductions accurately.

Tips for Effective Expense Management

a. Set Up a Clear Expense Policy:

Establish clear guidelines for expense reimbursement, including what expenses are eligible, documentation requirements, and approval processes.

b. Encourage Regular Expense Reporting:

Don’t wait until tax season to deal with expenses. Encourage your employees to submit expense reports promptly, ensuring up-to-date financial records.

c. Review Expenses Regularly:

Regularly review your expenses to identify any potential issues or areas for improvement. This proactive approach can save you money and prevent overspending.

d. Use Technology to Streamline:

Utilize software that automates expense tracking, reduces manual input, and provides insights into your spending patterns.

3. Financial Reporting and Analysis

Comprehensive financial reporting is essential for tracking your business’s performance and making informed decisions. Choose software that generates customizable reports, including profit and loss statements, balance sheets, and cash flow statements. Advanced reporting features like budgeting tools and forecasting capabilities can help you plan for the future and stay on top of financial trends.

4. Payroll Processing and Compliance

Payroll management can be complex and time-consuming, but the right software can make it a breeze. Look for a solution that handles all aspects of payroll, including direct deposit, payroll tax calculations, and compliance with government regulations. Automated payroll processing can save you countless hours and ensure timely and accurate payments to your employees.

5. Integration with Other Business Applications

To maximize efficiency, consider software that integrates with your other business applications, such as customer relationship management (CRM) systems, e-commerce platforms, and inventory management tools. This integration allows for seamless data transfer and eliminates the need for manual data entry, reducing errors and saving you time.

Choosing the Right Solution for Your Small Business

When choosing small business accounting software with payroll capabilities, it’s important to consider your specific needs and budget. Evaluate the features offered by different solutions, read online reviews, and consider demos or free trials to ensure the software aligns with your business requirements.

Conclusion

With the right small business accounting software with payroll, you can automate your financial processes, improve accuracy, and gain valuable insights into your business performance. By considering the features outlined in this article, you can streamline your operations, save time and money, and stay compliant with regulations. Embrace the power of technology to better manage your finances and drive your small business towards success.

Small Business Accounting Software with Payroll: Your Trusted Financial Navigator

In the ever-evolving business landscape, small enterprises face a constant challenge to maintain financial stability and efficiency. Embracing the right accounting software with integrated payroll capabilities can be a game-changer, empowering businesses to streamline their financial processes, enhance accuracy, and simplify payroll management. One such software that has gained prominence is [Software Name], a comprehensive solution designed to meet the unique needs of small businesses.

With [Software Name], business owners can bid farewell to tedious manual calculations and time-consuming paperwork. Its user-friendly interface and automated features make it a breeze to track income, expenses, payroll, and tax liabilities. No more fumbling with spreadsheets or relying on multiple software programs – this software seamlessly integrates all your financial data, giving you a crystal-clear view of your financial health.

But the benefits of using [Software Name] don’t end there. It’s like having a financial wizard at your fingertips, ensuring compliance with complex tax laws and regulations. The software automatically calculates payroll taxes, generates payroll reports, and even handles direct deposits – saving you countless hours and potential headaches. Furthermore, its robust reporting capabilities provide valuable insights into your business performance, helping you make informed decisions and stay on top of your finances.

Benefits of Using Accounting Software with Payroll

1. Streamlined Financial Processes

Think of your financial processes as a tangled knot of paperwork. Accounting software with payroll integration is like a magic wand, untangling that knot with ease. No more juggling multiple spreadsheets or stacks of invoices – everything is organized and accessible in one central location. From tracking expenses to generating reports, this software automates tasks, freeing up your time to focus on growing your business.

Imagine the time you’ll save when you can generate invoices with a few simple clicks, or when your software automatically reconciles bank statements. It’s like having an extra pair of hands, helping you stay on top of your finances without breaking a sweat.

2. Enhanced Accuracy

Accuracy is the name of the game when it comes to your financial records. Manual calculations can lead to costly errors, but with accounting software with payroll integration, you can bid farewell to those worries. The software performs calculations with precision, ensuring that your financial statements are always up-to-date and accurate.

Think of it this way: it’s like having a built-in calculator that never makes mistakes. No more double-checking your calculations or worrying about accidentally transposing numbers. The software handles the heavy lifting, giving you the peace of mind that your financial records are always reliable.

3. Significant Time Savings

Time is money, especially for small businesses. Accounting software with payroll integration can help you save both by automating repetitive tasks and streamlining your workflows. Imagine spending less time on data entry and more time on growing your business. Here’s how:

- Automated Payroll Processing: The software automatically calculates payroll taxes, generates paychecks, and handles direct deposits, saving you hours of manual work each pay period.

- **Seamless Expense Tracking:** Capture receipts with a snap of a photo or upload them directly into the software, eliminating the need for manual data entry.

- Simplified Invoicing:** Create and send invoices with ease, and track payments and outstanding balances in real-time.

With these time-saving features, you can free up your schedule and focus on the tasks that truly matter – like building your business and serving your customers.

4. Ensured Tax Compliance

Navigating the complexities of tax laws can be a daunting task. But with accounting software with payroll integration, you can rest assured that you’re meeting your tax obligations. The software automatically calculates payroll taxes, generates tax reports, and provides reminders for upcoming tax deadlines. It’s like having a tax expert on your team, ensuring that you stay compliant and avoid costly penalties.

Imagine the peace of mind you’ll have knowing that your tax filings are accurate and on time. No more scrambling to meet deadlines or worrying about making mistakes. The software handles the tax complexities, giving you the confidence that your business is in good standing with tax authorities.

In conclusion, embracing accounting software with payroll integration is a strategic investment for any small business. Its ability to streamline financial processes, enhance accuracy, save time, and ensure tax compliance makes it an invaluable tool for managing your finances and growing your business. Don’t waste another minute struggling with manual tasks or worrying about tax headaches. Choose [Software Name] today and unlock the power of efficient and stress-free financial management.

Small Business Accounting Software with Payroll: Do You Really Need It?

In the cutthroat world of entrepreneurship, staying afloat means juggling a myriad of tasks, from marketing and sales to customer service and finance. And when it comes to finance, the task of managing your company’s financial health can be a real headache – especially if you’re not equipped with the right tools.

Enter small business accounting software with payroll – a lifesaver for entrepreneurs like you who want to simplify their financial management and streamline their payroll processes. With the right software, you can automate tasks, track expenses, generate reports, and pay your employees with ease. But not all accounting software is created equal. Here’s what you need to know to find the perfect solution for your business.

Small Business Accounting Software with Payroll: A Time-Saving Necessity

Picture this: you’re buried under a mountain of receipts, invoices, and payroll slips. You’re spending hours each week trying to keep track of everything, and you’re still not sure if your books are accurate. Sound familiar?

If so, it’s time to consider investing in small business accounting software with payroll. This software can help you:

- Automate tasks like invoicing, expense tracking, and payroll processing

- Generate financial reports with just a few clicks

- Track your cash flow and identify areas for improvement

- Stay compliant with tax regulations

Plus, most accounting software also includes payroll features that can help you calculate payroll taxes, issue paychecks, and file payroll returns. This can save you a significant amount of time and hassle, and it can also help you avoid costly mistakes.

Tips for Choosing the Right Software

With so many small business accounting software options on the market, choosing the right one for your business can be overwhelming. Here are a few tips to help you make the best decision:

1. Evaluate Your Business Needs

The first step is to take a good look at your business and identify your specific needs. What features are important to you? Do you need to be able to track inventory? Generate reports? Process payroll? Once you know what you need, you can start to narrow down your options.

2. Research Different Options

Once you have a good understanding of your needs, it’s time to start researching different software options. Read reviews, talk to other small business owners, and demo different products. This will help you get a feel for the different features and pricing options available.

3. Seek Recommendations from Trusted Sources

If you’re not sure where to start your research, ask for recommendations from trusted sources. Your accountant, lawyer, or other business advisors can all be helpful in pointing you in the right direction.

4. Consider Your Long-Term Needs

When choosing accounting software, it’s important to think about your long-term needs. Will you need to grow your business in the future? Add new employees? Integrate with other software? Choose a software that can scale with your business and meet your needs for years to come.

The Best Small Business Accounting Software with Payroll

Now that you know what to look for, here are a few of the top-rated small business accounting software with payroll features:

QuickBooks Online

QuickBooks Online is one of the most popular small business accounting software options on the market. It’s easy to use, even for beginners, and it offers a wide range of features, including invoicing, expense tracking, payroll processing, and financial reporting. QuickBooks Online also integrates with a variety of other business software, which can help you streamline your workflow.

Xero

Xero is another popular option for small businesses. It’s known for its user-friendly interface and its powerful reporting features. Xero also offers a variety of add-ons that can help you customize the software to meet your specific needs.

Sage Business Cloud Accounting

Sage Business Cloud Accounting is a comprehensive accounting software solution for small businesses. It offers a wide range of features, including inventory management, project tracking, and multi-currency support. Sage Business Cloud Accounting also integrates with a variety of other business software, which can help you streamline your workflow.

Conclusion

Choosing the right small business accounting software with payroll can be a daunting task, but it’s worth taking the time to do your research. By following the tips in this article, you can find the perfect software for your business needs and start saving time and money.

Small Business Accounting Software with Payroll: Simplifying Financials and Workforce Management

In the bustling landscape of small businesses, seamless accounting and payroll management are crucial for success. With advancements in technology, a wealth of accounting software solutions have emerged, offering tailored features and payroll capabilities to streamline operations. Choosing the right software can be a daunting task, but we’ve curated a comprehensive guide to popular options that will help you make an informed decision.

QuickBooks: The Industry Standard

QuickBooks, an undisputed industry leader, has long been the go-to choice for small businesses. Its comprehensive suite of accounting tools, robust payroll features, and intuitive interface make it a user-friendly and efficient solution. With customizable reports, real-time financial tracking, and the ability to integrate with third-party apps, QuickBooks caters to a wide range of business needs.

Xero: The Cloud-Based Contender

Xero, a cloud-based accounting software, has gained immense popularity for its sleek interface and ease of use. It simplifies financial management with automated bank feeds, expense tracking, and multi-currency support. Xero’s payroll module, while not as comprehensive as QuickBooks’, offers essential features like automated payroll processing, tax calculations, and direct deposits.

Sage 50cloud: Robustness with Scalability

Sage 50cloud, formerly known as Peachtree, offers a powerful accounting solution tailored for small businesses. With its robust accounting capabilities, inventory management tools, and flexible payroll system, Sage 50cloud can grow with your business as it expands. Its advanced reporting features provide valuable insights into your financial performance.

NetSuite: The Enterprise-Grade Solution

NetSuite, an enterprise-grade accounting software, caters to the needs of small businesses with complex operations. Its robust accounting module, advanced CRM capabilities, and integrated payroll system provide end-to-end business management. NetSuite offers a high level of customization and automation, making it a suitable choice for businesses with sophisticated accounting requirements.

FreshBooks: Simplicity and Affordability

FreshBooks, known for its simplicity and affordability, is an ideal choice for small businesses with basic accounting and payroll needs. Its user-friendly interface, customizable invoices, and automated payment reminders make it easy to manage your finances. FreshBooks’ payroll module covers essential features like payroll processing, tax calculations, and employee self-service.

Choosing the Right Software: A Step-by-Step Guide

The key to choosing the right small business accounting software with payroll is to assess your specific needs and consider your budget. Here’s a step-by-step guide to help you make an informed decision:

- Identify Your Business Needs: Determine the essential accounting and payroll features you require, such as invoicing, expense tracking, payroll processing, and tax calculations.

- Consider Your Budget: Small business accounting software with payroll capabilities can vary significantly in cost. Set a budget that aligns with your financial capabilities.

- Research and Compare Options: Explore different software solutions, read reviews, and compare their features and pricing to find the best fit for your business.

- Evaluate Ease of Use: Choose software that is easy to navigate and understand. Intuitive interfaces and user-friendly dashboards can save you time and frustration.

- Consider Integration Capabilities: Assess whether the software can integrate with other applications you use, such as CRM systems or e-commerce platforms.

- Seek Professional Advice: If you’re unsure about which software to choose, consider consulting with an accountant or IT professional for guidance.

Conclusion

Choosing the right small business accounting software with payroll can significantly streamline your financial management and payroll processes. By considering your specific needs, researching different options, and carefully evaluating their features, you can find a solution that will help your business thrive. Remember, the best software is the one that meets your unique requirements, enhances efficiency, and supports your long-term growth aspirations.

The Essential Guide to Small Business Accounting Software with Payroll: Streamline Your Finances

In today’s fast-paced business landscape, small businesses need every edge they can get. Managing finances efficacement is a crucial aspect of success, and using the right accounting software can make all the difference.

Introducing small business accounting software with payroll, a game-changer for streamlining your financial operations. With its comprehensive features, you can bid farewell to manual calculations and time-consuming paperwork, freeing up your precious time to focus on what really matters: growing your business.

Benefits of Small Business Accounting Software with Payroll

The benefits of using small business accounting software with payroll are as numerous as they are valuable. Let’s dive into the top advantages:

- Effortless Expense Tracking: Imagine having a virtual filing cabinet for all your business expenses. Just snap a photo of a receipt or enter a few details, and the software does the rest, keeping your expenses organized and accounted for.

- Accurate Invoicing, Every Time: No more embarrassments with incorrect invoices! The software automates invoice creation, ensuring accuracy and professionalism. Your clients will appreciate the error-free invoices they receive on time.

- Time-Saving Payroll Processing: Payroll can be a headache, but not with accounting software. It calculates salaries, deductions, and taxes automatically, saving you countless hours of manual labor and the associated headaches.

- Cash Flow Management at Your Fingertips: Know where your business stands financially, anytime, anywhere. The software gives you real-time insights into your cash flow, allowing you to make informed decisions for your business.

- Error Reduction: Manual accounting is prone to errors, but with accounting software, everything is automated, minimizing human mistakes. Plus, the software performs data validation, catching errors before they become problems.

- Simple Tax Preparation: Tax time used to be a nightmare, but not anymore. The software generates reports and summarizes your financial data, making tax preparation a breeze. You’ll be ready for tax season with just a few clicks.

Choosing the Right Software for Your Small Business

Selecting the perfect small business accounting software with payroll is a journey, not a destination. Consider these key factors to find the best fit for your needs:

- Number of Employees: Choose software that can handle your current payroll needs and has the capacity to grow with your business.

- Features You Need: Make a list of essential features you need, such as automatic invoicing, expense tracking, or payroll reports. Prioritize the features that are most critical for your business.

- User-Friendliness: You’re busy! Look for software that’s easy to use and navigate. A user-friendly interface will save you a lot of frustration in the long run.

- Customer Support: When you have questions or need assistance, you want to know that help is just a click away.

- Cost: Determine your budget and look for software that offers a fair price for the features and value it provides.

Implementation and Ongoing Management

Once you’ve chosen your software, it’s time to buckle up and implement it. Here are a few tips to ensure a smooth transition:

- Clean Data: Before importing your data, make sure it’s clean and accurate. This will prevent errors and ensure the software functions properly.

- Train Your Team: Educate your team on how to use the software effectively. Proper training will maximize the benefits and minimize the learning curve.

- Regular Updates: Software updates are essential for maintaining security and adding new features. Regularly update your software to keep it running smoothly.

- Review and Adjust: As your business grows and changes, revisit your accounting software to ensure it still meets your needs. Make adjustments as necessary to keep up with your evolving requirements.

Conclusion

In a competitive business world, every advantage counts. Small business accounting software with payroll can streamline your financial management, enhance efficiency, and support business growth. By choosing the right software and implementing it effectively, you’ll free up valuable time, minimize errors, and empower your business to reach new heights.