QuickBooks Online Credit Card Processing Fees

Posted: 02 Apr 2025 on General

Introduction

As a small business owner, you can breathe a sigh of relief knowing that you don’t have to go through the hassle of managing your finances manually. With the advent of cloud-based accounting software like QuickBooks Online (QBO), keeping track of your financial transactions has become a breeze. But what about those all-important credit card processing fees? They can be a real pain in the neck, can’t they? Don’t worry, we’ll delve into everything you need to know about QuickBooks Online’s credit card processing fees, so you can make informed decisions about your business’s financial strategy.

QBO Credit Card Processing Fees: A Breakdown

QBO offers two main types of credit card processing fees: a flat rate and a tiered rate. The flat rate is a fixed percentage of each transaction, regardless of the amount. The tiered rate, on the other hand, is a variable percentage that depends on the size of the transaction. QBO’s flat rate is 2.9% + 30 cents per transaction, while its tiered rates range from 1.9% + 30 cents to 2.9% + 30 cents, depending on the amount of the transaction.

In addition to these standard fees, QBO also charges a monthly service fee for its credit card processing services. This fee varies depending on the plan you choose, but it typically ranges from $20 to $100 per month. So, if you’re planning on processing a significant volume of credit card transactions, you’ll need to factor in these monthly fees as well.

Choosing the Right Fee Structure for Your Business

Now that you know about QBO’s credit card processing fees, the next step is to choose the fee structure that’s right for your business. If you’re not sure which structure is best for you, consider the following factors:

- The volume of credit card transactions you process each month

- The average size of your credit card transactions

- Your business’s budget

If you process a high volume of small transactions, the flat rate may be a better option for you. However, if you process a smaller volume of large transactions, the tiered rate may be more cost-effective.

Tips for Minimizing Credit Card Processing Fees

Once you’ve chosen the right fee structure for your business, there are a few things you can do to minimize your credit card processing fees:

- Negotiate with your credit card processor. Many processors are willing to negotiate their rates, especially if you’re a large business.

- Use a payment gateway that offers competitive rates. There are a number of payment gateways out there that offer competitive rates on credit card processing. Do some research to find the best gateway for your business.

- Encourage your customers to use debit cards or electronic checks. Debit cards and electronic checks typically have lower processing fees than credit cards.

- Offer discounts for customers who pay with cash. This can help you to offset the cost of credit card processing fees.

By following these tips, you can minimize your credit card processing fees and keep more money in your pocket.

QuickBooks Online Credit Card Processing Fees: A Deep Dive

Take it from us, navigating the labyrinth of QuickBooks Online (QBO) credit card processing fees can be like trying to decipher a cryptic crossword puzzle. But fear not, intrepid reader! This comprehensive guide will unravel the complexities of QBO’s pricing structure, empowering you to make informed decisions and keep your financial ship afloat.

Before we plunge into the nitty-gritty, let’s set the stage with a quick recap. QBO, a cloud accounting software titan, charges a per-transaction percentage fee for credit and debit card transactions. This fee varies depending on your plan and processing volume, but typically falls within the range of 2.4% to 3.9%.

Processing Fees: A Breakdown

Let’s break down the processing fees into more manageable chunks. QBO offers three primary pricing tiers: Simple Start, Essentials, and Plus. Simple Start is the entry-level plan, charging 2.9% + $0.25 per transaction. Essentials bumps up the fee to 2.7% + $0.25, while Plus offers the lowest fee of 2.4% + $0.25.

However, these headline rates only tell half the story. QBO also offers volume discounts for high-volume processors. If your monthly transaction volume exceeds a certain threshold, you may qualify for a reduced processing fee. For example, businesses processing over $750,000 per month may snag a fee as low as 2.2% + $0.20 per transaction.

So, how do you determine which plan and fee structure is right for you? It all boils down to your business’s unique needs and transaction volume. If you’re just starting out or have a low transaction volume, Simple Start may be your sweet spot. For businesses with moderate transaction volumes, Essentials strikes a good balance between cost and features. And if you’re a high-volume processor, Plus is the clear winner, offering the lowest fees and most robust feature set.

Additionally, QBO offers a variety of add-on services that can increase your processing fees. For instance, if you need to accept payments over the phone or through invoices, you’ll need to shell out an additional fee. These add-on costs can add up, so it’s important to factor them into your decision-making process.

In conclusion, understanding QBO’s credit card processing fees is crucial for making informed financial decisions. By weighing the different pricing tiers, volume discounts, and add-on services, you can choose the plan that best aligns with your business’s needs. So, there you have it – the key to unlocking the mysteries of QBO’s credit card processing fees. Armed with this newfound knowledge, you can confidently navigate the financial waters and keep your business on the path to success.

Quickbooks Online Credit Card Processing Fees

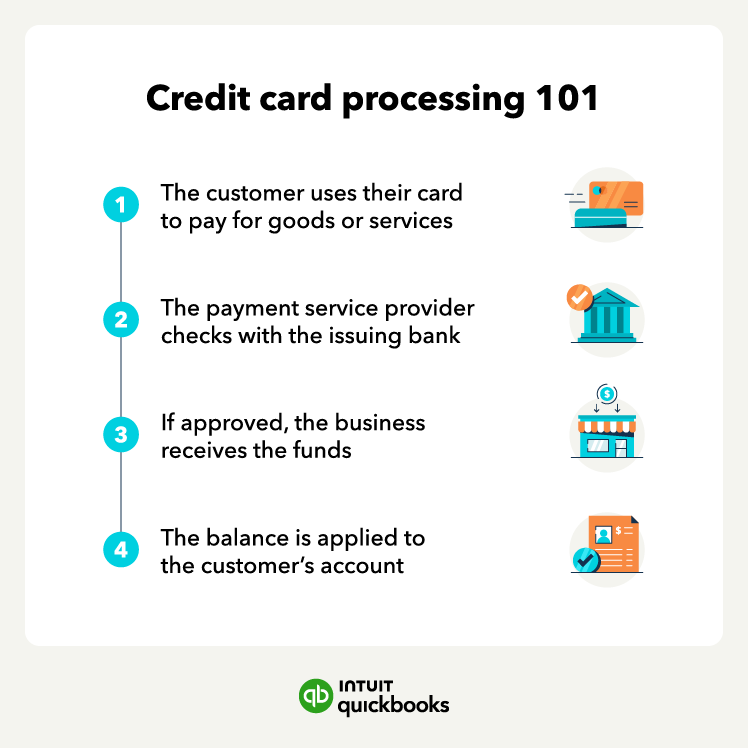

QuickBooks Online (QBO), a cloud-based accounting software, allows businesses to accept credit card payments with ease. However, it’s crucial to understand the associated processing fees to make informed decisions about your payment strategy.

Standard Processing Fees

Percentage-Based Fees:

QBO charges a percentage fee for each credit card transaction, depending on the card type. Visa, Mastercard, and Discover typically incur a 2.4% fee, while American Express transactions have a higher 2.9% rate.

Fixed Fees:

In addition to percentage-based fees, there’s a fixed fee of 25 cents per transaction. This fee applies to all credit card types, regardless of the transaction amount.

Flat-Rate Fees:

For businesses with high transaction volumes, QBO offers a flat-rate pricing plan. This plan charges a set monthly fee plus a variable transaction fee, which is typically lower than the percentage-based fees.

Additional Fees

Card-Specific Fees:

Certain card types come with additional fees. For instance, American Express transactions incur an additional 0.5% fee.

Non-Standard Transaction Fees:

Transactions processed over the phone or manually entered incur higher fees compared to online transactions.

Chargeback Fees:

If a customer disputes a transaction and initiates a chargeback, you may be charged a fee of $20 or more.

Insufficient Funds Fees:

If a customer’s credit card does not have sufficient funds to cover the transaction, you may be charged an NSF fee of $15 or more.

Monthly Statement Fees:

QBO charges a monthly statement fee of $10 for businesses with monthly processing volumes exceeding $25,000.

PCI Compliance Fees:

To ensure the security of your customers’ credit card information, you may need to pay PCI compliance fees. These fees vary depending on the level of security measures implemented.

Factors Affecting Fees

The following factors can influence your QBO credit card processing fees:

- Business Type: Not-for-profit organizations and government agencies may qualify for reduced fees.

- Transaction Volume: Higher transaction volumes may qualify you for lower fees.

- Average Transaction Amount: Businesses with higher average transaction amounts may pay lower fees.

- Industry: Certain industries, such as healthcare and hospitality, have higher processing fees.

- Processor: QBO partners with different credit card processors, each with their own fee structure.

Choosing the Right Plan

Understanding the various fees associated with QBO credit card processing is essential for choosing the right plan for your business. Consider your transaction volume, average transaction amount, and business type to find the most cost-effective solution.