Processing Fees: What You Need To Know About Credit Card Fees

Posted: 02 Apr 2025 on General

The Inside Scoop on Credit Card Processing Fees: A Merchant’s Guide to the Hidden Costs

In the ever-evolving world of e-commerce, accepting credit cards has become an indispensable tool for businesses of all sizes. However, lurking behind the convenience of these transactions are often-overlooked fees that can eat into your profits. These processing fees, charged by payment processors for their role in facilitating credit card transactions, are an unavoidable part of the game. But armed with the right knowledge, you can minimize their impact on your bottom line.

What are Credit Card Processing Fees?

Put simply, processing fees are a type of transaction fee paid by merchants to payment processors for the services they provide in handling credit card payments. These services include:

- Authorizing transactions

- Verifying cardholder information

- Transferring funds from the customer’s account to the merchant’s account

Anatomy of a Processing Fee

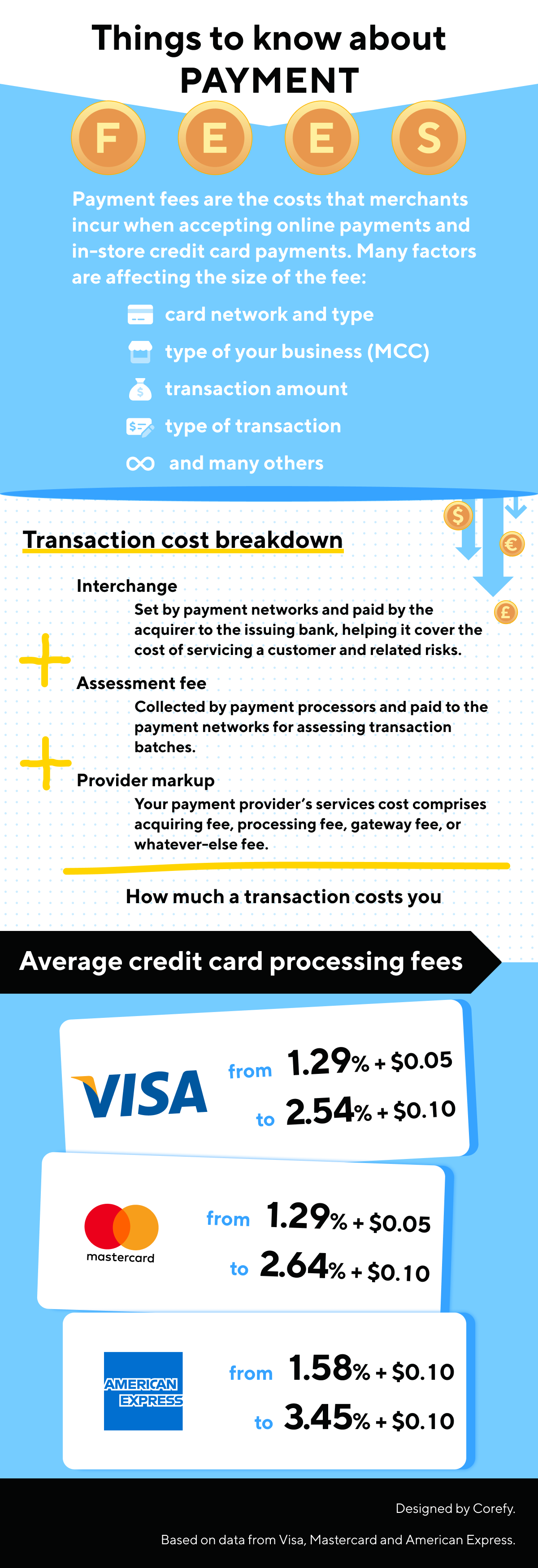

The anatomy of a processing fee can be a bit tricky to dissect. It typically comprises several components, each with its own function and impact on your bottom line. Let’s break it down:

- Interchange fee: This is a fee paid to the card-issuing bank by the merchant’s bank. It covers the costs associated with processing the transaction, including fraud prevention and network maintenance.

- Assessment fee: This fee goes to the payment processor and covers their operational costs, such as technology maintenance and customer support.

- PCI compliance fee: This fee may be charged by the payment processor to help the merchant meet the security standards of the Payment Card Industry (PCI).

- Gateway fee: This fee is charged by the payment gateway, a service that connects the merchant’s website to the payment processor.

- Chargeback fee: This fee is incurred when a customer disputes a transaction and requests a chargeback. It covers the costs of investigating and resolving the dispute.

Flat Fees vs. Percentage Fees

Processing fees can take two main forms: flat fees or percentage fees. Flat fees are a fixed amount charged per transaction, regardless of the amount being processed. Percentage fees, on the other hand, are a percentage of the transaction amount. The type of fee you’re charged will depend on your payment processor and the volume of transactions you process.

Processing Fees for Credit Cards: A Comprehensive Guide

In the realm of digital transactions, credit cards have become an indispensable tool for both consumers and businesses alike. However, processing these convenient payments comes with a not-so-insignificant cost known as a processing fee. It’s a common misconception that these fees are charged solely to the cardholder, but in reality, merchants bear the brunt of this financial burden.

This article delves into the intricacies of processing fees for credit cards, exploring how they’re calculated, the factors that influence their magnitude, and the potential impact on businesses. By gaining a deeper understanding of these fees, merchants can make informed decisions and develop effective strategies to mitigate their impact on their bottom line.

How are Processing Fees Calculated?

Processing fees are not a one-size-fits-all affair. They vary depending on a multitude of factors, including the type of card used, the merchant’s industry, and the volume of transactions processed. Let’s dissect these factors one by one:

1. Type of Card

Not all credit cards are created equal when it comes to processing fees. Premium cards, such as rewards cards and business cards, typically incur higher fees than standard cards. This is because these cards offer additional perks and benefits to cardholders, which come at a cost to the merchant.

2. Merchant’s Industry

The industry in which a merchant operates also plays a role in determining processing fees. High-risk industries, such as gambling and online pharmacies, are often subject to higher fees due to the increased risk of fraud and chargebacks associated with these transactions.

3. Volume of Transactions

The volume of transactions processed by a merchant can have a significant impact on processing fees. Merchants who process a high volume of transactions may be eligible for discounted rates or tiered pricing models, which offer lower fees for higher volumes.

Breakdown of Processing Fees

Processing fees typically consist of two components: an interchange fee and a network fee. The interchange fee is the portion of the fee that goes to the card-issuing bank, while the network fee goes to the payment processor, such as Visa or MasterCard. The interchange fee is the larger of the two components and can vary significantly depending on the factors discussed above.

Impact on Businesses

Processing fees can have a notable impact on a business’s profitability. Merchants with low margins may find that these fees eat into their earnings, while businesses with high-ticket items may be able to absorb the costs more easily. It’s important for merchants to factor in processing fees when pricing their goods and services and to explore options to minimize these fees, such as negotiating with payment processors or offering discounts for alternative payment methods.

Mitigating the Impact

While processing fees are an unavoidable cost of doing business, there are several strategies merchants can employ to mitigate their impact:

1. Negotiate with Payment Processors

Merchants with high transaction volumes may have some bargaining power when negotiating processing fees with payment processors. It’s worth reaching out to multiple processors and comparing their rates and terms to secure the best deal possible.

2. Offer Discounts for Alternative Payment Methods

Offering discounts for alternative payment methods, such as debit cards or ACH transfers, can incentivize customers to use these lower-cost options. This can help reduce overall processing fees.

3. Implement a Surcharge Program

In some jurisdictions, merchants are permitted to implement a surcharge on credit card transactions. This allows them to pass on a portion of the processing fees directly to the customer. However, it’s important to implement this strategy carefully to avoid alienating customers.

Conclusion

Processing fees for credit cards are an unavoidable reality for businesses. Understanding how these fees are calculated and the factors that influence their magnitude is crucial for merchants to make informed decisions and develop effective strategies to mitigate their impact on profitability. By implementing the strategies outlined in this article, businesses can minimize the burden of processing fees and maximize their earnings.

The Hidden Cost of Convenience: Processing Fees for Credit Cards

When you swipe that plastic, you’re not just paying for the goods or services you’re buying—you’re also likely paying a processing fee. These fees can add up quickly, so it’s important to understand what they are and how they’re calculated. In this article, we’ll break down the different types of processing fees and how you can minimize them.

Types of Processing Fees

There are several types of processing fees that businesses can charge when you use a credit or debit card. The most common types include:

Interchange Fees

Interchange fees are the fees that banks charge each other to process transactions. These fees are typically passed on to the business, and they can vary depending on the type of card used, the amount of the transaction, and the merchant category code (MCC) of the business.

Assessment Fees

Assessment fees are the fees that credit card networks, such as Visa and Mastercard, charge businesses to process transactions. These fees are typically a fixed amount per transaction.

Gateway Fees

Gateway fees are the fees that payment processors charge businesses to process transactions. These fees can vary depending on the payment processor and the type of transaction.

PCI Compliance Fees

PCI compliance fees are the fees that businesses must pay to maintain compliance with the Payment Card Industry Data Security Standard (PCI DSS). These fees can include the cost of security audits, software, and training.

Additional Fees

In addition to these common types of processing fees, businesses may also charge other fees, such as:

- Chargeback fees

- Foreign transaction fees

- Monthly minimum fees

- Early termination fees

The type and amount of processing fees that a business charges can vary depending on a number of factors, such as the size of the business, the industry, and the payment processor that they use.

How to Minimize Processing Fees

If you’re concerned about the cost of processing fees, there are a few things you can do to minimize them:

- Negotiate with your payment processor. You may be able to get a lower rate if you negotiate with your payment processor.

- Choose a payment processor that offers low fees. There are a number of payment processors that offer competitive rates on processing fees.

- Use a payment processor that offers interchange-plus pricing. Interchange-plus pricing is a transparent pricing model that allows businesses to see the interchange fees that they’re being charged.

- Pass the fees on to your customers. Some businesses choose to pass the cost of processing fees on to their customers. This can be done by adding a surcharge to the price of goods or services.

By following these tips, you can minimize the cost of processing fees and save money on your credit card transactions.