How To Calculate Credit Card Processing Fees

Posted: 02 Apr 2025 on General

Introduction

No matter what business you’re in, accepting credit cards is a must. But with that convenience comes a cost: credit card processing fees. These fees can add up quickly, so it’s important to understand how they’re calculated so you can make informed decisions about how to accept payments.

**In this article, we’ll break down everything you need to know about credit card processing fees, including:

- What they are

- How they’re calculated

- How to minimize them

So, grab a pen and paper and get ready to learn all about credit card processing fees!

What exactly are credit card processing fees?

Credit card processing fees are charges assessed by the companies that process credit card transactions. These fees cover the costs associated with processing the transaction, including:

- Authorizing the transaction

- Verifying the cardholder’s information

- Transferring the funds to your account

Credit card processing fees are typically a percentage of the transaction amount, but they can also be a flat fee. The amount of the fee will vary depending on the type of card being used, the payment processor you’re using, and your business’s volume of transactions.

How are credit card processing fees calculated?

There are two main components of credit card processing fees:

- The interchange fee: This is the fee charged by the credit card company to the merchant’s bank. It’s typically a percentage of the transaction amount, ranging from 1% to 3%.

- The assessment fee: This is the fee charged by the payment processor to the merchant. It’s typically a flat fee, ranging from $0.10 to $0.30 per transaction.

In addition to these two main components, there are other factors that can affect the amount of your credit card processing fees, including:

- The type of card being used: Some cards, such as rewards cards, have higher processing fees than others.

- The payment processor you’re using: Different payment processors have different fee structures.

- Your business’s volume of transactions: The more transactions you process, the lower your per-transaction fees will be.

How can you minimize credit card processing fees?

There are a few things you can do to minimize your credit card processing fees:

- Choose the right payment processor. There are many different payment processors out there, so it’s important to compare their fees and features before choosing one.

- Negotiate your rates. Once you’ve chosen a payment processor, be sure to negotiate your rates. You may be able to get a lower rate if you have a high volume of transactions.

- Offer discounts for cash payments. If you’re able to, offering a discount for cash payments can help you offset the cost of credit card processing fees.

- Consider surcharging for credit card payments. Surcharging is the practice of adding a small fee to credit card transactions. This fee can help you cover the cost of processing the transaction. However, it’s important to check your local laws before surcharging, as it’s not legal in all areas.

Conclusion

Credit card processing fees are a cost of doing business, but there are ways to minimize them. By understanding how these fees are calculated and taking steps to reduce them, you can save your business money.

How to Calculate Credit Card Processing Fees

Understanding the intricacies of credit card processing fees can feel like navigating a labyrinth, but fear not! This comprehensive guide will equip you with the knowledge to decipher these fees and calculate them accurately. Whether you’re a seasoned entrepreneur or just starting out, this article will illuminate the path for you.

Types of Fees

Processing fees are not one-size-fits-all; they vary depending on a trifecta of factors: the transaction type, the card network, and the processor involved. Allow us to break down each element in detail.

1. Transaction Type

Credit card transactions come in various flavors, each with its own set of fees. In-person transactions, where the customer swipes or dips their card at your physical store, typically incur lower fees compared to online transactions, where the cardholder enters their information remotely. The reasoning behind this disparity lies in the enhanced security measures required for online transactions to minimize fraud.

2. Card Network

The card network serves as the middleman between your business and the cardholder’s bank. Visa, Mastercard, American Express, and Discover are the major players in this arena, and each network has its own fee structure. Mastercard and Visa generally have the lowest fees, while American Express and Discover fees tend to be higher due to their premium services and wider acceptance. The specific fees charged by each network vary based on factors such as transaction volume, card type, and industry.

Calculating Card Network Fees:

To determine the card network fee, you’ll need to know the interchange fee and the assessment fee.

Interchange Fee: This fee is set by the card network and is paid by the merchant’s bank to the cardholder’s bank. The interchange fee varies based on the card type, transaction type, and cardholder’s country of origin.

Assessment Fee: This fee is also set by the card network and is paid by the merchant to the card network. The assessment fee is a percentage of the transaction amount and is typically lower than the interchange fee.

To calculate the card network fee, simply add the interchange fee and the assessment fee.

Example:

- Interchange fee: 1.5%

- Assessment fee: 0.10%

Card network fee = 1.5% + 0.10% = 1.6%

3. Processor

The processor acts as the gateway between your business and the card network. They handle the authorization and settlement of transactions and provide additional services such as fraud protection and reporting. Processors charge a variety of fees, including per-transaction fees, monthly fees, and PCI compliance fees. The fees charged by processors vary widely, so it’s important to compare different options before selecting one.

Calculating Total Fees

To calculate your total credit card processing fees, simply add up the fees charged by the transaction type, the card network, and the processor. Keep in mind that these fees can vary depending on your business’s specific circumstances and the volume of transactions you process.

Conclusion

Understanding and calculating credit card processing fees is not rocket science, but it does require a bit of research and understanding. By following the steps outlined in this guide, you can accurately calculate these fees and make informed decisions about your payment processing strategy.

How to Calculate Credit Card Processing Fees: A Comprehensive Guide

Credit card processing fees are a necessary evil for businesses that accept credit cards. These fees can add up quickly, so it’s important to understand how they work and how to calculate them accurately.

How to Calculate Credit Card Processing Fees

The total cost of credit card processing fees is determined by several factors, including the type of card being used, the amount of the transaction, and the merchant’s processing agreement.

- Type of card: Different types of cards have different interchange rates, which are the fees charged by the card issuer to the merchant. Interchange rates are typically higher for premium cards, such as rewards cards and business cards.

- Amount of the transaction: The amount of the transaction also affects the processing fee. Interchange rates are typically a percentage of the transaction amount, so the larger the transaction, the higher the fee.

- Merchant’s processing agreement: The merchant’s processing agreement with its payment processor will also affect the processing fee. This agreement will specify the interchange rates that the merchant will be charged, as well as any additional fees, such as monthly fees or PCI compliance fees.

Once you have determined the interchange rate and the other fees that will apply to your transaction, you can calculate the total processing fee by multiplying the transaction amount by the interchange rate and adding any additional fees.

For example, let’s say you are selling a product for $100. The interchange rate for the type of card being used is 2.5%. You also have a monthly fee of $20. The total processing fee for this transaction would be $2.50 (2.5% of $100) + $20 = $22.50.

Calculator Tools

Online calculators can help merchants estimate processing fees based on different factors. These calculators can be found on the websites of payment processors and other financial institutions.

To use a processing fee calculator, you will need to provide the following information:

- The type of card being used

- The amount of the transaction

- The merchant’s processing agreement

The calculator will then provide you with an estimate of the total processing fee for the transaction.

Factors to Consider When Choosing a Payment Processor

When choosing a payment processor, it is important to consider the following factors:

- Interchange rates: The interchange rates charged by the payment processor will have a significant impact on your processing costs.

- Additional fees: Some payment processors charge additional fees, such as monthly fees, PCI compliance fees, and chargeback fees.

- Customer service: The quality of the customer service provided by the payment processor is important in case you have any questions or issues.

- Reputation: The reputation of the payment processor is also important. You should choose a processor that is known for being reliable and trustworthy.

By understanding how to calculate credit card processing fees and by considering the factors listed above, you can choose the right payment processor for your business and minimize your processing costs.

How to Calculate Credit Card Processing Fees and Negotiate Like a Pro

Navigating the intricate world of credit card processing fees can be as daunting as finding the proverbial needle in a haystack. But fear not, dear reader, for we shall embark on a comprehensive journey to unravel the mysteries of these fees and empower you with the knowledge to negotiate like a seasoned pro.

Understanding the Anatomy of Credit Card Processing Fees

Before diving into the nitty-gritty, let’s establish a common language. Credit card processing fees are typically composed of three main components:

- Interchange fee: A fee paid to the card-issuing bank by the merchant’s bank to cover the cost of processing the transaction.

- Assessment fee: A fee levied by the card network (e.g., Visa, Mastercard) to cover network maintenance and security.

- Processor fee: A fee charged by the payment processor for handling the transaction.

Calculating Credit Card Processing Fees

To calculate your processing fees, you need to consider:

- Transaction volume: The number of transactions you process per month.

- Average transaction value: The average amount of each transaction.

- Interchange and assessment fees: These fees vary based on the card type and network.

- Processor fees: Processors typically charge a percentage of each transaction (e.g., 2.9% + $0.30 per transaction).

Example:

Suppose you process 500 transactions per month, with an average transaction value of $25. Let’s say the interchange and assessment fees for Visa transactions are 2.5% + $0.10 per transaction, and the processor charges 2.6% + $0.25 per transaction.

Your monthly processing fees would be:

500 (transactions) x (2.5% interchange + $0.10 assessment + 2.6% processor + $0.25 processor) = $320

Negotiating Fees

Negotiating Fees

Now, let’s don our negotiating hats and dive into the art of securing lower fees. Here are some strategies:

Compare Multiple Processors

Don’t limit yourself to the first processor you come across. Shop around and compare offers from different companies. Look for processors that offer transparent pricing and flexible fee structures.

Leverage Your Business Volume

If you have a high volume of transactions, you have more negotiating power. Use this leverage to negotiate lower fees or additional perks.

Consider Tiered Pricing

Some processors offer tiered pricing based on transaction volume. This can be beneficial if your transaction volume varies significantly throughout the year.

Bundle Services

Consider bundling other services, such as fraud protection or reporting tools, with your processing account. This can sometimes result in lower overall fees.

Review Your Fees Regularly

Don’t fall into the trap of complacency. Regularly review your processing fees to ensure they’re still competitive. If they’re not, don’t hesitate to renegotiate.

Additional Tips

Remember, negotiation is a two-way street. Be prepared to compromise and build a mutually beneficial relationship with your processor.

Don’t be afraid to ask for discounts or incentives, such as sign-up bonuses or free equipment.

Keep in mind that fees may fluctuate based on factors such as industry, card type, and risk factors.

By following these tips, you can empower yourself to negotiate lower credit card processing fees and optimize your business operations.

How to Calculate Credit Card Processing Fees: A Comprehensive Guide for Businesses

Calculating credit card processing fees can be like navigating a maze for many businesses. With so many variables at play, it’s easy to get lost. But what if there was a roadmap to simplify this process? Well, buckle up because this article will be your guide, demystifying the intricacies of credit card processing fees and empowering you with the formula to calculate them like a pro.

Before diving into the nitty-gritty, let’s clarify what these fees entail. Credit card processing fees are essentially the charges incurred by businesses for accepting credit card payments. These fees are levied by payment processors, who act as intermediaries between businesses and card issuers, ensuring secure and seamless transactions.

Breaking Down the Equation:

Calculating credit card processing fees is a multi-step equation that requires a bit of slicing and dicing. It all boils down to understanding the components involved. The total processing fee typically comprises the following elements:

-

Interchange Fee: This is the fee paid to the card issuer (Visa, Mastercard, etc.) for authorizing the transaction. It’s usually a percentage of the transaction amount plus a fixed fee.

-

Assessment Fee: This is a fee levied by the payment network (Visa, Mastercard, etc.) to cover the costs associated with maintaining the network and ensuring secure transactions.

-

Processor Fee: This is the fee charged by the payment processor for providing the technology and services that facilitate the transaction. It can be a flat fee, a percentage of the transaction amount, or a combination of both.

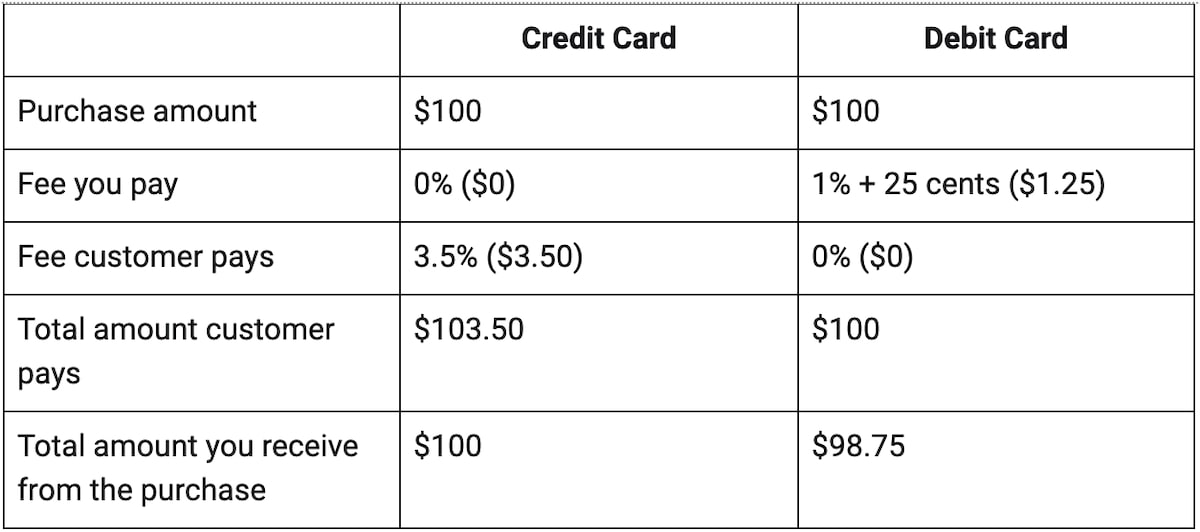

Passing on Costs

Some businesses take the path of least resistance and pass on a portion of the processing fees to their customers. This is often done through convenience fees or surcharges. By doing so, they shift the burden of these fees onto the customer, effectively mitigating their impact on their bottom line.

The Pros and Cons of Passing on Costs

However, this strategy has its upsides and downsides. On the one hand, it can help businesses recoup some of the costs associated with accepting credit cards. On the other hand, it can irk customers who may perceive it as an additional expense.

Example:

To further illustrate the calculation, let’s take a hypothetical transaction of $100 made using a Visa credit card. Assuming the following fee structure:

- Interchange Fee: 1.5% + $0.10

- Assessment Fee: 0.05%

- Processor Fee: 2%

Calculating the Total Processing Fee:

Interchange Fee: 1.5% x $100 + $0.10 = $1.60

Assessment Fee: 0.05% x $100 = $0.05

Processor Fee: 2% x $100 = $2.00

Total Processing Fee = $1.60 + $0.05 + $2.00 = $3.65

In this example, the total processing fee for a $100 transaction would be $3.65.

Questions to Consider:

Before implementing any fee-passing strategies, businesses should carefully consider a few key questions:

- Will the fees be transparently communicated to customers?

- How will customers react to the additional cost?

- What is the potential impact on sales volume?

Embracing Transparency:

Transparency is paramount. Customers should be fully informed about any fees associated with using credit cards. This fosters trust and minimizes the risk of backlash.

Striking the Right Balance:

Finding the right balance is crucial. While passing on fees can help offset costs, businesses should avoid overcharging customers to maintain customer satisfaction.

Conclusion:

Calculating credit card processing fees can be likened to a financial puzzle. By understanding the components and following a step-by-step approach, businesses can accurately determine these fees and make informed decisions regarding fee-passing strategies.

How Can I Calculate My Expected Credit Card Processing Fees?

Credit card processing fees are a necessary cost of doing business for any company that accepts credit cards. These fees can vary widely depending on the type of card, the payment processor, and the business’s volume. Calculating credit card processing fees can be tricky, but it’s important to understand how these fees work in order to minimize costs and ensure profitability.

Types of Credit Card Fees

There are a number of different types of credit card fees that businesses may encounter. These include:

How to Calculate Credit Card Processing Fees

The total credit card processing fee is the sum of all the individual fees associated with the cards. To calculate the total processing fee for a given transaction, simply add up the interchange fee, assessment fee, payment gateway fee, merchant account fee, and any other applicable fees.

For example, let’s say you’re a business that accepts Visa and Mastercard. The interchange fee for Visa is 1.5% and the assessment fee is 0.1%. The interchange fee for Mastercard is 2.0% and the assessment fee is 0.1%. The payment gateway fee is 0.25% and the merchant account fee is $0.30. To calculate the total credit card processing fee for a $100 transaction, you would add up all of the fees as follows:

- Interchange fee: $1.50

- Assessment fee: $0.10

- Payment gateway fee: $0.25

- Merchant account fee: $0.30

- Total processing fee: $2.15

As you can see, the total processing fee for this transaction is $2.15. This means that the business would pay $2.15 for every $100 of sales made with Visa or Mastercard.

Tips for Minimizing Credit Card Processing Fees

There are a number of things that businesses can do to minimize credit card processing fees. These include:

By following these tips, businesses can minimize credit card processing fees and ensure profitability.

Conclusion

Credit card processing fees are a necessary cost of doing business, but they can be minimized by understanding how these fees work and by taking steps to reduce them. By following the tips in this article, businesses can ensure that they are paying the lowest possible fees for credit card processing.