How Much Are Credit Card Processing Fees?

Posted: 02 Apr 2025 on General

How Much Are Credit Card Processing Fees?

The fees associated with processing credit card payments vary depending on the type of card used, the amount of the transaction, and the merchant’s payment processor. Interchange fees, which are charged by the card-issuing bank, typically range from 1.5% to 3.5% of the transaction amount. Network fees, charged by the credit card network (Visa, Mastercard, etc.), are typically around 0.1% to 0.2% of the transaction amount. Merchant fees, charged by the payment processor, can vary widely and may include a monthly fee, a per-transaction fee, and a percentage of the transaction amount. On average, businesses can expect to pay around 2% to 3% of each credit card transaction in processing fees.

How Credit Card Processing Fees Work

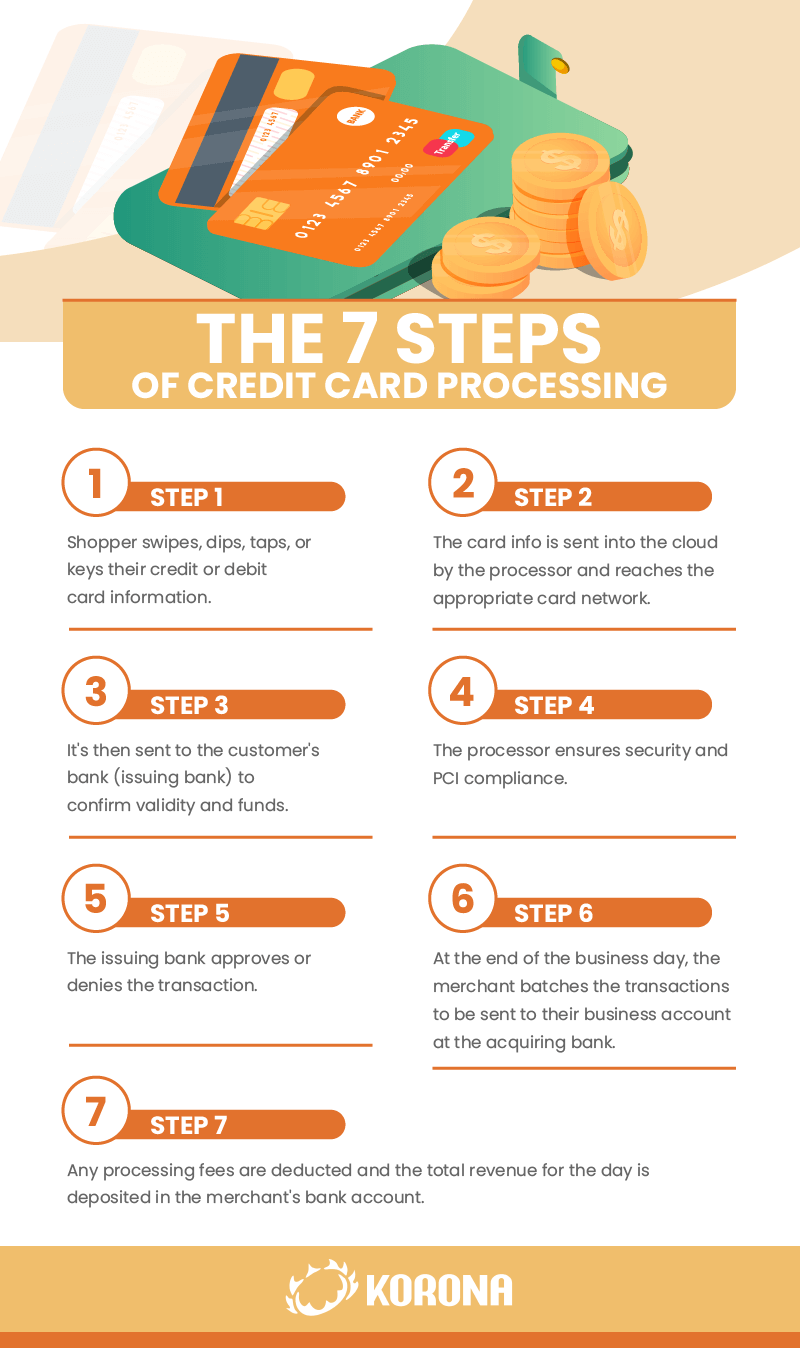

When a customer uses a credit card to make a purchase, the merchant’s payment processor initiates a series of steps to authorize and process the transaction. This process involves the following steps:

- **Authorization:** The payment processor sends a request to the card-issuing bank to authorize the transaction. The card-issuing bank checks the customer’s account to ensure that they have sufficient funds to cover the purchase.

- **Processing:** Once the transaction is authorized, the payment processor sends a request to the credit card network to process the transaction. The credit card network routes the transaction to the merchant’s bank account.

- **Settlement:** The merchant’s bank account is credited with the transaction amount, minus any processing fees.

The fees associated with processing credit card payments can vary depending on a number of factors, including:

- **Type of card:** Credit cards with higher rewards programs typically have higher processing fees.

- **Amount of the transaction:** The processing fee is typically a percentage of the transaction amount, so larger transactions will incur higher fees.

- **Merchant’s payment processor:** Different payment processors have different fee structures, so it’s important to compare rates before choosing a provider.

Businesses can reduce their credit card processing fees by negotiating with their payment processor, choosing a processor with a low fee structure, and encouraging customers to use lower-cost payment methods, such as debit cards or ACH transfers.

How Much Are Credit Card Processing Fees?

Credit card processing fees can be a significant expense for businesses, especially those that process a high volume of transactions. These fees can vary depending on the type of card being used, the amount of the transaction, and the payment processor.

But generally, you can expect to pay between 1.5% and 3.5% of the transaction amount in credit card processing fees. For example, if you process $10,000 worth of transactions in a month, you could pay between $150 and $350 in credit card processing fees.

Types of Credit Card Processing Fees

There are several different types of credit card processing fees, each of which serves a different purpose. Some of the most common types of fees include:

Interchange Fees

Interchange fees are the fees that are charged by the card-issuing bank to the merchant’s bank. Interchange fees are generally assessed as a percentage of the transaction amount, and they can vary depending on the type of card being used, the region in which the transaction is processed, and the merchant’s industry.

For example, interchange fees for Visa and Mastercard transactions in the United States typically range from 1.5% to 2.5%. Interchange fees are one of the largest components of credit card processing fees, and they can represent a significant expense for businesses that process a high volume of transactions.

Network Fees

Network fees are the fees that are charged by the credit card network (e.g., Visa, Mastercard, American Express) to the merchant’s bank. Network fees are typically assessed as a flat fee per transaction, and they can vary depending on the type of card being used and the region in which the transaction is processed.

For example, Visa and Mastercard charge network fees of $0.10 to $0.25 per transaction in the United States. Network fees are a relatively small component of credit card processing fees, but they can add up over time.

Gateway Fees

Gateway fees are the fees that are charged by the payment gateway to the merchant’s bank. Payment gateways are essential for processing credit card transactions online, and they typically charge a monthly fee as well as a per-transaction fee.

The monthly fee for a payment gateway can range from $20 to $200, and the per-transaction fee can range from $0.05 to $0.25. Gateway fees can be a significant expense for businesses that process a high volume of online transactions.

Other Fees

In addition to the above-mentioned fees, there are a number of other fees that can be associated with credit card processing. These fees may include:

- Chargeback fees: Chargeback fees are the fees that are charged by the credit card network to the merchant when a customer disputes a transaction. Chargeback fees can range from $25 to $100, and they can be a significant expense for businesses that have a high number of chargebacks.

- PCI compliance fees: PCI compliance fees are the fees that are charged by credit card companies to businesses that must comply with the Payment Card Industry Data Security Standard (PCI DSS). PCI compliance fees can vary depending on the size and complexity of the business, and they can range from $50 to $1,000 per year.

- Fraud prevention fees: Fraud prevention fees are the fees that are charged by credit card companies to businesses that use fraud prevention services. Fraud prevention fees can vary depending on the type of service being used, and they can range from $10 to $100 per month.

How to Reduce Credit Card Processing Fees

There are a number of things that businesses can do to reduce credit card processing fees. Some of the most effective strategies include:

- Negotiating with your payment processor: You can often negotiate with your payment processor to reduce your credit card processing fees. Be sure to compare quotes from multiple processors before you sign up with one.

- Choosing the right type of card: Some cards have lower interchange fees than others. For example, Visa and Mastercard have lower interchange fees than American Express.

- Processing transactions in batches: Processing transactions in batches can help you reduce your network fees.

- Using a payment gateway that offers low fees: There are a number of payment gateways that offer low fees. Be sure to compare the fees of different gateways before you choose one.

- Avoiding chargebacks: Chargebacks can be a significant expense. By avoiding chargebacks, you may be able to reduce your overall credit card processing fees.

How Much Are Credit Card Processing Fees?

Credit card processing fees, also known as merchant fees, are the costs businesses incur when accepting credit card payments. These fees can vary widely depending on several factors, including the type of card used, the cardholder’s rewards program, and the processing volume.

Factors Affecting Credit Card Processing Fees

The amount of credit card processing fees a business pays depends on several factors:

- Type of Card: Different types of cards have different processing fees. For example, rewards cards and premium cards typically have higher fees than standard credit cards.

- Cardholder Rewards: Cards that offer rewards, such as cash back or points, typically have higher processing fees than cards that do not offer rewards.

- Processing Volume: Businesses that process a large volume of credit card transactions typically qualify for lower processing fees than businesses that process a small volume of transactions.

- Interchange Fees: Interchange fees are the fees that banks charge each other to process credit card transactions. These fees are typically passed on to businesses in the form of processing fees.

- Assessment Fees: Assessment fees are the fees that credit card networks, such as Visa and Mastercard, charge to businesses for the use of their networks.

- Gateway Fees: Gateway fees are the fees that payment gateways, such as PayPal and Stripe, charge businesses for processing credit card transactions.

- Monthly Fees: Some payment processors charge businesses a monthly fee, regardless of the volume of transactions processed.

- PCI Compliance Fees: Businesses that accept credit card payments must comply with the Payment Card Industry Data Security Standard (PCI DSS). This can involve costs for security audits, software, and training.

How to Reduce Credit Card Processing Fees

There are several ways businesses can reduce credit card processing fees:

- Negotiate with Your Payment Processor: Businesses can negotiate with their payment processor to get lower processing fees.

- Use a Payment Gateway with Low Fees: There are several payment gateways that offer low processing fees.

- Choose Cards with Lower Processing Fees: Businesses can choose to accept cards that have lower processing fees.

- Offer Discounts for Cash Payments: Businesses can offer discounts to customers who pay with cash to encourage them to use this payment method.

- Increase Your Processing Volume: Businesses that process a large volume of credit card transactions typically qualify for lower processing fees.

Conclusion

Credit card processing fees can be a significant expense for businesses. However, there are several ways businesses can reduce these fees. By understanding the factors that affect processing fees and taking steps to reduce them, businesses can save money and improve their bottom line.

How Much Are Credit Card Processing Fees?

If you’re a business owner, you know that every penny counts. So when it comes to credit card processing fees, you want to make sure you’re getting the best possible deal. But how much are credit card processing fees, anyway?

The answer, unfortunately, is not a simple one. Credit card processing fees can vary depending on a number of factors, including the type of card being used, the amount of the transaction, and the payment processor you’re using.

However, as a general rule of thumb, you can expect to pay between 2% and 3% of each transaction in credit card processing fees. So, for a $100 transaction, you could end up paying $2 to $3 in fees.

While this may not seem like a lot, it can add up quickly, especially if you’re processing a lot of transactions. That’s why it’s important to shop around and compare rates from different payment processors before you decide on one.

How to Reduce Credit Card Processing Fees

Once you understand how much credit card processing fees are, you can start thinking about ways to reduce them. Here are a few tips:

- Negotiate with your payment processor. Most payment processors are willing to negotiate their rates, especially if you’re a high-volume merchant. So don’t be afraid to ask for a lower rate.

- Choose the right pricing model. There are two main pricing models for credit card processing: flat-rate pricing and tiered pricing. Flat-rate pricing is a simple, straightforward option that charges you the same rate for every transaction. Tiered pricing, on the other hand, charges you different rates for different types of transactions. If you process a lot of small transactions, flat-rate pricing may be a better option for you. But if you process a lot of large transactions, tiered pricing may be a better option.

- Use a payment gateway. A payment gateway is a third-party service that can help you process credit card payments. Payment gateways can offer a number of benefits, including lower processing fees.

- Offer discounts for cash. If you’re able to, offer discounts for customers who pay with cash. This can help you reduce your credit card processing fees and encourage customers to use cash.

Conclusion

Credit card processing fees can be a significant expense for businesses. However, by following these tips, you can reduce your fees and save money.

How Much Are Credit Card Processing Fees?

When you accept credit cards as payment for your products or services, you’re going to have to pay a fee. These fees can vary depending on the type of card, the amount of the transaction, and the payment processor you use. But how much are credit card processing fees, exactly? Well, that depends on a few factors. But don’t worry, we’ll break it down for you in this article, so you can make informed decisions about how to accept credit cards without breaking the bank.

Types of Credit Card Processing Fees

There are two main types of credit card processing fees: interchange fees and payment gateway fees. Interchange fees are charged by the credit card networks (Visa, Mastercard, etc.) to the merchant’s bank. Payment gateway fees are charged by the payment processor (the company that handles the transaction between your website and the customer’s bank).

Interchange Fees

Interchange fees are typically a percentage of the transaction amount, plus a fixed fee. The percentage varies depending on the type of card, the cardholder’s country of origin, and the type of transaction. For example, Visa charges a 1.5% interchange fee on all U.S.-issued credit cards. Mastercard charges a 1.6% interchange fee on all U.S.-issued credit cards. American Express charges a 2.5% interchange fee on all U.S.-issued credit cards.

Payment Gateway Fees

Payment gateway fees vary depending on the payment processor. Some payment processors charge a monthly fee, while others charge a per-transaction fee. The per-transaction fee is typically a percentage of the transaction amount, plus a fixed fee. For example, PayPal charges a 2.9% payment gateway fee on all transactions, plus a $0.30 fixed fee. Stripe charges a 2.9% payment gateway fee on all transactions, plus a $0.30 fixed fee. Square charges a 2.6% payment gateway fee on all transactions, plus a $0.10 fixed fee.

Factors That Affect Credit Card Processing Fees

In addition to the type of card and the payment processor, there are a few other factors that can affect credit card processing fees. These factors include:

How to Reduce Credit Card Processing Fees

If you’re looking to reduce credit card processing fees, there are a few things you can do. First, you can try to negotiate lower interchange fees with your merchant bank. You can also choose a payment processor that charges lower fees. Finally, you can encourage customers to use lower-cost payment methods, such as debit cards or ACH transfers.

Conclusion

Understanding credit card processing fees is essential for businesses to manage their costs and make informed financial decisions. By understanding the different types of fees and the factors that affect them, you can make smart choices about how to accept credit cards. And by following the tips above, you can reduce your credit card processing fees and save money.