Credit Card Processing Fees: A Guide For Small Businesses

Posted: 02 Apr 2025 on General

Introduction

Have you ever wondered why your small business isn’t as profitable as you thought it would be? It could be because you’re not paying attention to credit card processing fees. These fees can add up quickly, especially if you’re processing a lot of transactions. Credit card processing fees are often overlooked by small businesses, but they can have a significant impact on your bottom line. In fact, these fees can eat into your profits and make it difficult to grow your business.

Credit Card Processing Fees for Small Businesses

What are credit card processing fees? They’re the fees that you pay to your payment processor for the service of processing credit card transactions. These fees can vary depending on the type of card being used, the amount of the transaction, and the payment processor you use.

There are two main types of credit card processing fees:

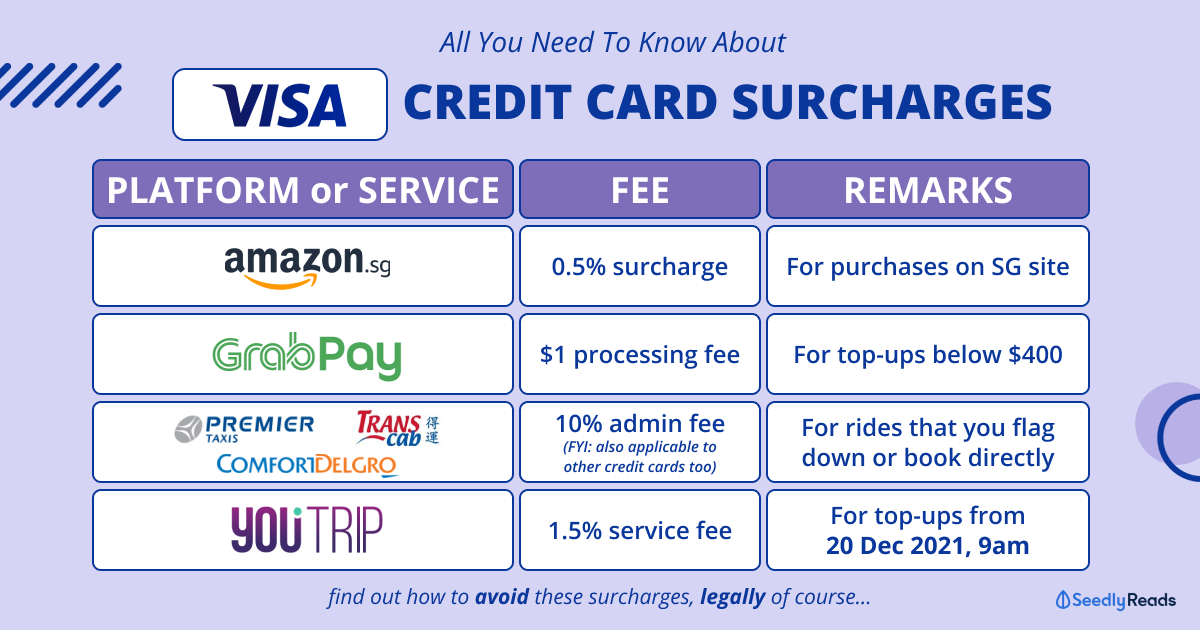

- ** Interchange fees:** These are the fees that are charged by the credit card networks (Visa, Mastercard, etc.) to the issuing bank. These fees are then passed on to the merchant by the payment processor.

- Processor fees: These are the fees that are charged by the payment processor for their services. These fees can include a monthly fee, a per-transaction fee, and a percentage of the transaction amount.

The Impact of Credit Card Processing Fees on Small Businesses

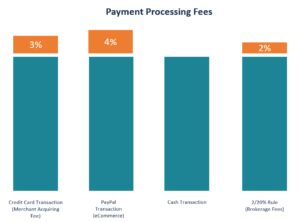

Credit card processing fees can have a significant impact on your small business. These fees can eat into your profits and make it difficult to grow your business. In fact, a recent study found that small businesses pay an average of 2.9% of their revenue in credit card processing fees. That means that for a small business with $100,000 in revenue, they would pay $2,900 in credit card processing fees.

How to Reduce Credit Card Processing Fees

There are a number of things that you can do to reduce your credit card processing fees. Here are a few tips:

- Negotiate with your payment processor. Many payment processors are willing to negotiate their fees. If you’re not happy with the fees you’re paying, don’t be afraid to ask for a better deal.

- Shop around for a different payment processor. There are a number of different payment processors out there, so it’s worth shopping around to find one that offers the best rates.

- Use a payment gateway that offers interchange-plus pricing. Interchange-plus pricing is a type of pricing that allows you to pay the interchange fees directly to the credit card networks. This can save you money compared to traditional pricing models.

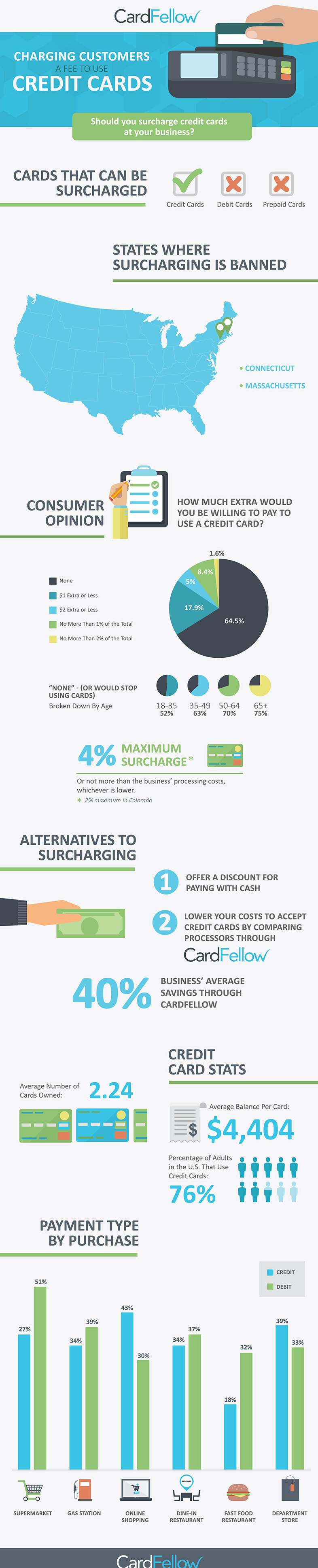

- Pass the fees on to your customers. Some businesses choose to pass the credit card processing fees on to their customers. This is a controversial practice, but it can be a way to reduce your costs.

Credit Card Processing Fees: A Comprehensive Guide for Small Businesses

In the ever-evolving landscape of small businesses, accepting credit cards is a must for staying competitive. However, it’s important to understand the fees associated with credit card processing, as they can have a significant impact on your bottom line. Let’s break down the different types of fees, and how you can minimize their impact on your business.

Types of Credit Card Fees

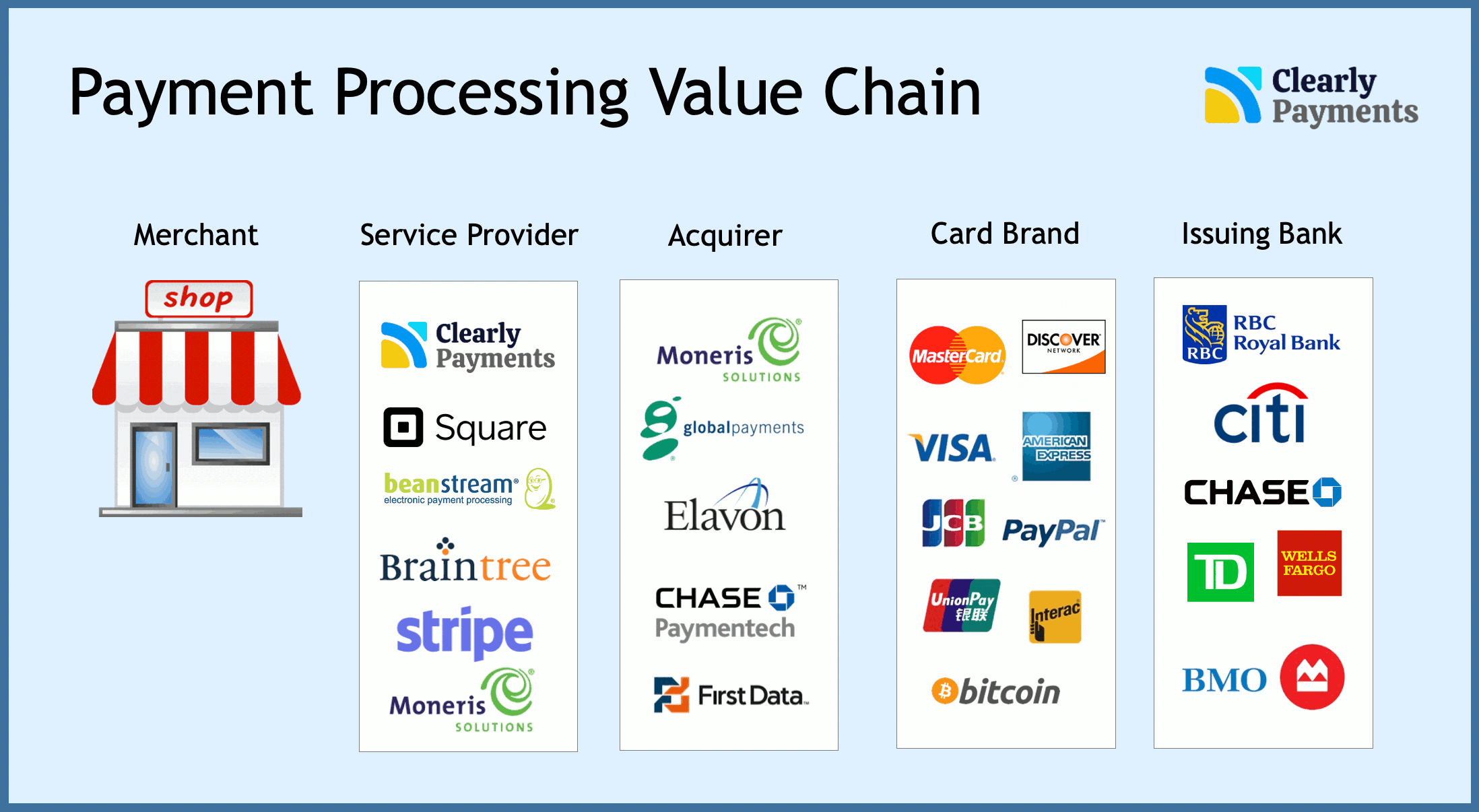

When a customer swipes their credit card, a complex network of financial institutions swings into action, each taking a small cut of the transaction. These fees can be categorized into three main types:

- Interchange Fees: The lion’s share of credit card fees, these are charged by the credit card networks (Visa, Mastercard, Discover, etc.) and banks that issue the cards to consumers. Interchange fees vary depending on the type of card used (debit, credit, reward card), the transaction amount, and the merchant’s industry.

- Network Fees: These are charged by the card networks for processing transactions. They include assessments, which are a flat fee per transaction, and authorization fees, which cover the cost of verifying the card’s validity.

- Processor Fees: Payment processors, which facilitate the connection between merchants and credit card networks, charge fees for their services. These fees can include monthly fees, transaction fees, and PCI compliance fees.

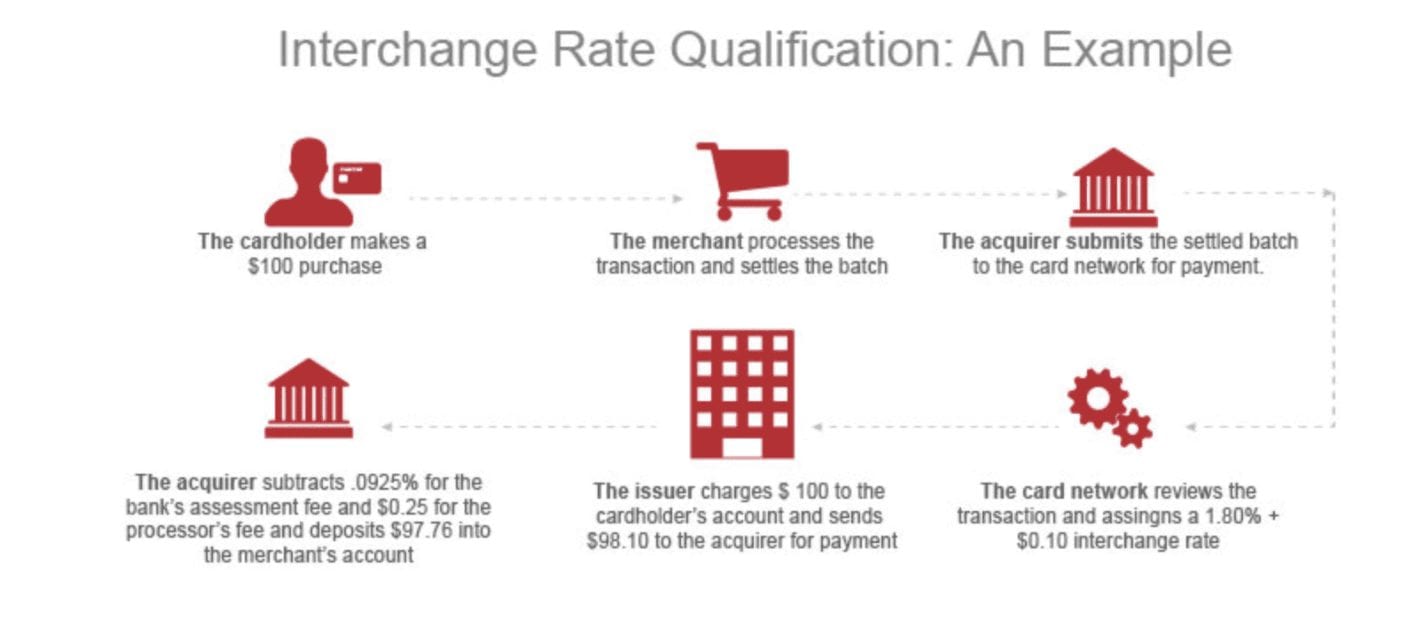

Understanding Interchange Fees

Interchange fees are the most complex and variable type of credit card fee. They’re determined by a number of factors, including the following:

- Card Type: Debit cards typically have lower interchange fees than credit cards, while reward cards have higher fees.

- Transaction Amount: Interchange fees are generally higher for larger transactions.

- Merchant Category Code (MCC): Different industries have different interchange fee rates, based on their risk profile.

- Card-Present vs. Card-Not-Present: Transactions where the card is physically present (e.g., in-store) have lower interchange fees than those where the card is not present (e.g., online or over the phone).

It’s crucial to understand how interchange fees affect your business. A small business that processes a lot of small transactions with debit cards may have lower interchange fees than a large business that processes a few high-value transactions with credit cards.

Calculate Fees for Credit Card Processing

Running a small business requires wearing many hats, and managing finances is one of the most crucial. Processing credit card payments is a vital aspect of modern commerce, but understanding the associated fees can be a bit like navigating a maze. If you want to budget effectively, calculating these fees accurately is paramount. Let’s dive into the details and shed some light on this often-murky topic.

Types of Fees

Credit card processing fees typically fall into three main categories: interchange fees, assessment fees, and gateway fees. Interchange fees are set by the credit card networks (Visa, Mastercard, etc.) and vary based on the type of card used (debit, credit, rewards, etc.). Assessment fees are levied by the issuing bank and are generally a flat fee per transaction. Gateway fees are charged by the payment processor that facilitates the transaction between the customer and the merchant. Understanding these different fees is the first step towards calculating your total processing costs.

Markup and Discount Rates

In addition to the standard fees mentioned above, payment processors often apply a markup or discount rate to transactions. A markup is an additional fee added to the interchange rate, while a discount rate is a reduction applied to it. This is where it gets tricky, as the markup or discount rate can vary depending on the processor, the type of account you have, and the volume of transactions you process. It’s important to carefully review these rates before signing up with a payment processor.

Negotiating Fees

Don’t be afraid to negotiate with payment processors. Many are willing to work with small businesses to find a fee structure that works for both parties. Be prepared to provide information about your business, including your average transaction volume and the types of cards you accept. By showing that you’re informed and willing to compare different options, you increase your chances of securing a favorable deal.

Calculating Total Costs

Once you have a clear understanding of the different types of fees and rates involved, you can calculate your total credit card processing costs. This can be done by multiplying the interchange rate by the number of transactions, adding the assessment fees, and then applying any applicable markup or discount rates. It’s worth noting that some payment processors offer tiered pricing, where fees vary based on the volume of transactions processed. Make sure you factor this into your calculations.

Impact of Fees

Credit card processing fees can have a significant impact on your business’s bottom line. Even small fees can add up over time, especially for businesses that process a high volume of transactions. It’s important to consider these fees when pricing your products or services to ensure you’re not absorbing too much of the cost yourself. Additionally, fees can vary depending on the industry you’re in, so it’s worth researching the average processing rates for similar businesses.

Conclusion

Calculating credit card processing fees accurately is essential for small businesses to budget effectively. By understanding the different types of fees, negotiating with payment processors, and carefully calculating your total costs, you can minimize the impact of these fees on your bottom line. Remember, it’s an ongoing process that requires regular review and adjustment as your business grows and changes. By staying informed and being proactive, you can ensure that your business is not overpaying for credit card processing.

Credit Card Processing Fees: A Burden for Small Businesses

For small businesses, every penny counts. That’s why the hefty fees associated with credit card processing can be such a pain in the neck. These fees can eat into your profits and make it harder to stay afloat. But what if we told you there’s a way to negotiate lower credit card processing fees? It’s true! By following the tips in this article, you can save your business money and put it towards more important things, like growing your business.

Understanding Credit Card Processing Fees

Before you can negotiate lower fees, it’s important to understand how credit card processing works. When a customer swipes their credit card, the transaction is sent to a payment processor. The payment processor then sends the transaction to the issuing bank, which authorizes the transaction and sends the funds to the merchant’s bank account. For each transaction, the merchant pays a fee to the payment processor and the issuing bank. These fees can vary depending on the type of card used, the amount of the transaction, and the merchant’s account type.

Negotiating Fees

Now that you understand how credit card processing works, it’s time to start negotiating lower fees. Here are a few tips:

- Shop around for different providers. There are many different credit card processing companies out there, so it’s important to shop around and compare rates. Don’t be afraid to ask for quotes from multiple providers before making a decision.

- Negotiate your fees. Once you’ve found a few providers that you’re interested in, it’s time to start negotiating. Be prepared to discuss your business volume, average transaction size, and other factors that can affect your fees. Don’t be afraid to ask for a lower rate, especially if you’re a high-volume merchant.

- Get everything in writing. Once you’ve negotiated a lower rate, make sure to get everything in writing. This will protect you in case the provider tries to raise your fees in the future.

Other Ways to Save on Credit Card Processing Fees

In addition to negotiating lower fees, there are a few other ways to save on credit card processing fees. Here are a few tips:

- Use a payment gateway that offers interchange-plus pricing. Interchange-plus pricing is a more transparent pricing model that can save you money on processing fees.

- Take advantage of discounts for high-volume merchants. Many credit card processing companies offer discounts to merchants who process a high volume of transactions.

- Offer discounts to customers who pay with cash. This can encourage customers to use cash, which can save you money on processing fees.

Conclusion

Credit card processing fees can be a burden for small businesses, but there are ways to save money on these fees. By following the tips in this article, you can negotiate lower fees, take advantage of discounts, and use other strategies to reduce your processing costs. This can help you save money and put it towards more important things, like growing your business.

Credit Card Processing Fees: A Burden for Small Businesses

Credit card processing fees represent a significant expense for many small businesses. These fees, which can range from 2% to 3% per transaction, can eat into a business’s profits, especially for businesses that rely heavily on credit card payments.

The Impact of Processing Fees

For small businesses, every dollar counts. Processing fees can have a tangible impact on a business’s bottom line. Consider this: a business that processes $100,000 in credit card payments each year could pay up to $3,000 in processing fees. For a small business with thin margins, this can be a substantial expense.

Exploring Alternative Payment Methods

Exploring alternative payment methods can help small businesses reduce their reliance on credit cards and associated fees. These methods include:

1. Cash and Check

Cash and checks remain viable payment options for many small businesses. These methods eliminate processing fees altogether. However, they also come with drawbacks, such as the need to handle physical cash and the potential for fraud.

2. Debit Cards

Debit cards offer a convenient and cost-effective alternative to credit cards. Processing fees for debit cards are typically lower than those for credit cards, ranging from 0.5% to 1.5% per transaction.

3. Gift Cards

Gift cards can be a lucrative option for small businesses. They allow customers to purchase goods and services without using credit cards or cash. Businesses can sell gift cards at a markup, generating additional revenue.

4. Online Payment Services

Online payment services, such as PayPal and Stripe, provide small businesses with a secure and convenient way to accept payments online. These services typically charge a small fee per transaction, but they offer features such as fraud protection and automated invoicing.

5. Mobile Payment Options

Mobile payment options, such as Apple Pay and Google Pay, are gaining popularity among consumers. These options allow customers to make payments using their smartphones or tablets. For small businesses, mobile payment options offer the convenience of accepting payments anywhere, anytime.

Negotiating Lower Fees

In addition to exploring alternative payment methods, small businesses can also negotiate lower processing fees with their payment processors. Here are a few tips:

- Shop around: Don’t be afraid to compare quotes from different payment processors.

- Negotiate: Once you find a processor you like, negotiate the best possible fees.

- Consider volume discounts: If you process a high volume of transactions, you may be able to qualify for volume discounts.

Conclusion

Credit card processing fees can be a significant burden for small businesses. By exploring alternative payment methods and negotiating lower fees, small businesses can reduce their expenses and increase their profits.

Credit Card Processing Fees: A Burden for Small Businesses

Credit card processing fees are a significant expense for small businesses, eating into their profits and making it harder to stay afloat. These fees can vary greatly depending on the payment processor, the type of card being used, and the volume of transactions. For small businesses with thin margins, every dollar counts, so it’s essential to understand these fees and find ways to minimize them.

Types of Credit Card Processing Fees

There are several types of credit card processing fees that small businesses need to be aware of, including:

- Interchange fees: These are fees charged by the card-issuing bank to the merchant’s bank. They typically range from 1% to 3% of the transaction amount.

- Assessment fees: These are fees charged by the payment processor to cover the cost of processing the transaction. They typically range from $0.05 to $0.20 per transaction.

- PCI compliance fees: These are fees charged by the payment processor to help merchants meet the Payment Card Industry Data Security Standard (PCI DSS). They typically range from $10 to $100 per month.

- Monthly minimum fees: These are fees charged by the payment processor regardless of the number of transactions processed. They typically range from $10 to $25 per month.

- Chargeback fees: These are fees charged by the payment processor when a customer disputes a transaction. They typically range from $15 to $100 per chargeback.

How to Minimize Credit Card Processing Fees

There are several ways that small businesses can minimize their credit card processing fees, including:

- Negotiate with your payment processor: Contact your payment processor and see if you can negotiate lower fees. You may be able to get a better deal if you process a high volume of transactions or if you’re willing to sign a long-term contract.

- Use a payment processor that offers low fees: There are a number of payment processors that offer low fees, so it’s worth shopping around to find the best deal. Some of the most popular low-fee payment processors include Square, PayPal, and Stripe.

- Offer discounts for cash payments: One way to reduce your credit card processing fees is to offer discounts for customers who pay with cash. This can encourage customers to use cash instead of credit cards, which will save you money on fees.

- Avoid chargebacks: Chargebacks can be a major expense for businesses, so it’s important to avoid them whenever possible. You can do this by making sure that your products and services are high quality, by providing excellent customer service, and by following the terms and conditions of your payment processor.

The Impact of Credit Card Processing Fees on Small Businesses

Credit card processing fees can have a significant impact on small businesses. These fees can eat into profits, making it harder for businesses to stay afloat. Additionally, credit card processing fees can make it more difficult for small businesses to compete with larger businesses that have more leverage with payment processors.

Calls for Reform

There have been growing calls for reform of the credit card processing industry. These calls have come from both small businesses and consumer advocates. Small businesses argue that credit card processing fees are too high and that they stifle competition. Consumer advocates argue that credit card processing fees are passed on to consumers in the form of higher prices.

Conclusion

Credit card processing fees are a major burden for small businesses. These fees can eat into profits, making it harder for businesses to stay afloat. Additionally, credit card processing fees can make it more difficult for small businesses to compete with larger businesses that have more leverage with payment processors. There have been growing calls for reform of the credit card processing industry. These calls have come from both small businesses and consumer advocates. Small businesses argue that credit card processing fees are too high and that they stifle competition. Consumer advocates argue that credit card processing fees are passed on to consumers in the form of higher prices.