Introduction

Picture this: You’re a small business owner, pouring your heart and soul into your venture, only to face unforeseen circumstances that threaten your financial stability. That’s where liability insurance steps in, acting as a safety net to protect you from a wide array of potential pitfalls. From customer injuries to property damage, a robust liability insurance policy can shield your business from costly lawsuits and financial ruin.

With a plethora of options available, finding the best small business liability insurance company can be a daunting task. But fear not, intrepid entrepreneur! In this comprehensive guide, we’ll delve into the ins and outs of liability insurance, exploring the top-rated providers in the industry and empowering you with the knowledge to make an informed decision for your business.

Understanding Liability Insurance

What exactly does liability insurance entail? It’s a type of insurance that protects your small business against financial losses resulting from bodily injury or property damage caused to others due to your business operations, products, or services. In essence, it serves as a financial safety net, ensuring that you’re not left footing the bill for legal claims or settlements.

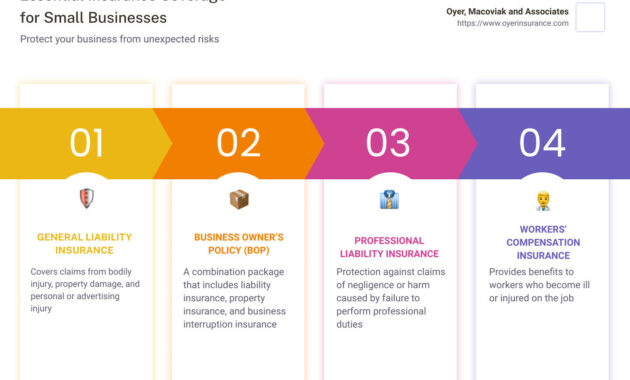

There are two main types of liability insurance: general liability insurance and professional liability insurance. General liability insurance covers a broad range of risks, including bodily injury, property damage, and personal injury (e.g., libel or slander). Professional liability insurance, on the other hand, is tailored specifically for professionals who provide services, such as consultants, accountants, or lawyers, and covers claims of negligence or errors and omissions.

Top-Rated Small Business Liability Insurance Companies

Now, let’s shift our focus to the crème de la crème of small business liability insurance providers. These companies have earned their stripes through a combination of comprehensive coverage, competitive rates, and exceptional customer service:

- The Hartford: Renowned for its customizable policies and industry-leading risk management services, The Hartford has been a trusted name in the insurance world for over 200 years.

- Hiscox: Specializing in tailored insurance solutions for small businesses, Hiscox offers comprehensive coverage and flexible policy options, making it a popular choice for entrepreneurs with unique insurance needs.

- Chubb: Known for its financial stability and expertise in underwriting high-risk businesses, Chubb provides robust liability insurance policies backed by a team of experienced underwriters.

- Zurich: With a global presence and a reputation for innovation, Zurich offers a wide range of liability insurance products designed to meet the evolving needs of small businesses.

- Liberty Mutual: Boasting a nationwide network of agents and a focus on customer satisfaction, Liberty Mutual offers competitive rates and customizable coverage options for small businesses of all sizes.

Factors to Consider When Choosing a Liability Insurance Provider

Selecting the right liability insurance provider is akin to finding the perfect pair of shoes: it’s all about finding the best fit for your business. Here are some key factors to ponder:

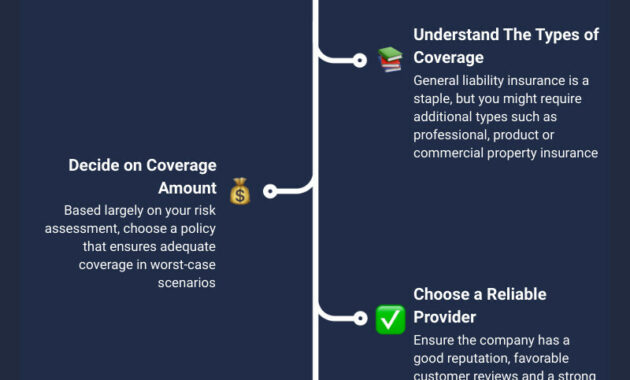

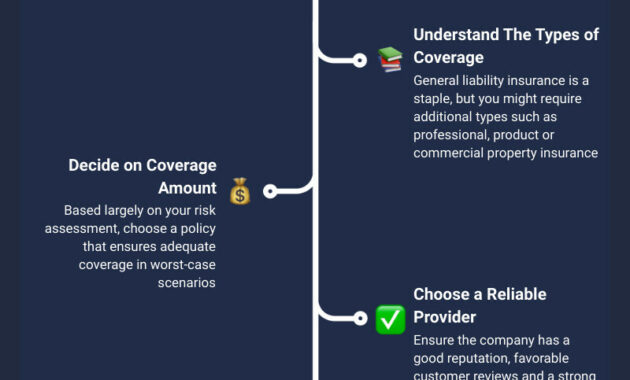

- Coverage: Evaluate the specific coverage options offered by each provider and ensure they align with the potential risks faced by your business.

- Premiums: Compare premiums from different providers to find the most cost-effective option that meets your coverage needs.

- Deductibles: Choose a deductible that strikes a balance between affordability and the level of risk you’re willing to assume.

- Customer Service: Look for providers with a proven track record of excellent customer service, ensuring you’ll have access to support when you need it most.

- Reputation: Research the reputation of potential providers by reading online reviews and checking their financial stability ratings.

Conclusion

Navigating the world of liability insurance can be a complex endeavor, but by understanding the basics and carefully considering your options, you can secure the peace of mind that comes with knowing your business is protected. Remember, liability insurance is not just a cost of doing business; it’s an investment in the future of your enterprise. By choosing the right provider and tailoring your coverage to your specific needs, you can safeguard your bottom line and focus on growing your business with confidence.

Best Small Business Liability Insurance Companies

In the realm of business, where risks lurk around every corner, having a reliable liability insurance policy is like donning a sturdy suit of armor. It shields your small business from the financial blows that can arise from lawsuits, accidents, and other mishaps.

Selecting the best liability insurance provider is crucial, but with countless options on the market, it can be a daunting task. Fear not, intrepid entrepreneur! This comprehensive guide will illuminate the top insurance providers specifically tailored to the needs of small businesses, helping you make an informed decision to safeguard your enterprise.

Top Insurance Providers for Small Businesses

Prepare to be amazed as we unveil the crème de la crème of liability insurance providers for small businesses. These renowned companies have earned their stripes by consistently delivering exceptional coverage, responsive customer service, and competitive rates.

Buckle up and get ready to discover the powerhouses that will protect your business from the slings and arrows of outrageous fortune:

- The Hartford: This time-honored insurance giant has been a trusted guardian of small businesses for over 200 years. With a comprehensive suite of liability policies and unwavering financial stability, The Hartford stands as a beacon of reliability in the vast insurance landscape.

- Hiscox: For those seeking a tailored insurance experience, Hiscox is the go-to choice. Their customizable policies are meticulously crafted to meet the unique needs of small businesses, ensuring that your coverage is a perfect fit. Hiscox’s reputation for exceptional customer service is the icing on the cake, guaranteeing that you’re in safe hands.

- Chubb: When it comes to unparalleled protection, Chubb reigns supreme. Their comprehensive liability policies are designed to provide peace of mind, safeguarding your business from a wide range of potential perils. With a deep understanding of small business risks, Chubb goes the extra mile to ensure your coverage is tailored to your specific needs.

- Travelers: If you’re looking for a provider that goes above and beyond, look no further than Travelers. Their commitment to risk management and claims handling is second to none, ensuring that your business is well-protected and taken care of in the event of a claim.

- Liberty Mutual: Liberty Mutual is the epitome of a customer-centric insurance provider. Their dedication to providing tailored solutions and exceptional service is unmatched, making them a popular choice among small businesses. With Liberty Mutual on your side, you can rest assured that your insurance needs are in capable hands.

Now that you’ve met the heavy hitters in the liability insurance arena, let’s dive a little deeper into their offerings and uncover what sets them apart.

Best Small Business Liability Insurance Companies

If you own a small business, you need liability insurance to protect yourself from financial losses in the event that someone is injured or their property is damaged as a result of your business activities. There are many different liability insurance companies out there, so it’s important to do your research and find one that’s right for you, here are some of the best small business liability insurance companies:

• Hiscox: Hiscox offers a wide range of liability insurance policies for small businesses, including general liability, professional liability, and product liability. Hiscox is a financially strong company with an excellent reputation for customer service.

• The Hartford: The Hartford offers a variety of liability insurance policies for small businesses, including general liability, commercial auto insurance, and workers’ compensation insurance. The Hartford is a financially strong company with a long history of providing insurance to small businesses.

• Liberty Mutual: Liberty Mutual offers a variety of liability insurance policies for small businesses, including general liability, commercial auto insurance, and workers’ compensation insurance. Liberty Mutual is a financially strong company with a good reputation for customer service.

Factors to Consider When Choosing

When choosing a liability insurance company for your small business, there are a few factors you should consider:

• **The coverage you need**. The type of coverage you need will depend on the nature of your business. If you have employees, you will need workers’ compensation insurance. If you own a vehicle that you use for business purposes, you will need commercial auto insurance. You may also need additional coverage, such as professional liability insurance or product liability insurance.

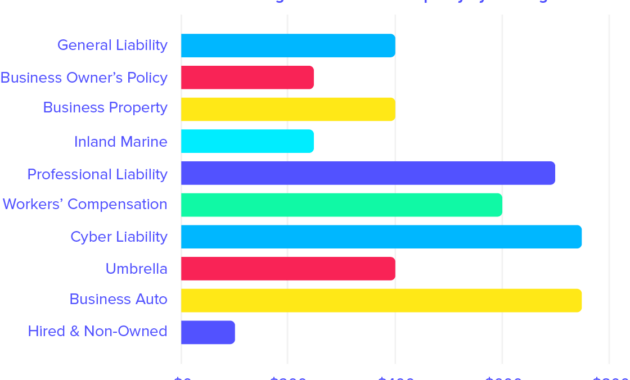

• **The cost of the insurance**. The cost of liability insurance will vary depending on the type of coverage you need, the size of your business, and your claims history. It is important to compare quotes from multiple insurance companies before making a decision.

• **The reputation of the insurance company**. It is important to choose an insurance company that has a good reputation for customer service and financial stability. You can read online reviews or talk to other small business owners to get their recommendations.

• **The deductible**. The deductible is the amount of money you will have to pay out of pocket before your insurance coverage kicks in. A higher deductible will result in a lower insurance premium, but it also means that you will have to pay more out of pocket if you file a claim.

• **The policy limits**. The policy limits are the maximum amount of money that your insurance company will pay out for a claim. It is important to choose policy limits that are high enough to protect your business from financial ruin.

• **The claims process**. In the event that you need to file a claim, you want to make sure that the claims process is easy and efficient. Ask the insurance company about their claims process and read online reviews to see what other customers have experienced.

Choosing the right liability insurance company for your small business is an important decision. By considering the factors listed above, you can find a policy that meets your needs and protects your business from financial losses.

Best Small Business Liability Insurance Companies

A robust liability insurance policy acts as a safeguard for your small business, shielding it from financial ruin in the event of a lawsuit. Navigating the plethora of insurance providers can be a daunting task, but fret not! This comprehensive guide will illuminate the best small business liability insurance companies, empowering you to make an informed decision that aligns with your unique needs.

Comparing Coverage Options

Liability insurance policies are not one-size-fits-all. Understanding the nuances of various coverage options is paramount to ensuring that your business is adequately protected. General liability insurance, the cornerstone of most policies, provides coverage for bodily injury and property damage claims arising from your business operations. Professional liability insurance, also known as errors and omissions insurance, safeguards you against claims of negligence or failure to perform services as promised. Employment practices liability insurance shields you from allegations of discrimination, wrongful termination, or harassment.

Beyond these core coverages, a myriad of additional options awaits. Product liability insurance protects you against claims stemming from defective products, while cyber liability insurance safeguards you from data breaches and cyberattacks. Understanding the potential risks associated with your industry is essential for tailoring a policy that meets your specific requirements.

Best Small Business Liability Insurance Companies

Now, let’s unveil the top-rated small business liability insurance providers that have earned the trust of countless businesses:

1. Hiscox: Renowned for its tailored coverage options and exceptional customer service, Hiscox is a formidable player in the liability insurance arena.

2. Travelers: With a century of experience under its belt, Travelers offers a comprehensive suite of insurance products, including robust liability coverage for businesses of all sizes.

3. The Hartford: Steeped in tradition, The Hartford has been safeguarding businesses for over 200 years. Its liability insurance policies are known for their flexibility and competitive pricing.

4. CNA: CNA stands out with its industry-leading expertise in professional liability insurance. It caters to a wide range of professions, providing tailored coverage that addresses the unique risks they face.

5. Liberty Mutual: Liberty Mutual has garnered a reputation for its personalized approach to insurance. Its liability policies are designed to meet the specific needs of small businesses, offering tailored coverage at competitive rates.

6. Progressive: Progressive has carved a niche for itself in the small business insurance market. Its liability policies are known for their simplicity and affordability, making them an attractive option for startups and entrepreneurs.

7. Nationwide: Nationwide is a trusted provider of insurance solutions for businesses of all sizes. Its liability coverage options are comprehensive and backed by a strong reputation for customer satisfaction.

8. Chubb: Chubb is synonymous with high-quality insurance coverage. Its liability policies are tailored to the unique risks faced by small businesses, providing peace of mind and financial protection.

9. AIG: A global insurance behemoth, AIG offers a comprehensive range of liability insurance products. Its policies are designed to meet the complex needs of businesses operating in diverse industries.

10. Farmers: Farmers Insurance has a long-standing commitment to protecting small businesses. Its liability policies are known for their flexibility and competitive pricing, making them an attractive option for businesses of all sizes and industries.

Navigating the Labyrinth of Small Business Liability Insurance

Protecting your small business from unforeseen risks and liabilities is crucial for its longevity and success. Liability insurance serves as a financial safety net, safeguarding your business from claims arising from bodily injury, property damage, or legal actions.

In the vast insurance landscape, selecting the right liability insurance company can be a daunting task. To unravel this complexity, we have meticulously researched and analyzed numerous providers to present you with the top small business liability insurance companies.

Understanding Liability Insurance Coverage Options

Liability insurance policies vary in the extent of protection they provide. General liability insurance, the cornerstone of coverage, shields your business from claims related to bodily injury or property damage caused by your operations, products, or premises.

Professional liability insurance, also known as errors and omissions insurance, safeguards professionals from claims alleging negligence or failure to perform services as promised. Employment practices liability insurance protects against accusations of discrimination, harassment, or wrongful termination.

Choosing the Right Insurance Carrier for Your Business

Finding the ideal liability insurance company for your small business requires careful consideration of several factors. Begin by assessing your specific risks and coverage needs. Determine the potential liabilities associated with your industry, business operations, and geographical location.

Research the reputation and financial stability of potential insurers. Read online reviews, check industry ratings, and consult with other business owners to gather insights into their experiences.

Compare policy terms, deductibles, and premiums of different companies. Don’t solely focus on cost; consider the overall value and protection provided by the policy.

Top Small Business Liability Insurance Companies

After extensive research and analysis, we have compiled a list of the best small business liability insurance companies known for their expertise, coverage options, and exceptional customer service:

- Hiscox: Renowned for its tailored policies and industry-specific coverage options.

- Chubb: A global leader offering comprehensive liability insurance solutions for businesses of all sizes.

- The Hartford: Known for its customizable policies and risk management services.

- Zurich: A trusted provider with a strong focus on risk prevention and claims handling.

- Liberty Mutual: A well-established insurer offering a wide range of liability coverage options and personalized support.

Additional Considerations: Deductibles, Premiums, and Coverage Limits

Deductibles represent the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums. Determine the deductible you can comfortably afford without compromising coverage.

Premiums are the periodic payments you make to maintain your insurance policy. They vary based on factors such as your business’s risk profile, coverage limits, and deductible. Compare premiums from multiple insurers to find the most competitive rates.

Coverage limits specify the maximum amount your insurance policy will pay towards a claim. Choose limits that provide adequate protection without overpaying for excessive coverage.

Conclusion

Selecting the right liability insurance company for your small business is a critical decision that requires careful evaluation of your risks, coverage needs, and financial considerations. By thoroughly researching and comparing the options available, you can make an informed choice that safeguards your business from unforeseen liabilities and ensures its continued success.