Best Professional Liability Insurance for Small Businesses: Shielding Your Enterprise from Costly Mistakes

In the competitive world of small businesses, safeguarding your enterprise against unforeseen liabilities is paramount. Professional liability insurance, akin to a financial fortress, stands as a crucial line of defense for businesses that provide professional services. It shields them from claims alleging negligence, errors, or omissions in the execution of their duties.

Like a vigilant guardian, professional liability insurance stands watch over your business, providing coverage for a wide spectrum of potential pitfalls. From erroneous advice to inadvertent oversights, this insurance policy can act as a safety net, mitigating the financial repercussions of such mishaps.

Who Needs Professional Liability Insurance?

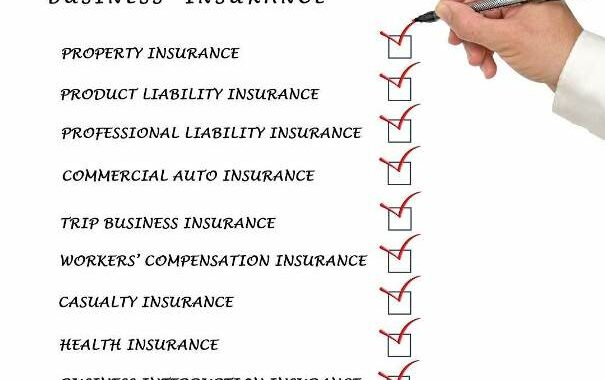

Professional liability insurance extends its protective umbrella over a diverse range of businesses that offer professional services. This includes, but is certainly not limited to:

- Consultants: Guiding clients through uncharted waters with their specialized knowledge, consultants may inadvertently encounter situations where errors or omissions could arise.

- Accountants: Ensuring the accuracy and integrity of financial records is essential for accountants. However, even the most meticulous professionals can stumble upon mistakes that could have far-reaching consequences.

- Lawyers: Navigating the intricate legal landscape, lawyers bear a heavy burden of responsibility. Errors in judgment or missed deadlines could lead to costly claims.

- Architects and Engineers: Designing and constructing structures requires precision and expertise. Professional liability insurance provides a safety net against potential errors and oversights that could compromise the safety or functionality of a project.

- Healthcare Professionals: Providing medical care carries inherent risks. Even the most skilled practitioners can face allegations of negligence or malpractice.

Benefits of Professional Liability Insurance

Investing in professional liability insurance offers numerous advantages that can safeguard your business’s financial well-being:

- Financial Protection: This insurance coverage serves as a financial cushion, shielding your business from the potentially crippling costs associated with legal defense, settlements, and judgments.

- Reputational Safeguard: A professional liability claim can tarnish your business’s reputation, leading to a loss of clients and revenue. This insurance can help mitigate reputational damage and preserve your hard-earned credibility.

- Peace of Mind: Knowing that your business is protected against professional liability claims provides peace of mind, allowing you to focus on growing your enterprise without the constant worry of financial setbacks.

How to Choose the Right Policy

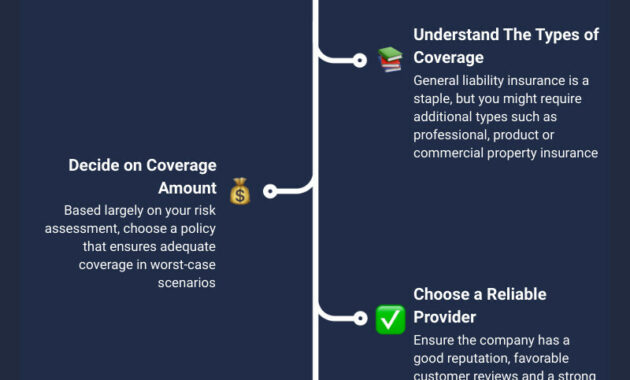

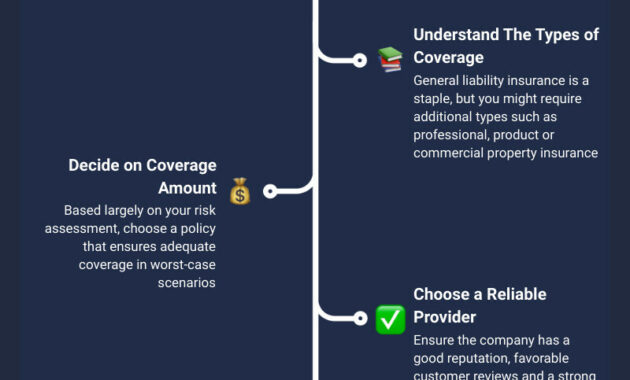

Selecting the right professional liability insurance policy requires careful consideration of several key factors:

- Coverage Limits: Determine the appropriate level of coverage to safeguard your business adequately.

- Deductibles: Establish a realistic deductible that balances affordability with financial protection.

- Exclusions: Understand the policy’s exclusions to avoid any gaps in coverage.

- Reputation of the Insurer: Choose an insurer with a strong track record and a proven commitment to supporting its policyholders.

Don’t Wait, Protect Your Business Today!

Professional liability insurance is an indispensable investment for any business that offers professional services. It’s a wise move that can safeguard your financial future, protect your reputation, and provide peace of mind. Don’t wait—contact an insurance professional today to secure the coverage your business needs to thrive in today’s competitive marketplace.

Introduction

In today’s litigious business climate, small businesses are more vulnerable than ever to lawsuits. Even a minor misstep can result in a costly legal battle that could put your business at risk. That’s why professional liability insurance is essential for any small business owner. This type of insurance can provide peace of mind and financial protection in the event that you are sued.

If you’re not sure whether or not you need professional liability insurance, ask yourself these questions: Do you provide professional services to clients? Do you have employees? Do you own or lease property? If you answered yes to any of these questions, then you should consider getting professional liability insurance.

Here are some of the benefits of professional liability insurance: It can protect your business from financial ruin. It can help you avoid costly legal battles. It can give you peace of mind knowing that you are protected.

What is Professional Liability Insurance?

Professional liability insurance is a type of insurance that protects businesses from financial losses resulting from claims of negligence, errors, or omissions in the performance of professional services. It is also known as errors and omissions (E&O) insurance, or professional indemnity insurance.

Professional liability insurance can cover a wide range of claims, including:

Professional liability insurance is essential for any business that provides professional services, such as:

Why Small Businesses Need Professional Liability Insurance

Small businesses are particularly vulnerable to lawsuits, even if they are not at fault. This is because small businesses often lack the resources to defend themselves against legal claims. Even a single lawsuit can bankrupt a small business. Consider these sobering statistics:

How Much Professional Liability Insurance Do I Need?

The amount of professional liability insurance you need will depend on a number of factors, including the size of your business, the type of services you provide, and the number of employees you have.

A good rule of thumb is to purchase at least $1 million in coverage. However, you may need more coverage if you have a high-risk business, such as a medical practice or a law firm.

You should also consider purchasing an umbrella policy. Umbrella policies provide additional coverage beyond the limits of your professional liability insurance policy. When evaluating your insurance policies keep in mind a sufficient limit of coverage is imperative.

What Are the Best Professional Liability Insurance Companies?

There are a number of different professional liability insurance companies out there. It’s important to compare quotes from several different companies before you make a decision.

Here are some of the best professional liability insurance companies:

How to Get Professional Liability Insurance

Getting professional liability insurance is easy. You can purchase a policy online or through an insurance agent.

Here are some tips for getting professional liability insurance:

Conclusion

Professional liability insurance is an essential part of any small business owner’s risk management plan. It can protect your business from financial ruin, it can help you avoid costly legal battles, and it can give you peace of mind knowing that you are protected.

Best Professional Liability Insurance for Small Businesses: A Comprehensive Guide

In the cutthroat world of small business, protecting oneself from financial risks is paramount. One crucial line of defense is professional liability insurance, a safety net that shields businesses from the financial fallout of errors, omissions, or negligence claims. With the right policy, you can rest assured that your business will bounce back stronger even after unforeseen setbacks.

What Professional Liability Insurance Covers

Picture this: A client hires your web design firm to create a visually stunning website. However, a coding error leads to a security breach, exposing sensitive customer data. The client sues your business for negligence. Who foots the bill? With professional liability insurance, you’re covered. This type of insurance typically safeguards against financial losses stemming from:

• Errors or omissions in professional services

• Negligence leading to bodily injury or property damage

• Breach of contract

• Misrepresentation or misadvice

• Defamation or slander

Why Your Small Business Needs Professional Liability Insurance

You might wonder, "Why do I need professional liability insurance if I’m extra careful?" The truth is, even the most diligent professionals can make mistakes. Besides, clients may not always be reasonable in their expectations or accusations. Professional liability insurance provides a financial cushion, preventing a single costly lawsuit from derailing your business’s growth.

Moreover, certain industries and professions require professional liability insurance as a legal requirement. For instance, healthcare providers, financial advisors, and lawyers must carry this coverage to protect their clients and themselves.

Choosing the Right Professional Liability Insurance

Selecting the right professional liability insurance policy is like finding the perfect puzzle piece—it has to fit your business’s unique needs. Here are a few key factors to consider:

• Coverage limits: Determine the maximum amount your insurance will cover in case of a claim. Higher limits offer greater protection, but they also come with a higher premium.

• Deductible: This is the amount you’ll pay out of pocket before your insurance kicks in. Choose a deductible that balances affordability and coverage.

• Exclusions: Some policies exclude certain types of claims, such as intentional wrongdoing or fraud. Make sure you understand the limitations of your policy.

• Additional coverage options: Consider adding endorsements to enhance your policy, such as cyber liability coverage or employment practices liability coverage.

How to Get Professional Liability Insurance

Obtaining professional liability insurance is a straightforward process. Here’s a step-by-step guide:

- Gather your business information: Prepare financial statements, business licenses, and a list of your professional services.

- Compare quotes from multiple insurers: Don’t settle for the first quote you receive. Get quotes from several reputable insurance companies to find the best coverage at a competitive price.

- Choose an insurance agent: An experienced insurance agent can guide you through the process, explain different policy options, and advocate for your best interests.

- Review your policy carefully: Before signing anything, read your policy thoroughly to ensure it meets your coverage needs and expectations.

Conclusion

Professional liability insurance is an essential investment for any small business. It’s a safety net that safeguards your company’s financial well-being against the unforeseen risks that come with providing professional services. By carefully considering the coverage options and choosing the right policy, you can protect your business and focus on achieving success.

Best Professional Liability Insurance for Small Businesses: A Comprehensive Guide

In today’s competitive business landscape, it’s crucial for small businesses to protect themselves against potential risks and liabilities. Professional liability insurance, also known as errors and omissions (E&O) insurance, is a must-have for any business that provides professional services. It safeguards your company from financial losses resulting from mistakes, negligence, or errors in your work.

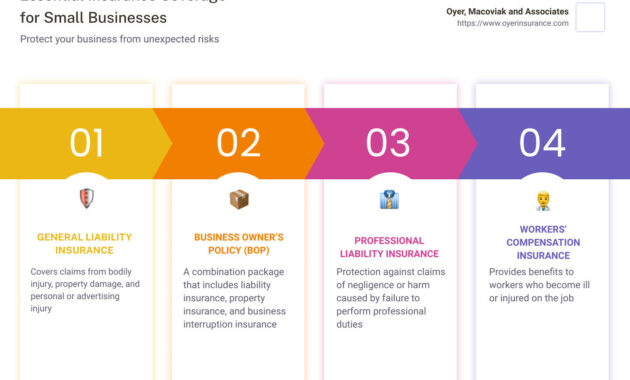

Defining Professional Liability Insurance

Professional liability insurance acts as a financial safety net, covering legal costs, settlements, and damages associated with claims alleging your business committed a breach of duty or made a mistake while providing services. It’s crucial to distinguish it from general liability insurance, which protects against bodily injury, property damage, and other general business risks.

Choosing the Right Policy

When selecting a professional liability insurance policy, several factors come into play:

1. Business Size and Structure

The size of your business and its legal structure influence the level and type of coverage you need. For instance, a sole proprietorship may require different coverage compared to a limited liability corporation (LLC).

2. Services Provided

The nature of your services directly impacts the potential risks you face. Businesses that provide consulting, advisory, or design services may need more comprehensive coverage than those engaged in less specialized activities.

3. Potential Risks

Assess the potential risks associated with your industry and services to determine the appropriate coverage limits. Consider factors like client demographics, contractual obligations, and regulatory compliance.

4. Policy Features and Exclusions

深入了解保险单的条款非常重要,包括承保范围、免赔额、共同保险、索赔限制,以及任何可能的排除或限制。确保您的保单涵盖您业务面临的主要风险。

a. Coverage Limits

Coverage limits refer to the maximum amount the insurance company will pay for a covered claim. Higher limits provide greater protection but come with increased premiums.

b. Deductible

The deductible is the amount you must pay out of pocket before the insurance coverage kicks in. A higher deductible lowers your premiums but increases your potential financial exposure.

c. Coinsurance

Coinsurance is a clause requiring you to share a percentage of the loss with the insurance company. A higher coinsurance percentage reduces your premiums but also increases your financial responsibility in the event of a claim.

d. Claim Restrictions

Some policies may have restrictions on the number of claims you can file within a specific period or lifetime limits on coverage. Understand these restrictions to avoid unexpected surprises.

e. Exclusions

Policies typically have exclusions that outline specific circumstances or types of claims not covered. These exclusions vary depending on the insurer and the industry.

5. Policy Cost and Premium Calculations

The cost of professional liability insurance premiums is determined by several factors, including your business’s risk profile, coverage limits, and the insurance company you choose. It’s essential to compare quotes from multiple insurers to secure the best coverage at a competitive price.

Remember, obtaining the right professional liability insurance is not just about meeting legal requirements but also about protecting your business from financial ruin. By carefully assessing your risks and choosing the appropriate policy, you can safeguard your company’s future and maintain peace of mind in the face of potential claims.

Best Professional Liability Insurance for Small Businesses: A Comprehensive Guide

Protecting your small business from potential lawsuits is paramount. Professional liability insurance can serve as a safety net, providing coverage against claims made by clients alleging negligence, errors, or omissions in your professional services. With numerous insurance providers vying for your attention, choosing the best one for your small business can be daunting. In this article, we’ll delve into the intricacies of professional liability insurance, exploring the top five providers and deciphering their offerings to help you make an informed decision.

Top 5 Professional Liability Insurance Providers for Small Businesses

1. [Provider 1]

[Provider 1] stands tall as a reliable provider, offering tailored insurance solutions for small businesses. Their robust coverage options and competitive premiums make them a formidable contender. They grasp the unique challenges faced by small businesses and design their policies accordingly.

2. [Provider 2]

[Provider 2] excels in providing customized insurance solutions. They recognize that every small business is different and tailor their policies to specific industry needs. Their proactive approach and commitment to customer satisfaction have earned them a loyal following among small businesses.

3. [Provider 3]

[Provider 3] has made a name for itself as an industry leader. With a long track record of success, they’ve garnered a reputation for providing comprehensive coverage at competitive rates. They pride themselves on their unwavering support and dedication to helping small businesses thrive.

4. [Provider 4]

[Provider 4] is renowned for its innovative approach to professional liability insurance. They embrace technology to streamline the insurance process, making it effortless for small businesses to secure coverage. Their customer-centric philosophy and commitment to delivering exceptional service have made them a favorite among small businesses.

5. [Provider 5]

[Provider 5] is a true powerhouse in the professional liability insurance realm. Their comprehensive coverage options, tailored to a wide range of industries, set them apart. They possess an unparalleled understanding of the risks faced by small businesses and go the extra mile to ensure they have the protection they need.

Delving deeper into [Provider 5]’s offerings, we’ll unveil their comprehensive coverage options:

- Errors and Omissions (E&O) Coverage: This cornerstone of professional liability insurance safeguards you against claims alleging mistakes, omissions, or negligence in your professional services.

- Cyber Liability Coverage: In this digital age, protecting your business from cyber threats is crucial. This coverage shields you from claims arising from data breaches, cyberattacks, or privacy violations.

- Media Liability Coverage: If your business involves publishing content, this coverage provides protection against claims alleging libel, slander, or copyright infringement.

- Employment Practices Liability Insurance (EPLI): This coverage protects you from claims related to wrongful termination, discrimination, harassment, or other employment-related issues.

- Directors and Officers (D&O) Liability Insurance: If your business is structured as a corporation, this coverage safeguards your directors and officers from claims alleging breach of fiduciary duty or mismanagement.

Remember, professional liability insurance is not a “one-size-fits-all” solution. Assessing your specific business needs and risks is paramount. Engaging with an experienced insurance agent can provide invaluable guidance in tailoring a policy that aligns perfectly with your requirements.

Conclusion

Navigating the realm of professional liability insurance for your small business requires careful consideration. The providers outlined in this article represent the crème de la crème, each offering a unique array of coverage options. By delving into their offerings and tailoring your policy to your business’s specific needs, you can rest assured that you have a robust safety net in place to protect your livelihood.