Best Product Liability Insurance for Small Businesses

If you’re a small business owner, you know that product liability insurance is a must-have. It protects you from financial ruin if someone is injured or their property is damaged by a product you sell. But with so many different insurance companies out there, it can be tough to know which one to choose. That’s why we’ve put together this guide to help you find the best product liability insurance for your small business.

What is Product Liability Insurance?

Product liability insurance is a type of insurance that protects businesses from financial liability if their products cause injury or damage to others. This can include injuries to consumers, property damage, and even lawsuits. Product liability insurance can help cover the costs of medical expenses, legal fees, and settlements. It can also help protect your business’s assets if you are sued.

Who Needs Product Liability Insurance?

Any business that sells products should have product liability insurance. This includes businesses that sell physical products, such as manufacturers, retailers, and distributors, as well as businesses that sell digital products, such as software and online courses. Even if you don’t think your products are dangerous, you could still be held liable if someone is injured or their property is damaged. That’s why it’s important to have product liability insurance in place, just in case.

How to Get Product Liability Insurance

There are a few different ways to get product liability insurance. You can purchase it through a traditional insurance company, or you can get it through a specialized product liability insurance provider. Once you’ve decided where you want to get your insurance, you’ll need to provide the insurance company with some basic information about your business, such as your name, address, and the types of products you sell. The insurance company will then provide you with a quote for your insurance policy.

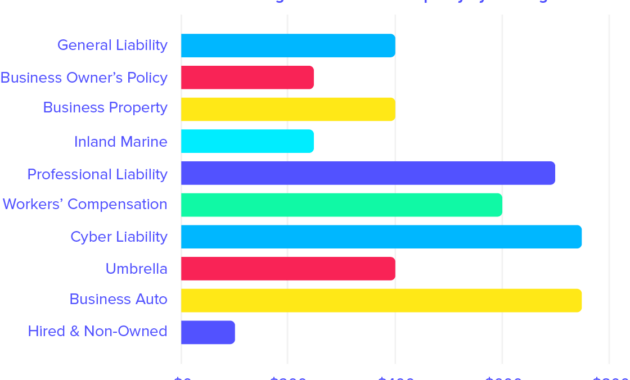

When you’re comparing quotes from different insurance companies, be sure to compare the coverage limits, deductibles, and premiums. The coverage limits are the maximum amount of money the insurance company will pay out if you are sued. The deductible is the amount of money you will have to pay out-of-pocket before the insurance company starts to pay. And the premium is the amount of money you will pay for the insurance policy.

Once you’ve chosen an insurance company and purchased a policy, you’ll be protected from financial liability if someone is injured or their property is damaged by your products. Product liability insurance is an important part of any small business’s insurance portfolio. It can help protect your business from financial ruin, and it can give you peace of mind knowing that you’re covered if something goes wrong.

Additional Tips for Getting the Best Product Liability Insurance

Here are a few additional tips for getting the best product liability insurance for your small business:

- Shop around for quotes from multiple insurance companies. This will help you get the best price on your insurance policy.

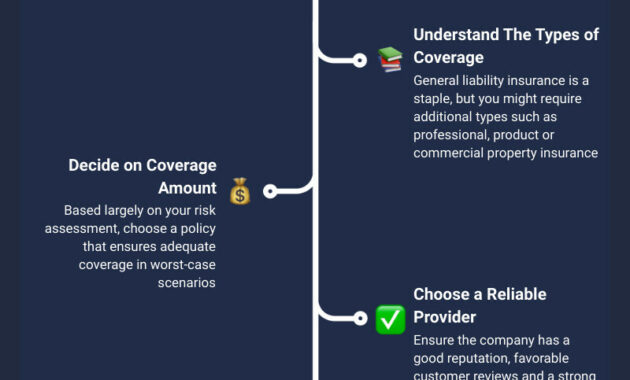

- Read the policy carefully before you purchase it. Make sure you understand the coverage limits, deductibles, and exclusions.

- Ask your insurance agent about discounts. Many insurance companies offer discounts for businesses that have a good safety record or that purchase multiple policies.

- Review your policy regularly. Your business’s insurance needs may change over time, so it’s important to review your policy regularly to make sure it still meets your needs.

By following these tips, you can get the best product liability insurance for your small business.

Product liability insurance is an important part of any small business’s insurance portfolio. It can help protect your business from financial ruin, and it can give you peace of mind knowing that you’re covered if something goes wrong.

The Best Product Liability Insurance for Small Businesses

Protecting your small business from the financial consequences of product-related claims is paramount. That’s where product liability insurance steps in, serving as a safety net against lawsuits alleging injuries or damages caused by your products.

What is Product Liability Insurance?

Product liability insurance shields your business from financial ruin in the event of a lawsuit alleging harm or property damage caused by a product you manufacture, distribute, or sell. This coverage protects you against legal expenses, settlements, and judgments, providing peace of mind and safeguarding your financial stability.

Why Do Small Businesses Need Product Liability Insurance?

Product liability lawsuits can be incredibly costly, even for small businesses. Just one lawsuit has the potential to drain your business’s resources and threaten its very existence. Product liability insurance acts as a financial buffer, ensuring that your business can withstand the financial burden of defending against and settling product-related claims.

Coverage Options

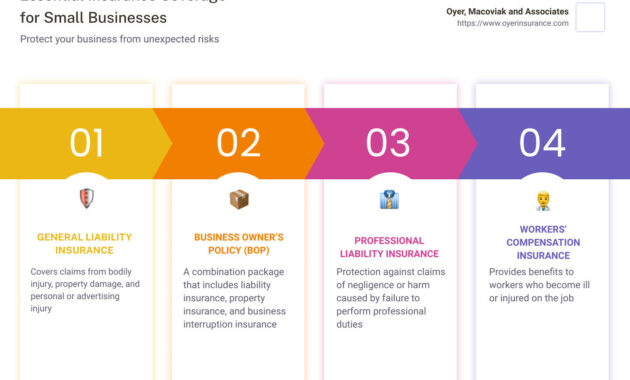

Product liability insurance policies typically cover the following:

- Bodily injury

- Property damage

- Legal expenses

- Defense costs

You can tailor your policy to meet the specific needs of your business, ensuring optimal protection against potential risks.

Factors to Consider When Choosing a Policy

When selecting a product liability insurance policy, consider the following factors:

- Business size and industry

- Nature of products sold

- Distribution channels

- Coverage limits

- Premiums

Our Recommendations

Here are our top picks for the best product liability insurance companies for small businesses:

- Hiscox: Known for its comprehensive coverage and tailored policies for small businesses.

- Travelers: Offers a wide range of coverage options and customizable policies to suit your unique needs.

- CNA: Provides tailored solutions for small businesses, specializing in high-risk industries.

Additional Tips

- Regularly review your policy and make adjustments as your business grows or evolves.

- Document all product-related processes and safety measures to minimize liability risks.

- Train your employees on product safety and liability prevention techniques.

Conclusion

Product liability insurance is an essential component of a comprehensive risk management strategy for any small business that sells products. By investing in this coverage, you protect your business from the potentially devastating financial consequences of product-related claims, allowing you to focus on running your business with confidence and peace of mind.