Best General Liability Insurance for Small Businesses: A Comprehensive Guide to Protecting Your Enterprise

In the realm of small business ownership, safeguarding your enterprise against unforeseen risks is paramount. Amidst the myriad insurance policies available, general liability insurance stands as a cornerstone, offering a crucial safety net for businesses of all sizes. Whether you’re a seasoned entrepreneur or just starting your venture, understanding the nuances of general liability insurance is essential to ensure the long-term success of your business.

What is General Liability Insurance?

Imagine this: A customer stumbles upon a slippery floor in your store, injuring themselves. Or, a client alleges that your product caused damage to their property. In such scenarios, general liability insurance steps in as your knight in shining armor, providing financial protection against claims of bodily injury, property damage, or personal injury.

This comprehensive insurance policy serves as a lifeline for small businesses, covering a wide range of potential perils, including:

- Bodily injury caused by your products, services, or operations

- Property damage resulting from your business activities

- Personal injury, such as libel, slander, or invasion of privacy

As a small business owner, you can breathe a sigh of relief knowing that general liability insurance has your back, safeguarding your financial well-being in the face of unforeseen events.

Why Do I Need General Liability Insurance?

Let’s face it, running a small business is like navigating a stormy sea. Unpredictable challenges can arise from any direction, threatening to capsize your vessel. General liability insurance acts as your sturdy lifeboat, providing stability and protection against financial turmoil.

Without adequate insurance, a single lawsuit could sink your business, draining your hard-earned savings and leaving you with an insurmountable burden of debt. It’s like trying to patch a hole in a boat with a toothpick – it’s simply not going to hold up.

Investing in general liability insurance is a smart move, ensuring that your business remains afloat and resilient in the face of legal squalls.

How Much General Liability Insurance Do I Need?

Determining the right amount of general liability insurance coverage is like finding the perfect fit for a puzzle. It depends on several factors, including:

- The size and nature of your business

- The number of employees you have

- The potential risks associated with your industry

- The limits required by your clients or contracts

To avoid being underinsured or overpaying for coverage, it’s wise to consult with an insurance professional. They can assess your unique needs and recommend the optimal level of coverage for your business.

The Best General Liability Insurance for Small Businesses

Navigating the labyrinth of insurance providers can be daunting, especially for small businesses. To help you make an informed decision, here are some of the top-rated general liability insurance providers:

- Progressive

- Hiscox

- The Hartford

- Chubb

- Nationwide

These reputable insurers offer tailored coverage options and exceptional customer service, ensuring that your business is well-protected.

Additional Considerations

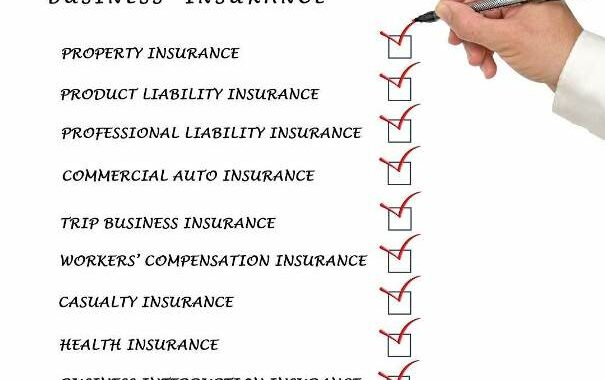

Beyond the basics of general liability insurance, there are several optional coverages you may want to consider, including:

- Commercial property insurance

- Business interruption insurance

- Errors and omissions insurance

- Cyber liability insurance

These add-ons provide extra layers of protection, ensuring that your business is shielded from a wide range of potential risks.

Conclusion

In the competitive world of small business, it’s imperative to safeguard your enterprise against unforeseen calamities. General liability insurance stands as an indispensable tool, providing financial protection and peace of mind. By understanding the ins and outs of this essential insurance, you can ensure that your business remains strong and resilient in the face of any storm.

Navigating the General Liability Insurance Landscape for Small Business Success

For any small business owner, securing the right insurance coverage is paramount to safeguarding their enterprise against unforeseen risks and financial setbacks. General liability insurance stands as an indispensable pillar in this protective framework, offering a comprehensive shield against a wide array of potential liabilities. It’s like an umbrella on a stormy day, providing peace of mind and financial security in the face of unexpected claims.

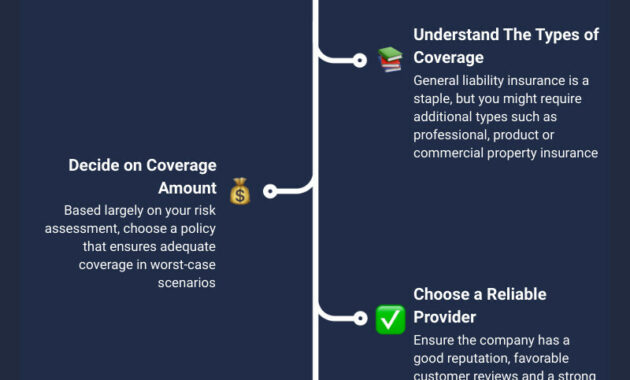

When it comes to selecting the best general liability insurance for your small business, there are a few key things to keep in mind. First and foremost, consider the size and scope of your operations. The coverage you need will vary depending on the number of employees you have, the type of work you do, and the potential risks associated with your industry.

Next, take into account your budget. General liability insurance premiums can vary widely depending on the level of coverage you choose and the insurance company you select. It’s important to shop around and compare quotes from multiple providers to find the best deal.

Finally, make sure you understand the terms and conditions of your policy. This includes knowing what is covered, what is not covered, and what your deductible is. Reading the fine print may seem tedious, but it’s essential to avoid any surprises down the road.

Benefits of General Liability Insurance: A Lifeline for Small Businesses

General liability insurance is more than just a legal requirement; it’s an essential investment in the well-being of your small business. It provides a safety net against a multitude of potential liabilities, including:

- Bodily injury to others

- Property damage to others

- Personal injury claims, such as libel, slander, or defamation

- Advertising injury, such as copyright infringement or trademark infringement

Without general liability insurance, you could be held personally liable for any damages or injuries that occur as a result of your business operations. This could result in a financial catastrophe, forcing you to sell your assets or even close your business.

In contrast, general liability insurance provides a financial cushion, protecting you from the potentially devastating consequences of a lawsuit. It covers the costs of legal defense, settlements, and judgments, giving you peace of mind and allowing you to focus on running your business.

Choosing the Right Insurer: A Match Made in Business Heaven

Partnering with the right insurance company is crucial to ensuring you get the best possible coverage at a competitive price. Here are some tips for finding the right insurer:

Get quotes from multiple companies. This will help you compare coverage levels and premiums to find the best deal.

Read online reviews. See what other small businesses have to say about their experiences with different insurance companies.

Talk to an insurance broker. A broker can help you compare quotes and find the right coverage for your specific needs.

Once you’ve found an insurance company you’re comfortable with, make sure you understand the terms and conditions of your policy. This includes knowing what is covered, what is not covered, and what your deductible is.

Keeping your general liability insurance up to date is essential for maintaining your protection. Make sure to review your policy annually and make any necessary adjustments to your coverage. Your business is like a precious child, and you wouldn’t let your child go out into the world without proper protection. The same goes for your business. General liability insurance is the best way to safeguard your small business from the unexpected and ensure its continued success.

Recommended General Liability Insurance Providers for Small Businesses

The market is teeming with insurance providers, each vying for your attention. To help you navigate this crowded landscape, we’ve compiled a list of reputable and reliable general liability insurance providers specifically tailored to the needs of small businesses:

- The Hartford

- Hiscox

- Liberty Mutual

- Nationwide

- Progressive

These providers offer a range of coverage options and competitive premiums, making them excellent choices for small businesses seeking comprehensive protection at an affordable price.

Conclusion: Securing Your Small Business’s Future with Peace of Mind

General liability insurance is an essential investment for any small business owner. It provides peace of mind and financial protection against a wide range of potential liabilities. By understanding the coverage you need, shopping around for the best deal, and choosing the right insurance company, you can ensure your business is well-protected against the unexpected.

Best General Liability Insurance for Small Businesses in 2023

Running a small business is no walk in the park, and protecting it from potential liabilities is paramount. That’s where general liability insurance comes in, acting as a safety net for your business against claims of bodily injury, property damage, or advertising injuries.

Choosing the right general liability insurance policy for your small business can be a daunting task, but we’ve got you covered. This comprehensive guide will take you through the crucial factors to consider when selecting a policy that meets your specific needs. Dive right in and let’s find the best general liability insurance for your small business!

Factors to Consider When Choosing a Policy

When it comes to selecting the perfect general liability insurance policy, there are several key factors you need to keep in mind. Let’s break them down one by one:

Coverage Limits:

These limits determine the maximum amount your insurance company will pay out for covered claims. Opt for limits that align with the potential risks your business faces. For instance, if you operate a construction company, higher coverage limits are advisable due to the inherent risks involved.

Deductibles:

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premiums, but make sure it’s an amount you can comfortably afford in case of a claim.

Coverage Exclusions:

Not all general liability policies cover every conceivable risk. There may be certain exclusions, such as claims arising from pollution or intentional acts. Carefully review the policy to ensure it covers the risks relevant to your business.

Policy Costs:

Premiums for general liability insurance vary depending on your business’s size, industry, and risk profile. Get quotes from multiple insurers to compare costs and find the best deal. Don’t just go for the cheapest option; consider the coverage and reliability of the insurance company as well.

Coverage Exclusions: What’s Not Covered?

While general liability insurance provides broad protection, it’s essential to be aware of common exclusions. These may include:

-

Intentional Acts: Coverage doesn’t extend to damages resulting from deliberate or intentional acts.

-

Criminal Acts: Illegal activities are not covered.

-

Employee Dishonesty: Losses caused by dishonest employees are typically excluded.

-

Punitive Damages: These are not covered by most general liability policies.

-

Professional Errors and Omissions: Coverage for professional mistakes or errors is usually excluded.

Understanding these exclusions will help you identify any gaps in coverage and consider additional policies to protect your business comprehensively.

Best General Liability Insurance for Small Businesses: Protecting Your Enterprise

In the dynamic landscape of small businesses, safeguarding against potential liabilities is paramount. General liability insurance serves as a safety net, shielding businesses from a wide range of claims, including bodily injury, property damage, and legal expenses. Choosing the right provider is crucial for ensuring adequate protection and peace of mind.

With a plethora of options available, selecting the best general liability insurance can be a daunting task. Our comprehensive guide delves into the top providers, highlighting their unique strengths and offerings, to empower small business owners with the knowledge they need to make informed decisions.

Top General Liability Insurance Providers for Small Businesses

-

Travelers: Travelers stands out as a reputable provider offering a comprehensive suite of general liability insurance options tailored to small businesses. Their extensive experience, financial stability, and personalized approach make them a top choice for businesses seeking reliable protection.

-

Hiscox: Hiscox caters specifically to the needs of small businesses, providing tailored coverage for various industries, including technology, media, and professional services. Their flexible policies and exceptional customer service set them apart in the market.

-

Progressive: Known for its budget-friendly options, Progressive offers general liability insurance plans designed to meet the unique needs of small businesses on a tight budget. Their user-friendly online platform simplifies the application process, making it a convenient choice for entrepreneurs.

-

Hartford: Hartford boasts a long-standing reputation in the industry, offering a wide range of general liability insurance options for small businesses. Their customizable policies and personalized risk management services provide businesses with the flexibility and protection they need to thrive.

Hartford: A Comprehensive Look at a Leading Provider

Experience and Expertise

With over 200 years of experience in the insurance industry, Hartford has established itself as a trusted and knowledgeable provider. Their extensive understanding of small business risks enables them to tailor policies that effectively address the unique challenges faced by entrepreneurs.

Tailored Coverage Options

Hartford offers a range of general liability insurance options designed to meet the specific needs of various small businesses. Whether you operate in construction, retail, or professional services, Hartford has a policy that is tailored to protect your business.

Personalized Risk Management

Beyond insurance coverage, Hartford provides personalized risk management services to help small businesses identify and mitigate potential liabilities. Their experienced risk management team works closely with policyholders to develop strategies that reduce the likelihood of claims and minimize their impact.

Value-Added Services

Hartford goes the extra mile by offering value-added services that enhance the overall customer experience. These services include online claims reporting, 24/7 customer support, and access to a network of preferred vendors for repairs and legal services.

Financial Stability

Hartford is backed by the financial strength and stability of The Hartford Financial Services Group, a Fortune 500 company. This financial stability ensures that policyholders can rely on Hartford to fulfill its obligations, even in the event of large or catastrophic claims.

Customer Testimonials

Hartford has consistently received positive customer testimonials, praising their responsive customer service, knowledgeable agents, and tailored coverage options. Here’s what some satisfied small business owners have to say:

- "Hartford’s personalized coverage gave me the peace of mind I needed to grow my business."

- "Their risk management team helped us identify potential liabilities and develop strategies to mitigate them."

- "The claims process was smooth and hassle-free, allowing us to get back on our feet quickly."

Conclusion

Choosing the best general liability insurance provider for your small business requires careful consideration. By thoroughly researching reputable providers like Travelers, Hiscox, Progressive, and Hartford, you can find a policy that meets your specific needs and provides peace of mind. Hartford stands out with its experience, expertise, tailored coverage options, personalized risk management services, value-added services, and financial stability.

Best General Liability Insurance for Small Businesses: A Comprehensive Guide

As a small business owner, shielding your enterprise from unforeseen risks is paramount. General liability insurance emerges as an indispensable safeguard, providing a financial cushion against claims of bodily injury, property damage, or personal and advertising injuries. This article delves into the intricate world of general liability insurance, empowering you with the knowledge to navigate this crucial step towards safeguarding your business. We will unravel the secrets of comparing quotes, selecting the ideal provider, understanding coverage limits, deciphering premium rates, and leveraging customer service to make an informed decision that aligns seamlessly with your unique business needs.

What is General Liability Insurance?

Think of general liability insurance as a stalwart knight standing guard, protecting your small business from potential legal onslaughts. It shields you from financial liability in the event of lawsuits alleging bodily harm, property destruction, or reputational damage to third parties stemming from your business operations. This invaluable coverage serves as a safety net, ensuring that unforeseen incidents don’t derail your entrepreneurial dreams.

Why is General Liability Insurance Crucial for Small Businesses?

Just as a sturdy shield protects a warrior in battle, general liability insurance defends your small business against a myriad of costly mishaps. Imagine a disgruntled customer slipping and falling on your premises, sustaining a nasty injury. Without general liability coverage, you could find yourself footing the hefty medical bills and legal fees associated with their claim. Or picture a disgruntled client alleging that your marketing campaign infringed upon their intellectual property rights. The ensuing legal battle could drain your business’s financial resources, potentially threatening its very existence. General liability insurance acts as a robust shield, safeguarding your business from such financial setbacks.

Understanding Coverage Limits and Premium Rates

Coverage limits and premium rates are two pivotal factors that shape your general liability insurance policy. Coverage limits establish the maximum amount the insurer will pay out in the event of a covered claim. Higher coverage limits provide broader protection but naturally come with higher premiums. Premium rates, on the other hand, represent the annual cost of your policy. They are influenced by several factors, including the nature of your business, its size, claims history, and the coverage limits you choose. Striking the right balance between coverage limits and premium rates is essential to ensure adequate protection without overpaying.

Tips for Comparing Quotes and Choosing a Provider

Navigating the insurance market can be akin to navigating a labyrinth, but with the right strategies, you can emerge with the optimal general liability insurance policy for your small business. Here are some expert tips to guide your decision-making:

-

Obtain Multiple Quotes: Don’t settle for the first quote you encounter. Reach out to several insurers to gather a range of options and compare coverage limits, premium rates, and customer service offerings. This comprehensive analysis empowers you to make an informed choice that aligns with your specific business needs.

-

Scrutinize Coverage Limits: Carefully examine the coverage limits of each policy to ensure they align with the potential risks your business faces. Consider factors such as the size of your premises, the number of employees, and the nature of your operations. Adequate coverage limits provide peace of mind, knowing that you are protected in the event of unforeseen incidents.

-

Evaluate Premium Rates: While cost is an important consideration, it should not be the sole determining factor. Remember, the cheapest policy may not provide the most comprehensive coverage. Analyze premium rates alongside coverage limits and customer service offerings to find the policy that offers the best value for your money.

-

Assess Customer Service: Excellent customer service is invaluable when navigating insurance claims. Look for insurers with a reputation for prompt and responsive support. A reliable insurer will be there for you when you need them most, ensuring a smooth claims process and minimizing disruptions to your business operations.

-

Consider the following additional factors:

-

Endorsements: Endorsements are riders that can be added to your policy to enhance coverage for specific risks. Carefully review the endorsements offered by different insurers and select those that align with your business’s unique needs.

-

Deductibles: A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, but it’s important to choose a deductible that you can comfortably afford in the event of a claim.

-

Claims Handling: Inquire about the insurer’s claims handling process. A streamlined and efficient process can ensure a prompt resolution of your claims, minimizing disruptions to your business operations.

-

Financial Stability: The financial stability of your insurer is a crucial consideration. Ensure that the insurer you choose has a solid track record and a strong financial rating. This provides peace of mind, knowing that your claims will be honored even in the face of unforeseen circumstances.

-

Industry Expertise: Consider partnering with an insurer that specializes in providing coverage to businesses in your industry. They are likely to have a deep understanding of the risks associated with your operations and can tailor a policy that meets your specific needs.

Conclusion

Securing general liability insurance is a prudent investment for any small business. By following the expert tips outlined in this article, you can navigate the complex world of insurance with confidence, selecting a policy that provides the optimal protection for your unique business needs. Remember, general liability insurance is not just a financial safeguard; it’s a vital tool that empowers you to operate with peace of mind, knowing that you are shielded from unforeseen risks that could threaten the very foundation of your entrepreneurial endeavor.

What Is General Liability Insurance, and Why Do You Need It?

The first question that comes to mind is, "What exactly is general liability insurance?" In a nutshell, it’s like an umbrella that protects your small business from financial fallout caused by claims of bodily injury, property damage, libel, slander, and advertising errors. Imagine this: a customer slips and falls in your store, or a competitor accuses you of copyright infringement. Without general liability insurance, you’re on the hook for hefty legal costs, damages, and settlements that could put your business in jeopardy.

Best General Liability Insurance for Small Businesses

Navigating the maze of insurance providers can be daunting, but we’ve done the legwork for you. After meticulously comparing coverage options, customer reviews, and financial stability, we’ve handpicked the top general liability insurance providers for small businesses:

- Hiscox: Renowned for its exceptional customer service and customizable policies tailored to small businesses.

- The Hartford: A time-honored insurer offering comprehensive coverage and competitive rates.

- Progressive: A budget-friendly option with flexible policies to meet various business needs.

- Nationwide: Known for its strong financial foundation and extensive industry experience.

- Travelers: A trusted provider with a wide range of coverage options, including specialized policies for specific industries.

Additional Coverage Options

While general liability insurance provides a solid foundation, consider enhancing your protection with these additional coverage options:

Employee Benefits Liability Insurance

This coverage safeguards your business against claims related to employee benefits, such as discrimination, wrongful termination, or failure to provide adequate benefits. It’s especially crucial for businesses offering health insurance or retirement plans.

Cyber Liability Insurance

In this digital age, cyber threats are a growing concern. Cyber liability insurance shields your business from financial losses and legal liabilities resulting from data breaches, cyberattacks, or privacy violations.

Professional Liability Insurance

If your business provides professional advice or services, such as consulting, accounting, or legal services, professional liability insurance protects you against claims of negligence, errors, and omissions. It provides peace of mind and safeguards your reputation.

Tailored Coverage for Your Industry

Every business has unique risks and needs. Consider exploring industry-specific coverage options to ensure your policy is tailored to your specific line of work. For instance, contractors may need additional coverage for tools and equipment, while healthcare providers require protection for medical malpractice.

Understanding Your Policy

General liability insurance policies can vary in coverage and terms. It’s imperative to thoroughly review and understand your policy to avoid any surprises down the road. Here are key elements to pay close attention to:

Policy Limits

Policy limits determine the maximum amount your insurance will cover for claims. Ensure you have adequate limits to protect your business from catastrophic events.

Deductibles

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Choose a deductible that balances affordability with your risk tolerance.

Exclusions

Review the policy exclusions carefully to understand what types of claims are not covered. Common exclusions include intentional acts, criminal activities, and pollution.

Finding the Right Provider

Choosing the right general liability insurance provider is paramount. Consider these factors:

Reputation and Customer Reviews

Research the insurer’s reputation and customer satisfaction ratings to gauge their reliability and responsiveness.

Financial Strength

Ensure the insurer has a solid financial foundation to meet its obligations in the event of a claim.

Coverage Options and Customization

Select a provider that offers comprehensive coverage options and allows you to customize your policy to meet your specific needs.

Price and Value

Compare quotes from multiple providers, but don’t solely focus on price. Consider the value of the coverage and the provider’s reputation.

Customer Service and Support

Look for a provider with responsive and helpful customer service to assist you with any questions or claims.

Conclusion

General liability insurance is an essential investment for any small business. It provides peace of mind and protects your business from financial risks. By choosing the right provider and customizing your coverage, you can ensure your business is well-protected and ready to navigate unexpected challenges.

Best General Liability Insurance for Small Businesses

In the competitive landscape of today’s business world, small businesses face a myriad of risks that can threaten their financial well-being. One crucial insurance policy that every small business should consider is general liability insurance. This insurance acts as a safety net, protecting businesses from financial burdens resulting from bodily injury, property damage, or other legal liabilities arising from their operations.

With the right general liability insurance policy, small businesses can rest assured that they have a solid foundation to mitigate potential financial risks. However, choosing the best general liability insurance for your small business can be a daunting task. To guide you through this process, we’ve compiled everything you need to know about general liability insurance, from its benefits to selecting the right coverage for your business.

What is General Liability Insurance?

General liability insurance is a fundamental type of insurance that provides coverage for businesses against claims resulting from bodily injury or property damage caused to third parties due to the business’s operations, products, or services. This coverage is crucial as it helps businesses avoid the high costs associated with legal defense, settlements, and judgments.

General liability insurance is not a one-size-fits-all solution. The specific coverage you need depends on the unique risks associated with your business. As such, it’s essential to work with an experienced insurance agent who can assess your business’s needs and recommend the appropriate coverage.

Benefits of General Liability Insurance for Small Businesses

General liability insurance offers a multitude of benefits that can safeguard the financial stability of small businesses:

- Protection against lawsuits: General liability insurance provides a safety net in the event of a lawsuit alleging bodily injury or property damage. It covers legal expenses, settlements, and judgments, preventing these costs from crippling your business.

- Peace of mind: Knowing that your business is protected from financial liabilities can provide invaluable peace of mind, allowing you to focus on growing your business without the constant worry of potential risks.

- Customer confidence: General liability insurance demonstrates to customers that your business is responsible and financially secure, fostering trust and confidence.

- Increased credibility: Having general liability insurance can enhance your business’s credibility in the eyes of potential partners, investors, and clients.

How to Choose the Right General Liability Insurance for Your Small Business

Selecting the right general liability insurance policy for your small business is crucial. Here are some key factors to consider:

- Assess your business risks: Before purchasing insurance, take time to identify the specific risks associated with your business. Consider the nature of your operations, products, and services, as well as the potential for third-party claims.

- Determine appropriate coverage limits: Coverage limits refer to the maximum amount your insurance policy will pay in the event of a claim. Determine the appropriate coverage limits based on your business’s size, industry, and potential risks.

- Choose a reputable insurance company: Partner with a financially stable and reputable insurance company that has a proven track record of providing excellent customer service.

Additional Coverage Options to Consider

In addition to general liability insurance, there are other coverage options you may want to consider to further protect your business:

- Property insurance: Property insurance protects your business’s physical assets, such as buildings, equipment, and inventory, from damage or loss due to fire, theft, or other covered perils.

- Business interruption insurance: Business interruption insurance covers lost income and expenses if your business is forced to close or suspend operations due to a covered event.

- Workers’ compensation insurance: Workers’ compensation insurance provides coverage for employees who suffer work-related injuries or illnesses, regardless of fault.

Conclusion

General liability insurance is a critical investment for small businesses looking to protect their financial stability and mitigate potential risks. By understanding its benefits, selecting the right policy, and considering additional coverage options, you can ensure that your business is well-protected. Remember, general liability insurance is not just a smart business decision – it’s an essential foundation for long-term success.