The Best Commercial Truck Insurance Rates

Are you a commercial truck driver looking for the best insurance rates? If so, you’re in luck. This article will cover everything you need to know about getting the best rates on commercial truck insurance. We’ll cover everything from comparing quotes to getting discounts. So whether you’re a new driver or you’ve been on the road for years, this article has something for you.

How to Find the Best Commercial Truck Insurance Rates

The first step to getting the best commercial truck insurance rates is to compare quotes from multiple insurers. There are a number of ways to do this. You can use an online insurance comparison tool, or you can contact insurers directly. When comparing quotes, be sure to compare the coverage, the deductible, and the premium. You should also consider the insurer’s financial strength and reputation.

How to Get Discounts on Commercial Truck Insurance

There are a number of ways to get discounts on commercial truck insurance. Some of the most common discounts include:

- Bundling your insurance policies

- Having a good driving record

- Taking a defensive driving course

- Installing safety features on your truck

By taking advantage of these discounts, you can save a significant amount of money on your commercial truck insurance.

Other Ways to Save Money on Commercial Truck Insurance

In addition to comparing quotes and getting discounts, there are a number of other ways to save money on commercial truck insurance. Here are a few tips:

- Increase your deductible

- Pay your premium in full

- Shop around for insurance every year

By following these tips, you can get the best commercial truck insurance rates possible.

What to Look for in a Commercial Truck Insurance Policy

When choosing a commercial truck insurance policy, there are a few things you should keep in mind. First, you need to make sure that the policy provides the coverage you need. This includes liability coverage, collision coverage, and comprehensive coverage. You should also consider getting uninsured motorist coverage and underinsured motorist coverage. Second, you need to make sure that the policy has a high enough limit. The limit is the maximum amount that the insurance company will pay for a claim. Third, you need to make sure that the policy is affordable. The premium is the amount that you pay for the insurance policy. You should shop around for insurance to find the best rate.

Conclusion

Commercial truck insurance is an important part of protecting your business. By following the tips in this article, you can get the best rates on commercial truck insurance. So don’t wait, get started today!

Best Commercial Truck Insurance Rates

In the trucking industry, every penny counts. That’s why finding the best commercial truck insurance rates is crucial for businesses looking to save money and protect their assets. By shopping around and comparing quotes from multiple insurers, you can secure the coverage you need at a price that won’t break the bank.

Compare quotes from multiple insurers

Getting quotes from multiple insurers is the best way to compare rates and find the best deal. Don’t just settle for the first quote you receive. Take the time to reach out to several insurers and request quotes based on your specific business needs and coverage requirements. This will give you a clear picture of the market rates and allow you to make an informed decision.

When comparing quotes, pay attention to the following factors:

- Coverage limits: Make sure the quotes you’re comparing provide the same level of coverage so you’re comparing apples to apples.

- Deductibles: The deductible is the amount you pay out of pocket before the insurance coverage kicks in. Higher deductibles typically result in lower premiums, but make sure you choose a deductible that you can afford to pay in the event of a claim.

- Policy terms: Read the policy terms carefully to understand what is and isn’t covered. Look for exclusions and limitations that could impact your coverage.

By taking the time to compare quotes from multiple insurers, you can increase your chances of finding the best commercial truck insurance rates that meet your needs and budget.

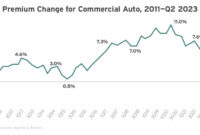

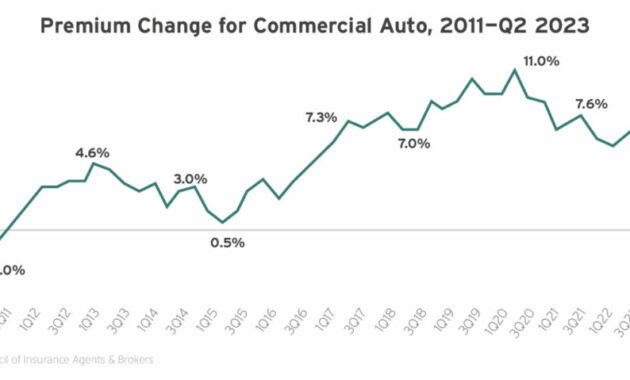

Factors that affect commercial truck insurance rates

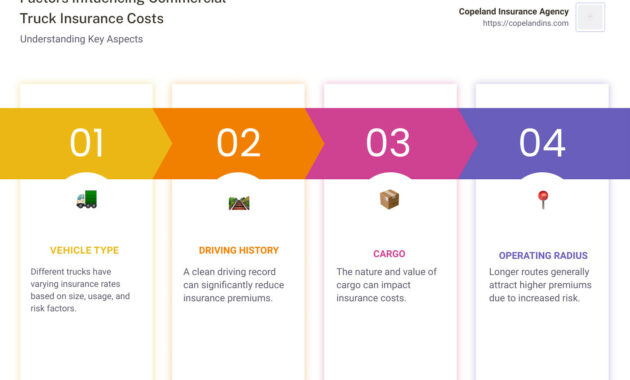

Several factors can affect the cost of your commercial truck insurance rates, including:

- Type of truck: The type of truck you operate, such as a semi-truck, box truck, or dump truck, can impact your rates.

- Business history: Insurers will consider your business’s history, including any claims or accidents, when determining your rates.

- Driving record: The driving records of your employees can also affect your rates. A clean driving record will typically result in lower premiums.

- Location: The location where you operate your business can also impact your rates.

By understanding the factors that affect commercial truck insurance rates, you can take steps to reduce your costs and secure the best possible coverage for your business.

Tips for finding the best commercial truck insurance rates

In addition to comparing quotes from multiple insurers, there are several other things you can do to find the best commercial truck insurance rates:

- Maintain a good credit score: Insurers often use your business’s credit score as a factor in determining your rates. A higher credit score can lead to lower premiums.

- Take safety courses: Completing safety courses for your drivers can demonstrate your commitment to safety and potentially reduce your rates.

- Install safety devices: Installing safety devices such as GPS tracking systems, dashcams, and collision avoidance systems can also help you qualify for discounts on your insurance rates.

By following these tips, you can increase your chances of finding the best commercial truck insurance rates for your business.

Best Commercial Truck Insurance Rates

Planning to embark on a commercial trucking venture? It’s not just about getting behind the wheel and hitting the open road; you’ll need to safeguard your investment with the right commercial truck insurance. And when it comes to finding the best rates, a few key factors can make all the difference. Let’s delve into the ins and outs of commercial truck insurance so you can secure the most affordable coverage that meets your needs.

Consider Your Driving Record and Claims History

Your driving record is like a report card for your time on the road. Insurance companies scrutinize it to assess your risk level. The fewer accidents and violations you have, the lower your rates will be. So, if you’ve been a safe and responsible driver, you can expect to reap the rewards in the form of reduced premiums. Similarly, a history free of insurance claims speaks volumes about your driving habits, earning you favor with insurers.

On the flip side, if your driving record is less than stellar, don’t despair. While you may face higher premiums initially, maintaining a clean record going forward can gradually improve your insurance score and lower your rates over time. It’s a journey, not a destination, so stay focused on safe driving practices.

Let’s say you’ve had a few bumps and bruises on the road, resulting in a couple of accidents and claims. All is not lost! Insurance companies understand that accidents happen, especially in the trucking industry. By demonstrating a commitment to safe driving through defensive driving courses or other initiatives, you can show insurers that you’re making an effort to improve your driving habits. Insurance is all about managing risk, and by taking proactive steps to reduce your risk profile, you’ll make yourself a more attractive customer in the eyes of insurers.

Remember, insurance companies aren’t out to get you. They want to provide you with the coverage you need at a fair price. By understanding the factors that influence your insurance rates and taking steps to improve your driving record, you can position yourself to secure the best commercial truck insurance rates available.

Best Commercial Truck Insurance Rates: A Comprehensive Guide to Saving Money on Premiums

Introduction

Securing the best commercial truck insurance rates can be a daunting task. With numerous insurance providers offering a vast array of policies and coverage options, navigating this complex landscape can be a challenge. However, by understanding the factors that influence premiums and employing savvy strategies, businesses can significantly reduce their insurance costs without compromising coverage.

Factors Influencing Premiums

The cost of commercial truck insurance is primarily determined by several key factors, including:

- Driving Record: A clean driving record with minimal accidents or violations can lower premiums.

- Coverage Limits: Higher coverage limits will generally result in higher premiums.

- Type of Truck: The size, weight, and type of truck being insured impact the premium.

- Business History: A stable and profitable business operation can improve insurability and reduce premiums.

- Location: Geographic location and crime rates can influence premiums.

Strategies for Lowering Premiums

By implementing the following strategies, businesses can effectively lower their commercial truck insurance premiums:

1. Shop Around and Compare Quotes

Obtaining quotes from multiple insurance providers is crucial. Comparison shopping allows businesses to compare coverage options and premiums side-by-side, ensuring they find the most competitive rates.

2. Increase your Deductible

Increasing your deductible will lower your insurance premiums. However, you should only increase your deductible if you can afford to pay it in the event of an accident. A higher deductible means you will be responsible for a larger portion of the repair costs, but it can significantly reduce your premiums.

3. Improve your Safety Record

Maintaining a clean driving record is one of the most effective ways to lower insurance costs. By adhering to traffic laws, avoiding accidents, and completing defensive driving courses, businesses can demonstrate their commitment to safety and reduce their risk profile.

4. Bundle Policies

If your business has multiple vehicles or insurance needs, consider bundling your policies with the same provider. Many insurers offer discounts for bundling policies, such as combining commercial truck insurance with general liability or workers’ compensation insurance.

5. Install Safety Devices

Equipping trucks with safety devices, such as anti-lock brakes, lane departure warning systems, and dash cams, can reduce the risk of accidents and lower premiums. Insurers may provide discounts for installing these devices.

6. Maintain Good Credit

Insurance companies often consider credit scores when setting premiums. A good credit score can indicate financial responsibility and reduce insurance costs.

7. Seek Professional Advice

Working with an insurance agent or broker who specializes in commercial truck insurance can provide valuable guidance and help you find the best rates for your specific needs. They can also advocate for your interests and negotiate the most favorable terms.

Additional Tips

- Review your insurance coverage regularly to ensure it meets your current business needs.

- Consider purchasing additional coverage, such as physical damage coverage or cargo insurance, to protect your assets.

- Explore government programs or incentives that may offer reduced insurance rates for businesses that prioritize safety and compliance.

Conclusion

By understanding the factors influencing premiums and implementing effective strategies, businesses can secure the best commercial truck insurance rates while maintaining adequate coverage. By shopping around, increasing deductibles, improving safety records, and bundling policies, businesses can significantly reduce their insurance costs and protect their financial stability. Remember, investing time in finding the right insurance partner and coverage will pay dividends in the long run.

Best Commercial Truck Insurance Rates: A Comprehensive Guide to Saving Money

In the realm of commercial trucking, securing the most competitive insurance rates is akin to finding a hidden treasure. With premiums often amounting to a hefty chunk of your operating expenses, every penny saved can make a significant difference to your bottom line. This article will guide you through the labyrinth of commercial truck insurance, revealing the secrets to unlocking the best rates and reaping the rewards of optimal coverage.

Take Advantage of Discounts: Unlocking Hidden Savings

Much like a treasure hunt, commercial truck insurance offers a trove of discounts waiting to be uncovered. By strategically leveraging these hidden gems, you can significantly reduce your premiums without compromising coverage.

-

Bundle Up: Combining your commercial truck insurance with other policies, such as general liability or workers’ compensation, can often earn you substantial discounts. Insurers appreciate the loyalty of consolidating your policies under one roof, rewarding you with reduced rates.

-

Safety First: Equipping your trucks with safety devices, such as GPS tracking systems, lane departure warnings, and anti-lock brakes, demonstrates your commitment to minimizing risk. In turn, insurers recognize this proactive approach and reward you with lower premiums.

-

Defensive Driving Defense: Defensive driving courses are not just useful for improving your driving skills; they also serve as a testament to your responsible driving habits. By completing these courses, you signal to insurers that you are a safe and conscientious operator, making them more inclined to offer you reduced rates.

-

Clean Record Rewards: Maintaining a clean driving record is like hitting a commercial truck insurance jackpot. Unblemished by accidents or traffic violations, you become an attractive prospect for insurers, who view you as a low-risk investment and reward you with the best rates.

-

Mileage Matters: If your trucks are primarily used for short-distance trips or in limited geographic areas, you may qualify for lower premiums based on your mileage. Insurers recognize the reduced risk associated with fewer miles driven, translating into savings for you.

Choosing the Right Insurance Company: A Balancing Act

Navigating the sea of commercial truck insurance providers can be a daunting task. To find the right one for your needs, consider these key factors:

-

Reputation and Reliability: Seek out insurers with a strong reputation in the industry and a proven track record of financial stability. Their ability to pay claims promptly and efficiently is crucial for your peace of mind.

-

Coverage Options: Different insurers offer varying levels and types of coverage. Carefully evaluate the options available to ensure you have the protection you need, whether it’s liability, collision, or cargo coverage.

-

Customer Service: Excellent customer service is invaluable when dealing with claims or any other insurance-related matters. Look for an insurer known for its responsiveness, professionalism, and willingness to go the extra mile.

-

Discounts and Incentives: Take advantage of the discounts offered by different insurers. These savings can add up over time, making a significant impact on your overall insurance costs.

-

Premiums vs. Coverage: Striking the right balance between premiums and coverage is essential. While lower premiums may be tempting, don’t sacrifice essential coverage that could leave you exposed in the event of an accident.

Coverage Considerations: Tailoring Protection to Your Needs

Commercial truck insurance is not a one-size-fits-all solution. The type of coverage you need depends on the size and nature of your business. Here’s a breakdown of key considerations:

-

Liability Insurance: This is the foundation of any commercial truck insurance policy, providing protection against claims of bodily injury or property damage caused by your trucks.

-

Collision Insurance: Covers damage to your own truck in the event of an accident, regardless of fault.

-

Cargo Insurance: Protects the goods you transport against loss or damage.

-

Non-Trucking Liability: Provides coverage for situations when your truck is not being used for business purposes, such as when it’s parked or being repaired.

-

Additional Coverages: Consider additional coverages like medical payments, uninsured motorist coverage, and physical damage coverage to enhance your protection further.

Understanding the Insurance Policy: Navigating the Fine Print

Before signing on the dotted line, thoroughly understand the terms and conditions of your commercial truck insurance policy. Pay attention to the following:

-

Policy Limits: Determine the maximum amount of coverage provided for different types of claims.

-

Deductibles: Understand the amount you are responsible for paying before the insurance coverage kicks in.

-

Exclusions: Be aware of any situations or circumstances that are not covered by your policy.

-

Endorsements: Review any additional endorsements or riders that extend the coverage provided by the base policy.

-

Claims Process: Familiarize yourself with the process for filing claims and the steps involved in obtaining a settlement.

Additional Tips for Savings: Maximizing Your Savings Strategy

Beyond the discounts and coverage considerations, here are a few additional tips to help you maximize your savings:

-

Shop Around and Compare Quotes: Don’t settle for the first quote you receive. Obtain multiple quotes from different insurers to compare rates and coverage options.

-

Negotiate with Your Insurer: Once you have a few quotes in hand, don’t hesitate to negotiate with your insurer. Politely inquire if there’s any room for further discounts or premium adjustments.

-

Maintain a Good Credit Score: Your credit score can impact your insurance rates, so strive to maintain a good credit history.

-

Consider Raising Your Deductible: Increasing your deductible can lower your premiums, but make sure you can comfortably afford to pay the higher out-of-pocket costs in the event of a claim.

-

Drive Safely and Responsibly: The best way to keep your insurance rates low is to avoid accidents and traffic violations. Maintain a clean driving record and demonstrate your commitment to safe driving practices.

Best Commercial Truck Insurance Rates

Insurance can be a real pain in the neck, especially when you’re a small business owner. You need to make sure you have the right coverage, but you also don’t want to break the bank. That’s why it’s important to shop around for the best rates. So, if you’re in the market for commercial truck insurance, here are a few tips to help you find the best deal.

Shop around for the best rates

One of the best ways to save money on commercial truck insurance is to shop around. There are a lot of different insurance companies out there, and they all offer different rates. So, it’s important to compare rates from at least three or four different companies before you buy a policy. You can do this online, or you can talk to an insurance agent.

Compare coverage

When you’re comparing rates, it’s important to make sure you’re comparing the same coverage. Not all insurance policies are created equal, so it’s important to read the fine print before you buy a policy. Make sure you understand what’s covered and what’s not, and make sure you’re getting the coverage you need.

Consider your deductible

Your deductible is the amount of money you have to pay out of pocket before your insurance coverage kicks in. The higher your deductible, the lower your premium will be. But, it’s important to choose a deductible that you can afford to pay. If you have a high deductible, you could end up paying a lot of money out of pocket if you have an accident.

Look for discounts

Many insurance companies offer discounts for things like safe driving, good credit, and being a member of certain organizations. So, be sure to ask your insurance agent about any discounts you might be eligible for.

Bundle your policies

If you have other insurance policies, such as auto insurance or home insurance, you may be able to save money by bundling them together. Many insurance companies offer discounts for customers who bundle their policies.

Get a higher credit score

Insurance companies use your credit score to determine your insurance rates. So, if you have a good credit score, you’re more likely to get a lower rate on your insurance. If you have a bad credit score, you can work on improving it by paying your bills on time and reducing your debt.