The Ultimate Guide to Business Liability Insurance: Protecting Your Business from Unforeseen Perils

In today’s litigious business environment, it’s more important than ever to have adequate business liability insurance to protect your company from financial ruin. Whether you’re a small business owner or a Fortune 500 CEO, liability insurance is essential to safeguard your assets and ensure the continued success of your enterprise.

What is Business Liability Insurance?

Business liability insurance, also known as commercial general liability (CGL) insurance, is a type of insurance that protects businesses from financial loss resulting from claims of negligence or liability for injury or damage to others. This includes claims for bodily injury, property damage, and personal injury, such as libel, slander, and defamation.

Business liability insurance is a crucial component of any comprehensive business insurance policy. It provides a safety net for businesses, protecting them from the financial consequences of unforeseen events that could potentially cripple their operations.

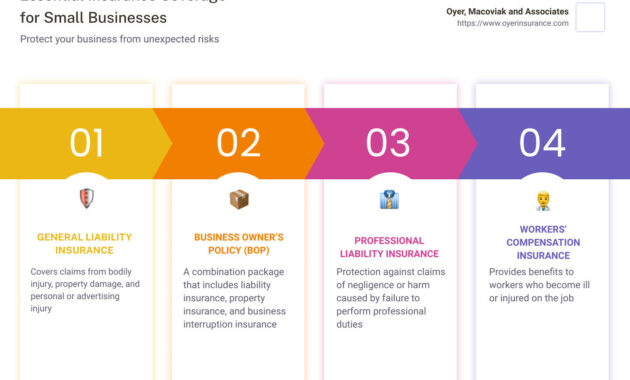

Types of Business Liability Insurance

There are two main types of business liability insurance:

- General liability insurance: This is the most common type of business liability insurance and covers claims for bodily injury, property damage, and personal injury.

- Professional liability insurance: This type of insurance is designed to protect businesses that provide professional services, such as accountants, lawyers, and doctors, from claims of negligence or errors and omissions.

Benefits of Business Liability Insurance

Business liability insurance offers a number of benefits, including:

- Protection from financial loss: Liability insurance can help businesses pay for the costs of defending themselves against lawsuits, as well as any damages that may be awarded to the plaintiff.

- Peace of mind: Knowing that your business is protected from financial loss can give you peace of mind and allow you to focus on running your business.

- Improved customer relations: Having liability insurance can help you build trust with your customers and clients, knowing that they are protected if they are injured or their property is damaged as a result of your business activities.

Choosing the Right Business Liability Insurance Company

When choosing a business liability insurance company, it’s important to consider the following factors:

- The company’s financial strength and stability: Make sure the company you choose is financially sound and has a good reputation for paying claims.

- The company’s coverage options: Make sure the company offers the coverage you need to protect your business.

- The company’s customer service: Make sure the company you choose has a good customer service record and is easy to work with.

One of the leading business liability insurance companies in the United States is Hiscox. Hiscox offers a wide range of coverage options to meet the needs of businesses of all sizes. Hiscox is also known for its excellent customer service and financial strength.

How Much Business Liability Insurance Do I Need?

The amount of business liability insurance you need depends on a number of factors, including the size of your business, the industry you’re in, and the number of employees you have. A good rule of thumb is to purchase enough liability insurance to cover your business’s assets and potential liabilities.

Conclusion

Business liability insurance is an essential part of any comprehensive business insurance policy. It protects businesses from financial loss resulting from claims of negligence or liability for injury or damage to others. When choosing a business liability insurance company, it’s important to consider the company’s financial strength and stability, coverage options, and customer service.

Need Business Liability Insurance? Here’s the Scoop on the Best Provider

The adage goes, “Hope for the best, but prepare for the worst.” In the world of business, this means having the foresight to protect your enterprise from unforeseen events. Business liability insurance is a crucial safeguard that can shield your company from financial ruin in the event of lawsuits, accidents, or property damage. By providing coverage for legal expenses, settlements, and judgments, liability insurance gives you peace of mind, knowing that your business is protected.

Navigating the maze of insurance providers can be daunting, but there’s one company that stands out as a beacon of reliability and excellence: Hiscox. With a reputation for exceptional customer service, comprehensive coverage options, and competitive rates, Hiscox has earned its place as the gold standard in business liability insurance.

Why is Business Liability Insurance a Must-Have?

Liability insurance is not just a nice-to-have; it’s an essential investment for any business, large or small. Why? Because lawsuits are an unfortunate reality of modern business. Even the most diligent companies can fall victim to accidents, property damage, or employee negligence. Without liability insurance, the financial burden of these incidents can cripple your business.

Liability insurance acts as a financial safety net, protecting your business from the following expenses:

- Legal Fees: Lawsuits can be incredibly expensive, and even if you win, you’ll still incur legal costs. Liability insurance covers these expenses, ensuring that your business doesn’t suffer a financial blow.

- Settlements and Judgments: If you’re found liable for an accident or injury, you may be required to pay a settlement or judgment. Liability insurance provides coverage for these payments, safeguarding your business from catastrophic financial losses.

- Property Damage: If your business is responsible for damaging someone else’s property, liability insurance will cover the repair or replacement costs.

- Bodily Injury: If someone is injured on your business premises or as a result of your business operations, liability insurance will cover the medical expenses and other damages.

By investing in liability insurance, you’re not just protecting your business financially; you’re also protecting your reputation. A lawsuit can tarnish your company’s image and erode customer trust. Liability insurance can help mitigate this damage by providing coverage for public relations expenses.

Hiscox: The Gold Standard in Business Liability Insurance

When it comes to business liability insurance, choosing the right provider is paramount. Hiscox has consistently exceeded expectations, earning a reputation for unparalleled customer service, comprehensive coverage, and competitive rates.

Hiscox’s customer service is second to none. Their dedicated team of experts is always available to answer your questions and guide you through the claims process. They understand the unique needs of businesses and tailor their policies accordingly.

Hiscox offers a wide range of coverage options to meet the specific needs of your business. From general liability insurance to professional liability insurance, they have a solution for every industry. Their policies are designed to protect your business from a comprehensive range of risks, giving you peace of mind.

Despite their exceptional service and coverage, Hiscox maintains competitive rates. They understand that businesses need affordable insurance without sacrificing quality. By partnering with Hiscox, you can rest assured that you’re getting the best value for your money.

Conclusion

Business liability insurance is an indispensable investment for any business, regardless of size or industry. It provides a financial safety net, protecting your company from the unexpected. By choosing Hiscox as your insurance provider, you’re partnering with a company that is committed to providing exceptional customer service, comprehensive coverage, and competitive rates. With Hiscox, you can focus on growing your business while knowing that you’re protected against the unforeseen.

Best Business Liability Insurance Company: A Comprehensive Guide

The world of business is brimming with unforeseen challenges, and safeguarding your enterprise against potential liabilities is paramount. One of the most crucial aspects of business protection is procuring comprehensive liability insurance. Choosing the right insurer can make all the difference, ensuring your business remains resilient in the face of adversity. In this in-depth guide, we’ll delve into the factors to consider when selecting the best business liability insurance company, empowering you to make an informed decision that shields your enterprise from financial ruin.

Factors to Consider When Choosing a Business Liability Insurance Company

Financial Stability: A Bedrock of Protection

Selecting an insurer with impeccable financial stability is like erecting a fortress around your business. You need an insurer who can weather financial storms and honor claims when you need them most. Look for companies with high ratings from reputable agencies like A.M. Best, Moody’s, or Standard & Poor’s. These ratings attest to an insurer’s ability to fulfill its financial obligations and provide peace of mind that your business will be there when you need it most.

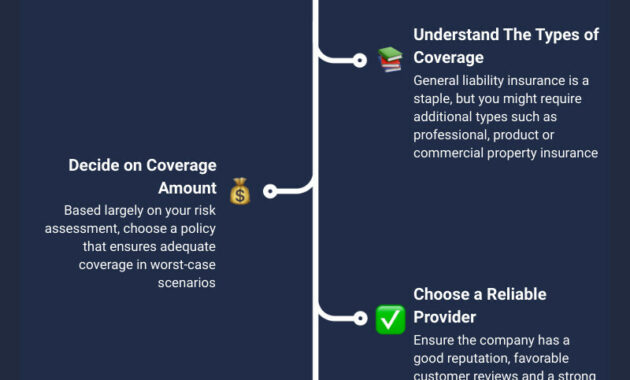

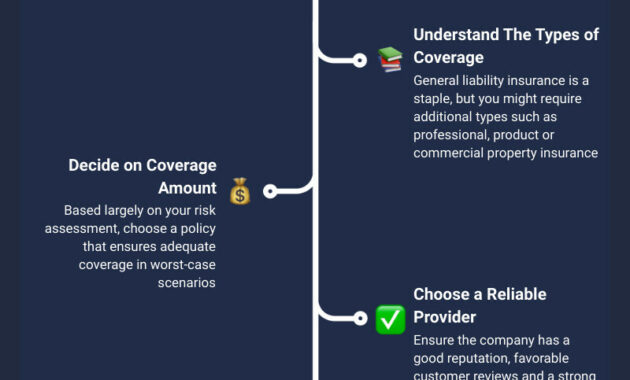

Coverage Options: Tailoring Protection to Your Needs

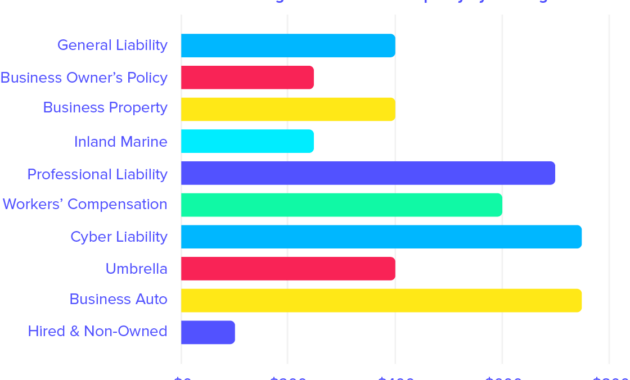

The liability coverage you choose should be as unique as your business. The best liability insurance companies offer a wide range of coverage options, allowing you to customize a policy that aligns perfectly with your specific risks. Consider the following essential coverages:

- General liability insurance: Protects against bodily injury or property damage claims arising from your business operations.

- Product liability insurance: Covers claims alleging injury or damage caused by your products.

- Professional liability insurance: Provides protection for businesses offering professional services, such as attorneys, accountants, and medical providers.

- Cyber liability insurance: Essential in today’s digital world, protecting against data breaches, cyberattacks, and other online threats.

Customer Service: A Lifeline in the Time of Need

When you need to file a claim, exceptional customer service is your lifeline. The best liability insurance companies prioritize policyholder satisfaction and go above and beyond to ensure a seamless claims process. Look for insurers with 24/7 claims reporting, easy-to-use online portals, and dedicated claims adjusters who are responsive, empathetic, and committed to resolving claims quickly and fairly.

Industry Reputation: A Testament to Excellence

The best liability insurance companies build a reputation for excellence over time. Seek recommendations from trusted sources, read industry reviews, and conduct thorough research to identify insurers who consistently deliver on their promises. A strong reputation is a testament to an insurer’s commitment to customer satisfaction, financial stability, and comprehensive coverage.

Cost-Effectiveness: Balancing Protection and Budget

While cost is certainly a consideration, it shouldn’t be the sole factor driving your decision. Remember, the cheapest option may not always be the best value. The key is to find an insurer that offers competitive rates without sacrificing coverage or customer service. Be sure to compare quotes from multiple insurers and ask about discounts for bundling policies or implementing risk management measures.

Conclusion

Choosing the best business liability insurance is a critical step towards protecting your business from financial ruin. By carefully considering the factors outlined above, you can select an insurer who provides the right coverage, financial stability, customer service, and cost-effectiveness to meet your unique needs. With a reliable liability insurance policy in place, you can focus on growing your business with confidence, knowing that you’re prepared for the unexpected.

Best Business Liability Insurance Company

In the realm of business operations, safeguarding your enterprise against unforeseen liabilities is paramount. Liability insurance acts as a sturdy shield, protecting your company from the financial repercussions of accidents, negligence, and other mishaps. Navigating the insurance landscape can be a daunting task, with a plethora of providers vying for your attention. However, one name stands tall, a beacon of reliability and unwavering commitment to its clientele: The Hartford.

Top Business Liability Insurance Companies

The Hartford stands head and shoulders above the competition, earning a well-deserved reputation as the gold standard in business liability insurance. Their comprehensive coverage, exceptional customer service, and unwavering financial strength make them the undisputed choice for businesses seeking peace of mind.

Beyond The Hartford, several other insurance providers have carved a niche for themselves in the business liability arena. Travelers, Nationwide, Liberty Mutual, and Progressive round out the top five, each offering its unique strengths and areas of expertise.

Factors to Consider When Choosing a Business Liability Insurance Company

Selecting the ideal business liability insurance company demands a discerning eye and a thorough understanding of your company’s specific needs. Several key factors should guide your decision-making process:

-

Coverage Options: Different policies vary in the types of coverage they provide. Ensure the policy you choose aligns precisely with the potential risks your business faces.

-

Financial Strength: Opt for an insurance carrier with a robust financial standing, ensuring they have the resources to honor claims promptly and effectively.

-

Customer Service: Exceptional customer service is a non-negotiable. Seek a provider renowned for its responsiveness, professionalism, and willingness to go the extra mile.

-

Cost: Premiums can vary significantly between providers. Obtain quotes from multiple insurers to compare costs and secure the最佳 coverage at the most competitive price.

-

Reputation: Industry reputation speaks volumes about a provider’s reliability and trustworthiness. Research online reviews, consult industry experts, and seek referrals to gauge the experiences of others.

Liberty Mutual: A Deeper Dive into a Leading Insurer

Liberty Mutual, a cornerstone of the insurance industry, has garnered a loyal following among businesses seeking comprehensive liability protection. Their unwavering commitment to customer satisfaction shines through in their personalized approach, tailored coverage options, and exceptional claims handling.

When disaster strikes, Liberty Mutual stands ready to swiftly address your needs, minimizing disruption to your operations. Their claims adjusters are known for their empathy, efficiency, and dedication to ensuring fair and timely settlements.

Liberty Mutual’s comprehensive policies shield your business from a wide range of liabilities, including general liability, professional liability, product liability, and cyber liability. They recognize that every business is unique, and they tailor their coverage to meet your specific requirements.

Coupled with their robust financial strength and a reputation for integrity, Liberty Mutual emerges as a formidable contender in the business liability insurance arena. Their unwavering commitment to protecting businesses against unforeseen risks makes them a trusted partner for countless enterprises.

Additional Considerations in Selecting Your Business Liability Insurance Provider

Beyond the aforementioned factors, several additional considerations can further refine your selection process:

-

Industry Specialization: Some insurers specialize in providing coverage for specific industries. Seek a provider with expertise in your particular field to ensure a thorough understanding of your unique risks.

-

Policy Limits: Determine the appropriate coverage limits for your business. Insufficient limits can leave you exposed to financial hardship, while excessive limits can result in unnecessary premium payments.

-

Deductibles: Understand the deductibles associated with different policies. A higher deductible lowers your premiums but requires you to pay more out-of-pocket when filing a claim.

-

Endorsements: Endorsements are附加 that can extend or modify the coverage provided by your policy. Consider whether any endorsements are necessary to address specific risks your business faces.

-

Bundling Options: Explore the possibility of bundling your business liability insurance with other types of coverage, such as property insurance or workers’ compensation insurance. Bundling can often result in cost savings.

Conclusion

Selecting the best business liability insurance company is a critical decision that can safeguard your enterprise against unforeseen liabilities. By carefully considering the factors outlined above and conducting thorough research, you can identify the provider that aligns perfectly with your company’s unique needs.