Comparing Credit Card Processing Fees Navigating the labyrinth of credit card processing fees can be a daunting task for businesses. To assist in this endeavor, we will delve into the various charges associated with this essential service. By carefully dissecting each fee, you will gain the insights necessary to make informed decisions and optimize your payment processing strategy. Gateway Fees Gateway fees are the charges levied by the gateway provider, the intermediary that facilitates the communication between your website or point-of-sale system and the credit card networks. These fees are typically assessed on a per-transaction basis, ranging from a few […]

Author: admin

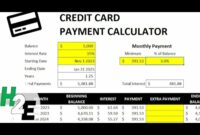

Credit Card Processing Fees Calculator

Credit Card Processing Fees: A Simple Guide to Calculating and Minimizing Costs Are you tired of credit card processing fees eating into your profits? Do you feel like you’re paying too much, but don’t know where to turn? You’re not alone. Credit card processing can be a complex and confusing topic, but it doesn’t have to be. Let’s clear up the fog and help you get a handle on your credit card processing fees. We’ll start with the basics, then move on to more advanced topics. By the end, you’ll be able to use our free calculator to estimate your […]

how much is a credit card processing fee

Introduction Have you ever wondered how much it costs to process a credit card transaction? If you accept credit cards as payment, you’re likely incurring some type of fee. The average cost of processing a credit card transaction in the US is roughly 2.9%, plus $.30. While this may seem like a small amount, it can add up quickly, especially for businesses that process a high volume of transactions. In this article, we’ll take a closer look at the different factors that influence credit card processing fees and how you can minimize them. We’ll cover everything from interchange fees to […]

Merchant Cash Advance Attorneys in New York

Overview of Merchant Cash Advances: A Comprehensive Guide In the ever-evolving landscape of business financing, merchant cash advances have emerged as a popular option for businesses seeking short-term capital. These advances, essentially loans, are designed to provide businesses with a swift infusion of funds that can be repaid through a percentage of daily credit card sales. However, like any financial instrument, merchant cash advances come with their own set of complexities and potential pitfalls. That’s where the expertise of a merchant cash advance attorney in New York becomes invaluable. Merchant cash advance attorneys possess a deep understanding of the legal […]

Merchant Cash Advance CRM: A Comprehensive Guide

Introduction In the realm of business financing, merchant cash advances (MCAs) have emerged as a lifeline for countless enterprises seeking a quick and convenient infusion of capital. Unlike traditional loans, MCAs offer a unique approach to financing, providing businesses with a lump sum of cash in exchange for a percentage of their future sales. This innovative funding option has gained immense popularity among businesses of all sizes, particularly those with immediate cash flow needs. To effectively manage the complexities of MCA financing, businesses require a robust customer relationship management (CRM) system tailored specifically to the nuances of this industry. A […]

merchant cash advance providers

Merchant Cash Advance Overview For business owners seeking immediate financial assistance, merchant cash advances have emerged as a popular financing tool. Provided by specialized lenders known as merchant cash advance providers, these short-term loans offer a lifeline to businesses in need of swift access to funds. In exchange for a percentage of their future sales, businesses can secure a lump-sum advance, typically ranging from $2,000 to $250,000. This flexibility has made merchant cash advances an attractive option for businesses of all sizes, particularly those with limited access to traditional bank loans. Unlike traditional loans, merchant cash advances do not require […]

Merchant Cash Advance Funding: A Quick and Easy Way to Get Funding

Merchant Cash Advance Funding Merchant cash advance funding, or MCA funding, is a lifesaver for entrepreneurs, providing a financial lifeline to businesses that need a quick cash infusion. It’s like getting a loan without the red tape and hassle of traditional bank loans. Instead of borrowing a fixed amount, you receive a lump sum in exchange for a percentage of your future sales. It’s a flexible, short-term solution that can help you cover unexpected expenses, expand your operations, or seize new opportunities. How Does Merchant Cash Advance Funding Work? Getting an MCA is a relatively straightforward process. You typically apply […]

Merchant Cash Advance: A Lifeline for Small Businesses

Merchant Cash Advances for Small Businesses: The Path to Growth In the ever-changing landscape of the business world, small businesses often face the challenge of securing funding to fuel their growth aspirations. Enter merchant cash advances—a financial lifeline that can bridge the gap between where you are and where you want to be. Merchant Cash Advances: A lifeline for small businesses You’ve poured your heart and soul into your business, but growth can sometimes feel like a distant dream. Merchant cash advances step into the picture, offering a helping hand to small businesses in need of a cash infusion. These […]

Merchant Cash Advance Companies Near Me

Merchant Cash Advance Companies Near Me If you’re a business owner in need of quick funding, you may have considered a merchant cash advance. But how do merchant cash advances work? And are they right for your business? In this article, we’ll take a closer look at merchant cash advances and help you decide if they’re a good option for you. How Merchant Cash Advances Work A merchant cash advance is a short-term loan that’s based on your business’s future sales. Unlike traditional loans, which are based on your creditworthiness and assets, merchant cash advances are based on your business’s […]