Yes, merchant cash advances are legal in most states. They are regulated by state law, which varies from state to state. In some states, merchant cash advances are considered loans, while in others they are considered sales of future receivables. Regardless of how they are classified, merchant cash advances are legal and can be a helpful way for businesses to get the financing they need.

It’s important to note that there are some restrictions on who can get a merchant cash advance. For example, some lenders may only lend to businesses that have been in operation for at least a year. Additionally, some lenders may have minimum sales requirements. It’s important to shop around and compare different lenders to find the best deal for your business.

Are Merchant Cash Advances Legal?

If you’re a small business owner in need of quick cash, you may have considered a merchant cash advance (MCA). MCAs are short-term loans that are typically repaid through a percentage of your daily credit card sales. But are merchant cash advances legal? The answer is yes, MCAs are legal in most states. However, there are some important things to keep in mind before you take out an MCA.

Risks and Considerations

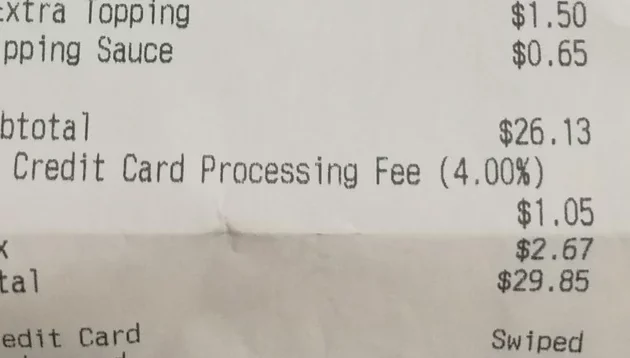

One of the biggest drawbacks of MCAs is that they can be very expensive. Interest rates on MCAs can range from 10% to 50%, which can make them much more expensive than traditional business loans. Additionally, MCAs often have short repayment terms, which can make it difficult to repay the loan on time. If you default on your MCA, you could face legal action from the lender.

It is important to weigh the risks and benefits of an MCA before you take one out. If you are considering an MCA, be sure to shop around and compare different lenders. You should also make sure that you understand the terms of the loan before you sign anything.

Regulation

The MCA industry is regulated by the federal government and by state governments. The federal government regulates MCAs through the Dodd-Frank Wall Street Reform and Consumer Protection Act. This law requires lenders to provide borrowers with clear and concise information about the terms of the loan. State governments also have laws that regulate MCAs. These laws vary from state to state, so it is important to check the laws in your state before you take out an MCA.

Alternatives to MCAs

If you are looking for a small business loan, there are a number of alternatives to MCAs. Traditional business loans from banks or credit unions typically have lower interest rates and longer repayment terms than MCAs. You may also be able to qualify for a government-backed loan, which can have even lower interest rates and more flexible repayment terms. Finally, you could consider crowdfunding or invoice factoring as alternative ways to raise capital for your business.

Are Merchant Cash Advances Legal?

The legality of merchant cash advances (MCAs) varies from jurisdiction to jurisdiction. In most countries, MCAs are regulated by consumer protection laws and financial services regulations. These laws and regulations aim to protect businesses from predatory lending practices and ensure that MCAs are transparent and fair.

In the United States, MCAs are regulated by the Truth in Lending Act (TILA) and the Dodd-Frank Wall Street Reform and Consumer Protection Act. These laws require MCA providers to disclose the terms and conditions of the advance, including the total cost of the advance, the repayment period, and the fees and charges associated with the advance. MCA providers must also obtain the borrower’s consent before disbursing the advance.

Some states have also enacted laws specifically regulating MCAs. For example, California requires MCA providers to be licensed by the state and to comply with certain lending standards. New York has a law that limits the amount of interest that MCA providers can charge.

What is a Merchant Cash Advance?

A merchant cash advance is a lump sum of money that businesses can borrow and repay with a percentage of their future sales. MCAs are typically used by small businesses that need quick access to capital but do not qualify for traditional bank loans. MCA providers typically require businesses to have a strong track record of sales and a consistent cash flow.

The terms of MCAs vary depending on the provider. However, most MCAs have the following features:

- The advance is repaid as a percentage of the business’s future sales.

- The repayment period typically ranges from 3 to 12 months.

- The interest rate is typically higher than the interest rate on a traditional bank loan.

- There are typically no prepayment penalties.

MCAs can be a helpful financing option for small businesses that need quick access to capital. However, it is important to understand the terms and conditions of the advance before signing up. Businesses should also be aware of the risks associated with MCAs, such as the potential for high interest rates and fees.

How Do Merchant Cash Advances Work?

Merchant cash advances are a type of short-term financing that is available to businesses. These advances are typically repaid as a percentage of the business’s daily credit card sales. The repayment period can vary from a few months to a year. The interest rates on merchant cash advances are typically higher than those of traditional bank loans, but they can be a good option for businesses that need quick access to cash.

To qualify for a merchant cash advance, businesses must typically have a strong track record of sales and a consistent cash flow. The amount of the advance is based on the business’s sales volume and the percentage of sales that the business agrees to repay. The repayment process is typically automatic, with the business’s credit card processor deducting the agreed-upon percentage from each sale.

Merchant cash advances can be a helpful financing option for businesses that need quick access to cash. However, it is important to understand the terms and conditions of the advance before signing up. Businesses should also be aware of the risks associated with merchant cash advances, such as the potential for high interest rates and fees.

Advantages of Merchant Cash Advances

Merchant cash advances offer a number of advantages over traditional bank loans, including:

- Quick access to cash: Merchant cash advances can be funded in as little as 24 hours, making them a good option for businesses that need quick access to cash.

- No collateral required: Merchant cash advances do not require collateral, making them a good option for businesses that do not have any assets to pledge.

- Flexible repayment terms: The repayment period for merchant cash advances can be tailored to the business’s cash flow, making them a good option for businesses that have seasonal sales or other fluctuations in their cash flow.

- No prepayment penalties: Most merchant cash advances do not have prepayment penalties, which means that businesses can repay the advance early without paying a penalty.

Merchant cash advances can be a helpful financing option for small businesses that need quick access to capital. However, it is important to understand the terms and conditions of the advance before signing up. Businesses should also be aware of the risks associated with merchant cash advances, such as the potential for high interest rates and fees.

Disadvantages of Merchant Cash Advances

Merchant cash advances also have some disadvantages, including:

- High interest rates: The interest rates on merchant cash advances are typically higher than those of traditional bank loans. This can make merchant cash advances a more expensive option for financing.

- Repayment can be unpredictable: The repayment amount for merchant cash advances is based on the business’s sales volume. This can make it difficult for businesses to budget for their repayment obligations.

- Merchant cash advances can hurt your credit score: If you default on your merchant cash advance, it can hurt your credit score. This can make it more difficult to qualify for other financing options in the future.

Merchant cash advances can be a helpful financing option for small businesses that need quick access to capital. However, it is important to understand the terms and conditions of the advance before signing up. Businesses should also be aware of the risks associated with merchant cash advances, such as the potential for high interest rates and fees.

Alternatives to Merchant Cash Advances

There are a number of alternatives to merchant cash advances that businesses can consider, including:

- Traditional bank loans: Traditional bank loans are a good option for businesses that have a strong credit history and can provide collateral. However, bank loans can be difficult to qualify for and can take a long time to get approved.

- Small business loans: Small business loans are another option for businesses that need financing. Small business loans are typically easier to qualify for than traditional bank loans and can be approved more quickly. However, small business loans typically have higher interest rates than traditional bank loans.

- Lines of credit: Lines of credit are a good option for businesses that need access to a revolving line of credit. Lines of credit can be used to finance short-term needs or to cover unexpected expenses.

- Invoice factoring: Invoice factoring is a good option for businesses that sell products or services on credit. Invoice factoring allows businesses to sell their unpaid invoices to a factoring company for a percentage of the invoice amount.

The best financing option for a business will depend on the business’s individual needs and circumstances. Businesses should carefully consider their options before choosing a financing option.

Are Merchant Cash Advances Legal?

Are merchant cash advances legal? It’s a question that many business owners have, especially those who are looking for quick and easy access to capital. The answer is yes, merchant cash advances are legal in most states. However, there are some states that have laws that regulate them, such as California, New York, and Florida. These laws are designed to protect consumers from predatory lending practices.

Are MCAs Legal in All States?

MCAs are legal in most states, but some states have laws that regulate them. For example, California has the Merchant Cash Advance Act, which requires lenders to be licensed by the state and to follow certain lending practices. New York has the Small Business Financing Act, which prohibits lenders from making loans to businesses with annual revenues of less than $500,000. Florida has the Merchant Cash Advance Regulation Act, which requires lenders to register with the state and to provide borrowers with certain disclosures.

How Do Merchant Cash Advances Work?

Merchant cash advances are a type of short-term financing that is typically used by small businesses. The lender provides the business with a lump sum of cash, which the business then repays over a period of time, usually through daily or weekly deductions from its credit card sales. The amount of the advance and the repayment period will vary depending on the lender and the business’s needs. Merchant cash advances are typically more expensive than traditional loans, but they can be a good option for businesses that need quick access to capital.

Are Merchant Cash Advances Right for Your Business?

Merchant cash advances can be a good option for businesses that need quick access to capital, but they are not right for everyone. If you are considering a merchant cash advance, it is important to compare the costs and terms of the loan to other financing options. You should also make sure that you understand the risks involved and that you are comfortable with the repayment terms.

How to Find a Reputable Merchant Cash Advance Lender

If you are considering a merchant cash advance, it is important to find a reputable lender. There are a number of things you can do to find a reputable lender, such as:

- Ask for referrals from other businesses.

- Check online reviews.

- Contact the Better Business Bureau.

- Make sure the lender is licensed and bonded.

- Get a written agreement that outlines the terms of the loan.

Conclusion

Merchant cash advances can be a good option for businesses that need quick access to capital, but they are not right for everyone. If you are considering a merchant cash advance, it is important to compare the costs and terms of the loan to other financing options. You should also make sure that you understand the risks involved and that you are comfortable with the repayment terms.

Are Merchant Cash Advances Legal?

Are merchant cash advances legal? The answer is a resounding yes. Merchant cash advances (MCAs) are a type of financing that allows businesses to get a lump sum of cash in exchange for a percentage of their future sales. They are a popular option for businesses that need quick access to capital, but they can also be expensive. It’s important to weigh the risks and benefits of MCAs before deciding if they are right for your business.

What are the risks of MCAs?

MCAs can be expensive, and they can have high interest rates and fees. The average interest rate on an MCA is between 10% and 30%, and fees can range from 2% to 5%. This can add up to a significant amount of money over the life of the loan.

How do MCAs work?

MCAs are repaid through a daily or weekly deduction from your business’s bank account. The amount of the deduction is based on a percentage of your sales, so your payments will fluctuate depending on how much you are bringing in. This can make it difficult to budget for MCA payments, and it can be a problem if your sales are seasonal or unpredictable.

What are the alternatives to MCAs?

There are a number of alternatives to MCAs, including traditional bank loans, lines of credit, and invoice factoring. These options may have lower interest rates and fees than MCAs, but they can also be more difficult to qualify for.

How can you avoid the risks of MCAs?

If you are considering an MCA, it is important to do your research and compare offers from multiple lenders. Be sure to understand the terms of the loan, including the interest rate, fees, and repayment schedule. You should also make sure that you have a realistic plan for repaying the loan.

Conclusion

MCAs can be a quick and easy way to get access to capital, but they are also expensive. It is important to weigh the risks and benefits of MCAs before deciding if they are right for your business. If you are not comfortable with the risks, there are a number of other financing options available.

Are Merchant Cash Advances Legal?

In the realm of business financing, the question of legality often arises when discussing merchant cash advances (MCAs). These financial instruments have garnered attention for providing quick access to funds, but concerns about their legality persist. The answer to this question is not straightforward, as the legality of MCAs varies depending on the jurisdiction and the specific terms of the agreement. Let’s delve into the complexities of MCA legality to provide clarity on this matter.

Understanding Merchant Cash Advances

To fully grasp the legality of MCAs, it is essential to comprehend their nature. MCAs are a form of business financing that provides businesses with an advance on their future credit card receivables. Unlike traditional bank loans, which are based on collateral and creditworthiness, MCAs are secured by the business’s future sales. This unique financing mechanism has made MCAs attractive to businesses seeking quick access to capital, especially those with limited credit history or collateral.

The Legality Conundrum

The legality of MCAs is a multifaceted issue that has been subject to legal challenges and regulatory scrutiny. In some jurisdictions, MCAs have been deemed legal, while in others, they have been classified as a form of predatory lending. The primary concern surrounding MCAs is the high fees and interest rates they often carry. These charges can be burdensome for businesses, making it difficult for them to repay the advance and potentially leading to financial distress.

Legal Considerations

To navigate the legal landscape of MCAs, businesses need to be aware of the relevant laws and regulations in their jurisdiction. In some countries, MCAs are regulated by consumer protection laws, which impose limits on fees and interest rates. It is crucial for businesses to carefully review the terms and conditions of an MCA agreement before signing to ensure that they fully understand the financial obligations they are undertaking.

Alternatives to MCAs

If MCAs raise legal concerns or are not a suitable financing option, businesses can explore alternative sources of funding. Traditional bank loans and lines of credit remain popular options, offering more favorable terms and lower interest rates. Additionally, there are government-backed loans and grants available to businesses that meet specific criteria. Exploring these alternatives can provide businesses with access to capital without the potential legal pitfalls associated with MCAs.