Need Cash Advance For Your Business?

Have you ever been in a situation where you need a cash infusion fast to keep your business afloat? Maybe you have a seasonal opportunity to stock up on inventory, or maybe you have a big order to fill but can’t afford to buy the materials upfront. If so, then you may have considered applying for a merchant cash advance.

Before you run out and apply for a merchant cas Advance, do your research to learn what all the fuss is about. This will help you make the best decision for your business. We’ll cover everything you need to know about merchant cash advances, including how they work, the pros and cons, and how to apply for one.

What is a Merchant Cash Advance?

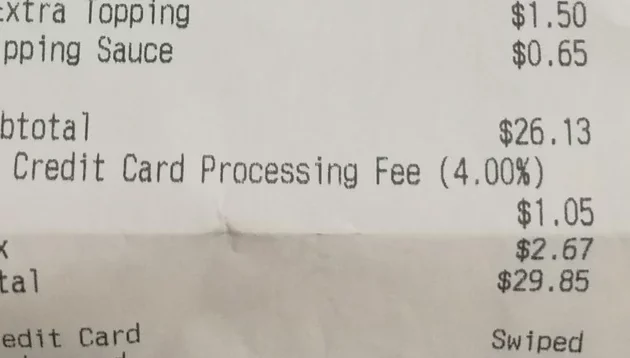

A merchant cash advance is a short-term business funding option that allows you to borrow money against your future sales. Here’s how it works: you apply for a merchant cash advance, and if you’re approved, the lender will give you a lump sum of cash. You then repay the advance plus fees over a period of time, typically through a percentage of your daily credit card sales. The repayment period usually lasts for a few months, and the fees can vary depending on the lender and the amount of money you borrow.

Merchant cash advances can be a good option for businesses that need cash quickly and don’t have other financing options. They’re also relatively easy to qualify for, as lenders typically don’t require a personal guarantee or collateral. However, merchant cash advances can have high fees, so it’s important to compare offers from multiple lenders before making a decision.

Here are some of the benefits of using a merchant cash advance:

- It’s quick and easy to apply for. You can usually get approved within a few days.

- You don’t need to provide a personal guarantee or collateral.

- You can use the money for any business purpose.

- Repayment is flexible and based on your sales volume, so you don’t have to worry about making fixed monthly payments.

Here are some of the drawbacks of using a merchant cash advance:

- It can be expensive. Fees can range from 10% to 30% of the amount you borrow.

- The repayment period is typically short, so you’ll need to make sure you can afford the payments.

- It can hurt your credit score if you default on your loan.

Applying for a Merchant Cash Advance: A Streamlined Guide

In today’s fast-paced business environment, access to quick financing can be crucial for growth and success. Merchant cash advances have emerged as a popular option for businesses seeking a short-term cash infusion. The application process for a merchant cash advance is generally straightforward, but it’s essential to understand the steps involved to ensure a smooth and successful experience. This guide will provide a comprehensive overview of how to apply for a merchant cash advance, empowering you to make an informed decision for your business.

Step 1: Gather Your Business Details

The first step in applying for a merchant cash advance is to gather the necessary business details. These typically include:

- Business name and address

- Tax ID number

- Monthly revenue

- Bank statements

- Credit card processing statements

Having these documents readily available will expedite the application process and allow lenders to assess your business’s financial health.

Step 2: Explore Funding Options and Compare Lenders

There’s no shortage of lenders offering merchant cash advances, so it’s crucial to shop around and compare their offerings. Consider the following factors:

- Interest rates and fees: Lenders vary in the interest rates and fees they charge, so it’s important to compare these costs carefully.

- Repayment terms: The repayment period for a merchant cash advance typically ranges from 3 to 18 months. Choose a lender that offers terms that align with your business’s cash flow.

- Reputation and experience: Read online reviews and testimonials from previous customers to gauge the lender’s reliability and customer service.

Step 3: Submit Your Application

Once you’ve chosen a lender, the next step is to submit an application. The application typically involves providing the following information:

- Business information: This includes the details you gathered in Step 1.

- Financial statements: Lenders will need to review your financial performance to assess your ability to repay the advance.

- Personal guarantee: Many lenders require a personal guarantee from the business owner or a principal as a condition of the loan.

Step 4: Underwriting and Approval

After submitting your application, the lender will review it and perform due diligence to verify your information. They may request additional documentation or ask for clarification on certain aspects of your business. Once they are satisfied, they will make a decision on whether to approve your request.

Step 5: Advance Funding and Repayment

If your application is approved, the lender will advance the agreed-upon amount to your business bank account. Repayment is typically made through daily or weekly deductions from your credit card processing receipts. The specific repayment schedule will vary depending on the terms of your agreement.

In-Depth Exploration of Funding Options and Lender Comparison: A Journey Through the Financial Landscape

In the realm of business finance, understanding the intricate landscape of funding options is paramount. When considering a merchant cash advance, it’s essential to embark on a thorough exploration of the available lenders. This endeavor can be likened to navigating a labyrinth, where each lender offers its unique path to financial prosperity.

One crucial aspect to consider when comparing lenders is their approach to calculating interest and fees. Some lenders employ fixed rates, akin to the steady tick of a clock, while others opt for a factor rate, which fluctuates with the ebbs and flows of your business revenue. Understanding these nuances can prevent you from getting caught in a financial labyrinth.

Another pivotal factor to ponder is the repayment terms offered by different lenders. Just as a compass guides a traveler, the repayment period dictates the pace at which you’ll repay the advance. Some lenders offer short expeditions, spanning a mere few months, while others lead you on a longer journey of up to 18 months. Choosing a repayment period that aligns with your business’s cash flow tempo is akin to finding the right gear in a car, ensuring a smooth and efficient ride.

Unveiling the Secrets of Lender Reputation and Experience: A Glimpse into the Past, Present, and Future

In the world of merchant cash advances, reputation and experience serve as beacons of trustworthiness, guiding you towards reliable lenders. Delving into online reviews is akin to consulting a wise sage, offering valuable insights into the lender’s track record and customer service. These testimonials can reveal hidden gems or steer you clear of potential pitfalls.

Experience, on the other hand, represents the lender’s well-trodden path, a testament to their expertise in navigating the financial terrain. A lender with years of experience has likely encountered every conceivable business scenario, ensuring that they possess the wisdom to guide you through even the most complex challenges. Consider their experience as a sturdy bridge, connecting you to a brighter financial future.

Apply for a Merchant Cash Advance

When it comes to financing your business, a merchant cash advance can be a great option. It’s a quick and easy way to get the funds you need, and there are no restrictions on how you use the money. If you’re considering a merchant cash advance, here’s what you need to know about the application process.

Merchant cash advances are typically unsecured, meaning you don’t need to put up any collateral. The lender will simply review your business’s financial information to determine your eligibility. The application process is usually quick and easy, and you can often get approved for financing within a few days.

What to Expect When You Apply

When you apply for a merchant cash advance, you’ll typically need to provide the following information:

- Your business’s financial statements

This will include your profit and loss statement, balance sheet, and cash flow statement. The lender will use this information to assess your business’s financial health and determine your eligibility for a loan.

- Your personal financial information

This will include your credit score, income, and assets. The lender will use this information to assess your personal financial stability and determine your ability to repay the loan.

- Your business plan

This is a document that outlines your business’s goals, strategies, and financial projections. The lender will use this information to assess the potential of your business and determine your ability to repay the loan.

Once you have submitted your application, the lender will review your information and make a decision. If you are approved for a loan, the lender will typically fund your account within a few days.

How to Get the Best Deal

When you’re applying for a merchant cash advance, it’s important to shop around and compare offers from different lenders. This will help you ensure that you’re getting the best possible deal.

Here are a few tips for getting the best deal on a merchant cash advance:

- Compare interest rates. Interest rates on merchant cash advances can vary significantly from lender to lender. Be sure to compare rates from several lenders before making a decision.

- Compare fees. In addition to interest rates, lenders may also charge fees for merchant cash advances. These fees can include application fees, closing fees, and monthly maintenance fees. Be sure to compare fees from several lenders before making a decision.

- Compare terms. Merchant cash advances typically have repayment terms of 6 to 12 months. Be sure to compare terms from several lenders before making a decision.

By following these tips, you can increase your chances of getting the best possible deal on a merchant cash advance.

Conclusion

A merchant cash advance can be a great way to get the financing you need to grow your business. By following the tips in this article, you can increase your chances of getting approved for a loan and getting the best possible deal.

The Ins and Outs of Merchant Cash Advances: A Comprehensive Guide for Aspiring Applicants

So, you’re considering applying for a merchant cash advance? It’s a smart move for businesses of all stripes looking to give their cash flow a boost. But before you dive in, it’s crucial to understand everything there is to know about qualifying for one, so you can strut into the process with your head held high and confidence radiating from your pores.

Qualifying for a Merchant Cash Advance: The Nitty-gritty

Lenders will take a microscope to your business’s financial history, revenue, and credit score to gauge whether you’re a good fit for a cash infusion.

1. Financial History: The Past Speaks Volumes

Your financial history serves as a crystal ball, revealing to lenders how you’ve handled your finances in the past. Lenders will be particularly keen on your business bank statements. These statements are like a personal diary for your business finances, detailing all the ins and outs, the highs and lows.

2. Revenue: The Lifeblood of Your Business

Revenue is the oxygen that keeps your business alive. It’s the cash that flows in, enabling you to keep the lights on, pay your employees, and invest in the future. Lenders will want to see a steady stream of revenue to ensure that you’ll have the means to repay your cash advance.

3. Credit Score: A Numerical Reflection of Your Financial Prowess

Your credit score is like a report card, giving lenders a snapshot of how you’ve managed your personal and business debts. A higher credit score signals to lenders that you’re a reliable borrower.

The 4 Cs of Merchant Cash Advance Eligibility: Diving Deeper

Now, let’s dive deep into the four crucial factors that lenders consider when evaluating your merchant cash advance application.

1. Character: The Bedrock of Trustworthiness

Lenders want to know that you’re a trustworthy individual, someone who will repay your debts and honor your commitments. They’ll scrutinize your personal and business credit history, looking for any red flags that might indicate financial irresponsibility.

2. Capacity: Gauging Your Repayment Abilities

Lenders will assess your business’s financial strength to determine if you can handle the added financial burden of a cash advance. They’ll review your income, expenses, and debt obligations to ensure that you have the capacity to repay the loan.

3. Capital: The Foundation of Your Business

Lenders will evaluate your business’s assets and equity to determine if you have the capital to support a cash advance. This includes examining your inventory, equipment, and real estate.

4. Conditions: External Factors Shaping Your Business

Lenders will also consider external factors that may impact your business’s ability to repay the cash advance. This includes the industry you operate in, the current economic climate, and any potential risks or challenges that your business may face.

Remember, each lender has its own unique set of criteria and underwriting standards. However, these four Cs provide a solid framework for understanding the key factors that lenders will consider when evaluating your application.

So, if you’re ready to take the plunge and apply for a merchant cash advance, make sure you’ve got all your ducks in a row. A solid understanding of the qualifying criteria will empower you to present a compelling case to lenders, increasing your chances of securing the financing you need to fuel your business’s growth.

Merchant Cash Advances: A Comprehensive Guide to Application and Approval

If you’re a business owner in need of quick financing, applying for a merchant cash advance is a smart move. These advances provide you with a lump sum of cash that you can use for any business purpose, and they’re typically repaid through a percentage of your future sales. If you’re considering applying for a merchant cash advance, follow these steps to increase your chances of approval.

Get Your Ducks in a Row

Before you apply for a merchant cash advance, you need to make sure you have all your ducks in a row. This means gathering all the necessary documentation, such as your business financials, bank statements, and tax returns. You’ll also need to provide the lender with a business plan and a personal guarantee;.

Find the Right Lender

Not all lenders are created equal. When choosing a lender, it’s important to compare interest rates, fees, and repayment terms. You should also make sure the lender is reputable and has a good track record. Once you’ve found a few lenders that you like, apply for a merchant cash advance and compare the offers.

Get Approved

If your application is approved, the lender will provide you with a loan agreement. This agreement will outline the terms of the loan, including the amount of the loan, the interest rate, and the repayment period. Once you’ve signed the loan agreement, the lender will deposit the money into your business bank account.

Use the Money Wisely

Once you have the money from a merchant cash advance, be wise about how you use it. Like any other type of loan, you’ll need to repay it plus interest. Use the money for business purposes that will help you grow your business and increase your profits. That way, you’ll be able to repay the loan and have a stronger business in the end.

Get Help If You Need It

If you’re having trouble getting approved for a merchant cash advance, don’t give up. There are many resources available to help you, such as the Small Business Administration (SBA) and your local chamber of commerce. You can also get help from a financial advisor. With a little help, you can get the financing you need to grow your business and reach your goals.

Apply for Merchant Cash Advance: A Comprehensive Guide

Are you a business owner in need of immediate funding? Merchant cash advances (MCAs) could be the solution you’ve been looking for. MCAs provide quick and easy access to cash, enabling you to cover unexpected expenses, invest in growth opportunities, or simply keep your business afloat during challenging times.

Understanding Merchant Cash Advances

MCAs are a type of business financing that allows you to access a lump sum of cash in exchange for a percentage of your future sales. Unlike traditional loans, MCAs don’t require collateral or a lengthy application process. Instead, lenders assess your business’s financial health and sales volume to determine your eligibility and loan amount.

The repayment process for MCAs is straightforward. Each day, a predetermined percentage of your sales is automatically deducted from your business account. This deduction continues until the loan is fully repaid, typically within 6 to 18 months.

Benefits of Merchant Cash Advances

MCAs offer several advantages over other financing options:

- Quick and Easy: MCAs are typically approved and funded within a matter of days, making them a viable option for businesses in need of immediate cash.

- No Collateral Required: Unlike traditional loans, MCAs don’t require you to pledge any assets as security.

- Flexible Repayment: The repayment process is tied to your sales volume, allowing you to adjust your payments based on your business’s financial performance.

- Business Building Tool: MCAs can provide the capital you need to invest in growth opportunities, expand your operations, or hire additional staff.

Eligibility Requirements

To be eligible for an MCA, your business must meet certain requirements, including:

- Established Business: Most lenders require businesses to have been operating for at least 6 months.

- Minimum Sales Volume: Lenders will analyze your business’s sales volume to determine your eligibility and loan amount.

- Positive Cash Flow: Your business must have a positive cash flow to ensure that you can make the required payments.

How to Apply for a Merchant Cash Advance

Applying for an MCA is a relatively straightforward process:

- Gather Your Documents: You’ll need to provide financial statements, business licenses, and other documentation to support your application.

- Choose a Lender: There are numerous lenders offering MCAs. Compare their interest rates, fees, and repayment terms to find the best one for your business.

- Submit Your Application: Once you’ve chosen a lender, submit your application online or through their office.

- Receive Approval and Funding: If approved, you’ll receive a loan agreement outlining the loan terms and repayment schedule. Once signed, the funds will be deposited into your business account.

- Traditional Loans: Traditional loans require collateral and a lengthy application process but typically offer lower interest rates than MCAs.

- Business Lines of Credit: Business lines of credit provide access to a revolving line of credit that you can draw on as needed.

- Equipment Financing: Equipment financing allows you to finance the purchase of equipment without having to pay for it upfront.

- Invoice Factoring: Invoice factoring allows you to sell your outstanding invoices to a factoring company for immediate cash.

- Quick and easy approval: Unlike traditional loans, MCAs do not require a lengthy application process or a good credit score.

- Flexible repayment terms: Your repayments will fluctuate based on your sales volume, so you’ll never be stuck making payments you can’t afford.

- No collateral required: MCAs are unsecured loans, so you don’t have to put up any collateral to qualify.

- High interest rates: MCAs typically have higher interest rates than traditional loans.

- Short repayment terms: MCAs are typically repaid over a shorter period of time than traditional loans.

- Can be expensive: The total cost of an MCA can be high, especially if you have a long repayment term.

- Charging you late fees: Late fees can add up quickly, so it’s important to make your payments on time.

- Reporting you to credit bureaus: Defaulting on your loan can damage your credit score, making it difficult to qualify for future loans.

- Suing you: In some cases, the lender may sue you to recover the money you owe.

- Make sure you can afford the payments: Before you take out an MCA, make sure you have a realistic plan for how you’re going to repay the loan.

- Keep track of your sales: Track your sales volume so you can see how much you’ll need to repay each month.

- Set up automatic payments: Set up automatic payments from your business bank account to avoid missing a payment.

- Contact the lender if you’re having trouble making payments: If you’re having trouble making your payments, contact the lender immediately to discuss your options.

Using Your Funds

Once you have received your funds, you can use them for any business purpose. Whether you need to cover unexpected expenses, invest in growth opportunities, or simply keep your business afloat during challenging times, MCAs provide the flexibility to use the funds as you see fit.

Repaying Your Merchant Cash Advance

As mentioned earlier, MCA repayments are tied to your sales volume. Each day, a predetermined percentage of your sales is automatically deducted from your business account. This deduction continues until the loan is fully repaid. The repayment period for MCAs typically ranges from 6 to 18 months.

It’s crucial to ensure that your business has a consistent sales volume to support the required payments. If your sales drop significantly, you may face difficulties repaying the loan, which could lead to additional fees or penalties.

Alternatives to Merchant Cash Advances

If MCAs are not the right fit for your business, there are alternative financing options to consider:

Conclusion

Merchant cash advances can be a valuable financial tool for businesses in need of quick and easy access to cash. However, it’s crucial to understand the terms and conditions of an MCA before applying. By carefully considering your business’s needs and repayment capacity, you can determine if an MCA is the right financing option for you.

Applying for a Merchant Cash Advance

If you’re a business owner in need of quick cash, a merchant cash advance (MCA) could be a viable option. Unlike traditional loans, MCAs are based on your future sales, not your credit score. This makes them a more accessible form of financing for businesses with less-than-stellar credit.

To apply for an MCA, you’ll need to provide the lender with some basic information about your business, including your sales volume, average transaction size, and repayment terms. The lender will then review your application and make a decision on whether or not to approve you for a loan.

How Merchant Cash Advances Work

MCAs are typically repaid through a percentage of your daily sales. The lender will set a fixed percentage, usually between 10% and 20%, and you’ll agree to pay that percentage of your sales until the loan is repaid. This means that your repayments will fluctuate based on your sales volume.

For example, if you have a $10,000 MCA with a 15% repayment rate, you’ll pay $1,500 back to the lender each month if your sales total $10,000. If your sales increase to $15,000, your repayment will increase to $2,250.

Benefits of Merchant Cash Advances

There are several benefits to using an MCA to finance your business, including:

Drawbacks of Merchant Cash Advances

There are also some drawbacks to using an MCA, including:

Is a Merchant Cash Advance Right for You?

Whether or not an MCA is right for you depends on your individual circumstances. If you need quick and easy access to cash and you’re comfortable with the high interest rates and short repayment terms, an MCA could be a good option. However, if you have good credit and can qualify for a traditional loan, you may be better off exploring that option instead.

## Paying Back Your Loan

You will typically repay your loan through a percentage of your daily sales. The lender will set a fixed percentage, usually between 10% and 20%, and you’ll agree to pay that percentage of your sales until the loan is repaid.

The amount you repay each month will fluctuate based on your sales volume. For example, if you have a $10,000 MCA with a 15% repayment rate, you’ll pay $1,500 back to the lender each month if your sales total $10,000. If your sales increase to $15,000, your repayment will increase to $2,250.

There are several ways to make your MCA payments. You can set up automatic payments from your business bank account, or you can mail in a check each month. You can also pay online through the lender’s website.

It’s important to make your MCA payments on time to avoid late fees and damage to your credit. If you’re having trouble making your payments, contact the lender immediately to discuss your options.

## What Happens if You Default on Your Loan?

If you default on your MCA loan, the lender may take several actions, including:

## How to Avoid Defaulting on Your Loan

There are several things you can do to avoid defaulting on your MCA loan, including:

## Conclusion

MCAs can be a helpful way to finance your business, but it’s important to understand the terms of the loan before you sign up. Make sure you can afford the payments and that you have a plan for how you’re going to repay the loan. If you have any questions or concerns, be sure to contact the lender before you apply for an MCA.