Aged Merchant Cash Advance Leads: An Untapped Goldmine for Revenue

It’s no secret that the financial services industry is a lucrative one. But what if we told you there was a way to tap into a virtually untapped market, one that could generate significant revenue for your business? Enter aged merchant cash advance leads.

Aged merchant cash advance leads are simply leads that have been generated from businesses that have already received a merchant cash advance. These leads are often overlooked by traditional lenders, but they can be a goldmine for businesses that are willing to put in the effort to nurture them.

Here are just a few of the reasons why aged merchant cash advance leads are so valuable:

- They’re pre-qualified. The businesses that have already received a merchant cash advance have already been vetted by a lender, so you can be confident that they’re creditworthy.

- They’re motivated. These businesses are already familiar with the benefits of merchant cash advances, so they’re more likely to be interested in your product or service.

- They’re easy to reach. These businesses have already provided their contact information to a lender, so you can easily reach out to them with your offer.

If you’re looking for a way to generate more revenue for your business, aged merchant cash advance leads are a great option. Here are a few tips for getting started:

- Partner with a reputable lead provider. There are a number of companies that specialize in providing aged merchant cash advance leads. Do your research to find a provider that has a good reputation and that can provide you with high-quality leads.

- Create a targeted marketing campaign. Once you have a list of leads, it’s important to create a targeted marketing campaign that will reach them effectively. Consider using email marketing, direct mail, or social media advertising to reach your target audience.

- Provide excellent customer service. When you’re dealing with aged merchant cash advance leads, it’s important to provide excellent customer service. This means being responsive to their inquiries, answering their questions, and helping them through the application process.

By following these tips, you can tap into the untapped goldmine of aged merchant cash advance leads and generate significant revenue for your business.

Aged Merchant Cash Advance Leads: A Valuable Resource for Businesses

In today’s competitive business landscape, every edge counts. Aged merchant cash advance leads can provide businesses with a unique opportunity to reach potential customers who are in immediate need of funding. These leads are a valuable resource that can help businesses grow their customer base and increase revenue. However, it’s crucial to approach this market ethically and responsibly.

Ethical Considerations

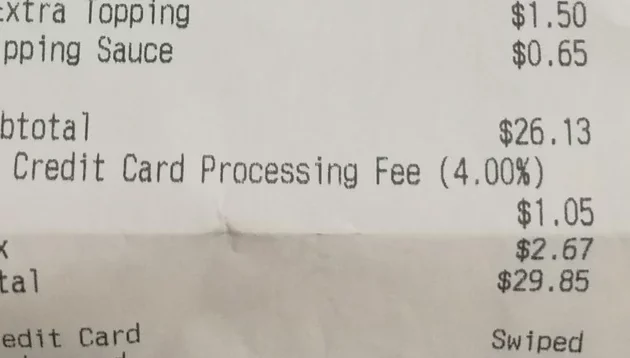

Always adhere to ethical practices and disclose all relevant information to potential customers. Avoid making false or misleading claims about your products or services. Be transparent about the terms and conditions of your merchant cash advance, including the repayment schedule and any associated fees. Ensure you have a clear and concise privacy policy that outlines how you will use and protect your customer’s personal information. By following these principles, you can build trust with potential customers and establish a positive reputation for your business.

Understanding Aged Merchant Cash Advance Leads

Aged merchant cash advance leads are leads that have been generated some time ago, typically within the last 6 to 12 months, but have not yet been converted into a loan. These leads may come from various sources, such as online marketplaces, lead generators, or even your own marketing efforts. The advantage of aged leads is that they have had time to “age,” meaning businesses have had an opportunity to review them and decide whether or not they are a good fit for their needs. Consequently, aged leads tend to be more qualified and have a higher conversion rate than fresh leads.

Benefits of Using Aged Merchant Cash Advance Leads

There are several benefits to utilizing aged merchant cash advance leads for your business. First, they provide you with access to a pool of pre-qualified potential customers who have already expressed an interest in obtaining funding. This can save you time and effort compared to generating your own leads from scratch. Second, aged leads tend to have a higher conversion rate than fresh leads, as they have had time to consider their options and make a decision. Third, aged leads can be purchased at a lower cost than fresh leads since they have already been nurtured by other businesses. By leveraging aged merchant cash advance leads, you can cost-effectively expand your customer reach and increase your chances of closing deals.

How to Find and Qualify Aged Merchant Cash Advance Leads

There are several ways to find and qualify aged merchant cash advance leads. One option is to purchase them from a reputable lead provider. These providers specialize in generating and selling leads to businesses. Another option is to use online marketplaces that connect businesses with potential customers. Finally, you can also generate your own leads through your marketing efforts, such as content marketing, social media advertising, and email marketing.

Once you have identified potential leads, it’s important to qualify them to ensure they are a good fit for your business. Consider factors such as the business’s industry, revenue, and credit history. You should also contact the business and speak with the owner or manager to get a better understanding of their needs and financial situation. By qualifying your leads, you can increase your chances of converting them into paying customers.

Using Aged Merchant Cash Advance Leads Effectively

To maximize the effectiveness of your aged merchant cash advance leads, follow these tips:

- Contact the business promptly: Don’t let your leads go cold. Reach out to potential customers within a few days of receiving their information.

- Be prepared to answer questions: Businesses may have questions about your products or services. Be prepared to provide detailed answers and demonstrate how your merchant cash advance can help them.

- Tailor your pitch to the business’s needs: Every business is unique. Customize your sales pitch to address the specific needs and pain points of each potential customer.

- Follow up regularly: Don’t give up on a lead after one conversation. Follow up regularly to nurture the relationship and move the sale forward.

Conclusion

Aged merchant cash advance leads can provide businesses with a valuable opportunity to grow their customer base and increase revenue. By following ethical practices and using effective lead generation and qualification techniques, you can maximize the ROI of your marketing efforts. By partnering with a reputable lead provider like [Insert Company Name], you can access a pool of qualified leads and gain a competitive edge in the marketplace. Contact us today to learn more about our aged merchant cash advance leads and how they can help your business succeed.

.