Affordable Individual Health Insurance Plans

In today’s uncertain healthcare landscape, safeguarding your health and well-being shouldn’t come at a premium. With affordable individual health insurance plans, you can breathe easy knowing that you’re covered without emptying your wallet. These plans are tailored to meet your unique needs and circumstances, ensuring you have access to essential medical care when you need it most. Whether you’re self-employed, recently unemployed, or transitioning between jobs, individual health insurance plans provide a safety net to protect you and your loved ones.

Understanding Individual Health Insurance Plans

Individual health insurance plans are designed specifically for individuals who are not covered under an employer-sponsored health plan. They offer comprehensive coverage for a range of medical expenses, including doctor’s visits, hospital stays, prescription drugs, and preventive care. Premiums, the monthly payments you make for your coverage, vary depending on factors such as your age, health status, and the level of coverage you choose.

The Affordable Care Act (ACA), also known as Obamacare, has made individual health insurance plans more accessible and affordable for many Americans. Through the ACA, individuals can qualify for premium tax credits and cost-sharing reductions that lower their monthly premiums and out-of-pocket costs. Open enrollment for ACA plans typically runs from November 1st to January 15th each year.

Types of Individual Health Insurance Plans

There are several types of individual health insurance plans available, each with its unique benefits and limitations.

- Health Maintenance Organizations (HMOs): HMOs offer low monthly premiums but require you to use a specific network of doctors and hospitals. You will typically need a referral from your primary care physician to see a specialist.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility than HMOs, allowing you to see doctors and hospitals both within and outside of their network. However, out-of-network care will typically cost more.

- Exclusive Provider Organizations (EPOs): EPOs are similar to HMOs, but they do not cover out-of-network care at all. EPOs typically have lower premiums than PPOs.

- Point-of-Service (POS): POS plans offer a combination of HMO and PPO features. You can choose to use a network provider for lower costs or go out-of-network for more flexibility, but you will pay more for out-of-network care.

Choosing the Right Plan for You

Selecting the right individual health insurance plan depends on several factors, including your health needs, budget, and lifestyle. Consider the following questions to help you make an informed decision:

- What is your overall health status?

- What types of medical services do you typically use?

- How much can you afford to pay for monthly premiums and out-of-pocket costs?

- Do you prefer to use a specific network of doctors and hospitals?

- Are you comfortable with the restrictions and limitations of certain plan types?

By carefully considering your individual circumstances, you can choose an affordable individual health insurance plan that meets your unique needs and provides peace of mind.

Affordable Individual Health Insurance Plans: A Comprehensive Guide

Navigating the labyrinth of individual health insurance can be a daunting task, especially when affordability is a primary concern. But fret not, for there’s a plethora of options available to cater to diverse needs and budgets. Join us as we delve into the world of affordable individual health insurance plans, unraveling their types, benefits, and how to find the perfect fit for you.

Types of Affordable Individual Health Insurance Plans

Choosing the right health insurance plan is akin to selecting the perfect pair of shoes – it should fit comfortably and provide adequate protection. To help you find your ideal match, let’s explore the diverse landscape of affordable individual health insurance plans:

1. Health Maintenance Organizations (HMOs)

HMOs, like a cozy neighborhood clinic, offer a comprehensive range of healthcare services from primary care to specialist visits, all under one roof. They typically feature lower premiums compared to other plans, making them an attractive option for the budget-conscious. However, HMOs come with a catch: you’re restricted to a specific network of doctors and healthcare providers.

2. Preferred Provider Organizations (PPOs)

PPOs, on the other hand, grant you greater flexibility in choosing your healthcare providers, whether they’re in-network or out-of-network. While premiums tend to be higher than HMOs, PPOs offer more freedom and choice. It’s like having a larger pool of doctors to choose from, ensuring you find the best fit for your specific needs.

2a. Traditional PPO Plans

Traditional PPO plans follow the tried-and-tested approach of providing coverage for a wide range of healthcare services, including preventive care, doctor visits, specialist consultations, hospital stays, and prescription drugs. These plans offer the flexibility to visit any doctor or hospital, but you’ll typically pay higher out-of-pocket costs when seeking care from out-of-network providers.

2b. High-Deductible Health Plans (HDHPs) with a Health Savings Account (HSA)

HDHPs are a cost-saving option for those willing to take on higher deductibles. By paying a lower monthly premium, you’ll accumulate funds in a tax-advantaged Health Savings Account (HSA). This account can be used to cover qualified medical expenses, including deductibles, copays, and coinsurance. HDHPs with HSAs are particularly beneficial for healthy individuals with low healthcare utilization.

2c. Point-of-Service (POS) Plans

POS plans strike a balance between HMOs and PPOs. They offer the flexibility of seeing out-of-network providers while maintaining lower premiums compared to traditional PPOs. However, POS plans typically require you to choose a primary care physician (PCP) who serves as your gatekeeper, referring you to specialists when necessary.

3. Exclusive Provider Organizations (EPOs)

EPOs are a hybrid between HMOs and PPOs, offering a limited network of providers at a lower cost than PPOs. They’re similar to HMOs in that you’re restricted to a specific network of doctors and hospitals. However, EPOs don’t require referrals from a PCP, granting you more flexibility in choosing specialists within the network.

4. Indemnity Plans

Indemnity plans, also known as fee-for-service plans, give you the ultimate freedom in choosing your healthcare providers. You’re not restricted to a specific network, and you can see any doctor or hospital you want. However, indemnity plans come with a hefty price tag, making them a less affordable option for many individuals.

5. Catastrophic Health Plans

Catastrophic health plans are a low-cost option designed for younger, healthy individuals who rarely seek medical care. These plans offer limited coverage for major medical expenses, such as hospitalizations and surgeries. Catastrophic health plans have very high deductibles and low monthly premiums, making them a viable option for those who prioritize saving money over comprehensive coverage.

How to Find the Right Affordable Individual Health Insurance Plan

Now that you’re familiar with the different types of affordable individual health insurance plans, it’s time to embark on the journey of finding the perfect fit for you. Here are a few tips to guide you along the way:

-

Consider your healthcare needs: Assess your current health status and estimate your future healthcare expenses. This will help you determine the level of coverage you need and the type of plan that best suits your requirements.

-

Compare plans: Don’t settle for the first plan you come across. Take the time to compare different plans from multiple insurance companies. Look at premiums, deductibles, copays, and covered services to find the best value for your money.

-

Read the fine print: Before signing on the dotted line, carefully review the plan’s terms and conditions. Make sure you understand the coverage details, exclusions, and any limitations that may apply.

-

Ask for assistance: If you’re struggling to navigate the complexities of health insurance, don’t hesitate to seek help from a licensed insurance agent. They can provide personalized guidance and help you find the right plan for your unique situation.

Affordable Individual Health Insurance Plans: The Bottom Line

Finding affordable individual health insurance doesn’t have to be a herculean task. By understanding the different types of plans available, assessing your healthcare needs, and following our tips, you can secure the coverage you need without breaking the bank. Remember, health insurance is not just an expense; it’s an investment in your well-being. So take the time to find the right plan, and safeguard your health for years to come.

Finding the Right Affordable Individual Health Insurance Plan

In this day and age, health insurance is no longer a luxury, it’s a necessity. But with the rising cost of healthcare, finding an affordable individual health insurance plan can feel like searching for a needle in a haystack. Fear not! By following a few simple steps, you can find a plan that fits your budget and meets your needs without breaking the bank.

Health insurance is like a financial safety net, protecting you from unexpected medical expenses that can quickly add up and derail your financial stability. Whether you’re facing a minor illness or a more serious health condition, having health insurance can give you peace of mind knowing that you’re covered.

When it comes to finding the right individual health insurance plan, there are several factors to consider. Your health needs, budget, and lifestyle all play a crucial role in determining the best plan for you.

Understanding Your Health Needs

The first step in finding an affordable individual health insurance plan is to understand your health needs. Consider your current health status, any pre-existing conditions you may have, and your family’s medical history. If you have any ongoing health issues, such as chronic conditions or prescription medications, you’ll want to make sure the plan you choose provides adequate coverage.

Think about your future health goals as well. Are you planning to start a family? Do you have any upcoming surgeries or medical procedures scheduled? Considering these factors will help you determine the level of coverage you need.

Setting a Budget

Once you have a good understanding of your health needs, it’s time to set a budget. Health insurance premiums can vary widely, so it’s important to determine how much you can afford to spend each month. Consider your income, other expenses, and any savings goals you have. Remember, the cheapest plan isn’t always the best plan. You want to find a plan that provides the coverage you need at a price you can afford.

Considering Your Lifestyle

Your lifestyle can also impact your choice of health insurance plan. If you’re young and healthy, you may be able to get away with a plan with a higher deductible and lower monthly premium. However, if you’re older or have health concerns, you may need a plan with a lower deductible and higher monthly premium.

Do you travel frequently? If so, you’ll want to make sure your plan provides coverage outside of your home state. Do you have a family? If so, you’ll need to find a plan that covers your dependents. Considering these factors will help you narrow down your options and find a plan that’s right for you.

Comparing Plans

Once you have a good understanding of your health needs, budget, and lifestyle, it’s time to start comparing plans. There are a number of different ways to do this, such as through online insurance marketplaces, brokers, or directly through insurance companies.

When comparing plans, be sure to pay attention to the following factors:

Monthly premium: This is the amount you’ll pay each month for your coverage.

Deductible: This is the amount you’ll have to pay out-of-pocket before your insurance starts to cover costs.

Coinsurance: This is the percentage of the cost of covered services that you’ll have to pay after you meet your deductible.

Copay: This is a fixed amount you’ll have to pay for certain covered services, such as doctor’s visits or prescriptions.

Out-of-pocket maximum: This is the maximum amount you’ll have to pay out-of-pocket for covered services in a given year.

Network of providers: This is the group of doctors and hospitals that are covered by your plan.

Choosing a Plan

Once you’ve compared plans and found one that meets your needs, it’s time to make a decision. Be sure to read the plan’s summary of benefits and coverage carefully before you enroll. This document will outline all of the plan’s details, including the coverage you’re eligible for, the costs you’ll have to pay, and the network of providers you’ll have access to.

If you have any questions about the plan, don’t hesitate to contact the insurance company or a broker for assistance. They can help you understand the plan’s details and make sure you’re making the right choice for your needs.

Affordable Individual Health Insurance Plans: A Comprehensive Guide to Finding the Right Coverage

Finding the right health insurance plan can be a daunting task, but it doesn’t have to be. With a little research, you can find affordable individual health insurance plans that meet your needs and budget.

Here are a few things to keep in mind when shopping for health insurance:

- Your age: Premiums for health insurance typically increase with age.

- Your health: People with pre-existing conditions may have to pay higher premiums.

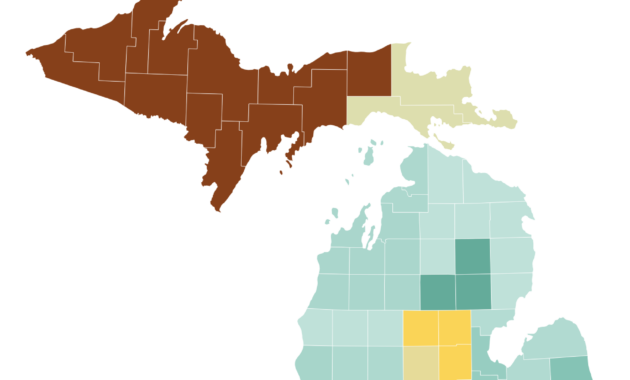

- Your location: Premiums can vary depending on where you live.

- Your income: You may be eligible for subsidies if your income is low.

Once you’ve considered these factors, you can start shopping for health insurance plans. There are a few different ways to do this:

- Through your employer: Many employers offer health insurance plans to their employees. If your employer offers a plan, it’s a good idea to compare it to other plans before enrolling.

- Through the Health Insurance Marketplace: The Health Insurance Marketplace is a government-run website where you can compare and purchase health insurance plans.

- Through a private insurance company: You can also purchase health insurance directly from a private insurance company.

When comparing health insurance plans, it’s important to consider the following factors:

- The monthly premium: This is the amount you’ll pay each month for your health insurance plan.

- The deductible: This is the amount you’ll have to pay out-of-pocket before your health insurance plan starts to cover your expenses.

- The copay: This is the amount you’ll have to pay for each doctor’s visit or prescription drug.

- The out-of-pocket maximum: This is the maximum amount you’ll have to pay out-of-pocket for covered expenses in a given year.

Once you’ve found a few health insurance plans that meet your needs, it’s time to make a decision. The best plan for you will depend on your individual circumstances.

Saving Money on Your Plan

There are a number of ways to save money on your affordable individual health insurance plan. Here are a few tips:

- Take advantage of discounts. Many health insurance companies offer discounts for things like paying your premiums on time or going to the doctor for preventive care.

- Get tax credits. If your income is low, you may be eligible for tax credits that can help you pay for your health insurance premiums.

- Choose a high-deductible plan. High-deductible plans have lower monthly premiums, but they also have higher deductibles. If you’re healthy and don’t expect to have many medical expenses, a high-deductible plan could be a good option for you.

- Use a health savings account (HSA). HSAs are tax-advantaged accounts that you can use to pay for qualified medical expenses. If you have a high-deductible health insurance plan, you can contribute to an HSA to save money on your medical expenses.

Following these tips can help you save money on your affordable individual health insurance plan.

If you’re looking for an affordable way to protect your health, then you need to consider an affordable individual health insurance plan. These plans are designed to provide you with the coverage you need at a price you can afford.

Affordable individual health insurance plans are available through a variety of different insurers, so you can find a plan that meets your needs and budget.

These plans can help you cover the costs of medical expenses, including doctor visits, hospital stays, and prescription drugs. Some plans also offer coverage for dental and vision care.

How to Find an Affordable Individual Health Insurance Plan

There are several ways to find an affordable individual health insurance plan. You can use the online marketplace, work with an insurance agent, or contact insurers directly.

The online marketplace is a government website where you can compare plans from different insurers. You can also use the marketplace to apply for subsidies that can help lower the cost of your health insurance.

Insurance agents can help you find a plan that meets your needs and budget. Agents can also help you understand the different coverage options and benefits available.

What to Look for in an Affordable Individual Health Insurance Plan

When you are looking for an affordable individual health insurance plan, there are several factors you should consider.

The first thing you need to do is determine what type of coverage you need. There are two main types of health insurance plans: HMOs and PPOs.

HMOs are more restrictive than PPOs, but they are also typically less expensive. With an HMO, you can only see doctors who are in the plan’s network. PPOs allow you to see any doctor you want, but they are more expensive than HMOs.

You should also consider the deductible and copay when choosing a plan. The deductible is the amount of money you have to pay out-of-pocket before your insurance coverage begins. The copay is the amount of money you have to pay each time you see a doctor.

Getting the Most Out of Your Plan

Once you have found an affordable individual health insurance plan, there are several things you can do to get the most out of it.

The first thing you need to do is understand your coverage. Read your policy carefully so that you know what is covered and what is not.

You should also use your insurance wisely. Don’t go to the doctor for every little thing. If you have a minor illness, try to treat it at home first.

You can also save money on your health insurance by using generic drugs and getting preventive care.

Other Ways to Save Money on Health Insurance

In addition to choosing an affordable individual health insurance plan, there are other ways to save money on health insurance.

One way to save money is to get a high-deductible health plan (HDHP). HDHPs have lower monthly premiums, but they also have higher deductibles.

Another way to save money on health insurance is to contribute to a health savings account (HSA). HSAs are tax-advantaged accounts that can be used to pay for qualified medical expenses.

You can also save money on health insurance by staying healthy. If you don’t smoke, eat a healthy diet, and exercise regularly, you are less likely to get sick and need medical care.

Conclusion

Affordable individual health insurance plans are a great way to protect your health and budget. By following these tips, you can find an affordable plan that meets your needs and get the most out of it.

Affordable Individual Health Insurance: Comprehensive Guide and Cost-Effective Plans

Introduction

Navigating the complex world of health insurance can be a daunting task. If you’re looking for an affordable individual health insurance plan that fits your budget and meets your needs, this comprehensive guide has got you covered. We’ll delve into various types of plans, coverage options, and cost-saving strategies to ensure you secure the best possible coverage without breaking the bank.

Understanding Individual Health Insurance

Individual health insurance plans are designed for people who don’t have access to health insurance through their employer or a government program. These plans provide coverage for a wide range of medical expenses, including doctor’s visits, hospital stays, and prescription drugs.

Types of Individual Health Insurance Plans

There are several types of individual health insurance plans available, each offering different levels of coverage and deductibles. Here’s a breakdown of the most common plans:

Coverage Options

When choosing an individual health insurance plan, it’s important to consider the coverage options available. Essential Health Benefits (EHBs) are mandated by law and include coverage for doctor’s visits, hospitalization, maternity care, and mental health services. Additional coverage options may include:

Factors Affecting Cost

The cost of individual health insurance plans can vary significantly depending on several factors:

Cost-Saving Strategies

Finding an affordable individual health insurance plan is possible by following these cost-saving strategies:

Conclusion

Finding an affordable individual health insurance plan that meets your needs is crucial for protecting your health without breaking the bank. By understanding the different types of plans, coverage options, and cost-saving strategies outlined in this guide, you can make an informed decision and secure the coverage you need to stay healthy and secure. Remember, having access to affordable health insurance is an investment in your well-being and a safeguard for your financial future.