Mississippi Affordable Health Insurance Plans

Searching for affordable health insurance plans in Mississippi? You’re not alone. The rising cost of healthcare is a concern for many Mississippians. But don’t worry, there are several affordable options available to you. In this comprehensive guide, we’ll provide you with all the information you need to find the best plan for your needs and budget. We’ll cover everything from eligibility and enrollment to coverage and costs.

So, whether you’re uninsured or looking for a more affordable option, read on to learn more about Mississippi’s affordable health insurance plans.

Understanding Your Options

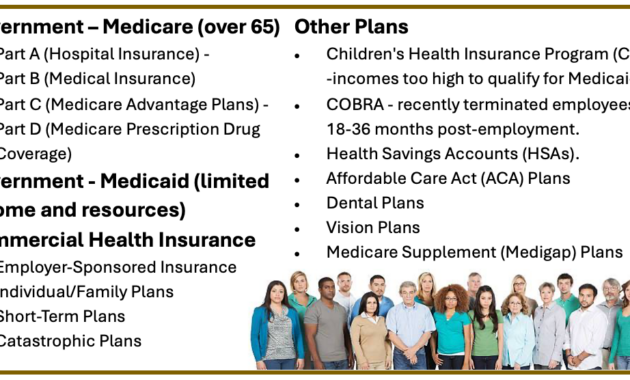

The first step in finding affordable health insurance is understanding your options. There are two main types of health insurance plans available in Mississippi: Marketplace plans and Medicaid. Marketplace plans are offered by private insurance companies and are available to individuals, families, and small businesses. Medicaid is a government program that provides health coverage to low-income individuals and families.

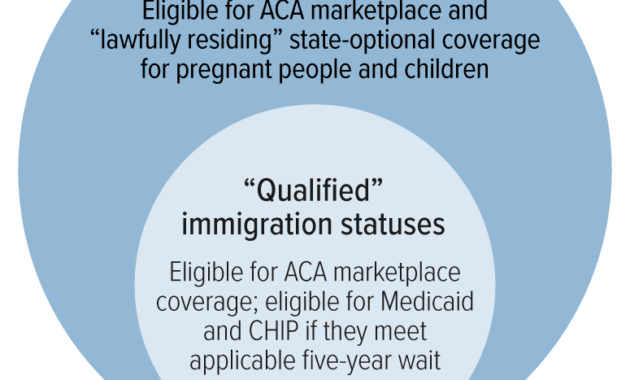

To be eligible for Marketplace plans, you must be a U.S. citizen or legal resident and not be incarcerated. You must also meet certain income requirements. Medicaid eligibility is based on your income and family size.

Once you know which type of plan you’re eligible for, you can start shopping around for the best option. There are several different plans available, so it’s important to compare coverage and costs before you make a decision.

Enrolling in a Plan

Once you’ve found an affordable health insurance plan, you can enroll in the plan during the Open Enrollment Period, which runs from November 1st to January 15th. You can also enroll in a plan outside of the Open Enrollment Period if you have a qualifying life event, such as losing your job or getting married.

To enroll in a Marketplace plan, you can visit the Health Insurance Marketplace website or call the Marketplace call center. To enroll in Medicaid, you can contact your state Medicaid agency.

Coverage and Costs

The coverage and costs of health insurance plans vary depending on the plan you choose. Marketplace plans offer a range of coverage options, from basic plans that cover essential health benefits to more comprehensive plans that cover a wider range of services.

Medicaid provides comprehensive coverage for a wide range of health services, including doctor visits, hospital stays, and prescription drugs. Medicaid also covers long-term care services, such as nursing home care.

The cost of health insurance plans also varies depending on the plan you choose. Marketplace plans are typically more expensive than Medicaid plans, but they offer a wider range of coverage options. Medicaid plans are free or low-cost for eligible individuals and families.

Getting Help

If you need help finding affordable health insurance, there are several resources available to you. You can contact your local health department or community health center. You can also get help from a health insurance agent or broker.

There are also several online resources available to help you find affordable health insurance. You can visit the Health Insurance Marketplace website or call the Marketplace call center. You can also get help from the Mississippi Department of Medicaid.

Affordable Health Insurance Plans in Mississippi

If you’re a resident of Mississippi, you’re in luck – there are a number of affordable health insurance plans available to you. Whether you’re looking for an HMO, PPO, or EPO, you’re sure to find a plan that fits your needs and budget with a little research.

Types of Plans

There are three main types of health insurance plans available in Mississippi:

Health Maintenance Organizations (HMOs)

HMOs are a type of health insurance plan that offers comprehensive coverage at a fixed monthly rate. With an HMO, you’ll have a primary care physician (PCP) who will coordinate all of your care. You’ll be required to get referrals from your PCP to see specialists, and you’ll generally have to stay within the HMO’s network of providers.

HMOs are often the most affordable type of health insurance plan, and they can be a good option for people who are healthy and don’t expect to need a lot of medical care to be the most affordable.

Preferred Provider Organizations (PPOs)

PPOs are a type of health insurance plan that offers more flexibility than HMOs. With a PPO, you can choose any doctor or hospital you want, and you don’t need to get referrals from your PCP. You’ll pay a higher monthly premium for a PPO than you would for an HMO, but you’ll also have more choice and flexibility.

PPOs are a good option for people who want the freedom to choose their own doctors and hospitals. They’re also a good option for people who expect to need a lot of medical care.

Exclusive Provider Organizations (EPOs)

EPOs are a type of health insurance plan that is similar to HMOs. With an EPO, you’ll have a primary care physician (PCP) who will coordinate all of your care. You’ll be required to get referrals from your PCP to see specialists, and you’ll generally have to stay within the EPO’s network of providers.

EPOs are generally less expensive than PPOs, but they also offer less flexibility. They’re a good option for people who are healthy and don’t expect to need a lot of medical care.

Which Type of Plan Is Right for You?

The type of health insurance plan that’s right for you depends on your individual needs and budget. If you’re healthy and don’t expect to need a lot of medical care, an HMO or EPO may be a good option for you. If you want more flexibility and choice, a PPO may be a better fit.

How to Find Affordable Health Insurance Plans in Mississippi

There are a number of ways to find affordable health insurance plans in Mississippi. You can:

- Contact your employer. Many employers offer health insurance plans to their employees. If your employer offers health insurance, be sure to compare the plan’s coverage and costs to other plans that are available to you.

- Shop for health insurance on the Mississippi Health Insurance Marketplace. The Mississippi Health Insurance Marketplace is a state-run website where you can compare and purchase health insurance plans. If you qualify, you may be eligible for subsidies to help you pay for your health insurance.

- Contact a health insurance agent. A health insurance agent can help you compare plans and find the best plan for your needs and budget.

Tips for Saving Money on Health Insurance

There are a number of things you can do to save money on health insurance, including:

- Choose a plan with a high deductible. A plan with a high deductible will have a lower monthly premium, but you’ll be responsible for paying more out-of-pocket costs if you need medical care.

- Get healthy. If you’re healthy, you’re less likely to need medical care, which can save you money on your health insurance premiums.

- Shop around. Don’t just stick with the first health insurance plan you find. Take the time to compare plans and find the best deal for your needs and budget.

Affordable Health Insurance Plans in Mississippi: A Lifeline for Financial Security

Navigating the complexities of healthcare can be daunting, especially if you’re uninsured or underinsured. That’s where affordable health insurance plans in Mississippi step in as lifelines, providing a safety net for unexpected medical expenses and ensuring access to essential healthcare services.

Benefits

Health insurance plans in Mississippi offer a comprehensive range of benefits tailored to your specific needs, including:

- Routine doctor visits: Coverage for check-ups, screenings, and consultations to maintain your overall health.

- Hospital stays: Protection against the hefty costs associated with hospitalizations, including room and board, surgeries, and other necessary treatments.

- Prescription drugs: Access to prescription medications, essential for managing chronic conditions and improving well-being.

Eligibility and Enrollment

Eligibility for affordable health insurance plans in Mississippi is determined based on your income and household size. Residents with incomes below certain thresholds may qualify for subsidies, making coverage even more accessible. Enrollment typically occurs during open enrollment periods, which usually run from November to January.

Types of Plans

Mississippi offers a range of health insurance plan options, each with its own benefits and costs:

- Managed care plans (HMOs, PPOs): These plans provide care through a network of providers and generally have lower premiums but may limit your choice of doctors.

- Fee-for-service plans: With these plans, you can choose any provider but typically pay higher premiums and out-of-pocket expenses.

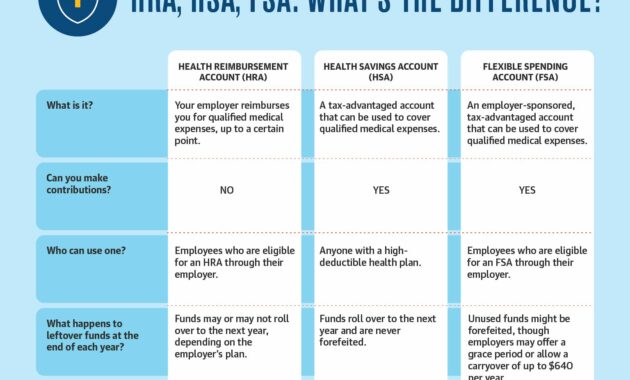

- High-deductible health plans (HDHPs): These plans have lower premiums but higher deductibles, meaning you pay more out-of-pocket before insurance coverage kicks in.

Choosing the Right Plan

Selecting the right health insurance plan depends on your individual circumstances, including your health needs, budget, and lifestyle. Consider factors such as:

- Monthly premiums: How much you can afford to pay each month.

- Deductibles: The amount you must pay out-of-pocket before insurance coverage begins.

- Copays: Fixed amounts you pay for specific services, such as doctor visits or prescription drugs.

- Network of providers: Whether your preferred doctors and hospitals are included in the plan’s network.

Finding Affordable Options

Finding affordable health insurance plans in Mississippi doesn’t have to be a nightmare. Here are some tips:

- Shop around: Compare plans from multiple insurance companies to find the best deal.

- Check for subsidies: Determine if you qualify for tax credits or other financial assistance.

- Consider high-deductible plans: These plans may have lower premiums, making them more affordable upfront.

- Negotiate with your employer: If your employer offers group health insurance, see if you can negotiate a lower rate.

Conclusion

Affordable health insurance plans in Mississippi provide peace of mind and financial protection in the face of unexpected medical expenses. By carefully considering your needs and exploring available options, you can find a plan that meets your budget and ensures your well-being.

Affordable Health Insurance Plans in Mississippi: A Comprehensive Guide

If you’re a resident of Mississippi in search of affordable health insurance, you’ve come to the right place. Mississippi offers various plans that can fit your budget and needs.

Eligibility

To qualify for an affordable health insurance plan in Mississippi, you must meet certain income requirements. Your income must fall within a specific range to be eligible for subsidies that can lower your monthly premiums. These subsidies are available to individuals and families with incomes below a certain threshold.

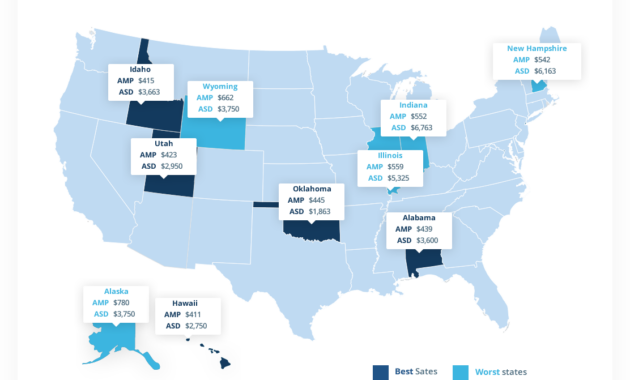

For example, if your annual income is less than $47,600 for an individual or $97,200 for a family of four, you may qualify for premium tax credits that can significantly reduce your monthly health insurance costs. These tax credits are available through the federal health insurance marketplace, Healthcare.gov.

In addition to income requirements, you must also be a U.S. citizen or legal resident to be eligible for affordable health insurance plans in Mississippi. You must also not be incarcerated or receiving Medicaid benefits.

Types of Affordable Health Insurance Plans

Mississippi offers a variety of affordable health insurance plans to choose from, including:

Each type of health insurance plan has its own advantages and disadvantages. It’s important to compare plans and choose the one that best meets your needs and budget.

Finding Affordable Health Insurance

There are a few different ways to find affordable health insurance in Mississippi. You can:

Getting Help with Affordable Health Insurance

If you need help finding affordable health insurance in Mississippi, there are a few resources available to you. You can:

Don’t go without health insurance. There are affordable options available to you. Contact one of these resources today to get the help you need.

Affordable Health Insurance Plans in Mississippi: A Comprehensive Guide

Navigating the healthcare landscape can be like walking through a labyrinth, especially when it comes to finding affordable health insurance. But don’t fret, folks! Mississippi has got you covered—figuratively and literally—with an array of plans that won’t break the bank. From the Health Insurance Marketplace to private companies, there’s an option for every pocketbook.

How to Apply

Whether you’re a newbie to the insurance game or a seasoned pro, applying for an affordable health insurance plan in Mississippi is a breeze. You can either waltz on down to the Health Insurance Marketplace or tap into the services of a private insurance company. The choice is yours, my friend!

Understanding Health Insurance Terminology

Before we dive into the nitty-gritty, let’s brush up on some essential health insurance lingo. Premiums? Deductibles? Copayments? These terms may sound like a foreign language, but we’ll break them down into bite-sized pieces.

Types of Health Insurance Plans

Mississippi offers a smorgasbord of health insurance plans, each with its own unique flavor. HMOs, PPOs, and EPOs—it’s like a buffet of choices! But don’t worry, we’ll help you pick the plan that’s just right for your taste buds.

Finding Affordable Health Insurance Plans

Now, let’s get down to business. Finding affordable health insurance in Mississippi is like finding a hidden treasure—it’s there, just waiting to be discovered! We’ll guide you through the twists and turns of the search process, ensuring you land the best deal for your hard-earned dough.

How to Compare Health Insurance Plans

Comparing health insurance plans is like comparing apples and oranges—each one has its own sweet and sour notes. We’ll show you how to peel back the layers of each plan, revealing the hidden costs and benefits that might surprise you.

Tips for Choosing the Right Health Insurance Plan

Choosing a health insurance plan is like choosing a new bestie—you want to find one that complements your lifestyle and fits like a glove. We’ll share our insider tips and tricks to help you find the perfect match for your needs and budget.

Conclusion

Navigating the world of affordable health insurance in Mississippi doesn’t have to be a headache. By following our comprehensive guide, you’ll be equipped with the knowledge and confidence to find a plan that keeps you healthy and financially sound. Remember, healthcare shouldn’t be a burden—it should be a lifeline!