Maryland’s Affordable Health Insurance: A Lifeline for Your Well-being

Healthcare is a cornerstone of our well-being, yet the spiraling costs of health insurance can leave many Marylanders searching for affordable options that won’t break the bank. Fortunately, Maryland offers a lifeline: a range of health insurance plans tailored to fit diverse budgets and healthcare needs. These plans provide peace of mind and access to essential medical services, empowering you to prioritize your health without sacrificing your financial security.

Benefits of Affordable Plans

Affordable health insurance plans in Maryland don’t skimp on coverage. They offer comprehensive protection for your health, including preventive care, doctor visits, and prescription drugs. Preventive care, like routine check-ups and screenings, is crucial for catching health issues early on, often preventing costly and invasive treatments down the road. Regular doctor visits ensure timely diagnosis and management of illnesses, while access to prescription drugs helps keep chronic conditions in check.

Choosing the Right Plan: Navigating the Options

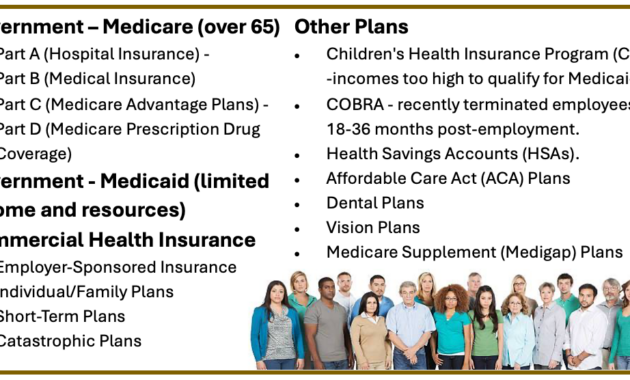

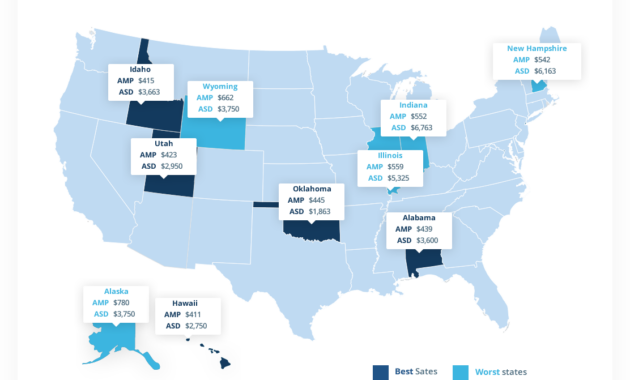

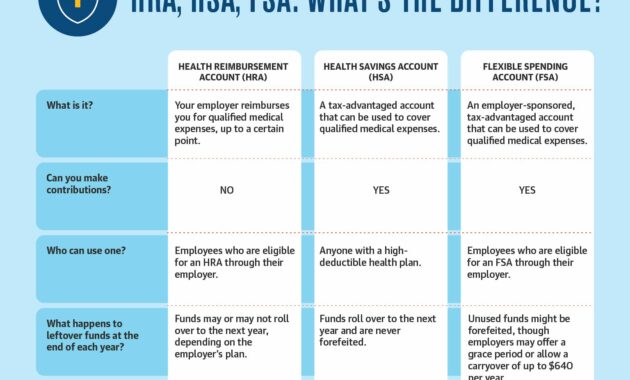

Maryland’s health insurance marketplace is brimming with plans to choose from, each with varying premiums, deductibles, and covered services. Sifting through the options can be daunting, but it’s worth taking the time to find a plan that aligns with your needs and budget. Consider your health status, anticipated medical expenses, and income level when making your choice.

Financial Assistance: Helping You Save

The state of Maryland recognizes the financial burden of health insurance and offers financial assistance to those who qualify. Income-based subsidies can significantly reduce your monthly premiums, making affordable health insurance an attainable goal. If you’re worried about affording health insurance, don’t hesitate to explore these assistance programs.

Enrollment: Securing Your Health Coverage

Enrolling in an affordable health insurance plan in Maryland is a straightforward process. You can apply online, by phone, or through a licensed insurance agent. The open enrollment period typically runs from November 1st to January 31st, but special enrollment periods may be available if you experience certain life events, such as losing your job or getting married. Remember, having health insurance is not just a financial decision; it’s an investment in your well-being.

Maintaining Your Health Insurance: Tips for Success

Once you’ve enrolled in an affordable health insurance plan, there are a few things you can do to ensure you maintain your coverage and maximize its benefits. Firstly, pay your premiums on time to avoid lapses in coverage. Secondly, understand your plan’s benefits and limitations to avoid unexpected expenses. Regular check-ups and screenings are covered under most plans, so take advantage of these preventive measures to stay healthy and save money in the long run.

Conclusion: Prioritizing Your Health with Affordable Insurance

Affordable health insurance plans in Maryland are not just about saving money; they’re about investing in your health and future. By choosing a plan that fits your needs and budget, you can access essential medical services, protect yourself from unexpected healthcare expenses, and enjoy peace of mind knowing that your well-being is prioritized. Remember, everyone deserves to have access to quality healthcare, and Maryland’s affordable health insurance plans make that a reality for countless residents.