Delaware Residents’ Guide to Affordable Health Insurance Plans

In today’s healthcare landscape, finding an affordable and comprehensive health insurance plan can be a daunting task. For Delaware residents, there’s good news: there are a plethora of options available to help you secure the coverage you need without breaking the bank. Whether you’re self-employed, a small business owner, or simply seeking individual or family coverage, this guide will provide you with the essential information you need to make informed decisions and find the best plan for your unique circumstances.

The Importance of Health Insurance in Delaware

In the United States, health insurance is not just a luxury; it’s a necessity. With the rising cost of healthcare, having adequate coverage can protect you from financial ruin in the event of an unexpected illness or injury. Delaware residents are fortunate to have access to a variety of affordable health insurance plans, both through the state’s marketplace and private insurers. Whether you have a pre-existing condition or are in good health, there are options available to meet your needs and budget.

Types of Affordable Health Insurance Plans in Delaware

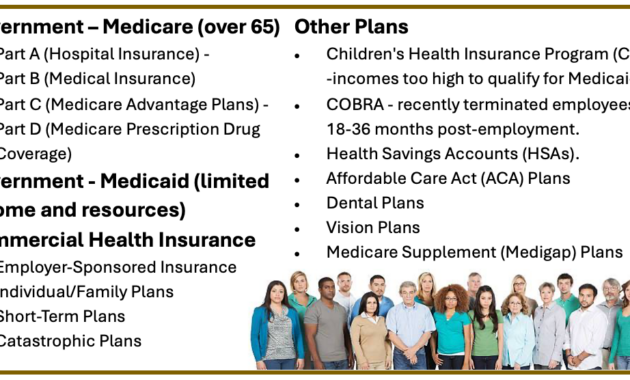

There are several types of affordable health insurance plans available to Delaware residents. These include:

-

Health Maintenance Organizations (HMOs): HMOs are a type of managed care plan that provides comprehensive coverage for a fixed monthly premium. You will typically have a primary care physician who will refer you to specialists as needed. HMOs often have lower premiums than other types of plans, but they may also have more restrictions on your choice of providers.

-

Preferred Provider Organizations (PPOs): PPOs are another type of managed care plan that offers more flexibility than HMOs. You can see any doctor or specialist in the plan’s network, but you will pay a higher premium if you choose to see a provider outside the network. PPOs typically have higher premiums than HMOs, but they offer more freedom of choice.

-

Point-of-Service (POS): POS plans are a hybrid of HMOs and PPOs. You can choose to see a primary care physician within the plan’s network or a specialist outside the network, but you will pay a higher premium for out-of-network services. POS plans typically have premiums that are in between HMOs and PPOs.

-

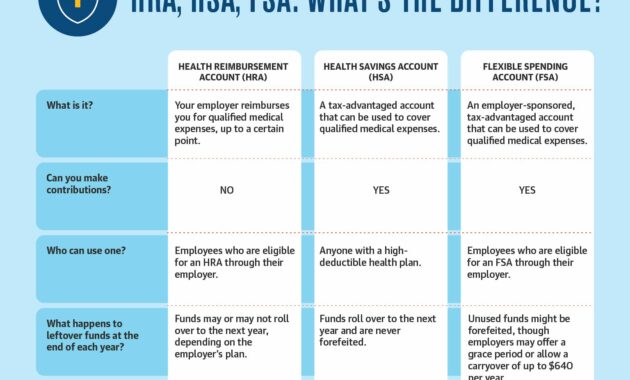

High-Deductible Health Plans (HDHPs): HDHPs are a type of health insurance plan that has a high deductible but a lower monthly premium. You will pay for most of your healthcare costs out-of-pocket until you reach your deductible, after which the insurance company will start to cover your expenses. HDHPs are often paired with a health savings account (HSA), which allows you to save money tax-free to use towards your healthcare expenses.

How to Find Affordable Health Insurance in Delaware

There are a few things you can do to find affordable health insurance in Delaware:

- Shop around: There are a number of different insurance companies that offer health insurance plans in Delaware. It’s important to compare plans from multiple insurers to find the one that offers the best coverage and price for your needs.

- Consider your budget: How much can you afford to spend on health insurance each month? It’s important to factor in your income and other expenses when choosing a plan.

- Look for discounts: Many insurance companies offer discounts for certain groups of people, such as seniors, veterans, and low-income families. Be sure to ask about any discounts that you may qualify for.

- Take advantage of tax credits: The federal government offers tax credits to help people afford health insurance. These credits are available to people who purchase health insurance through the state’s marketplace.

Conclusion

Affordable Health Insurance Plans in Delaware: A Comprehensive Guide

In today’s healthcare landscape, finding affordable health insurance plans can be a daunting task. If you’re a resident of Delaware, you’re in luck! We’ve scoured the market to bring you a comprehensive guide to the most affordable health insurance plans in the state. Whether you’re looking for individual coverage or a family plan, we’ve got you covered.

Comparing Plans and Providers

Navigating the maze of health insurance plans can be a challenge. That’s why it’s crucial to compare different plans and providers to find the one that’s right for you. Here are some factors to consider when making your decision:

- **Coverage:** Make sure the plan covers the essential health benefits you need, such as doctor visits, hospital stays, and prescription drugs. If you have specific health conditions, you’ll want to ensure the plan covers those as well.

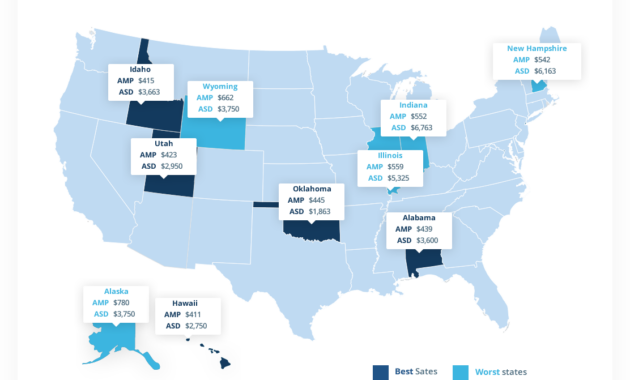

- **Cost:** Calculate the total cost of the plan, including premiums, deductibles, co-pays, and out-of-pocket expenses. Don’t just focus on the monthly premium; factor in all costs before choosing a plan.

- **Network:** Consider the provider network associated with the plan. If you have a preferred doctor or hospital, you’ll want to make sure they’re in the network.

- **Customer service:** Read reviews and check the plan’s customer service rating. You want to ensure you’ll have a positive experience when you need to use your insurance.

- **Deductible:** The deductible is the amount you pay out-of-pocket before your insurance starts to cover costs. A higher deductible typically means a lower premium, but it also means you’ll have to pay more upfront for medical expenses.

- **Co-pays:** Co-pays are fixed amounts you pay for certain medical services, such as doctor visits or prescriptions. Lower co-pays mean more out-of-pocket expenses, but they can also help you save money on routine care.

- **Out-of-pocket maximum:** This is the maximum amount you’ll have to pay out-of-pocket for covered medical expenses in a year. Once you reach your out-of-pocket maximum, your insurance will cover 100% of covered costs.

- **Wellness benefits:** Some plans offer wellness benefits, such as gym memberships or discounts on healthy foods. These benefits can help you improve your overall health and well-being.

Comparing health insurance plans can be time-consuming, but it’s worth the effort to find the plan that meets your needs and budget. Remember, the best plan for you will depend on your individual circumstances, so it’s important to do your research and make an informed decision.

Affordable Health Insurance Plans in Delaware: Navigating Your Options

Searching for budget-friendly health insurance plans in Delaware? You’re not alone. Navigating the world of healthcare coverage can be a daunting task, especially when you’re on a tight budget. But don’t worry, we’ve got you covered. This comprehensive guide will help you understand your coverage options and find the perfect plan that meets your needs and wallet.

Understanding Your Coverage Options

The first step to securing affordable health insurance is understanding the different types of plans available. In Delaware, you’ll encounter three main types: Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs).

HMOs are known for their lower monthly premiums and co-pays. However, they come with a catch: you’re restricted to a network of healthcare providers. If you venture outside of this network, you’ll pay a hefty price. PPOs offer more flexibility, allowing you to see doctors both within and outside of the network. Of course, this added freedom comes with higher premiums.

EPOs fall somewhere in between HMOs and PPOs. They offer a wider network than HMOs but a narrower one than PPOs. Like HMOs, EPOs typically come with lower premiums than PPOs. So, which type of plan is right for you? It depends on your budget, your health needs, and your preferred level of flexibility.

HMOs: A Budget-Friendly Option with a Twist

HMOs (Health Maintenance Organizations) are known for their affordability. They offer low monthly premiums and co-pays, making them an attractive option for budget-conscious individuals. However, there’s a catch: HMOs restrict you to a network of healthcare providers. If you want to see a specialist outside of the network, you’ll have to pay a higher fee. This can be a major drawback if you have a specific doctor or specialist you prefer to see.

HMOs typically require you to choose a primary care physician (PCP). Your PCP will be responsible for coordinating your care and referring you to specialists within the network. This can be a convenient way to manage your healthcare, but it can also limit your access to certain providers. If you’re looking for a low-cost health insurance plan and don’t mind being restricted to a network of providers, an HMO could be a good option.

But if you value flexibility and want to have the freedom to see any doctor you choose, you might want to consider a PPO instead. PPOs offer more freedom but come with higher premiums. Ultimately, the best way to decide if an HMO is right for you is to weigh the pros and cons and consider your individual needs and preferences. It’s also worth noting that HMOs tend to have lower out-of-pocket costs than PPOs, so you may end up saving money in the long run even if the premiums are slightly higher.

When choosing an HMO, it’s important to carefully review the network of providers to make sure it includes the doctors and specialists you need. You should also consider the plan’s co-pays and deductibles to make sure they fit your budget. If you have any pre-existing conditions, you’ll want to make sure the plan covers them. With careful planning, you can find an HMO that meets your needs and budget.

Here are a few things to keep in mind when considering an HMO:

- You’ll have to choose a primary care physician (PCP) who will coordinate your care.

- You’ll be limited to a network of providers within the HMO.

- You’ll typically have lower out-of-pocket costs than with a PPO.

- You may have to pay a higher fee if you want to see a specialist outside of the network.

If you’re looking for a budget-friendly health insurance plan and don’t mind being restricted to a network of providers, an HMO could be a good option. But if you value flexibility and want the freedom to see any doctor you choose, you might want to consider a PPO instead.

PPOs: More Flexibility, Higher Premiums

PPOs (Preferred Provider Organizations) offer more flexibility than HMOs, but they also come with higher premiums. With a PPO, you can see any doctor you want, whether they’re in the network or not. This gives you the freedom to choose the providers you trust and the specialists you need. However, you’ll typically pay a higher co-pay or coinsurance when you see a doctor outside of the network.

PPOs don’t require you to choose a primary care physician (PCP). You can see any doctor you want, whenever you want. This can be a major advantage if you have a specialist you prefer to see or if you don’t like the idea of being restricted to a certain network of providers. PPOs also offer more flexibility when it comes to referrals. You don’t need to get a referral from your PCP to see a specialist. This can save you time and hassle.

If you’re looking for a health insurance plan that gives you the most flexibility, a PPO is a good option. However, be prepared to pay higher premiums. PPOs typically have higher monthly premiums than HMOs. You’ll also have to pay higher co-pays and coinsurance when you see doctors outside of the network. If you’re on a tight budget, a PPO may not be the best option for you.

Here are a few things to keep in mind when considering a PPO:

- You can see any doctor you want, whether they’re in the network or not.

- You don’t need to choose a primary care physician (PCP).

- You don’t need a referral to see a specialist.

- You’ll typically have higher out-of-pocket costs than with an HMO.

- You’ll pay a higher co-pay or coinsurance when you see a doctor outside of the network.

If you’re looking for a health insurance plan that gives you the most flexibility, a PPO is a good option. But if you’re on a tight budget, an HMO may be a better choice.

EPOs: A Middle Ground between HMOs and PPOs

EPOs (Exclusive Provider Organizations) are a hybrid between HMOs and PPOs. They offer more flexibility than HMOs but less flexibility than PPOs. With an EPO, you can see any doctor within the network without a referral. However, you’ll pay a higher co-pay or coinsurance if you see a doctor outside of the network. EPOs typically have lower premiums than PPOs but higher premiums than HMOs.

EPOs are a good option for people who want more flexibility than an HMO but don’t want to pay the high premiums of a PPO. EPOs also offer more flexibility when it comes to referrals. You don’t need to get a referral from your PCP to see a specialist. This can save you time and hassle.

Here are a few things to keep in mind when considering an EPO:

- You can see any doctor within the network without a referral.

- You’ll pay a higher co-pay or coinsurance if you see a doctor outside of the network.

- EPOs typically have lower premiums than PPOs but higher premiums than HMOs.

If you’re looking for a health insurance plan that offers more flexibility than an HMO but don’t want to pay the high premiums of a PPO, an EPO is a good option.

Affordable Health Insurance Plans in Delaware

Navigating the world of health insurance can be a daunting task, especially if you’re looking for affordable options. But don’t fret, Delawareans! This article will guide you through the ins and outs of finding the right health insurance plan for your needs and budget.

Here, we’ll cover everything from open enrollment and special enrollment periods to understanding different plan types and costs. So, whether you’re a first-time health insurance shopper or simply looking to switch plans, read on for all the info you need to make an informed decision.

Understanding Health Insurance Plans

Before we dive into the nitty-gritty, let’s get a quick rundown of the different types of health insurance plans available in Delaware:

- Health Maintenance Organizations (HMOs): HMOs offer comprehensive coverage at a set monthly premium. You’ll typically choose a primary care physician who will coordinate your care with specialists within the HMO’s network.

- Preferred Provider Organizations (PPOs): PPOs give you more flexibility than HMOs. You can choose any doctor or hospital you want, but you’ll pay a higher premium for out-of-network care.

- Exclusive Provider Organizations (EPOs): EPOs are similar to HMOs but offer a narrower network of providers. This can lead to lower premiums, but it’s important to make sure your preferred doctors are within the network.

- Point-of-Service (POS) Plans: POS plans combine features of HMOs and PPOs. You can choose to stay within the network for lower costs or go out of network for a higher price.

Navigating Open Enrollment and Special Enrollment Periods

Now that you’re familiar with the different plan types, it’s crucial to understand when you can enroll in health insurance. There are two main enrollment periods:

- Open Enrollment: Open enrollment for the Affordable Care Act (ACA) marketplace runs from November 1st to January 15th each year. This is your chance to enroll in or change your health insurance plan if you don’t have coverage through an employer or other group.

- Special Enrollment Periods: If you experience a qualifying life event, such as losing your job or getting married, you may be eligible for a special enrollment period. This allows you to enroll in health insurance outside of the open enrollment period.

Finding Affordable Health Insurance Plans

Cost is often a major factor when choosing a health insurance plan. Here are some tips for finding affordable options:

- Shop around: Compare plans from different insurance companies to find the best deal. Don’t just go with the first plan you find.

- Consider your needs: Think about what kind of coverage you need and how much you can afford to pay. If you’re healthy and don’t need a lot of care, a lower-premium plan may be a good choice.

- Take advantage of subsidies: If you meet certain income requirements, you may be eligible for premium subsidies to help lower your monthly costs.

Getting Help

If you’re struggling to find affordable health insurance, don’t hesitate to reach out for help. There are several resources available, including:

- Health Insurance Marketplace: The Health Insurance Marketplace is a government-run website where you can compare plans and enroll in coverage. They also offer free assistance to help you find the right plan for your needs.

- Community Health Centers: Community health centers provide affordable healthcare services to low-income individuals and families. They can also help you enroll in health insurance.

- Insurance Agents: Insurance agents can help you find and enroll in a health insurance plan that meets your needs. However, it’s important to note that agents may charge a fee for their services.

Remember, finding affordable health insurance in Delaware doesn’t have to be a hassle. By following these tips and reaching out for help when needed, you can secure the coverage you need to protect your health and well-being.

Affordable Health Insurance Plans in Delaware

The cost of health insurance is on the rise, and many Delaware residents are struggling to afford coverage. But there are a number of affordable health insurance plans available in Delaware, and with the right research, you can find a plan that fits your budget and your needs.

When shopping for health insurance, it’s important to compare plans from different insurers. You’ll want to consider the monthly premium, the deductible, and the co-pays. You’ll also want to make sure that the plan covers the doctors and hospitals that you use.

If you’re having trouble affording health insurance, there are a number of financial assistance programs available. These programs can help you pay for your monthly premium, your deductible, and your co-pays. To qualify for these programs, you must meet certain income requirements.

Delaware Health Insurance Marketplace

The Delaware Health Insurance Marketplace is a state-based marketplace where you can shop for health insurance. The Marketplace offers a variety of plans from different insurers, and you can compare plans side-by-side to find the best fit for you.

To shop for health insurance on the Marketplace, you must create an account. Once you have an account, you can browse plans and compare prices. You can also apply for financial assistance. If you qualify for financial assistance, you will receive a subsidy that will help you pay for your monthly premium.

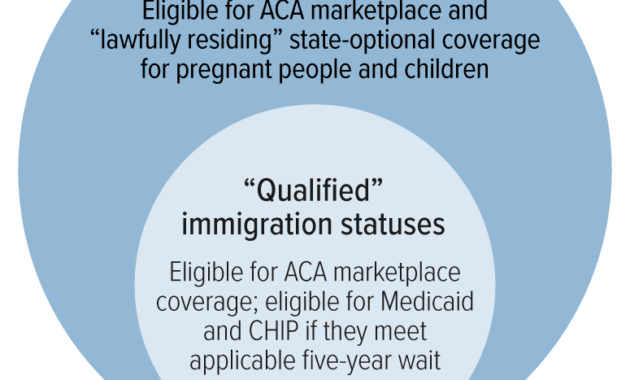

Medicaid

Medicaid is a health insurance program for low-income individuals and families. Medicaid is funded by the federal government and the state of Delaware. To qualify for Medicaid, you must meet certain income requirements. If you qualify for Medicaid, you will receive free or low-cost health insurance.

CHIP

The Children’s Health Insurance Program (CHIP) is a health insurance program for low-income children. CHIP is funded by the federal government and the state of Delaware. To qualify for CHIP, your child must be uninsured and meet certain income requirements. If your child qualifies for CHIP, they will receive free or low-cost health insurance.

Financial Assistance and Subsidies

There are a number of financial assistance programs available to help Delaware residents afford health insurance. These programs include:

- Premium tax credits

- Cost-sharing reductions

- Medicaid

- CHIP

Premium Tax Credits

Premium tax credits are available to help Delaware residents pay for their monthly health insurance premium. To qualify for premium tax credits, you must meet certain income requirements. The amount of your premium tax credit will depend on your income and the number of people in your household.

Cost-Sharing Reductions

Cost-sharing reductions are available to help Delaware residents pay for their deductibles, copays, and coinsurance. To qualify for cost-sharing reductions, you must meet certain income requirements. The amount of your cost-sharing reduction will depend on your income and the number of people in your household.

Medicaid

Medicaid is a health insurance program for low-income individuals and families. Medicaid is funded by the federal government and the state of Delaware. To qualify for Medicaid, you must meet certain income requirements. If you qualify for Medicaid, you will receive free or low-cost health insurance.

CHIP

The Children’s Health Insurance Program (CHIP) is a health insurance program for low-income children. CHIP is funded by the federal government and the state of Delaware. To qualify for CHIP, your child must be uninsured and meet certain income requirements. If your child qualifies for CHIP, they will receive free or low-cost health insurance.

If you’re struggling to afford health insurance, don’t give up. There are a number of financial assistance programs available to help you. Contact your local Department of Health and Social Services to learn more about these programs and to apply for coverage.

Affordable Health Insurance Plans in Delaware

Delawareans seeking affordable health insurance coverage have a wide range of options to consider. Whether you’re an individual, family, or small business, there are plans available to meet your needs and budget. Here’s a comprehensive guide to help you navigate the Delaware health insurance marketplace and find the right plan for you.

Types of Health Insurance Plans

In Delaware, there are several types of health insurance plans to choose from, including:

- Health Maintenance Organizations (HMOs): HMOs provide coverage through a network of providers. You must choose a primary care physician (PCP) who will refer you to specialists if necessary. HMOs typically have lower premiums than other plans but may have more restrictions on your choice of providers.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility than HMOs. You can see any provider within the network, but you’ll pay less if you stick with in-network providers. PPOs typically have higher premiums than HMOs but give you more freedom of choice.

- Exclusive Provider Organizations (EPOs): EPOs are similar to HMOs, but they do not allow you to see out-of-network providers. EPOs typically have lower premiums than PPOs but offer less flexibility.

- Point-of-Service (POS): POS plans combine features of HMOs and PPOs. You can choose to see in-network providers for lower costs or out-of-network providers for a higher cost. POS plans typically have premiums that fall between HMOs and PPOs.

How to Find Affordable Health Insurance

Finding affordable health insurance can be a challenge, but it’s possible with some research and planning. Here are some tips to help you save money on health insurance:

1. Shop around: Don’t just accept the first plan you’re offered. Take the time to compare plans from multiple insurers to find the one that’s right for you.

2. Consider a high-deductible plan: High-deductible health plans (HDHPs) have lower premiums than traditional plans. However, you’ll have to pay more out-of-pocket costs before your insurance kicks in.

3. Adjust your deductible: The deductible is the amount you have to pay out-of-pocket before your insurance starts to cover costs. Increasing your deductible can lower your premiums.

4. Choose a generic plan: Generic health insurance plans offer basic coverage at a lower cost than branded plans.

5. Take advantage of discounts: Many insurers offer discounts for things like signing up online or staying with the same insurer for multiple years.

6. Explore government programs: If you meet certain income requirements, you may be eligible for government programs like Medicaid or the Children’s Health Insurance Program (CHIP).