Introduction

You know that sinking feeling you get when you think about health insurance? Like you’re about to jump off a financial cliff? Well, hold your horses, Alabama residents! There are affordable health insurance plans out there that won’t break the bank. In fact, we’ve done the legwork for you and found a few options that are sure to fit your budget. So, sit back, relax, and let us guide you through the maze of health insurance plans. Because, let’s be honest, who has time to spend hours deciphering insurance jargon? We’ll keep it simple and straightforward, so you can get the coverage you need without the headache.

Understanding Health Insurance in Alabama

Before we dive into the plans, let’s take a quick detour to understand the basics of health insurance in Alabama. Just bear with us—it’s not as boring as it sounds. Health insurance is like a safety net that catches you when unexpected medical expenses come knocking. It helps you pay for doctor’s visits, hospital stays, and prescriptions without having to sell your prized possessions. And in Alabama, there are two main types of health insurance plans: HMOs (Health Maintenance Organizations) and PPOs (Preferred Provider Organizations).

HMOs

Think of HMOs as a cozy neighborhood clinic where everyone knows your name. You have a primary care physician who coordinates your care and refers you to specialists if needed. The beauty of HMOs is their often lower premiums and copays. But here’s the catch: you’re usually limited to using providers within the HMO’s network. It’s like being part of an exclusive club—only the doctors are the bouncers.

PPOs

PPOs, on the other hand, are like the cool kids in school who hang out with everyone. You have more freedom to choose your doctors, even outside the PPO’s network. However, this flexibility comes at a price—higher premiums and copays. It’s like having a personal shopper who takes you to the best stores, but you have to pay a premium for their services.

Affordable Health Insurance Plans in Alabama

Now, let’s get down to business. Here are some affordable health insurance plans that Alabama residents can choose from:

Blue Cross Blue Shield of Alabama

Blue Cross Blue Shield of Alabama is like the granddaddy of health insurance in the state. They’ve been around forever, and they offer a wide range of plans to fit every budget. Their HMO plans start at around $30 per month, while their PPO plans start at around $50 per month. Plus, they have a variety of discounts and incentives to help you save even more money.

UnitedHealthcare of Alabama

UnitedHealthcare is another big player in the Alabama health insurance market. They offer a variety of plans, including HMOs, PPOs, and even dental and vision coverage. Their HMO plans start at around $25 per month, while their PPO plans start at around $40 per month. They also have a variety of plans that are specifically designed for low-income families.

Cigna Health and Life Insurance Company

Cigna is a bit of a newcomer to the Alabama market, but they’re quickly making a name for themselves. They offer a variety of affordable plans, including HMOs and PPOs. Their HMO plans start at around $35 per month, while their PPO plans start at around $50 per month. Cigna is also known for its excellent customer service, so you can rest assured that you’ll be in good hands.

Finding the Right Plan for You

Choosing the right health insurance plan is like finding the perfect pair of shoes—it’s all about finding the one that fits you best. Consider your budget, your health needs, and your lifestyle. If you’re healthy and don’t need a lot of medical care, an HMO might be a good option for you. But if you have chronic health conditions or need more flexibility, a PPO might be a better choice. And don’t forget to shop around and compare prices before you make a decision. Health insurance is a big investment, so you want to make sure you’re getting the best value for your money.

Conclusion

There you have it, folks! A comprehensive guide to affordable health insurance plans in Alabama. We hope this information has helped you navigate the murky waters of health insurance. Remember, the right plan for you is the one that meets your needs and fits your budget. So, take your time, do your research, and don’t be afraid to ask for help if you need it. Because everyone deserves access to quality healthcare, without having to break the bank.

Affordable Health Insurance Plans in Alabama

Finding affordable health insurance plans in Alabama doesn’t have to be a headache. There are a variety of options available to fit your budget and needs. One of the best ways to save money on health insurance is to shop around and compare quotes from different providers. You can also look into government programs like Medicaid and Medicare to see if you qualify. And don’t forget to ask your employer if they offer health insurance benefits. If you’re still struggling to find an affordable plan, you can contact a health insurance agent for help.

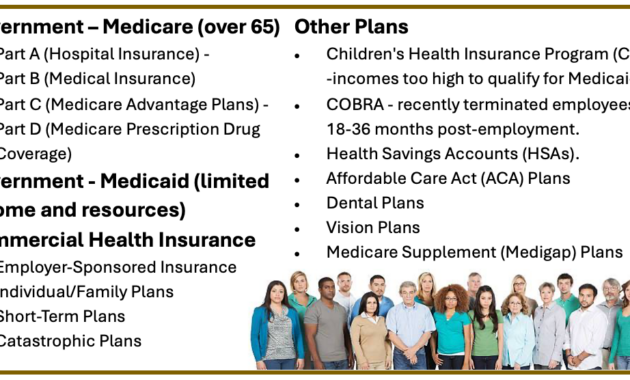

Types of Plans

There are three main types of health insurance plans: HMOs, PPOs, and catastrophic plans. HMOs (Health Maintenance Organizations) are the most affordable type of plan, but they also have the most restrictions. With an HMO, you must choose a primary care physician who will refer you to specialists if necessary. PPOs (Preferred Provider Organizations) are more expensive than HMOs, but they give you more flexibility. With a PPO, you can see any doctor you want, but you’ll pay more if you see a doctor who is not in the PPO network. Catastrophic plans are the least expensive type of plan, but they also have the highest deductibles. Catastrophic plans are only designed to cover major medical expenses, so they’re not a good option if you need regular medical care.

Which Type of Plan is Right for Me?

The type of health insurance plan that’s right for you depends on your individual needs and budget. If you’re healthy and don’t need regular medical care, a catastrophic plan might be a good option. If you have a chronic condition or need regular medical care, an HMO or PPO might be a better choice. And if you’re on a tight budget, an HMO is likely to be the most affordable option.

How to Find Affordable Health Insurance Plans in Alabama

There are a few things you can do to find affordable health insurance plans in Alabama. First, shop around and compare quotes from different providers. You can use a health insurance agent to help you with this process. Second, look into government programs like Medicaid and Medicare to see if you qualify. And third, ask your employer if they offer health insurance benefits. If you’re still struggling to find an affordable plan, you can contact a health insurance agent for help.

Conclusion

Finding affordable health insurance plans in Alabama doesn’t have to be difficult. By following these tips, you can find a plan that fits your budget and needs. And remember, if you need help, you can always contact a health insurance agent.

Affordable Health Insurance Plans in Alabama

Are you tired of being burdened by the high cost of health insurance? Are you looking for affordable health insurance plans in Alabama that fit your budget and meet your specific needs? Look no further, as we delve into the world of health insurance in Alabama to provide you with a comprehensive guide to finding the best plans at unbeatable prices.

Finding affordable health insurance shouldn’t be a daunting task. That’s why we’ve put together this comprehensive guide to help you navigate the healthcare maze and uncover the most budget-friendly options that provide the coverage you need.

Costs and Coverage

The cost of health insurance plans varies widely depending on several factors, including your age, health status, and the type of plan you choose. The coverage provided by these plans can also vary significantly, ranging from basic doctor visits to comprehensive coverage for hospital stays and prescription drugs.

Types of Health Insurance Plans

In Alabama, there are several types of health insurance plans available, each with its own unique set of benefits and costs. Let’s explore the most common types:

- Health Maintenance Organizations (HMOs): HMOs offer a comprehensive range of healthcare services through a network of contracted providers. Premiums are typically lower than other plan types, but you may have limited choice in choosing your doctors.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility than HMOs, allowing you to see both in-network and out-of-network providers. However, premiums tend to be higher, and you will likely have to pay more for out-of-network care.

- Point-of-Service (POS) Plans: POS plans combine features of both HMOs and PPOs. You can typically choose to see either in-network or out-of-network providers, but you may have to pay higher deductibles and coinsurance for out-of-network care.

- High-Deductible Health Plans (HDHPs): HDHPs come with lower premiums but higher deductibles. You pay for most healthcare costs out-of-pocket until you meet your deductible. After that, the insurance plan starts to cover a share of the costs.

Finding Affordable Health Insurance

Now that we’ve covered the different types of health insurance plans available, let’s dive into some tips for finding affordable options:

- Shop around: Don’t settle for the first plan you come across. Take the time to compare quotes from multiple insurance companies to find the best deal.

- Consider a high-deductible plan: If you’re generally healthy and don’t anticipate needing frequent medical care, a high-deductible plan could save you money on premiums.

- Take advantage of employer-sponsored insurance: If your employer offers health insurance, be sure to take advantage of it. Employer-sponsored plans often offer lower premiums and better coverage than individual plans.

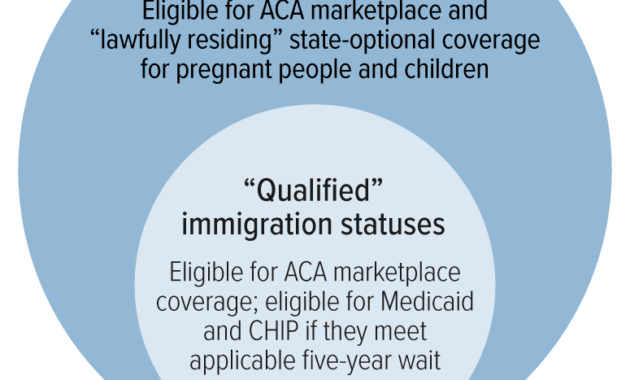

- Explore government programs: If you meet certain income requirements, you may qualify for government programs such as Medicaid or Medicare, which can provide low-cost or free health insurance.

Additional Tips for Saving Money

Here are some bonus tips to help you save even more on your health insurance premiums:

- Negotiate your premium: Don’t be afraid to negotiate with your insurance company to lower your premium. You may be surprised at how much you can save.

- Ask about discounts: Many insurance companies offer discounts for things like staying healthy, not smoking, or taking wellness classes. Be sure to ask your insurance company about any discounts you may qualify for.

- Bundle your insurance policies: If you have multiple insurance policies, such as auto and home insurance, bundling them together with the same company can often save you money.

Finding affordable health insurance in Alabama doesn’t have to be a daunting task. By following these tips and tricks, you can find a plan that fits your budget and protects your health.

So, what are you waiting for? Start comparing quotes and exploring your options today, and secure the peace of mind that comes with having affordable health insurance. Your well-being is worth it!

Affordable Health Insurance Plans in Alabama: A Comprehensive Guide to Finding Coverage

In today’s healthcare landscape, finding affordable health insurance can feel like navigating a maze. But fear not, Alabama residents! This comprehensive guide will illuminate the path towards discovering the most budget-friendly options tailored to your needs.

Understanding Health Insurance Costs

Before embarking on your search, it’s crucial to understand the factors influencing your premium. Deductibles, co-pays, and out-of-pocket expenses play a significant role. Deductibles represent the amount you’ll pay before your insurance kicks in, while co-pays are fixed fees for doctor’s visits and prescriptions. Out-of-pocket expenses encompass all costs you cover before reaching your deductible limit, including deductibles and co-pays.

Exploring Affordable Options

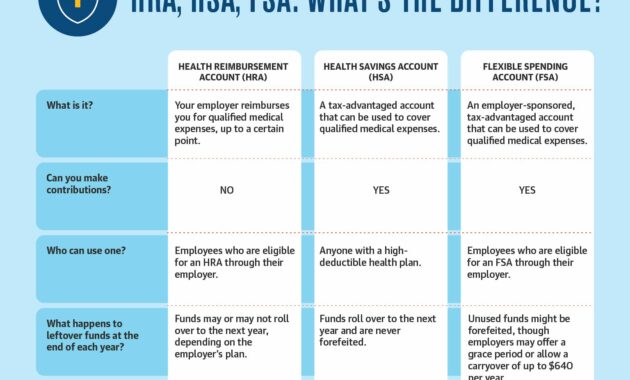

Start by comparing plans from different insurance providers. Seek plans with lower monthly premiums and deductibles, as these will minimize your upfront costs. Consider high-deductible health plans (HDHPs) with health savings accounts (HSAs), which offer tax-free savings for healthcare expenses.

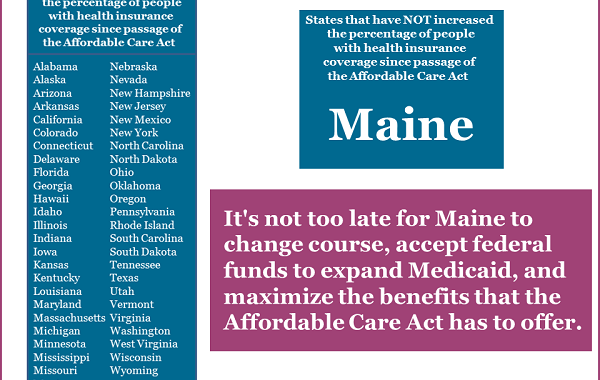

Subsidies and Tax Credits: A Lifeline for the Insured

Alabama residents may qualify for subsidies or tax credits that significantly reduce their health insurance premiums. The Affordable Care Act (ACA) provides tax credits to low- to moderate-income families. Additionally, Medicaid expansion in Alabama has extended coverage to low-income adults, helping them access affordable healthcare.

Navigating Healthcare Exchanges

Healthcare exchanges, like Alabama’s Health Insurance Marketplace, serve as platforms where individuals and families can compare and enroll in health insurance plans. They offer access to a wide range of options and may facilitate subsidy eligibility determination. Exploring plans through exchanges can simplify the process and ensure you find the most cost-effective coverage.

Employer-Sponsored Insurance: A Convenient Option

If you’re fortunate to have an employer who offers health insurance, this can be a convenient and affordable option. Employer-sponsored plans often provide a range of plan choices, and your employer may contribute to the premium, reducing your out-of-pocket costs.

Additional Tips for Saving Money

Consider generic drugs over brand-name medications to save on prescription costs. Regular check-ups and preventive care can detect and address health issues early on, potentially preventing costly future treatments. Explore community health centers that offer low-cost or free services to uninsured or underinsured individuals.

Alabama’s Healthcare Landscape: A Bright Horizon

Alabama has made significant strides in expanding access to affordable healthcare. The state’s Medicaid expansion has provided coverage to thousands of low-income residents, and the Health Insurance Marketplace offers a wide range of plans to choose from. These efforts are paving the way for a healthier and more secure Alabama.

Don’t Be Afraid to Seek Help

If you’re struggling to find affordable health insurance, don’t give up! Reach out to local healthcare organizations or community resources that can provide guidance and assistance. They can help you navigate the complexities of health insurance and identify the most cost-effective options for your situation.

Conclusion

Finding affordable health insurance in Alabama doesn’t have to be a daunting task. By understanding your needs, exploring subsidies and tax credits, and utilizing the resources available, you can secure coverage that meets your budget and protects your health. Remember, healthcare is a right, and every Alabamian deserves access to quality, affordable care.

Affordable Health Insurance Plans in Alabama: A Comprehensive Guide

The rising cost of healthcare has become a significant concern for many Alabamians, making it essential to secure affordable health insurance coverage. Alabama offers a range of insurance plans designed to meet the diverse needs and budgets of its residents. Whether you’re an individual, a family, or a business owner, there’s a plan tailored to your needs.

Navigating the vast array of health insurance options can be daunting, but it’s crucial to make an informed decision that ensures you have adequate coverage at a price you can afford. This article delves into the intricacies of affordable health insurance plans in Alabama, providing essential information to help you make the right choice.

Types of Health Insurance Plans

In Alabama, several types of health insurance plans are available, each with its unique features and benefits. Understanding these plan types is the first step toward finding the best fit for your needs.

**Health Maintenance Organizations (HMOs)**: HMOs are a popular choice for those seeking comprehensive coverage at a lower cost. They offer a network of designated healthcare providers, which limits your choice of doctors but often results in lower premiums and deductibles.

**Preferred Provider Organizations (PPOs)**: PPOs provide more flexibility than HMOs by allowing you to see healthcare providers outside of their network. However, this flexibility comes with higher premiums and deductibles.

**Exclusive Provider Organizations (EPOs)**: EPOs resemble HMOs by restricting you to a specific network of providers. However, EPOs typically have lower premiums and deductibles than HMOs.

**Point-of-Service (POS) Plans** : POS plans combine features of both HMOs and PPOs. They offer a network of preferred providers with lower costs but allow you to see out-of-network providers at a higher cost.

Coverage and Benefits

The coverage and benefits included in your health insurance plan are crucial considerations. Affordable plans often provide essential coverage, including:

- Doctor visits and checkups

- Hospitalization and surgery

- Prescription drug coverage

- Preventive care, such as screenings and immunizations

Depending on your plan, additional benefits may be available, such as dental, vision, and mental health coverage.

Plan Premiums, Deductibles, and Copayments

Understanding the financial aspects of your health insurance plan is essential for budgeting and making informed decisions. Below are key terms to know:

**Premiums:** Premiums are the monthly payments you make to your insurance carrier. Affordable plans often have lower premiums to accommodate varying budgets.

**Deductibles:** A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums.

**Copayments:** Copayments are fixed amounts you pay when you receive healthcare services, such as doctor visits or prescription drugs.

Choosing the Right Plan

Selecting the right affordable health insurance plan in Alabama requires careful consideration of your needs, budget, and preferences. Here are some key factors to keep in mind:

- Consider your overall health and medical history.

- Estimate your healthcare expenses and compare them to the coverage provided by different plans.

- Factor in your financial situation and how much you can afford to pay for premiums and other out-of-pocket costs.

It’s advisable to compare quotes from multiple insurance carriers and consult with an insurance agent who can guide you through the process and help you make an informed decision.

Conclusion

Choosing the right affordable health insurance plan in Alabama is a vital step toward securing financial protection against medical expenses and ensuring peace of mind. By understanding the different types of plans, coverage options, and financial considerations, you can make an informed decision that meets your unique needs and budget.

Remember, investing in affordable health insurance is an investment in your well-being and the well-being of your loved ones. Don’t hesitate to seek professional advice and compare quotes to find the best plan for you and your family.