Affordable Health Insurance: A Lifeline for Small Businesses

In the labyrinthine landscape of healthcare, finding affordable health insurance can feel like navigating a treacherous maze for small businesses. The cost of providing comprehensive coverage for employees can weigh heavily on their financial stability, threatening their very existence. Yet, access to quality healthcare is not merely a luxury; it’s an indispensable lifeline that ensures a healthy workforce and bolsters productivity.

Enter affordable health insurance, a beacon of hope for small businesses seeking to balance their financial well-being with their employees’ health needs. This type of coverage offers a cost-effective solution, mitigating the burden of medical expenses without compromising the quality of care.

Navigating the complexities of health insurance can be daunting, especially for small businesses with limited resources. That’s where we step in, offering a comprehensive guide to understanding and securing affordable health insurance plans. Together, we’ll unravel the ins and outs of coverage options, eligibility criteria, and cost-saving strategies, empowering you to make informed decisions that safeguard your employees’ health and your business’s financial vitality.

What is Affordable Health Insurance?

Defining affordability in the context of health insurance is a nuanced endeavor. It encompasses not only the premium costs but also factors such as deductibles, copays, and out-of-pocket expenses. For small businesses, affordability often translates into plans that offer comprehensive coverage at a price that aligns with their budgetary constraints.

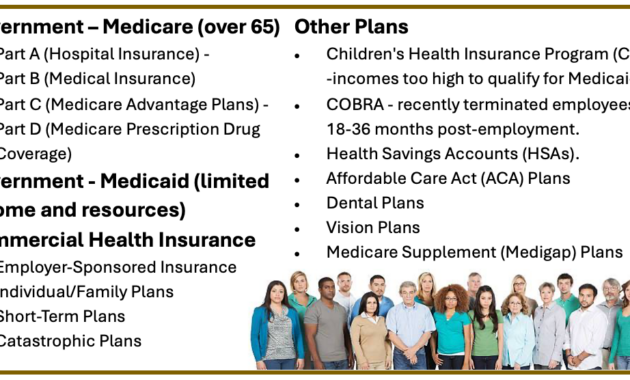

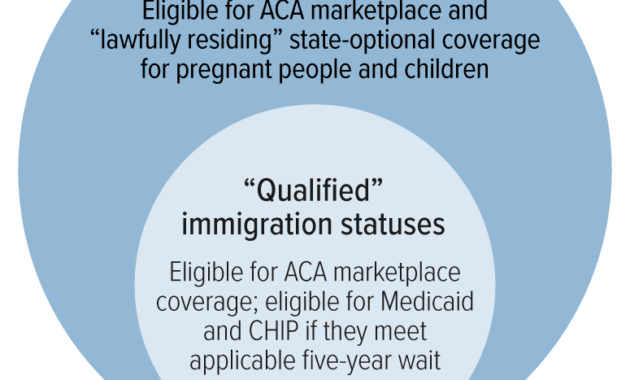

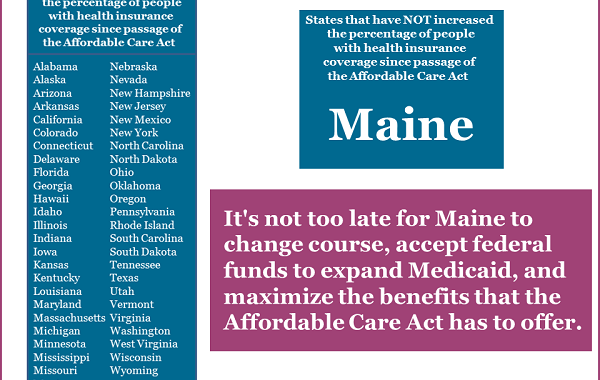

The Affordable Care Act (ACA), enacted in 2010, introduced significant reforms to the health insurance market, including provisions designed to make coverage more accessible and affordable for small businesses. These provisions include tax credits, subsidies, and the establishment of health insurance exchanges, which provide a marketplace where businesses can compare plans and purchase coverage.

The ACA also introduced essential health benefits (EHBs), which are a set of ten essential health services that all health insurance plans must cover. These benefits include, but are not limited to, preventive care, maternity care, and mental health services. By mandating the inclusion of these essential benefits, the ACA ensures that small businesses can offer their employees comprehensive coverage that meets their primary healthcare needs.

Types of Affordable Health Insurance Plans for Small Businesses

The world of health insurance plans can be a veritable alphabet soup, with acronyms and jargon aplenty. Let’s break down the most common types of plans available to small businesses:

1. **Health Maintenance Organizations (HMOs)**: HMOs offer a network of healthcare providers, such as doctors, hospitals, and clinics, from which members can choose. Patients typically have a primary care physician who coordinates their care and refers them to specialists within the network. HMOs often have lower premiums than other types of plans, but they may also have more restrictions on choice of providers and services.

2. **Preferred Provider Organizations (PPOs)**: PPOs offer a wider network of healthcare providers than HMOs, giving members more flexibility in choosing their doctors and hospitals. PPOs typically have higher premiums than HMOs, but they also offer more freedom of choice and may have lower out-of-pocket costs for out-of-network care.

3. **Point-of-Service (POS) Plans**: POS plans combine features of both HMOs and PPOs. Members typically have a primary care physician within a network, but they can also see out-of-network providers with a referral. POS plans offer more flexibility than HMOs, but they may have higher premiums and out-of-pocket costs than PPOs.

4. **Exclusive Provider Organizations (EPOs)**: EPOs are similar to HMOs in that members have a network of providers from which to choose. However, EPOs do not require members to have a primary care physician, and they typically have lower premiums than HMOs. The downside is that EPOs may have more restrictions on out-of-network care.

Affordable Health Insurance Plans for Small Businesses: Navigating the Healthcare Landscape

In today’s competitive business arena, providing affordable health insurance plans for small business owners and their employees has become paramount. With the rising cost of healthcare, finding a plan that fits both the budget and the needs of a small business can be daunting. Fortunately, there are a range of options available, each with its own advantages and disadvantages.

Types of Affordable Health Insurance Plans

When exploring affordable health insurance plans, small businesses have several options to consider, including:

- Health Maintenance Organizations (HMOs): HMOs offer a comprehensive network of healthcare providers at a fixed monthly premium. Members typically choose a primary care physician (PCP) who coordinates their care and refers them to specialists within the network. HMOs provide cost-effective coverage, but they may also limit the choice of providers.

- Preferred Provider Organizations (PPOs): PPOs allow members to access a wider network of healthcare providers, including both in-network and out-of-network providers. While in-network providers offer lower costs, members can still use out-of-network providers at a higher cost. PPOs provide greater flexibility, but they may also result in higher premiums.

- Exclusive Provider Organizations (EPOs): EPOs are similar to HMOs in that members must use in-network providers to receive coverage. However, unlike HMOs, EPOs do not require members to have a PCP. This type of plan typically offers lower premiums than PPOs, but it also limits the choice of providers.

Each type of plan has its own advantages and disadvantages, so it’s crucial to carefully evaluate the specific needs of a small business and its employees before making a decision. Factors to consider include the size of the network, the cost of premiums and deductibles, and the availability of specific healthcare services.

Affordable Health Insurance Plans for Small Businesses

For small business owners, providing affordable health insurance plans can be a daunting task. With the rising cost of healthcare, it’s more important than ever to find a plan that fits both your budget and the needs of your employees. Fortunately, there are a number of affordable options available, making it possible to provide your team with the coverage they need without breaking the bank. Here’s a closer look at what’s out there.

Benefits of Affordable Health Insurance

There are many benefits to offering affordable health insurance to your employees. These include:

Types of Affordable Health Insurance Plans

There are a number of different types of affordable health insurance plans available for small businesses. These include:

How to Choose an Affordable Health Insurance Plan

When choosing an affordable health insurance plan for your small business, there are a few things you should keep in mind:

Getting Help with Affordable Health Insurance

If you’re struggling to find an affordable health insurance plan for your small business, there are a number of resources available to help you. These include:

Conclusion

Providing affordable health insurance to your employees is an important part of running a successful small business. By following the tips in this article, you can find a plan that fits your budget and the needs of your employees. Don’t wait, get started today and give your employees the coverage they need.

Affordable Health Insurance Plans for Small Businesses: A Guide to Savings and Peace of Mind

In today’s competitive business landscape, providing affordable health insurance to employees is crucial for attracting and retaining top talent. However, finding a plan that meets your budget and coverage needs can be a daunting task. Here’s a comprehensive guide to help you navigate the complexities of small business health insurance and secure a plan that fits your unique requirements.

Choosing the Right Affordable Health Insurance Plan

Selecting the most suitable health insurance plan for your small business involves considering several key factors. Let’s explore the essential elements to look for when making this critical decision:

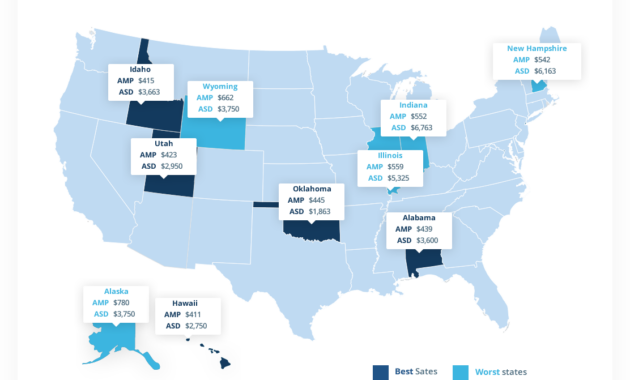

* Premiums: These are the regular payments you make to the insurance company to maintain coverage. Lower premiums can significantly reduce your overall healthcare expenses.

* Deductibles: This is the amount you pay out-of-pocket before the insurance coverage kicks in. Higher deductibles typically result in lower premiums, but they also mean you’ll have to shoulder more costs upfront.

* Co-Pays: Co-pays are fixed amounts you pay for certain medical services, such as doctor’s visits or prescription drugs. Lower co-pays provide greater convenience and peace of mind, but they may come with higher premiums.

Types of Affordable Health Insurance Plans

There are several types of health insurance plans available for small businesses, each with its own advantages and disadvantages:

* Health Maintenance Organizations (HMOs): HMOs offer comprehensive coverage at a fixed monthly premium. They require you to choose a primary care physician (PCP) who manages your care and refers you to specialists as needed.

* Preferred Provider Organizations (PPOs): PPOs provide more flexibility than HMOs, allowing you to see any doctor within the network without a referral. However, the premiums and out-of-pocket costs may be higher than HMOs.

* Exclusive Provider Organizations (EPOs): EPOs are similar to HMOs, but they typically have a narrower network of providers. This can lead to lower premiums but may limit your choice of doctors.

* Point-of-Service (POS) Plans: POS plans offer a combination of HMO and PPO features, allowing you to choose between in-network and out-of-network providers. Premiums and out-of-pocket costs may vary depending on the provider you choose.

Additional Considerations for Choosing an Affordable Plan

Beyond premiums, deductibles, and co-pays, there are several other factors to consider when selecting an affordable health insurance plan for your small business:

* Network Size: A larger provider network typically means more choice and flexibility, but it can also come with higher premiums. Consider the size of your business and the locations of your employees when evaluating network size.

* Prescription Drug Coverage: Prescription drug coverage is an essential consideration for many small businesses. Determine the types of medications your employees typically use and ensure the plan you choose provides adequate coverage.

* Wellness Benefits: Some health insurance plans offer wellness benefits, such as gym memberships or nutrition counseling, which can help improve employee health and potentially lower healthcare costs.

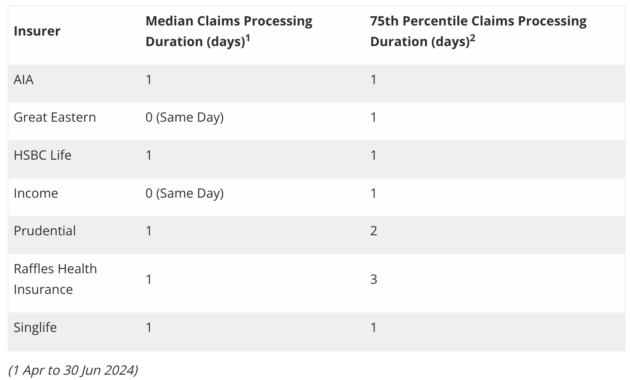

* Customer Service: The quality of the insurance company’s customer service can significantly impact your experience with the plan. Look for insurers with a reputation for responsiveness and helpfulness.

Affordable Health Insurance Plans for Small Businesses

To help you get started, here are a few examples of affordable health insurance plans available for small businesses:

* Kaiser Permanente: Kaiser Permanente offers HMO plans with a wide range of coverage options and competitive premiums.

* Blue Cross Blue Shield: Blue Cross Blue Shield offers a variety of PPO and EPO plans, providing flexibility and choice for small businesses.

* UnitedHealthcare: UnitedHealthcare offers POS plans that combine the benefits of HMOs and PPOs, giving small businesses customizable coverage options.

Conclusion

Finding affordable health insurance for your small business is essential for employee retention and overall business success. By considering the factors outlined above and carefully evaluating your options, you can secure a plan that provides adequate coverage at a cost that fits your budget. Remember, investing in your employees’ health and well-being not only improves morale but also contributes to a healthier and more productive workforce.

Navigating the Affordable Care Act for Small Business Health Insurance

In the realm of health insurance, small businesses often find themselves navigating a labyrinthine maze. The Affordable Care Act (ACA), with its complexities and nuances, can leave business owners scratching their heads. However, understanding the ins and outs of the ACA can unlock a treasure trove of affordable health insurance options for small businesses. The key lies in embracing the act’s fundamental principles: negotiation and cost-sharing.

Negotiating Premiums: The Art of Haggling

Health insurance premiums are like a high-stakes poker game, where small businesses hold the cards. By skillfully negotiating with insurance providers, businesses can secure lower rates without sacrificing coverage. It’s a delicate dance, requiring preparation, research, and a willingness to walk away if necessary. But like a master negotiator, small businesses can emerge victorious, securing affordable premiums that won’t break the bank.

Pooling Resources: The Power of Collective Bargaining

Just as strength lies in numbers, small businesses can harness the collective power of collaboration to negotiate lower health insurance premiums. By joining forces with other small businesses in their industry or region, they form employer groups that give them more clout in negotiations. United, they become a formidable force, commanding the attention of insurance providers and securing favorable terms.

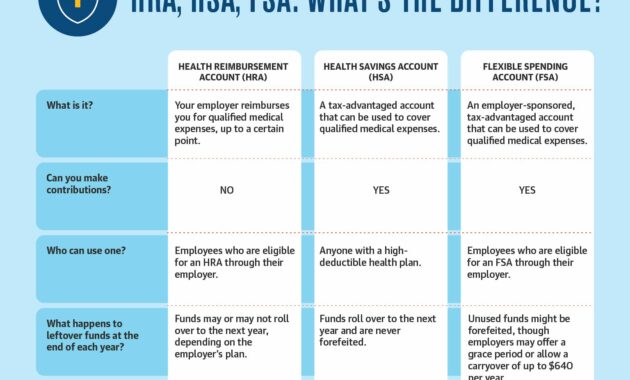

Exploring Cost-Sharing Strategies: Dividing the Burden

Cost-sharing strategies are the secret weapons in the arsenal of small businesses seeking affordable health insurance. These strategies, like the proverbial sharing of a heavy load, distribute the financial burden among employees and employers. From high-deductible health plans (HDHPs) to flexible spending accounts (FSAs), there’s a cost-sharing option tailored to every business’s needs. By embracing these strategies, small businesses can lighten the load and keep their health insurance costs under control.

Choosing the Right Plan: A Tailored Fit

Selecting the right health insurance plan for a small business is like finding the perfect jigsaw puzzle piece—the one that seamlessly fits the unique contours of their needs and budget. The ACA offers a diverse array of plans, each with its benefits and drawbacks. From HMOs to PPOs, businesses must carefully evaluate their options and select a plan that aligns with their employees’ health care needs and financial constraints. It’s an investment in not just their employees’ well-being but also the long-term health of their business.

Harnessing Technology: Digital Tools for Success

In the digital age, technology has become an indispensable ally for small businesses seeking affordable health insurance. Online marketplaces, comparison websites, and insurance brokers armed with advanced search algorithms can streamline the process of researching and comparing plans. These tools empower business owners to make informed decisions and secure the best possible coverage for their employees, without the hassle of endless phone calls and paperwork.