Affordable Care Act Health Insurance Plans: A Path to Comprehensive Coverage

In the labyrinthine world of health insurance, the Affordable Care Act (ACA) emerged as a beacon of hope, illuminating a path towards affordable and comprehensive coverage for millions of Americans. This landmark legislation, commonly referred to as Obamacare, has transformed the healthcare landscape, providing a lifeline to those who were previously uninsured or underinsured.

What is the Affordable Care Act?

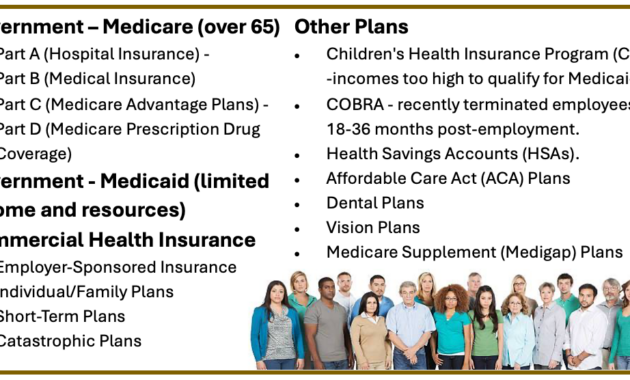

The Affordable Care Act, signed into law by President Barack Obama in 2010, stands as a monumental achievement in healthcare reform. Its primary objective was to expand health insurance coverage to as many Americans as possible, while also curbing spiraling healthcare costs. The ACA introduced a slew of provisions aimed at achieving these goals, including:

- Individual Mandate: This provision requires most Americans to have health insurance coverage or pay a penalty.

- Health Insurance Exchanges: The ACA established state-based marketplaces where individuals and small businesses can shop for and purchase health insurance plans.

- Subsidies: The law provides financial assistance to low- and middle-income individuals and families to help them afford health insurance premiums.

- Medicaid Expansion: The ACA expanded Medicaid eligibility to cover more low-income Americans.

- Essential Health Benefits: The ACA mandates that all health insurance plans cover a comprehensive set of essential health benefits, including doctor visits, hospitalization, and prescription drugs.

The ACA has significantly reduced the number of uninsured Americans, providing peace of mind and financial protection to millions. It has also promoted competition and innovation within the health insurance industry, leading to a wider range of affordable and comprehensive plans.

How Can I Enroll in an Affordable Care Act Health Insurance Plan?

Enrolling in an ACA health insurance plan is a relatively straightforward process. Here’s a step-by-step guide:

- Determine Your Eligibility: Check if you are eligible for Medicaid or other government programs that provide health insurance. If not, you can purchase a plan through the Health Insurance Marketplace.

- Shop for a Plan: Visit the Health Insurance Marketplace website to compare plans and prices. You can use filters to narrow down your search based on your needs and budget.

- Apply for Coverage: Once you have selected a plan, you can apply for coverage online or over the phone. You will need to provide personal information, income documentation, and proof of citizenship or legal residency.

- Pay Your Premiums: Once your application is approved, you will need to start paying your monthly premiums. You can choose to pay your premiums directly to the insurance company or through the Marketplace.

The Health Insurance Marketplace provides a user-friendly interface that simplifies the enrollment process. You can also seek assistance from a certified health insurance navigator or broker who can guide you through the process.

Benefits of Affordable Care Act Health Insurance Plans

Enrolling in an ACA health insurance plan offers numerous benefits, including:

- Comprehensive Coverage: ACA plans cover a comprehensive range of essential health benefits, ensuring that you have access to necessary medical care.

- Financial Protection: Health insurance provides a financial safety net, protecting you from the high costs of medical expenses.

- Peace of Mind: Knowing that you and your family have health insurance coverage provides peace of mind and reduces stress.

- Preventive Care: ACA plans cover preventive care services, such as annual checkups and screenings, which can help you stay healthy and avoid costly medical problems in the future.

- Access to Quality Care: ACA plans provide access to a network of healthcare providers, ensuring that you can find quality medical care when you need it.

The benefits of ACA health insurance plans far outweigh the costs, providing individuals and families with a path towards better health and financial security.

Conclusion

The Affordable Care Act has revolutionized the health insurance landscape, making health insurance more accessible and affordable for millions of Americans. By expanding coverage, promoting competition, and providing financial assistance, the ACA has paved the way for a healthier and more equitable healthcare system. Whether you are uninsured, underinsured, or simply looking for a better health insurance plan, the ACA provides a range of options to meet your needs. Embracing the benefits of ACA health insurance plans is an investment in your health and the well-being of your loved ones.

Affordable Care Act Health Insurance Plans

The Affordable Care Act (ACA), also known as Obamacare, was signed into law in 2010. One of the main goals of the ACA was to make health insurance more affordable and accessible for all Americans.

One of the key provisions of the ACA is the creation of health insurance marketplaces, also known as exchanges. These marketplaces allow individuals and small businesses to shop for and compare health plans that meet certain standards. The plans offered through the marketplaces must cover a range of essential health benefits, such as doctor visits, hospital stays, and prescription drugs.

The marketplaces are designed to make it easier for people to find and enroll in health insurance plans. They also provide financial assistance to help people pay for their premiums.

Health Insurance Plans Under the Affordable Care Act

The ACA created four different types of health insurance plans:

- Bronze plans have the lowest monthly premiums, but they also have the highest deductibles and out-of-pocket costs.

- Silver plans have slightly higher monthly premiums than bronze plans, but they also have lower deductibles and out-of-pocket costs.

- Gold plans have the highest monthly premiums, but they also have the lowest deductibles and out-of-pocket costs.

- Platinum plans have the highest monthly premiums, but they also have the lowest deductibles and out-of-pocket costs, and they cover more benefits than other plans.

The type of plan you choose will depend on your budget and your health needs. If you are healthy and don’t expect to have many medical expenses, a bronze or silver plan may be a good option for you. If you have a chronic condition or expect to have high medical expenses, a gold or platinum plan may be a better choice.

How to Enroll in an Affordable Care Act Health Insurance Plan

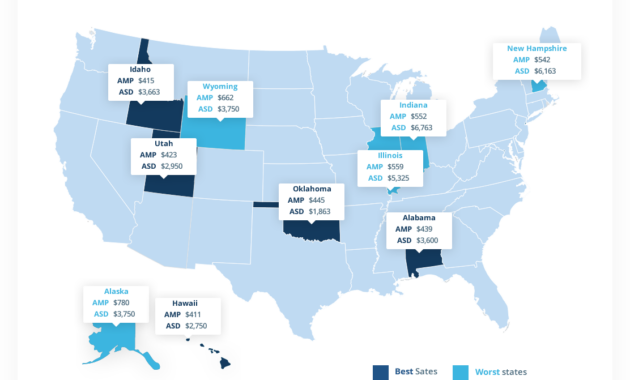

You can enroll in an ACA health insurance plan through the federal marketplace or through your state’s marketplace. The open enrollment period for the 2023 plan year runs from November 1, 2022 to January 15, 2023.

To enroll in a plan, you will need to provide information about your income, family size, and health status. You may also be eligible for financial assistance to help pay for your premiums.

If you miss the open enrollment period, you may still be able to enroll in a plan if you have a qualifying life event, such as losing your job or getting married.

Benefits of Affordable Care Act Health Insurance Plans

ACA health insurance plans offer a number of benefits, including:

- Guaranteed coverage: ACA plans must cover a range of essential health benefits, including doctor visits, hospital stays, and prescription drugs.

- No lifetime limits: ACA plans cannot impose lifetime limits on coverage.

- No preexisting condition exclusions: ACA plans cannot deny coverage to people with preexisting conditions.

- Financial assistance: ACA plans offer financial assistance to help people pay for their premiums.

If you are uninsured, or if you are unhappy with your current health insurance plan, the ACA marketplaces are a great place to shop for and compare plans.

Affordable Care Act Health Insurance Plans: Understanding Your Options

The Affordable Care Act (ACA), also known as Obamacare, has dramatically transformed the health insurance landscape in the United States. For millions of Americans, the ACA has made health insurance more accessible and affordable through the creation of health insurance marketplaces. These marketplaces offer a variety of health plans to choose from, each with its own unique benefits and costs.

Types of Health Plans Available

Metal Tiers: Navigating the Levels of Coverage

Bronze, Silver, Gold, and Platinum represent the four metal tiers of health plans available on the marketplaces. These tiers differ in terms of their monthly premiums, deductibles, and coinsurance. Bronze plans offer the lowest premiums but have higher deductibles and coinsurance, while Platinum plans have the highest premiums but offer the most comprehensive coverage with lower deductibles and coinsurance.

Choosing the right metal tier depends on your individual circumstances and healthcare needs. If you’re healthy and don’t expect to incur significant medical expenses, a Bronze plan may be a cost-effective option. On the other hand, if you have chronic health conditions or anticipate high medical costs, a Gold or Platinum plan may provide peace of mind and financial protection.

Deductibles: Understanding Your Out-of-Pocket Threshold

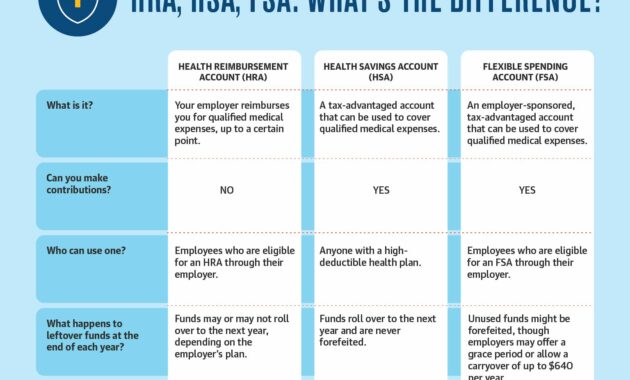

A deductible is the amount of money you must pay out-of-pocket before your health insurance begins to cover medical expenses. Deductibles vary widely across plans, and choosing the right one depends on your financial situation and health status.

If you’re healthy and don’t anticipate needing much healthcare, a high deductible plan may be a good option. This will lower your monthly premiums but increase your out-of-pocket costs if you do incur medical expenses. Conversely, if you have chronic health conditions or expect to need frequent medical care, a low deductible plan may be more beneficial, as it will reduce your out-of-pocket costs in the long run.

Copays and Coinsurance: Sharing the Burden of Healthcare Costs

Copays are fixed amounts you pay for specific healthcare services, such as doctor’s visits or prescription drugs. Coinsurance is a percentage of the cost of a medical service that you’re responsible for paying after you’ve met your deductible. Both copays and coinsurance vary across plans, and it’s important to consider these costs when choosing a health plan.

Copays and coinsurance can help you manage your healthcare costs. If you’re on a tight budget, choosing a plan with higher copays and coinsurance may lower your monthly premiums. However, if you anticipate needing frequent medical care, a plan with lower copays and coinsurance may be more cost-effective in the long run.

Affordable Care Act Health Insurance Plans: A Comprehensive Guide

In the wake of rising healthcare costs and the complexities of health insurance, the Affordable Care Act (ACA) emerged as a beacon of hope for millions of Americans. With the goal of making health insurance more accessible and affordable, the ACA introduced a myriad of changes that brought relief to those struggling to navigate the labyrinthine health insurance market.

One of the most significant aspects of the ACA is its creation of health insurance marketplaces, often referred to as "exchanges." These marketplaces provide a platform where individuals and families can compare and purchase health insurance plans from a variety of insurers. The plans offered through the exchanges are required to meet certain standards, ensuring that they provide comprehensive coverage at competitive prices.

Benefits of Affordable Care Act Health Plans

ACA health plans offer a multitude of benefits that have transformed the healthcare landscape for millions of Americans. These benefits include:

-

**Guaranteed coverage for essential health benefits:** ACA health plans are mandated to cover a comprehensive set of essential health benefits, including preventive care, hospitalization, and prescription drugs. This ensures that everyone has access to the healthcare services they need, regardless of their age, health status, or income level.

-

**No annual or lifetime limits on coverage:** Prior to the ACA, many health insurance plans imposed annual or lifetime limits on coverage. This meant that once a certain amount of coverage was reached, the insurance company would no longer pay for any additional medical expenses. ACA health plans, however, eliminate these limits, providing peace of mind knowing that you won’t be left financially vulnerable due to unforeseen medical costs.

-

**Subsidies to help low- and middle-income individuals and families afford coverage:** The ACA recognizes that healthcare costs can be a significant financial burden for many families. To address this issue, the ACA provides subsidies to help low- and middle-income individuals and families afford health insurance. These subsidies can significantly reduce the monthly cost of premiums, making health insurance more accessible for those who need it most.

Eligibility for Affordable Care Act Health Insurance Plans

To be eligible for ACA health insurance plans, you must meet certain criteria. These criteria include:

-

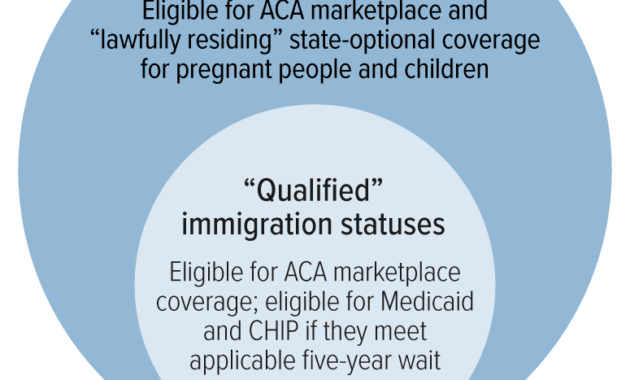

**Legal residency:** You must be a legal resident of the United States.

-

**Income requirements:** Individuals and families with incomes below certain thresholds are eligible for subsidies to help them afford health insurance. These thresholds vary depending on family size and location.

-

**Citizenship requirements:** Undocumented immigrants are not eligible for ACA health insurance plans. However, lawfully present immigrants may be eligible for coverage.

How to Apply for Affordable Care Act Health Insurance Plans

Applying for ACA health insurance plans is relatively straightforward. You can apply through the Health Insurance Marketplace, which is a government-run website that provides information about health insurance plans and helps you enroll in a plan that meets your needs. The Marketplace is open for enrollment during specific periods throughout the year. You can also apply for coverage directly through an insurance company or a health insurance agent.

Open Enrollment Period for Affordable Care Act Health Insurance Plans

The Open Enrollment Period for ACA health insurance plans typically runs from November 1st to January 15th. During this period, you can enroll in a new health insurance plan or change your existing plan. It’s important to note that if you miss the Open Enrollment Period, you may have to wait until the next enrollment period to enroll in a new plan, unless you qualify for a Special Enrollment Period.

Special Enrollment Periods for Affordable Care Act Health Insurance Plans

If you experience certain life events, such as losing your job or having a baby, you may qualify for a Special Enrollment Period (SEP). SEPs allow you to enroll in a health insurance plan outside of the regular Open Enrollment Period. Some common events that qualify for SEPs include:

-

Losing your job

-

Getting married or divorced

-

Having a baby or adopting a child

-

Moving to a new state

Additional Resources for Affordable Care Act Health Insurance Plans

There are a number of resources available to help you understand and access ACA health insurance plans. These resources include:

-

**Healthcare.gov:** The official website of the Health Insurance Marketplace. Provides information about health insurance plans and helps you enroll in a plan.

-

**State Health Insurance Assistance Programs (SHIPs):** State-based programs that provide free and unbiased counseling and assistance to individuals and families who need help with health insurance.

-

**Centers for Medicare & Medicaid Services (CMS):** The federal agency responsible for administering the ACA. Provides information about health insurance plans and other ACA programs.

-

**Kaiser Family Foundation:** A non-profit organization that provides research and analysis on health insurance and other healthcare issues. Provides information about ACA health insurance plans and other healthcare topics.

Conclusion

The Affordable Care Act has played a transformative role in the American healthcare system. By expanding access to affordable health insurance, the ACA has provided millions of Americans with peace of mind and financial security. If you are uninsured or underinsured, the ACA health insurance plans offer a lifeline to quality, affordable healthcare. Don’t wait to enroll, and enjoy the benefits of having comprehensive health insurance coverage.

Affordable Care Act Health Insurance Plans

Navigating the world of health insurance can feel like navigating a maze, but it doesn’t have to be. The Affordable Care Act (ACA) offers a lifeline to individuals and small businesses, providing access to affordable and comprehensive health plans. Dive into this comprehensive guide to discover how to enroll in an ACA health plan, understand its benefits, navigate its complexities, and find the plan that meets your unique needs.

How to Enroll in an Affordable Care Act Health Plan

Enrolling in an ACA health plan is a straightforward process. Individuals and small businesses have two primary avenues: the Health Insurance Marketplace website or a health insurance agent or broker. The Marketplace is a government-run online platform that offers a range of plans from various insurance companies. You can compare plans, review coverage details, and select the one that best fits your needs and budget. Alternatively, you can connect with a qualified agent or broker who can guide you through the enrollment process and provide personalized recommendations.

Plan Categories and Metal Tiers

ACA health plans come in four categories: Bronze, Silver, Gold, and Platinum. These categories represent different levels of coverage and premiums. Bronze plans offer the lowest monthly premiums but cover a smaller portion of medical expenses. Silver plans provide a slightly higher level of coverage with moderate premiums. Gold plans offer more comprehensive coverage with higher premiums, while Platinum plans provide the most comprehensive coverage with the highest premiums.

Cost-Sharing Provisions

Understanding the cost-sharing provisions associated with ACA health plans is crucial. These provisions determine how you share the financial burden of medical expenses with your insurance company. The main cost-sharing provisions include deductibles, copays, and coinsurance. The deductible is the fixed amount you must pay out-of-pocket before your insurance coverage kicks in. Copayments are fixed amounts you pay for specific services, such as doctor’s visits or prescription drugs. Coinsurance is the percentage of medical expenses you pay after you’ve met your deductible.

Benefits of ACA Health Plans

ACA health plans offer a wide range of benefits, including coverage for essential health services such as doctor’s visits, hospital stays, preventive care, and mental health services. They also provide financial assistance to low- and moderate-income individuals and families who qualify for premium tax credits and cost-sharing subsidies. These subsidies can significantly reduce the cost of health insurance, making it more affordable for those who need it most.

Finding the Right Plan for You

Selecting the right ACA health plan is not a one-size-fits-all approach. Consider your health needs, budget, and lifestyle when making a decision. If you have chronic health conditions or anticipate significant medical expenses, a Gold or Platinum plan may be a better option. For those on a tight budget, a Bronze or Silver plan may provide adequate coverage at a lower cost. It’s important to compare plans thoroughly and consult with a healthcare professional or insurance expert if you have any questions or need guidance.

Conclusion

The Affordable Care Act has made health insurance more accessible and affordable for millions of Americans. Understanding how to enroll, navigate the plan categories and cost-sharing provisions, and exploring the benefits of ACA health plans empowers you to make informed decisions about your health coverage. Whether you’re an individual or a small business owner, the ACA provides a path to affordable and quality healthcare. Don’t hesitate to explore your options and find the plan that meets your unique needs and budget.

Affordable Care Act Health Insurance Plans: A Comprehensive Guide

The Affordable Care Act (ACA), also known as Obamacare, has transformed the healthcare landscape in the United States since its implementation in 2010. One of its most significant impacts has been the expansion of health insurance coverage to millions of Americans who were previously uninsured. This article aims to provide a comprehensive overview of the Affordable Care Act and its impact on health insurance plans, arming you with the knowledge you need to make informed decisions about your healthcare coverage.

Understanding the Affordable Care Act

The ACA was a landmark piece of legislation designed to improve the accessibility, affordability, and quality of healthcare in the United States. Its primary objectives included expanding health insurance coverage, providing financial assistance to low- and moderate-income individuals and families, and implementing reforms to reduce healthcare costs.

Key Provisions of the Affordable Care Act

The ACA introduced several key provisions that have had a profound impact on health insurance plans. These include:

- Individual Mandate: All Americans are required to have health insurance coverage or face a tax penalty. This mandate aims to increase the pool of insured individuals, thereby spreading the risk of healthcare costs and lowering premiums.

- Health Insurance Marketplaces: The ACA created health insurance marketplaces, or exchanges, where individuals and families can compare and purchase health insurance plans from private insurers. These marketplaces provide access to subsidized plans for those who qualify based on income.

- Essential Health Benefits: All health insurance plans sold on the marketplaces must cover a comprehensive set of essential health benefits, including doctor visits, hospital care, prescription drugs, and mental health services.

- Employer Mandate: Employers with 50 or more employees are required to offer health insurance coverage to their full-time employees. This provision aims to reduce the number of uninsured Americans and shift the burden of providing health insurance away from the government.

Types of Affordable Care Act Health Insurance Plans

The ACA classifies health insurance plans into four tiers based on their level of coverage and premiums:

- Bronze Plan: These plans have the lowest premiums but also the highest deductibles and out-of-pocket costs.

- Silver Plan: Silver plans offer more comprehensive coverage than Bronze plans with slightly higher premiums and lower deductibles.

- Gold Plan: Gold plans provide the most comprehensive coverage with the highest premiums but the lowest deductibles.

- Platinum Plan: Platinum plans offer the highest level of coverage with the lowest out-of-pocket costs but also the highest premiums.

Coverage Options and Exclusions

Health insurance plans offered under the ACA must cover a comprehensive set of essential health benefits, but there are some limitations and exclusions to be aware of. For example, plans may have annual limits on coverage, may not cover certain treatments or procedures, and may have deductibles and copayments that must be met before coverage begins.

Financial Assistance

The ACA provides financial assistance to low- and moderate-income individuals and families to help them afford health insurance coverage. This assistance is available in the form of premium tax credits, which reduce the monthly premiums for marketplace plans, and cost-sharing reductions, which lower deductibles and out-of-pocket costs.

Enrollment Periods

The ACA established specific enrollment periods during which individuals and families can purchase health insurance coverage. These periods typically occur in the fall, but there are exceptions for special enrollment periods and coverage for those who experience qualifying life events.

Impact of the Affordable Care Act

The ACA has had a significant impact on the healthcare landscape in the United States, including:

- Increased Health Insurance Coverage: The ACA has significantly reduced the number of uninsured Americans, estimated to be around 20 million.

- Improved Access to Care: The expansion of health insurance coverage has led to improved access to primary care, preventive services, and specialty treatments.

- Reduced Healthcare Costs: The ACA has introduced measures to reduce healthcare costs, such as the creation of health insurance marketplaces, which has led to increased competition among insurers.

- Improved Quality of Care: The ACA has implemented reforms to improve the quality of healthcare, including quality reporting measures for healthcare providers and incentives for preventive care.

Conclusion

The Affordable Care Act has been a transformative piece of legislation that has expanded health insurance coverage, improved access to healthcare, and introduced reforms to reduce healthcare costs. While there are ongoing debates and controversies surrounding the ACA, its impact on the healthcare landscape in the United States has been undeniable. By understanding the key provisions, coverage options, and financial assistance available under the ACA, you can make informed decisions about your health insurance coverage and ensure you have access to the healthcare you need.