Introduction

Picture this: you’re a small business owner, and you’re drowning in paperwork. Invoices are piling up on your desk, expenses are scattered across multiple spreadsheets, and you can’t seem to get a clear picture of your financial situation. Sound familiar? If so, it’s time to consider investing in accounting software for a small business. But don’t just jump into the deep end without doing your research. With so many options on the market, choosing the right one can be a daunting task. That’s why we’re here to help.

In this article, we’ll walk you through everything you need to know about choosing accounting software for a small business. We’ll cover the different types of software available, the features to look for, and the factors to consider when making your decision. So whether you’re a seasoned entrepreneur or just starting out, read on for all the information you need to make an informed choice.

Types of Accounting Software

The first step in choosing accounting software is to understand the different types available. There are two main types of accounting software: desktop and cloud-based.

Desktop accounting software is installed on your computer. This type of software is typically more affordable than cloud-based software, but it can be more difficult to use and maintain. You’ll also need to make sure that your computer meets the software’s system requirements.

Cloud-based accounting software is accessed through the internet. This type of software is typically more user-friendly than desktop software, and it can be accessed from anywhere with an internet connection. However, cloud-based software can be more expensive than desktop software, and you’ll need to make sure that you have a reliable internet connection.

Features to Look For

Once you understand the different types of accounting software available, you can start to narrow down your choices by considering the features that are important to you. Here are some of the most common features to look for:

- Invoicing: The ability to create and send invoices to customers.

- Expense tracking: The ability to track expenses and categorize them.

- Reporting: The ability to generate financial reports, such as profit and loss statements and balance sheets.

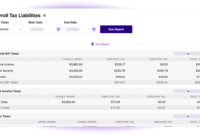

- Payroll: The ability to process payroll and pay employees.

- Bank reconciliation: The ability to reconcile your bank statements with your accounting records.

- Customer relationship management (CRM): The ability to track customer interactions and manage customer data.

Factors to Consider

In addition to the features that are important to you, there are also a number of other factors to consider when choosing accounting software for a small business, such as:

- Cost: How much does the software cost? Is it a one-time purchase or a subscription?

- Ease of use: How easy is the software to use? Is it intuitive and user-friendly?

- Customer support: What kind of customer support does the software provider offer? Is it available 24/7?

- Integration: Does the software integrate with other applications you use, such as your CRM or e-commerce platform?

- Scalability: How scalable is the software? Can it grow with your business as you add more employees and customers?

By taking all of these factors into account, you can choose accounting software for a small business and make the right choice for your needs.

Accounting Software for a Small Business: Your Gateway to Financial Success

In the realm of small businesses, navigating the complexities of accounting can be a daunting task. Fortunately, accounting software can serve as your trusty sidekick, streamlining your financial management and empowering you to make informed decisions. With a myriad of options available, selecting the right software can seem like navigating a minefield. But fear not, for this comprehensive guide will illuminate the path to finding the perfect accounting software for your small business.

The Bedrock of Accounting Software: Core Features

Before delving into the specific features of accounting software, let’s establish a solid foundation by exploring its core functions. At its heart, accounting software automates essential accounting tasks such as:

- Recording and tracking income and expenses

- Generating invoices and managing customer payments

- Reconciling bank accounts

- Creating financial reports

These fundamental capabilities provide a comprehensive overview of your financial health, allowing you to monitor cash flow, assess profitability, and make strategic decisions with confidence.

Essential Considerations: Tailoring Your Software to Your Needs

Choosing accounting software is akin to finding the perfect pair of shoes—it must fit your business like a glove. To ensure a seamless fit, consider the following factors:

- Business size and complexity: The size and nature of your business will determine the level of functionality you require.

- Industry-specific needs: Industries have unique accounting requirements. Choose software that caters to the specific needs of your industry.

- Integration with other systems: Seamless integration with your existing systems, such as CRM or e-commerce platforms, can streamline operations and save you time.

- Scalability: Opt for software that can grow with your business as it expands.

- Ease of use: User-friendly software makes it effortless to navigate and complete tasks efficiently.

Financial Reporting: Unlocking Insights, Empowering Decisions

Financial reporting is the backbone of accounting, providing you with a clear picture of your financial performance. Accounting software simplifies this process by generating a range of reports, including:

- Balance sheet: A snapshot of your assets, liabilities, and owner’s equity at a specific point in time.

- Income statement: A summary of your revenue, expenses, and profits over a specific period.

- Cash flow statement: A detailed breakdown of your cash inflows and outflows.

These reports serve as valuable tools for:

- Assessing financial health

- Identifying trends and patterns

- Making informed business decisions

Ongoing Support: A Lifeline for Your Accounting Journey

Reliable customer support and access to updates are the lifeblood of any accounting software. When the inevitable accounting conundrum arises, having a knowledgeable support team at your fingertips can save you countless hours of frustration. Upgrades and updates, meanwhile, ensure that your software remains current with the latest accounting practices and security standards.

Cloud-Based Accounting: The Future of Financial Management

In today’s digital age, cloud-based accounting software has emerged as the gold standard for small businesses. By storing your financial data online, you gain access to your accounting information from anywhere, at any time. Cloud-based software also offers:

- Enhanced collaboration: Multiple users can access and edit data simultaneously, fostering seamless teamwork.

- Automatic backups: Regular backups protect your data from loss or damage, giving you peace of mind.

- Reduced hardware costs: Eliminate the need for expensive servers and IT equipment.

Meet [Accounting Software Name]: A Small Business Powerhouse

If you’re seeking a robust and user-friendly accounting software tailored specifically to the needs of small businesses, [Accounting Software Name] stands out as a shining star. With its intuitive interface and comprehensive feature set, [Accounting Software Name] empowers you to:

- Manage invoices, expenses, and payments with ease

- Generate customizable financial reports

- Access real-time financial data from anywhere

- Receive exceptional customer support

Conclusion: Embracing the Power of Accounting Software

Choosing the right accounting software for your small business is a journey, not a destination. By carefully considering your needs and exploring the available options, you can find a solution that will streamline your accounting processes, provide invaluable insights, and fuel your business growth. Remember, accounting software is not merely a tool—it’s an investment in the financial future of your small business. Embrace its power and watch your business flourish!

Accounting Software for a Small Business

Are you struggling to keep track of your small business’s finances? Are you tired of spending hours manually entering data into spreadsheets? If so, it’s time to invest in accounting software. Accounting software can help you automate many of your accounting tasks, freeing up your time to focus on other aspects of your business. And with so many different accounting software programs on the market, there’s sure to be one that’s right for your business.

But with so many options to choose from, how do you know which accounting software is right for your small business? Here are a few things to keep in mind when making your decision:

Ease of use

The best accounting software is easy to use, even if you don’t have any accounting experience. Look for software that has a user-friendly interface and clear instructions. You should also be able to get help from the software’s customer support team if you need it.

Features

The features you need in your accounting software will depend on the size and complexity of your business. However, there are some basic features that all small businesses should look for, such as:

· Invoicing

· Expense tracking

· Income tracking

· Reporting

Price

Accounting software can range in price from free to hundreds of dollars per month. The price you pay will depend on the features you need and the number of users you have. When budgeting for accounting software, be sure to factor in the cost of implementation and training.

Support

Good customer support is essential for any software, but it’s especially important for accounting software. You want to be sure that you can get help if you have any problems with the software. Look for software that offers live chat, phone support, and email support.

Integration

If you use other business software, such as a CRM or e-commerce platform, you’ll want to make sure that your accounting software integrates with it. This will allow you to share data between your different software programs, which can save you time and money.

Scalability

As your business grows, you’ll need accounting software that can grow with you. Look for software that can handle the increased volume of transactions and users. You should also be able to add on new features as needed.

Cloud-based vs. on-premise

Cloud-based accounting software is hosted on a remote server, while on-premise accounting software is installed on your own computer. Cloud-based accounting software is more popular today because it is easier to access and maintain. However, on-premise accounting software may be a better option if you have security concerns.

Once you’ve considered all of these factors, you can start narrowing down your options. Here are a few of the most popular accounting software programs for small businesses:

· FreshBooks

· Xero

· QuickBooks Online

· Wave

· Zoho Books

These programs all offer a variety of features to help you manage your small business’s finances. They are also all relatively easy to use and affordable. To learn more about these programs, visit their websites or read reviews from other small business owners.

Conclusion

Investing in the right accounting software can significantly enhance your small business’s financial management and save you both time and money. By following the tips in this article, you can choose the right software for your business and start reaping the benefits today.