Selecting the Right A-Rated Commercial Truck Insurance Company

Navigating the labyrinth of commercial truck insurance can be daunting, especially when seeking providers with impeccable financial stability and a proven track record. A-rated commercial truck insurance companies, as designated by reputable agencies like AM Best or Fitch Ratings, stand out as beacons of reliability and fiscal prudence. Choosing the right A-rated insurer is paramount to safeguarding your business against unforeseen financial liabilities and ensuring peace of mind while you’re on the road.

Identifying A-Rated Commercial Truck Insurance Companies

Delving into the vast realm of commercial truck insurance companies, it’s imperative to identify those that have earned the coveted A-rating. This distinction signifies a company’s exceptional financial strength, claims-paying ability, and overall stability. It’s a testament to the insurer’s unwavering commitment to fulfilling its financial obligations and providing reliable coverage to its policyholders.

How to Find A-Rated Commercial Truck Insurance Companies:

- Consult Independent Rating Agencies: Renowned rating agencies such as AM Best, Fitch Ratings, and Standard & Poor’s rigorously evaluate insurance companies and assign ratings based on their financial health and claims-handling capabilities. These agencies provide valuable insights into an insurer’s ability to meet its financial commitments and honor claims.

- Check Company Websites: Many reputable commercial truck insurance companies proudly display their A-ratings on their websites. This serves as a testament to their financial stability and commitment to providing reliable coverage to their policyholders.

- Ask for Referrals: Networking with other truck owners and industry professionals can yield valuable referrals to A-rated insurance providers. These individuals have firsthand experience with different insurance companies and can provide insights into their reliability and customer service levels.

Vetting the Top A-Rated Commercial Truck Insurance Companies

Once you’ve identified a pool of A-rated commercial truck insurance companies, it’s time to meticulously vet each one to determine the best fit for your business. Consider the following factors:

- Coverage Options and Limits: Carefully review the coverage options and limits offered by each insurer to ensure they align with the specific risks and needs of your trucking operation. Look for policies that provide comprehensive coverage, including liability, collision, cargo, and uninsured/underinsured motorist protection.

- Policy Exclusions and Limitations: Understand the exclusions and limitations within each policy to avoid any coverage gaps or surprises down the road. Pay close attention to the specific conditions that may affect your coverage, such as the types of cargo transported or the geographical limits of the policy.

- Claims Handling Process: Inquire about the insurance company’s claims handling process, including their responsiveness, efficiency, and track record for resolving claims fairly and promptly. You want an insurer that will be there for you when you need them most.

- Customer Service and Support: Evaluate the level of customer service and support provided by each insurer. Look for companies that offer dedicated account managers, 24/7 claims reporting, and readily available support resources. Excellent customer service can make all the difference when you have questions or need assistance.

A-Rated Commercial Truck Insurance Companies: The Key to Financial Security

When it comes to protecting your commercial trucking business, choosing the right insurance company is paramount. With the myriad of options available, it can be daunting to navigate the market and make an informed decision. However, one key indicator of a reputable and reliable insurance provider is their A-rating from independent agencies such as AM Best, Fitch Ratings, and Standard & Poor’s. These agencies meticulously evaluate insurance companies’ financial stability, claims-paying ability, and overall performance, providing peace of mind to policyholders.

A-rated commercial truck insurance companies stand out in the industry for their exceptional financial strength and reliability. They possess the financial resources to meet their obligations, even in the face of significant claims or market fluctuations. This financial stability ensures that your claims will be paid promptly and without hassle, allowing you to focus on your business operations without the added stress of insurance-related worries.

Why Choose A-Rated Companies?

When it comes to commercial truck insurance, choosing A-rated companies offers a plethora of advantages:

- Financial Stability: A-ratings are a testament to the insurer’s financial strength and ability to honor its obligations, even during challenging economic times.

- Claims-Paying Ability: A-rated companies have a proven track record of paying claims promptly and fairly, ensuring your business is protected when the unexpected occurs.

- Reputation: A-ratings are a mark of excellence in the insurance industry, indicating that the company is reputable and trustworthy.

- Peace of Mind: Knowing that you’re insured by an A-rated company provides peace of mind and allows you to focus on running your business without insurance-related concerns.

Factors to Consider When Choosing an A-Rated Commercial Truck Insurance Company

While A-ratings are a crucial indicator of financial strength, there are other factors to consider when selecting an insurance provider. These include:

- Coverage Options: Ensure that the company offers the specific coverage options you need to protect your business adequately.

- Pricing: Compare quotes from multiple A-rated companies to find the best value for your money.

- Customer Service: Choose a company with a reputation for excellent customer service, as they will be your point of contact in the event of a claim.

- Industry Experience: Seek an insurer with experience in the trucking industry, as they will have a deep understanding of your unique risks and needs.

Conclusion

Choosing an A-rated commercial truck insurance company is a wise investment in the financial security of your business. These companies provide peace of mind, knowing that you’re protected by a financially stable insurer who will be there for you when you need them most. By carefully considering all the factors discussed above, you can make an informed decision and safeguard your business against unforeseen risks.

Top-Rated Commercial Truck Insurance Companies

Navigating the complexities of commercial truck insurance can be a daunting task, especially when searching for reputable and reliable providers. To assist you in making an informed decision, we’ve compiled a comprehensive review of some of the most highly-rated A-rated commercial truck insurance companies in the industry. These companies have consistently demonstrated their commitment to providing quality coverage, exceptional customer service, and competitive pricing.

Before we delve into the specifics of each provider, let’s briefly explore the significance of A-rated insurance companies. An A-rating from agencies like AM Best and Standard & Poor’s signifies financial stability, claims-paying ability, and overall reliability. By opting for an A-rated provider, you can rest assured that your insurance company has the resources and expertise to fulfill its obligations and provide you with the necessary protection.

Progressive Commercial

Progressive Commercial has established a strong reputation as a leading provider of commercial truck insurance. Their policies offer a comprehensive range of coverage options, including liability, physical damage, and cargo insurance. Progressive is known for its user-friendly online platform, which allows you to easily obtain quotes, manage your policies, and file claims. Their competitive pricing and discounts for safe driving records make them an attractive choice for many truck owners.

One of the standout features of Progressive Commercial is their “Snapshot” program. This innovative device tracks your driving habits and provides personalized feedback, helping you improve your driving skills and potentially reducing your insurance premiums. The program’s goal is to promote safer driving practices and reward responsible truck operators.

Travelers

Travelers is another highly-rated A-rated commercial truck insurance provider with a long history of serving the transportation industry. They offer a tailored approach to insurance, understanding the unique risks and challenges faced by truck owners and operators. Their policies are designed to provide comprehensive coverage, including liability, physical damage, cargo, and workers’ compensation insurance.

Travelers is committed to providing exceptional customer service, with dedicated claims adjusters and a 24/7 claims hotline. They also offer a variety of risk management resources, such as safety training programs and fleet safety assessments. By partnering with Travelers, truck owners can benefit from their industry expertise and comprehensive support.

Zurich North America

Zurich North America rounds out our list of top-rated A-rated commercial truck insurance providers. With a global presence and a deep understanding of the transportation industry, Zurich provides tailored insurance solutions for truck owners and operators of all sizes. Their policies cover a wide range of risks, including liability, physical damage, cargo, and specialized transportation insurance.

Zurich North America places a strong emphasis on innovation and technology. Their e-solutions platform allows you to manage your policies, access real-time information, and submit claims quickly and efficiently. The company’s commitment to sustainability is also evident in their efforts to reduce their carbon footprint and promote environmentally responsible practices in the transportation industry.

Making an Informed Decision

Choosing the right commercial truck insurance provider is crucial for protecting your business and ensuring your peace of mind. By carefully considering the factors discussed in this article, you can make an informed decision that aligns with your specific needs and budget. Remember to compare quotes from multiple A-rated providers, read customer reviews, and consult with a licensed insurance agent to find the best fit for your operation.

Commercial truck insurance is not just a legal requirement; it’s an investment in the safety and success of your business. By partnering with a reputable A-rated provider, you can mitigate risks, protect your assets, and enjoy the peace of mind that comes with knowing you’re covered in the event of an unexpected event.

A-Rated Commercial Truck Insurance Companies: Navigating Insurance Options for Safeguard and Peace of Mind

In the realm of commercial trucking, safeguarding your assets and ensuring peace of mind is paramount. One crucial aspect of this is securing reliable commercial truck insurance. When seeking a provider, it’s imperative to consider the crème de la crème – the A-rated commercial truck insurance companies. These companies have undergone rigorous evaluations by independent rating agencies, earning their exceptional ratings for financial strength and claims-paying ability. As you embark on your search, let’s explore the key factors to consider when selecting the A-rated partner that aligns with your specific needs.

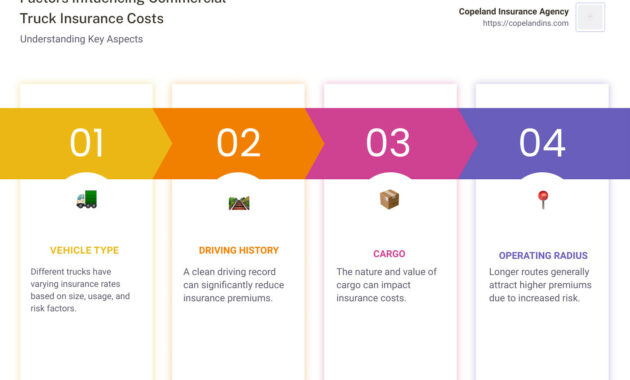

Factors to Consider: Unraveling the Essentials for Smart Insurance Decisions

Choosing the A-rated commercial truck insurance company that’s the perfect fit for your business requires careful consideration of several crucial factors. Let’s delve into each factor in detail to ensure an informed decision:

Coverage Options: Tailoring Protection to Your Unique Business

The coverage options offered by an insurance company are of utmost importance. You need a policy that provides comprehensive protection against the risks your business faces. Essential coverage options to consider include:

– Liability insurance: Safeguarding you from financial responsibility in case of accidents involving bodily injury or property damage to others.

– Physical damage coverage: Protecting your truck and trailer from damage caused by collisions, vandalism, or theft.

– Cargo insurance: Ensuring the goods you transport are covered in case of loss or damage.

Financial Stability: Assessing the Company’s Ability to Pay Claims

Financial stability is a cornerstone when selecting an insurance company. You want to trust that the company has the financial resources to honor its claims obligations, even in challenging economic times. Look for A-rated companies with strong financial reserves and a proven track record of timely and fair claims settlements.

Customer Service: The Backbone of Support and Peace of Mind

When you have a claim or need assistance, exceptional customer service is invaluable. Seek an insurance company known for its responsive and helpful staff. Consider the following factors:

– Accessibility: How easy is it to contact the company via phone, email, or online chat?

– Responsiveness: Are your inquiries promptly addressed and resolved?

– Expertise: Do the customer service representatives demonstrate a comprehensive understanding of commercial trucking insurance?

Premium Costs: Striking a Balance Between Coverage and Affordability

While cost is an important consideration, it should not be the sole determining factor. Remember, the cheapest insurance may not provide the coverage and protection you need. Instead, strive for a balance between comprehensive coverage and affordable premiums. Get quotes from multiple A-rated insurance companies to compare costs, but don’t compromise on essential coverage.

Additional Tips for Making an Informed Decision: Equipping Yourself for Success

Beyond these key factors, consider the following additional tips to make an informed decision:

– Read reviews and customer testimonials to gain insights into the experiences of policyholders.

– Consult with your insurance broker or agent for professional guidance and personalized recommendations.

– Regularly review your insurance coverage and make adjustments as needed to ensure it remains aligned with your business needs.

A-Rated Commercial Truck Insurance Companies: Securing Coverage for Your Business

In the realm of commercial trucking, having reliable insurance is not a luxury but a necessity. With an A-rated commercial truck insurance policy, you can safeguard your business against financial liabilities and unforeseen circumstances on the road. These reputable and financially stable insurance providers offer tailored policies to meet the unique needs of trucking companies, ensuring peace of mind and protection in the event of accidents, property damage, or lawsuits.

Steps to Secure Coverage

To obtain insurance, it’s essential to provide the insurer with comprehensive information about your business operations, vehicles, drivers, and intended hauls. This includes:

- Business details: Legal structure, revenue, claims history, and loss control measures

- Vehicle information: Year, make, model, VIN, odometer readings, and maintenance records

- Driver credentials: Licenses, endorsements, experience, and safety records

- Operational details: Types of commodities transported, routes, and frequency of trips

By providing accurate and detailed information, insurers can assess the risks associated with your business and offer customized quotes. Comparing these quotes and selecting the most appropriate policy will help you secure the coverage you need at a competitive price.

Five Essential Factors to Consider When Choosing an A-Rated Commercial Truck Insurance Provider

-

Financial Strength and Stability: Look for insurers with strong financial ratings from reputable organizations like AM Best, Fitch Ratings, and Standard & Poor’s. These ratings indicate the company’s ability to meet its obligations and pay claims promptly.

-

Coverage Options and Limits: Determine the types of coverage you need, such as liability, physical damage, and cargo insurance. Ensure the policy offers sufficient limits to cover potential expenses in the event of an accident or loss.

-

Deductibles and Premiums: Consider the balance between premiums and deductibles. Higher deductibles often result in lower premiums, but they increase your out-of-pocket expenses in the event of a claim. Choose options that align with your budget and risk tolerance.

-

Claims Handling: Inquire about the insurer’s claims process and reputation. Find a company known for prompt and fair claims settlements. Positive testimonials and industry awards can provide valuable insights.

-

Personalized Service and Risk Management: Look for insurers that offer personalized risk management services, such as safety training, fleet inspections, and tailored loss control measures. These services can help reduce risks, prevent accidents, and potentially lower premiums over time.