Overview of Merchant Cash Advances: A Comprehensive Guide

In the ever-evolving landscape of business financing, merchant cash advances have emerged as a popular option for businesses seeking short-term capital. These advances, essentially loans, are designed to provide businesses with a swift infusion of funds that can be repaid through a percentage of daily credit card sales. However, like any financial instrument, merchant cash advances come with their own set of complexities and potential pitfalls. That’s where the expertise of a merchant cash advance attorney in New York becomes invaluable.

Merchant cash advance attorneys possess a deep understanding of the legal and financial intricacies surrounding merchant cash advances. They can guide businesses through the application process, ensuring that they fully comprehend the terms and conditions of the agreement. Moreover, these attorneys can negotiate favorable terms on behalf of their clients, protecting their interests and mitigating potential risks.

Advantages and Disadvantages of Merchant Cash Advances

Before delving into the legal considerations of merchant cash advances, it’s essential to understand their inherent advantages and disadvantages. On the one hand, these advances offer several benefits:

- Swift access to funds: Merchant cash advances can be approved and disbursed within a matter of days, providing businesses with a rapid source of capital.

- No collateral required: Unlike traditional loans, merchant cash advances do not require collateral, making them accessible to businesses that may not have tangible assets to secure a loan.

- Flexible repayment options: Repayments are typically based on a percentage of daily credit card sales, providing businesses with flexibility during periods of fluctuating revenue.

However, merchant cash advances also come with certain drawbacks:

- High interest rates: Merchant cash advances often carry higher interest rates compared to traditional loans.

- Potential impact on credit scores: Late or missed payments can negatively affect a business’s credit score.

- Limited loan amounts: Merchant cash advances are typically offered in smaller amounts compared to traditional loans.

Legal Considerations for Merchant Cash Advances

Given the unique nature of merchant cash advances, there are a number of legal considerations that businesses should be aware of:

- Loan agreements: It’s crucial to carefully review the loan agreement before signing. Ensure that you understand the loan amount, interest rate, repayment terms, and any fees associated with the advance.

- Disclosure requirements: Lenders are required to provide borrowers with certain disclosures, including the annual percentage rate (APR) and the total cost of the loan.

- State laws: Merchant cash advances are regulated at the state level, so it’s important to familiarize yourself with the specific laws and regulations applicable in your jurisdiction.

- Consumer protection laws: In some cases, merchant cash advances may be subject to consumer protection laws, such as the Truth in Lending Act.

Seeking Legal Advice

Navigating the complex legal landscape of merchant cash advances can be challenging. If you’re considering obtaining a merchant cash advance, it’s highly recommended to consult with an experienced merchant cash advance attorney in New York. These attorneys can provide you with personalized legal advice, ensuring that you make informed decisions and protect your business’s interests.

Meet the Legal Eagles: Navigating Merchant Cash Advances in the Concrete Jungle of New York City

If you’re a business owner in the bustling metropolis of New York City, you may have come across the term “merchant cash advance” (MCA). These financial lifelines can be a quick way to get your hands on some much-needed capital, but they also come with a unique set of legal considerations. That’s where we swoop in – merchant cash advance attorneys in New York City. We’re here to guide you through the legal labyrinth, ensuring you make the right choices for your business.

Legal Considerations for Merchant Cash Advances

Before you sign on the dotted line, it’s crucial to understand the legal implications of MCA agreements. These agreements often contain complex terms and conditions that can be difficult to decipher without legal guidance. Engaging with a knowledgeable attorney can help you navigate the legal landscape, ensuring you’re not signing away your business’s future.

1. Know Your Agreement Inside Out

Think of an MCA agreement as a legal roadmap, guiding you through the terms of your financial journey. It outlines the amount you’re borrowing, the repayment period, and the all-important factor rate – the interest rate you’ll be paying. A lawyer can scrutinize this agreement, clarifying any confusing clauses and highlighting potential pitfalls.

2. Understand the Nuts and Bolts of Repayment

Repaying an MCA is like walking a tightrope – you need to balance timely payments with the well-being of your business. Your attorney can explain the repayment process, including the impact of early payments and the consequences of late payments. They can also help you negotiate a repayment plan that aligns with your business’s financial capabilities, preventing you from falling into a debt trap.

3. Be Aware of Your Rights and Obligations

MCA agreements are not just legal documents – they’re also contracts that bind you to certain obligations. An attorney can inform you of your rights as a borrower, ensuring you’re not taken advantage of. They can also clarify your responsibilities, such as maintaining proper financial records and providing timely updates.

4. Protect Your Assets

Your business is your baby, and you want to protect it with all your might. An MCA agreement may include provisions that could put your assets at risk, such as personal guarantees or liens on your property. An attorney can help you understand these provisions and negotiate terms that safeguard your assets, ensuring your business remains your own.

5. Seek Legal Counsel Before Signing

Don’t let a signature on an MCA agreement be your first step toward financial freedom. Before you put pen to paper, seek legal counsel. An experienced attorney can provide invaluable advice, ensuring you make an informed decision. It’s like having a legal GPS, guiding you toward a successful financial journey and protecting your business’s well-being.

Merchant Cash Advance Attorney New York: Navigating the Risks and Benefits

If you’re a business owner in New York City, you may have considered a merchant cash advance (MCA) to boost your cash flow. While MCAs can offer quick and easy access to funds, it’s crucial to understand the potential risks involved before signing on the dotted line. This article provides comprehensive insights into the perils associated with MCAs, empowering you to make an informed decision.

Understanding Merchant Cash Advances

Merchant cash advances are short-term loans that are secured by your future credit card sales. Unlike traditional loans, MCAs do not require a lengthy application process or collateral. Instead, lenders base their decision on your business’s credit card processing history. If approved, you receive a lump sum that you repay through a percentage of your daily credit card sales.

Potential Risks of Merchant Cash Advances

While MCAs can provide a much-needed cash infusion, they come with inherent risks that need to be carefully considered:

1. High Interest Rates and Fees

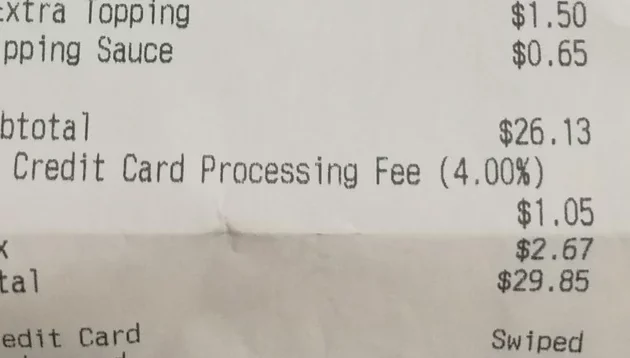

MCAs typically carry higher interest rates than traditional loans. The interest rate can range from 10% to 50% per year, significantly increasing your repayment costs. Additionally, MCA providers often charge various fees, such as origination fees, processing fees, and prepayment penalties, which further inflate the total cost of the advance.

2. Personal Liability

Unlike traditional loans, MCAs are often unsecured, meaning that the lender cannot seize any of your assets if you default on the loan. However, this does not mean that you are not personally liable for the debt. If you have provided a personal guarantee as part of the MCA agreement, the lender can pursue you for payment even if your business fails.

3. Impact on Credit Score

MCAs can have a negative impact on your business’s credit score. Because MCA providers report the loan as a tradeline on your credit report, it can lower your credit rating and make it more difficult to obtain traditional financing in the future. Furthermore, if you default on the MCA, it will appear as a negative mark on your credit report, further damaging your creditworthiness.

4. Legal Considerations

MCAs are regulated by both federal and state laws. In New York, MCAs are governed by the New York Finance Law, which imposes certain restrictions on the interest rates and fees that lenders can charge. However, it’s important to consult with a merchant cash advance attorney in New York to ensure that the MCA provider is complying with all applicable laws and regulations.

Weighing the Risks and Benefits

Before taking out an MCA, it’s essential to carefully weigh the risks and benefits. MCAs can be a viable financing option for businesses with limited traditional financing options. However, their high cost and potential impact on your credit score make them a risky proposition. If you’re considering an MCA, it’s crucial to consult with a reputable merchant cash advance attorney in New York to understand your rights and obligations fully.

Tips for Minimizing Risks

If you decide to proceed with an MCA, there are steps you can take to minimize the risks:

1. Shop Around

Compare rates and fees from multiple MCA providers before making a decision. Negotiate the best possible terms to reduce your overall cost of borrowing.

2. Read the Contract Carefully

Don’t sign anything until you have thoroughly reviewed the MCA contract with a qualified attorney. Make sure you understand the interest rates, fees, repayment terms, and any personal liability provisions.

3. Build a Strong Business Plan

Before applying for an MCA, develop a solid business plan that outlines your financial goals and how you plan to repay the loan. This will help you demonstrate to the lender that your business is a good investment.

Conclusion

Merchant cash advances can be a double-edged sword. While they offer quick access to funds, they come with significant risks that can outweigh the benefits. By understanding the potential pitfalls and taking steps to mitigate them, you can make an informed decision about whether an MCA is right for your business. If you’re considering taking out an MCA in New York City, don’t hesitate to consult with a reputable merchant cash advance attorney to protect your interests and maximize the chances for a successful outcome.

Merchant Cash Advance Attorneys in New York City: A Comprehensive Guide

Navigating the complex legal landscape surrounding merchant cash advances (MCAs) can be a daunting task. That’s where merchant cash advance attorneys in New York City come into play, offering expert guidance and representation to businesses seeking to secure or repay MCA financing.

In this comprehensive article, we’ll delve into the world of MCA attorneys in the Big Apple, providing insights into the importance of finding the right legal counsel, exploring the key considerations in the attorney selection process, and highlighting the invaluable role these attorneys play in protecting your business interests.

Finding the Right Attorney

Selecting the right MCA attorney is crucial for ensuring a successful outcome in your MCA-related matters. Look for an experienced attorney with a proven track record in business law and financing. They should possess an in-depth understanding of MCA agreements, the legal implications of MCA transactions, and the regulatory environment surrounding MCA lending.

Seek out attorneys who are members of professional organizations such as the American Bar Association or the New York State Bar Association. These organizations maintain high standards of ethical conduct and provide resources for attorneys to stay up-to-date on the latest legal developments.

Don’t hesitate to schedule consultations with potential attorneys to assess their experience, expertise, and communication style. Find an attorney who you feel comfortable with and who you believe can effectively represent your interests.

Assessing Your Needs

Before you embark on the search for an MCA attorney, it’s important to assess your specific legal needs. Consider the following factors:

- Are you seeking an attorney to review or negotiate an MCA agreement before you sign?

- Do you need legal assistance in understanding the terms and conditions of your existing MCA contract?

- Are you facing a dispute or default with an MCA lender?

- Are you considering restructuring or terminating your MCA financing?

By clearly defining your needs, you can effectively communicate them to potential attorneys and find the best match for your situation.

Negotiating MCA Agreements

If you’re entering into a new MCA agreement, it’s essential to have an experienced attorney negotiate the terms on your behalf. An attorney can help you understand the complex language in MCA agreements and ensure that your interests are protected.

Your attorney can negotiate key provisions such as the advance amount, repayment terms, interest rates, and default consequences. They can also advise you on potential pitfalls and suggest alternative financing options if appropriate.

Dispute Resolution and Litigation

In the event of a dispute or default with an MCA lender, an MCA attorney can provide invaluable assistance in resolving the matter. They can represent you in negotiations with the lender, file legal claims on your behalf, or defend you against lender lawsuits.

Your attorney will assess the facts of your case, evaluate your legal options, and develop a strategy to protect your business and financial interests. They will negotiate on your behalf to reach a favorable settlement or, if necessary, represent you in court.

An MCA attorney can also assist you in exploring alternative dispute resolution mechanisms such as mediation or arbitration, which can provide a more cost-effective and efficient path to resolution.

Conclusion

Navigating the legal complexities of merchant cash advances in New York City requires specialized knowledge and experience. By engaging the services of an experienced MCA attorney, businesses can protect their interests, ensure compliance with applicable laws, and mitigate potential risks. Whether you’re seeking to secure financing, review an MCA agreement, resolve a dispute, or explore refinancing options, an MCA attorney can provide invaluable guidance and representation.

Merchant Cash Advance Attorney New York: Navigating the Legal Maze

Merchant cash advances (MCAs) have become increasingly popular financing options for small businesses in need of a quick influx of capital. While these advances can provide much-needed funds, they can also come with hefty fees and restrictive terms. If you’re facing challenges with an MCA, seeking legal representation is crucial. Finding a reputable merchant cash advance attorney in New York is the first step towards protecting your interests.

Preparing for Legal Representation

Before consulting an attorney, it’s essential to gather all relevant documentation. This includes your MCA agreement, any correspondence with the lender, and any financial statements or other documents that pertain to your business. Organizing these materials will help your attorney better understand your situation and develop a legal strategy tailored to your specific needs.

Understanding Your Legal Options

Merchant cash advance attorneys can provide guidance on various legal options available to you, including:

- Negotiating with the lender to modify the terms of your MCA

- Filing a breach of contract lawsuit if the lender has violated the agreement’s terms

- Defending against collection actions if the lender is pursuing legal remedies

Choosing the Right Attorney

When selecting a merchant cash advance attorney in New York, it’s essential to consider their experience, reputation, and fees. It’s advisable to schedule consultations with several attorneys to find the right fit for your case. During the consultation, don’t hesitate to ask questions about their experience handling MCA disputes and their proposed legal strategy. Look for an attorney who is responsive, empathetic, and dedicated to protecting your interests.

What to Expect During the Legal Process

The legal process can vary depending on the specifics of your case. In general, you can expect your attorney to:

- Review the relevant documents and discuss your legal options

- Negotiate with the lender on your behalf

- Prepare and file any necessary legal documents

- Represent you in court, if necessary

Avoiding Common Pitfalls

To increase your chances of a successful outcome, it’s crucial to avoid common pitfalls, such as:

- Signing an MCA agreement without fully understanding its terms

- Missing payments or defaulting on your loan

- Ignoring correspondence from the lender regarding your MCA

By taking a proactive approach and seeking legal advice when necessary, you can navigate the complexities of merchant cash advance agreements and protect your business from financial distress.

Merchant Cash Advance Attorney New York: Protecting Your Business from Unfair Practices

Are you a business owner in New York struggling with a merchant cash advance (MCA)? You’re not alone. MCAs have become a popular financing option for small businesses, but they often come with high fees and restrictive terms. If you’re facing legal issues related to an MCA, it’s crucial to seek the advice of an experienced merchant cash advance attorney in New York.

Working with an Attorney

An attorney can help you in several ways when it comes to merchant cash advances:

-

Negotiate with the Lender: Attorneys can negotiate with the lender on your behalf, potentially lowering interest rates, reducing fees, or extending the loan term.

-

File Lawsuits: If negotiations fail, an attorney can file a lawsuit against the lender. This can help you recover damages or force the lender to comply with the law.

-

Provide Legal Guidance: Attorneys can provide valuable legal guidance on your rights and responsibilities regarding MCAs. They can explain the terms of your contract, advise you on your options, and protect your interests.

What to Look for in an Attorney

When choosing a merchant cash advance attorney, it’s important to consider:

-

Experience: Look for an attorney with extensive experience handling MCA cases.

-

Reputation: Choose an attorney with a strong reputation for ethical and effective legal representation.

-

Fees: Be clear about the attorney’s fees and payment structure upfront.

Alternatives to Legal Action

Before pursuing legal action, consider alternative options:

-

Communication: Reach out to the lender directly and express your concerns.

-

Negotiation: Attempt to negotiate a settlement that works for both parties.

-

Mediation: Seek the help of a mediator to facilitate a resolution between you and the lender.

Understanding Merchant Cash Advances

MCAs are short-term loans that are typically repaid over a short period of time, often with daily or weekly payments. They are often used by businesses that need quick access to funds but may not qualify for traditional bank loans.

Potential Legal Issues

Unfortunately, MCAs can be associated with several legal issues, including:

-

Unfair Lending Practices: Lenders may engage in deceptive marketing practices or charge excessive fees.

-

Breach of Contract: Lenders may violate the terms of the MCA, leading to financial penalties for the borrower.

-

Collection Harassment: Lenders may use aggressive tactics to collect payments, even if the borrower is experiencing financial hardship.

Avoiding Legal Pitfalls

To avoid legal pitfalls with merchant cash advances:

-

Do Your Research: Understand the terms of the MCA thoroughly before signing any documents.

-

Seek Legal Advice: Consult with an attorney before entering into an MCA agreement.

-

Negotiate Favourable Terms: Negotiate favourable terms, such as lower interest rates and flexible payment options.

-

Document Everything: Keep accurate records of all communications and transactions related to the MCA.

Conclusion

If you’re facing legal issues with a merchant cash advance, don’t hesitate to seek the help of an experienced merchant cash advance attorney in New York. An attorney can protect your rights, negotiate with lenders, and ensure that you’re treated fairly. By understanding the potential legal pitfalls and taking the necessary precautions, you can avoid costly mistakes and safeguard your business from unfair practices.