Merchant Cash Advances for Small Businesses: The Path to Growth

In the ever-changing landscape of the business world, small businesses often face the challenge of securing funding to fuel their growth aspirations. Enter merchant cash advances—a financial lifeline that can bridge the gap between where you are and where you want to be.

Merchant Cash Advances: A lifeline for small businesses

You’ve poured your heart and soul into your business, but growth can sometimes feel like a distant dream. Merchant cash advances step into the picture, offering a helping hand to small businesses in need of a cash infusion. These advances provide businesses with the funds they need to purchase equipment, expand inventory, hire staff, or pursue marketing initiatives—all essential ingredients for growth.

Think of merchant cash advances as a cash injection that can revitalize your business. It’s not a loan, so you don’t have to worry about fixed monthly payments or interest rates. Instead, you’ll repay the advance as a percentage of your daily credit card sales. It’s a flexible and convenient way to access funding without disrupting your cash flow.

How Merchant Cash Advances Can Help Small Businesses

Small businesses are the backbone of our economy, but they often face unique challenges when it comes to securing funding. Merchant cash advances offer a tailored solution to these challenges, providing a lifeline that can help businesses overcome hurdles and reach their full potential.

Fueling Business Growth

Merchant cash advances act as a catalyst for growth, providing small businesses with the capital they need to expand their operations and pursue new opportunities. This funding can be used to purchase new equipment, hire additional staff, or expand into new markets—all essential steps on the path to success.

For instance, a small restaurant struggling to keep up with demand could use a merchant cash advance to purchase a new oven, allowing them to increase their production capacity and serve more customers. Similarly, a retail store seeking to expand its product line could use the advance to stock up on new inventory, attracting more customers and boosting sales.

Bridging the Funding Gap

Traditional financing options, such as bank loans, can be elusive for many small businesses due to strict credit requirements and lengthy approval processes. Merchant cash advances offer a more accessible alternative, providing funding to businesses that may not qualify for traditional loans.

Imagine a small business owner with a great idea but a less-than-perfect credit score. A merchant cash advance can provide the funding they need to get their business off the ground without the hassle of traditional loan applications. This funding can be instrumental in bridging the gap between a business’s current financial situation and its future potential.

Supporting Cash Flow

Unlike traditional loans, merchant cash advances do not require fixed monthly payments. Instead, businesses repay the advance as a percentage of their daily credit card sales. This flexible repayment structure aligns with a business’s cash flow, ensuring that they have the funds available to meet their repayment obligations without straining their finances.

For example, a seasonal business that experiences peaks and valleys in its cash flow could greatly benefit from a merchant cash advance. During peak seasons, they can make larger payments on the advance, and during slower periods, their payments will be smaller, providing them with much-needed financial flexibility.

Choosing a Merchant Cash Advance Provider

When selecting a merchant cash advance provider, it’s crucial to do your research and choose a reputable company that offers competitive rates and flexible terms. Here are some key factors to consider:

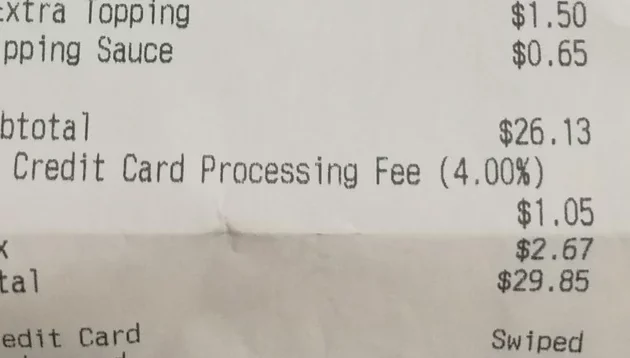

* Fees and interest rates: Different providers charge varying fees and interest rates on their advances. Compare multiple providers to find the best deal that meets your business’s needs.

* Repayment terms: Understand the repayment terms and make sure they align with your business’s cash flow. Choose a provider that offers flexible repayment options to avoid any financial strain.

* Customer service: Opt for a provider with a responsive and helpful customer service team. You want to work with a company that is there to support you throughout the process.

* Reputation: Read online reviews and testimonials to gauge the experiences of other businesses with the provider. A solid reputation is a good indicator of a reliable and trustworthy company.

Conclusion

Merchant cash advances offer a valuable financial tool for small businesses seeking to grow and succeed. By providing accessible funding, flexible repayment options, and support for cash flow, merchant cash advances can help businesses overcome hurdles and reach their full potential. However, it’s important to choose a reputable provider that offers competitive rates and flexible terms. With careful consideration and a trusted provider, small businesses can harness the power of merchant cash advances to fuel their growth and achieve their business goals.

Merchant Cash Advances: Small Business Funding That’s Right Around the Corner

In the competitive world of small business, every advantage counts. And when it comes to financing, a merchant cash advance (MCA) can be a powerful tool for growth. Unlike traditional loans, MCAs are quick and easy to get, with flexible repayment terms and no need for collateral. But before you jump into an MCA, it’s important to understand the pros and cons.

Pros of Merchant Cash Advances

MCAs offer a number of advantages for small businesses, including:

- Fast and easy approval: With an MCA, you can get funding in as little as 24 hours. The application process is simple and straightforward, and there’s no need to go through a lengthy underwriting process.

- Flexible repayment terms: MCAs are repaid as a percentage of your daily credit card sales. This means that your payments will fluctuate with your sales volume, so you’ll never have to worry about making a payment you can’t afford.

- No need for collateral: Unlike traditional loans, MCAs don’t require collateral. This makes them a great option for businesses that don’t have any assets to pledge.

- Quick access to funds: Once you’re approved for an MCA, you’ll have access to the funds immediately. This can be a lifesaver if you need to cover unexpected expenses or take advantage of a growth opportunity.

Cons of Merchant Cash Advances

While MCAs offer a number of advantages, there are also some potential drawbacks to consider:

- Higher interest rates: MCAs typically have higher interest rates than traditional loans. This is because they’re considered a higher-risk investment for lenders.

- Short repayment terms: MCAs typically have shorter repayment terms than traditional loans. This can make it difficult to budget for your payments.

- Early termination fees: If you need to pay off your MCA early, you may be charged an early termination fee. This can be a significant expense, so it’s important to factor it into your decision.

Is a Merchant Cash Advance Right for You?

Whether or not an MCA is right for you depends on your individual circumstances. If you need fast and easy access to funds and you’re comfortable with the higher interest rates and shorter repayment terms, an MCA could be a good option. However, if you’re looking for a more traditional loan with lower interest rates and longer repayment terms, an MCA may not be the best choice.

If you’re considering an MCA, it’s important to shop around and compare offers from multiple lenders. This will help you find the best deal on an MCA that meets your specific needs. Be careful to read the loan agreement carefully before you sign, so you understand all of the terms. Reach out to the small business administration of your state to ask about any additional options you may qualify for!

**Merchant Cash Advances Can Be a Lifeline for Small Businesses, But They’re Not Without Their Drawbacks**

If you’re a small business owner, you know that access to capital is essential for growth and success. But what do you do if you don’t have a strong credit history or traditional financing options aren’t available to you? That’s where merchant cash advances come in. Merchant cash advances are short-term loans that are repaid as a percentage of your future sales. They can be a great way to get the cash you need to expand your business, but they also come with some potential drawbacks.

**Here are a few things to keep in mind if you’re considering a merchant cash advance:**

**Pros of Merchant Cash Advances**

**1. Fast and easy to get.** Merchant cash advances are typically much faster and easier to get than traditional bank loans. You can often get approved for a merchant cash advance within 24 hours, and you don’t need to provide a lot of paperwork.

**2. No credit check required.** Merchant cash advances are not based on your credit score, so you can get approved even if you have bad credit.

**3. Flexible repayment terms.** Merchant cash advances are repaid as a percentage of your future sales, so you can adjust your payments based on your cash flow.

**Cons of Merchant Cash Advances**

**1. High interest rates.** Merchant cash advances typically have high interest rates, which can make them expensive in the long run.

**2. Fees.** Merchant cash advances often come with a variety of fees, such as application fees, processing fees, and late payment fees.

**3. Difficult to repay if your business is not doing well.** Merchant cash advances are repaid as a percentage of your future sales, so if your business is not doing well, you may have difficulty making your payments.

If you’re considering a merchant cash advance, it’s important to weigh the pros and cons carefully to make sure it’s the right option for your business.

**Here are some additional things to keep in mind:**

- Merchant cash advances are not regulated by the government, so it’s important to do your research and choose a reputable lender.

- Make sure you understand the terms of the loan before you sign anything.

- Be prepared to make regular payments, even if your business is not doing well.

If you’re not sure whether a merchant cash advance is right for your business, talk to a financial advisor.

**Merchant cash advances can be a great way to get the cash you need to grow your business, but it’s important to be aware of the potential drawbacks before you sign on the dotted line.**

**If you’re not sure whether a merchant cash advance is right for your business, talk to a financial advisor.**

Merchant Cash Advances: A Comprehensive Guide for Small Businesses

In today’s competitive business landscape, small businesses often face challenges in securing funding to kick-start or grow their operations. One increasingly popular option is the merchant cash advance, which provides quick access to capital for small businesses that may not qualify for traditional loans. However, before jumping on the merchant cash advance bandwagon, it’s crucial to understand its ins and outs, as well as explore alternative financing solutions that may better suit your specific needs.

What is a Merchant Cash Advance?

A merchant cash advance (MCA) is a type of financing that allows small businesses to borrow against their future credit card sales. Unlike traditional loans, MCAs are not based on credit history or collateral. Instead, lenders assess the business’s financial strength and potential for future revenue growth. Once approved, small businesses receive a lump sum of cash, which is repaid as a percentage of their daily credit card sales. MCAs typically have shorter repayment terms than traditional loans, ranging from 6 to 18 months.

Advantages of Merchant Cash Advances

- Fast and Easy Approval: The approval process for MCAs is relatively simple and straightforward, making it an attractive option for small businesses that need quick access to capital.

- No Collateral Required: Unlike traditional loans, MCAs do not require any collateral, making them accessible to small businesses that may not have significant assets.

- Flexible Repayment Terms: MCAs offer flexible repayment terms that are based on the business’s cash flow, ensuring that the business can comfortably repay the advance without straining its financial resources.

Disadvantages of Merchant Cash Advances

- High Interest Rates: Merchant cash advances typically come with higher interest rates compared to traditional loans, making it essential to carefully consider the potential impact on the business’s profitability.

- Limited Funding Amounts: MCAs often provide smaller funding amounts compared to traditional loans, which may not be sufficient for businesses with significant capital needs.

- Potential Legal Risks: MCAs fall under different regulatory frameworks than traditional loans, and it’s important to ensure that the contract is fully understood and legally compliant.

Alternatives to Merchant Cash Advances

While merchant cash advances can be a valuable financing tool, other options may be more suitable for certain businesses. Let’s explore some alternatives to MCAs:

- Small Business Loans: Traditional small business loans offer structured repayment terms, fixed interest rates, and larger funding amounts. This option is ideal for businesses with strong credit history and a proven track record.

- Lines of Credit: A line of credit provides businesses with a flexible source of funding that can be drawn on as needed. This option offers more control over borrowing and repayment, making it suitable for businesses with fluctuating cash flow.

- Equipment Financing: Equipment financing allows businesses to purchase essential equipment without paying the full cost upfront. This option is particularly beneficial for businesses that rely on equipment for their operations.

- Invoice Factoring: Invoice factoring involves selling unpaid invoices to a factoring company in exchange for an advance on the invoice amount. This option provides immediate access to cash while freeing up the business’s accounts receivable.

Ultimately, the best financing option for a small business depends on its specific needs, financial situation, and long-term goals. By carefully considering the alternatives to merchant cash advances, business owners can make an informed decision that aligns with their business objectives.

Merchant Cash Advances: A Lifeline for Small Businesses

In the ever-competitive landscape of small business, access to capital can often be the deciding factor between success and failure. Merchant cash advances (MCAs) have emerged as a popular financing option for small businesses, offering a quick and flexible way to obtain funding without the stringent requirements of traditional loans. If you’re considering an MCA for your business, read on to learn everything you need to know about applying for this type of financing.

How Do Merchant Cash Advances Work?

Unlike traditional loans, MCAs are not loans in the conventional sense. Instead, they are advances against your future credit card sales. The lender provides you with a lump sum of cash, which you repay as a percentage of your daily credit card receipts. The repayment period typically ranges from 6 to 18 months, and the interest rates are generally higher than those of traditional loans.

Benefits of Merchant Cash Advances

MCAs offer several advantages for small businesses, including:

- Quick and easy approval: MCAs typically have less stringent credit and eligibility requirements than traditional loans, making them easier to qualify for.

- Fast funding: Once approved, you can receive the funds within a few days.

- Flexibility: MCAs are designed to be flexible, with repayment amounts that fluctuate based on your sales volume.

- No collateral required: Unlike traditional loans, MCAs do not require collateral, making them a suitable option for businesses with limited assets.

How to Apply for a Merchant Cash Advance

If you’re considering an MCA for your business, follow these steps to apply:

- Gather your financial documents: You’ll need to provide the lender with financial statements, tax returns, and proof of credit card processing.

- Choose a lender: Compare interest rates and fees from multiple lenders to find the best deal for your business.

- Complete the application: The application process typically involves providing basic information about your business, financial history, and creditworthiness.

- Get approved: Once your application is submitted, the lender will review your information and make a decision.

- Receive the funds: If approved, you’ll receive the funds within a few days.

Factors to Consider Before Applying

Before applying for an MCA, consider the following factors:

- High interest rates: MCAs typically have higher interest rates than traditional loans.

- Impact on your credit: While MCAs are not reported to credit bureaus, they can affect your credit score if you default on the payments.

- Hidden fees: Some lenders may charge hidden fees, so be sure to read the fine print carefully before signing the contract.

Conclusion

Merchant cash advances can be a valuable financing option for small businesses in need of quick and flexible funding. However, it’s important to carefully consider the factors involved before applying. By following the steps outlined above and understanding the potential risks and benefits, you can make an informed decision about whether an MCA is the right choice for your business.

Merchant Cash Advances for Small Businesses: A Comprehensive Guide

In today’s fast-paced business world, small businesses often need quick and easy access to capital. Merchant cash advances have emerged as a popular financing option, providing businesses with a flexible way to get the funding they need.

But before you apply for a merchant cash advance, it’s crucial to understand how it works, its benefits, potential drawbacks, and how to find the best provider for your business.

How Merchant Cash Advances Work

A merchant cash advance is a type of short-term financing that allows businesses to borrow a lump sum of money based on their future credit card sales. The advance is repaid as a percentage of your daily or weekly credit card receipts until the balance is paid off.

Unlike traditional loans, merchant cash advances are not based on your credit score or collateral. Instead, lenders assess your business’s cash flow and repayment ability. This makes merchant cash advances a viable option for businesses that may not qualify for traditional financing.

Benefits of Merchant Cash Advances

Merchant cash advances offer several benefits for small businesses, including:

– **Quick and easy access to funding:** Merchant cash advances can be approved and funded within a few days, making them a great option for businesses that need cash fast.

– **No collateral required:** Unlike traditional loans, merchant cash advances do not require you to put up your assets as collateral.

– **Flexible repayment:** Repayments are based on your actual credit card sales, providing you with flexibility to adjust your payments based on your cash flow.

– **Improved cash flow:** By allowing you to access a lump sum of cash, merchant cash advances can help you improve your cash flow and cover unexpected expenses.

Drawbacks of Merchant Cash Advances

While merchant cash advances offer several benefits, there are also some potential drawbacks to consider:

– **Higher interest rates:** Merchant cash advances typically have higher interest rates compared to traditional loans.

– **Short repayment terms:** Merchant cash advances typically have shorter repayment terms than traditional loans, which can put pressure on your cash flow.

– **Repayment can be unpredictable:** Since repayments are based on your credit card sales, your repayment amount can fluctuate, making it difficult to budget effectively.

How to Find the Best Merchant Cash Advance Provider

When shopping for a merchant cash advance provider, it’s important to consider the following factors:

– **Interest rates:** Compare interest rates from different providers to ensure you’re getting the best deal.

– **Repayment terms:** Consider the repayment terms to make sure they fit your business’s cash flow.

– **Fees:** Some providers charge additional fees for processing and other services. Be sure to ask about any fees before you sign up.

– **Reputation:** Read online reviews and speak to other businesses that have used the provider to assess their reputation.

6. Alternatives to Merchant Cash Advances

If merchant cash advances aren’t right for your business, there are several alternative financing options available, including:

– **Traditional small business loans:** Traditional loans offer longer repayment terms and lower interest rates than merchant cash advances, but they can be more difficult to qualify for.

– **Lines of credit:** Lines of credit provide you with access to a revolving pool of funds that you can draw from as needed.

– **Equipment financing:** Equipment financing allows you to purchase equipment without paying the full cost upfront.

– **Invoice factoring:** Invoice factoring involves selling your unpaid invoices to a factoring company, which can provide you with immediate cash flow.

– **Crowdfunding:** Crowdfunding platforms allow you to raise capital from a large number of individual investors.

Conclusion

Merchant cash advances can be a helpful way to finance your small business, but it’s important to understand the pros and cons before you apply. By carefully considering the factors discussed in this article, you can make an informed decision about whether a merchant cash advance is right for your business.