Merchant Cash Advance Funding

Merchant cash advance funding, or MCA funding, is a lifesaver for entrepreneurs, providing a financial lifeline to businesses that need a quick cash infusion. It’s like getting a loan without the red tape and hassle of traditional bank loans. Instead of borrowing a fixed amount, you receive a lump sum in exchange for a percentage of your future sales. It’s a flexible, short-term solution that can help you cover unexpected expenses, expand your operations, or seize new opportunities.

How Does Merchant Cash Advance Funding Work?

Getting an MCA is a relatively straightforward process. You typically apply online, providing information about your business, financial history, and sales projections. If approved, you’ll receive a lump sum of cash, usually within a few days. Repayment is tied to your business’s sales, with a fixed percentage of each transaction going towards paying off the advance. This makes it a flexible option, as you only repay when your business is generating revenue.

The Pros and Cons of Merchant Cash Advance Funding

As with any financing option, there are pros and cons to consider with merchant cash advances. On the plus side, MCAs are relatively easy to qualify for, with less stringent requirements than traditional loans. They’re also quick and easy to obtain, providing fast access to cash when you need it most. Additionally, repayment is tied to your sales, so you only pay when your business is bringing in revenue.

On the downside, merchant cash advances can be expensive, with higher interest rates and fees than traditional loans. The repayment terms can also be short, typically ranging from six to eighteen months. This can put a strain on your cash flow, especially if your sales are slow or inconsistent. It’s important to carefully consider the costs and potential impact on your business before taking out an MCA.

Is Merchant Cash Advance Funding Right for Your Business?

Merchant cash advance funding can be a valuable tool for businesses that need short-term financing to cover unexpected expenses, expand their operations, or seize new opportunities. However, it’s important to carefully consider the costs and potential impact on your business before taking out an MCA. If you’re confident that your business can generate sufficient sales to repay the advance, then an MCA can be a viable option to help you achieve your financial goals.

Tips for Getting the Best Merchant Cash Advance Funding Deal

If you’re considering merchant cash advance funding, there are a few things you can do to get the best possible deal. First, shop around and compare offers from multiple lenders. Be sure to compare interest rates, fees, and repayment terms. Second, negotiate the terms of the advance, including the amount, repayment period, and interest rate. Third, make sure you understand all the terms and conditions of the agreement before signing on the dotted line.

Merchant Cash Advance Funding

Merchant cash advances can be a quick and easy way for businesses to get the funding they need to cover expenses, invest in growth, or manage cash flow. They’re a type of short-term loan that’s repaid as a percentage of your future sales. This can make them a more flexible option than traditional loans, which require you to make fixed monthly payments.

How Merchant Cash Advance Funding Works

Merchant cash advances are typically repaid as a percentage of your daily credit card sales. The factor rate, which is the percentage of your sales that go towards repaying the advance, is usually between 1.1 and 1.5. So, for example, if you receive a $10,000 merchant cash advance with a factor rate of 1.2, you would repay $12,000 over the term of the loan. The term of a merchant cash advance is typically between 6 and 12 months.

Benefits of Merchant Cash Advance Funding

There are a number of benefits to using merchant cash advances, including:

- Quick and easy to get. Merchant cash advances can be approved in as little as 24 hours, and you can receive the funds in your bank account within a few days.

- Flexible repayment terms. Merchant cash advances are repaid as a percentage of your sales, so you don’t have to worry about making fixed monthly payments. This can make them a more flexible option than traditional loans, which can be difficult to repay if your sales fluctuate.

- No collateral required. Merchant cash advances are unsecured loans, meaning you don’t have to put up any collateral to get one. This can make them a good option for businesses that don’t have any assets to pledge.

- Can be used for any business purpose. Merchant cash advances can be used for any business purpose, such as covering expenses, investing in growth, or managing cash flow.

Eligibility for Merchant Cash Advance Funding

To be eligible for a merchant cash advance, you must:

- Have a business that has been in operation for at least 6 months

- Have a strong sales history

- Have a good credit score

- Be able to provide collateral

How to Apply for Merchant Cash Advance Funding

To apply for a merchant cash advance, you will need to:

- Complete an application

- Provide financial statements

- Submit a business plan

- Provide collateral

Once you have submitted your application, it will be reviewed by a lender. If you are approved, you will receive a loan offer. You can then choose to accept or reject the offer.

Alternatives to Merchant Cash Advance Funding

If you’re not eligible for a merchant cash advance, or if you’re not sure if it’s the right option for your business, there are a number of other financing options available. These include:

- Traditional loans. Traditional loans are repaid in fixed monthly payments. They can be more difficult to get than merchant cash advances, but they typically have lower interest rates.

- Lines of credit. Lines of credit are similar to credit cards. You can borrow money up to a certain limit, and you only repay the interest on the amount you borrow.

- Invoice factoring. Invoice factoring is a type of financing that allows you to sell your unpaid invoices to a factoring company. The factoring company will advance you a percentage of the invoice amount, and you will repay the advance when the invoice is paid.

What on Earth Is Merchant Cash Advance Funding?

Picture this: You’re the proud owner of a thriving business, but cash flow is a bit like a roller coaster—sometimes up, sometimes down, and always unpredictable. That’s where merchant cash advance funding comes in, like a financial superhero swooping in to save the day. It’s a short-term loan secured against your future credit card sales, giving you a quick cash infusion to keep the lights on and the wheels turning.

How to Qualify for Merchant Cash Advance Funding

Now, let’s get down to the nitty-gritty. To qualify for merchant cash advance funding, your business needs to meet a few basic criteria:

-

Be in business for at least six months: This shows lenders that you’re a stable entity with a track record.

-

Have a minimum monthly revenue of $10,000: This demonstrates that you can generate enough income to repay the loan.

-

Accept credit cards: Since the loan is repaid through a percentage of your credit card sales, you’ll need to have a solid credit card processing system in place.

-

Have a good credit score: While not always required, a good credit score can increase your chances of approval and get you better terms.

Terms and Conditions: The Fine Print

Merchant cash advance funding comes with its own set of terms and conditions. Here are a few key points to keep in mind:

-

Repayment: You’ll typically repay the loan as a percentage of your daily credit card sales. This means your repayments will fluctuate with your sales volume.

-

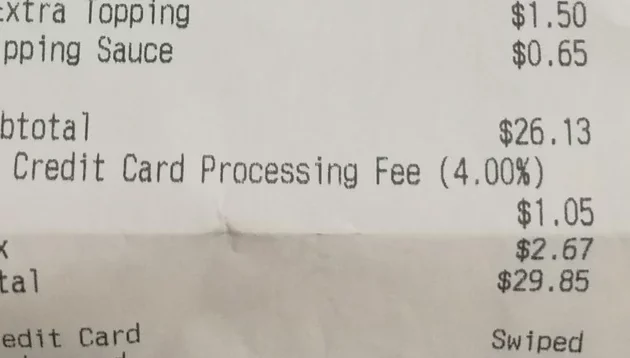

Fees: There are usually upfront fees and ongoing fees associated with merchant cash advance funding. Make sure you understand these costs before signing on the dotted line.

-

Interest rates: Merchant cash advance funding typically has higher interest rates than traditional loans. However, the rates are often fixed, so you won’t have to worry about them increasing over time.

-

Term length: Merchant cash advance funding terms typically range from 6 to 18 months. This gives you plenty of time to repay the loan without putting a strain on your cash flow.

The Pros and Cons: Weighing Your Options

Like any financial decision, there are pros and cons to consider with merchant cash advance funding:

Pros:

-

Quick and easy to obtain: Merchant cash advance funding is a relatively quick and easy way to get funding, compared to traditional loans.

-

No collateral required: Unlike traditional loans, merchant cash advance funding doesn’t require you to put up any collateral.

-

Flexible repayment: The repayment schedule is based on your sales volume, which gives you some flexibility in managing your cash flow.

Cons:

-

Higher interest rates: Merchant cash advance funding typically has higher interest rates than traditional loans.

-

Fees: There are often upfront fees and ongoing fees associated with merchant cash advance funding.

-

Not a long-term solution: Merchant cash advance funding is a short-term solution and should not be used to finance long-term business expenses.

Making the Right Choice for Your Business

Whether merchant cash advance funding is right for your business depends on your specific circumstances. If you need quick and easy access to funding, and you can afford the higher interest rates, it could be a viable option. However, if you’re looking for a long-term solution or have a low credit score, you may want to explore other financing options.

What Is Merchant Cash Advance Funding?

A merchant cash advance is a lump sum of money that a business can borrow from a lender. The loan is repaid as a percentage of the business’s daily sales. Merchant cash advances are typically used to cover short-term expenses, such as payroll or inventory. They can also be used to fund expansion or marketing campaigns. Unlike traditional loans, merchant cash advances do not require collateral. However, they do come with higher interest rates than traditional loans.

If you’re considering a merchant cash advance, it’s important to compare the terms of different lenders. You should also make sure that you can afford the repayments. Merchant cash advances can be a helpful way to get the money you need to grow your business. However, it’s important to understand the terms of the loan before you sign on the dotted line.

How Merchant Cash Advance Funding Works

Merchant cash advances are typically repaid through a fixed percentage of the business’s daily sales. The percentage is usually between 10% and 20%. The lender will typically collect the repayment directly from the business’s bank account. The repayment period is usually between 6 and 12 months, although some lenders may offer longer or shorter terms.

Merchant cash advances are a relatively expensive form of financing. The interest rates are typically higher than traditional loans. However, merchant cash advances can be a good option for businesses that need money quickly and don’t have the time or collateral to get a traditional loan.

Repayment of Merchant Cash Advance Funding

Merchant cash advances are typically repaid through a fixed percentage of the business’s daily sales. The percentage is usually between 10% and 20%. The lender will typically collect the repayment directly from the business’s bank account. The repayment period is usually between 6 and 12 months, although some lenders may offer longer or shorter terms.

Merchant cash advances can be a helpful way to get the money you need to grow your business. However, it’s important to understand the terms of the loan before you sign on the dotted line.

Benefits of Merchant Cash Advance Funding

Merchant cash advances offer a number of benefits for businesses. These benefits include:

- Quick and easy to get: Merchant cash advances are typically approved within a few days. This makes them a good option for businesses that need money quickly.

- No collateral required: Merchant cash advances do not require collateral, which makes them a good option for businesses that don’t have any assets to pledge.

- Flexible repayment terms: Merchant cash advances offer flexible repayment terms, which can be helpful for businesses that have fluctuating cash flow.

- Can be used for any purpose: Merchant cash advances can be used for any business purpose, such as payroll, inventory, or marketing.

Risks of Merchant Cash Advance Funding

Merchant cash advances also come with some risks. These risks include:

- High interest rates: Merchant cash advances typically have higher interest rates than traditional loans. This can make them a more expensive form of financing.

- Short repayment terms: Merchant cash advances typically have shorter repayment terms than traditional loans. This can make it difficult for businesses to repay the loan on time.

- Can damage your credit score: If you default on a merchant cash advance, it can damage your credit score. This can make it difficult to get other types of financing in the future.

Is Merchant Cash Advance Funding Right for Your Business?

Merchant cash advances can be a helpful way to get the money you need to grow your business. However, it’s important to understand the terms of the loan before you sign on the dotted line. If you’re not sure whether merchant cash advance funding is right for your business, you should talk to a financial advisor.

Merchant Cash Advance Funding: A Lifeline for Businesses

Merchant cash advance funding has become a popular financing option for businesses in need of quick access to capital. However, it’s important to understand that merchant cash advances come with their own set of risks and can be expensive. If you’re considering a merchant cash advance, it’s crucial to weigh your options carefully and explore other alternatives that may be better suited for your business.

What is Merchant Cash Advance Funding?

Merchant cash advance funding, also known as MCA funding, is a type of short-term financing that allows businesses to borrow against their future sales. Unlike traditional bank loans, which are based on the borrower’s creditworthiness, MCA funding is based on the business’s sales volume. This makes MCA funding an attractive option for businesses that have poor credit or are unable to qualify for a traditional bank loan.

How Does Merchant Cash Advance Funding Work?

With merchant cash advance funding, the lender advances the business a sum of money that is typically repaid as a percentage of the business’s daily sales. The repayment period is usually short, ranging from a few months to a year. The lender typically charges a factor rate on the amount advanced, which is essentially a fee for the loan.

Pros of Merchant Cash Advance Funding

- Quick and easy to obtain: MCA funding can be approved and funded quickly, making it a good option for businesses that need access to capital fast.

- No collateral required: MCA funding does not require the business to put up any assets as collateral, which can be a major advantage for businesses with limited assets.

- Flexible repayment terms: The repayment period for MCA funding is typically tailored to the business’s cash flow, making it easier to manage repayments.

Cons of Merchant Cash Advance Funding

- High cost: MCA funding can be expensive compared to other financing options. The factor rate charged by the lender can add up to a significant amount over the life of the loan.

- Short repayment period: The repayment period for MCA funding is typically short, which can put a strain on the business’s cash flow.

- Can be risky: MCA funding is a form of unsecured debt, which means that the lender can pursue personal assets if the business defaults on the loan.

Alternatives to Merchant Cash Advance Funding

If you’re considering merchant cash advance funding, it’s important to explore other financing options that may be better suited for your business. Here are a few alternatives to consider:

1. Traditional Bank Loans

Traditional bank loans are a more conventional form of financing that requires the business to go through a rigorous application and underwriting process. Bank loans typically have longer repayment terms and lower interest rates than MCA funding, but they can also be more difficult to qualify for.

2. Lines of Credit

Lines of credit provide businesses with a flexible source of funding that can be drawn upon as needed. Lines of credit typically have lower interest rates than MCA funding, but they can also require the business to provide collateral.

3. Equity Financing

Equity financing involves selling a portion of the business to investors in exchange for cash. Equity financing can provide businesses with a larger amount of capital than MCA funding, but it also gives investors a stake in the business.

4. Invoice Factoring

Invoice factoring is a type of financing where the business sells its outstanding invoices to a factoring company at a discount. Invoice factoring can provide businesses with quick access to cash, but it can also be expensive and may require the business to give up control of its accounts receivable.

5. Crowdfunding

Crowdfunding involves raising money from a large number of individuals, typically through online platforms. Crowdfunding can be a good option for businesses that are looking to raise small amounts of capital, but it can also be time-consuming and may not be successful.

Which Financing Option is Right for Your Business?

The best financing option for your business will depend on your individual needs and circumstances. It’s important to carefully consider the pros and cons of each financing option before making a decision. If you’re not sure which option is right for you, it’s a good idea to consult with a financial advisor.