Liberty Bank Investment Services: A Comprehensive Guide

When it comes to managing your hard-earned money, you need a partner you can trust. Enter Liberty Bank Investment Services, a trusted financial institution that offers a comprehensive suite of investment products and services tailored to meet your unique needs.

But don’t just take our word for it. Liberty Bank’s reputation speaks for itself. With over 150 years of experience in the financial industry, they have consistently earned accolades for their exceptional customer service, innovative investment solutions, and unwavering commitment to helping clients achieve their financial goals.

Investment Products and Services

Liberty Bank’s investment offerings are as diverse as their clientele. Whether you’re a seasoned investor or just starting out on your financial journey, you’ll find a range of products designed to suit your risk tolerance, investment goals, and time horizon.

Mutual Funds

Mutual funds are a popular investment vehicle that provides investors with instant diversification. With Liberty Bank’s mutual fund offerings, you can access a variety of investment strategies, including growth, income, and sector-specific funds. Their experienced investment team will help you select the funds that align with your investment objectives, ensuring your portfolio is working hard for you.

Imagine investing in a team of professional money managers who constantly monitor the market and make adjustments to your investments based on changing conditions. That’s what you get with Liberty Bank’s mutual fund services. It’s like having a financial GPS guiding you along the path to financial success.

Exchange-Traded Funds (ETFs)

ETFs are another popular investment choice, offering the convenience of stock ownership while providing the diversification benefits of a mutual fund. Liberty Bank’s ETF platform provides access to a wide range of index funds, sector ETFs, and bond ETFs, giving you the flexibility to tailor your investments to your specific goals.

Think of ETFs as investment baskets that track the performance of a specific market segment or industry. With Liberty Bank’s ETF offerings, you can spread your bets across entire sectors, giving you a diversified portfolio that’s less vulnerable to individual company risks.

Individual Stocks and Bonds

For investors who prefer to take a more hands-on approach, Liberty Bank offers access to individual stocks and bonds. Their knowledgeable brokers can provide guidance and research support, helping you identify investment opportunities that align with your unique risk tolerance and return expectations.

Investing in individual stocks and bonds is like building your own financial masterpiece. You get to choose the pieces that you believe will complement each other and paint a picture of your financial future. Liberty Bank’s brokers are like the art curators, guiding you through the gallery of investment options and helping you create a portfolio that’s both beautiful and profitable.

Retirement Planning

Retirement may seem like a distant dream, but it’s never too early to start planning. Liberty Bank offers a range of retirement planning services, including IRAs, 401(k)s, and annuities. Their financial advisors can help you develop a customized retirement savings strategy that aligns with your income, lifestyle goals, and risk tolerance.

Retirement planning is like planting a tree for the future. The sooner you start, the more time your investments have to grow and compound, providing you with a solid financial foundation for your golden years.

Liberty Bank Investment Services: A Comprehensive Guide to Tailored Financial Solutions

Liberty Bank, a cornerstone of the financial landscape for generations, stands as a trusted beacon guiding clients toward their financial dreams. Their comprehensive suite of investment services offers a sanctuary for individuals seeking personalized financial growth strategies. Among their unparalleled offerings, Liberty Bank’s customized investment portfolios reign supreme, meticulously crafted to align with each client’s unique financial aspirations and risk tolerance.

Customized Investment Portfolios: A Journey of Personalized Financial Growth

Liberty Bank’s customized investment portfolios are not mere financial products; they are bespoke masterpieces, meticulously tailored to each client’s financial blueprint. These portfolios are living, breathing entities, evolving alongside the client’s changing life circumstances and evolving financial goals.

At the heart of this tailored approach lies a team of dedicated financial advisors who serve as trusted financial navigators. These advisors embark on a profound journey with each client, delving deep into their financial aspirations and understanding their comfort levels with risk. Armed with this intimate knowledge, they translate these desires into a financial roadmap, meticulously assembling a portfolio that resonates with the client’s unique financial symphony.

Liberty Bank’s investment portfolio architects wield a vast array of investment instruments, each carefully selected to align with the client’s financial goals. From the steady pulse of bonds to the dynamic rhythm of stocks, they blend asset classes like a maestro orchestrating a harmonious symphony. The resulting portfolios are not static entities, but rather fluid masterpieces, continuously fine-tuned to reflect the ever-changing market landscape and the client’s evolving needs.

Understanding Risk Tolerance: A Delicate Balance in Investment Strategies

Risk tolerance, a crucial cornerstone of investment strategies, is not a fixed entity; it’s a dynamic dance between an individual’s financial fortitude and their emotional resilience to market fluctuations. Understanding and acknowledging one’s risk tolerance is paramount for crafting a customized investment portfolio that aligns with their financial dreamscape.

Liberty Bank’s financial advisors are skilled in deciphering the language of risk tolerance. They engage in thoughtful conversations, exploring the client’s financial history, investment experience, and emotional responses to market volatility. Through this intimate understanding, they gauge the client’s comfort level with the inherent uncertainty that accompanies investing.

Risk tolerance is a spectrum, and Liberty Bank’s advisors recognize that each client occupies a unique point along this continuum. Some clients embrace the exhilaration of higher-risk investments, while others seek the tranquility of lower-risk options. The advisors work hand-in-hand with clients, tailoring portfolios that strike a harmonious balance between the potential for growth and the preservation of capital.

Investment Goals: A Tapestry of Dreams and Aspirations

Investment goals, like the threads of a vibrant tapestry, weave together a vision of the financial future. Liberty Bank’s advisors engage in insightful conversations with clients, delving into their dreams, aspirations, and long-term financial objectives. These goals can span the spectrum, from the purchase of a dream home to securing a comfortable retirement or funding a child’s education.

Once these goals are clearly defined, the advisors embark on a meticulous process of aligning the investment portfolio with the client’s aspirations. They consider the time horizon, the desired level of return, and the client’s risk tolerance. This collaborative approach ensures that the portfolio is not merely a collection of financial instruments, but a reflection of the client’s deepest financial desires.

Conclusion: Empowering Clients on Their Financial Odyssey

Liberty Bank’s customized investment portfolios are not simply financial products; they are transformative tools that empower clients on their financial odyssey. Through a deep understanding of each client’s risk tolerance and investment goals, Liberty Bank’s financial advisors craft portfolios that resonate with their unique financial aspirations.

These portfolios are not static entities, but rather living, breathing entities, continuously adapting to the ever-changing market landscape and the client’s evolving needs. Liberty Bank’s commitment to personalized financial growth ensures that clients are not simply satisfied; they are empowered to pursue their financial dreams with confidence and conviction.

Liberty Bank Investment Services: Unveiling a World of Financial Solutions

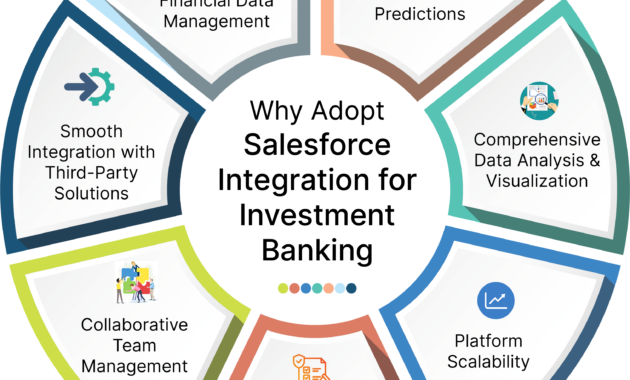

In the ever-evolving world of personal finance, finding a trusted partner to navigate the complexities of wealth management is paramount. Enter Liberty Bank, a financial institution renowned for its robust investment services tailored to meet the diverse needs of individuals and families. Their comprehensive offerings, including personalized financial planning, investment advisory, and trust and estate administration, empower clients to achieve their financial aspirations with confidence and expertise.

Wealth Management

Liberty Bank’s wealth management services are designed to provide a holistic approach to financial planning. Their experienced team of advisors works closely with clients to understand their unique circumstances, financial goals, and risk tolerance. Together, they craft customized financial plans that serve as roadmaps for long-term investment success.

At the heart of Liberty Bank’s wealth management philosophy lies the principle of diversification. They believe that spreading investments across various asset classes, such as stocks, bonds, real estate, and alternative investments, helps reduce risk and enhance returns. Their advisors leverage their expertise to construct well-diversified portfolios that align with each client’s individual goals and circumstances.

Investment Advisory

Liberty Bank’s investment advisory services provide clients with access to a team of seasoned professionals who possess deep knowledge of the financial markets. These advisors offer personalized investment recommendations based on thorough research and analysis. They stay abreast of the latest market trends and economic developments, enabling them to make informed decisions that maximize investment returns while minimizing risk.

One of the key advantages of Liberty Bank’s investment advisory services is their focus on active management. Their advisors continuously monitor portfolios and make adjustments as needed to align with changing market conditions and client circumstances. This proactive approach enhances the potential for long-term investment success.

Trust and Estate Administration

For individuals and families seeking to preserve and distribute their wealth effectively, Liberty Bank’s trust and estate administration services offer invaluable assistance. Their experienced trust officers provide comprehensive guidance on establishing and managing trusts, wills, and estate plans. They work closely with clients to ensure that their wishes are clearly documented and that their assets are managed and distributed according to their intentions.

Liberty Bank’s trust and estate administration services extend beyond financial management. They also provide personal and administrative support to clients and their families, assisting with tasks such as estate tax preparation, probate administration, and beneficiary communication. Their compassionate and professional approach ensures that the transition of wealth occurs smoothly and in accordance with the client’s wishes.

Liberty Bank Investment Services: A Comprehensive Guide

Liberty Bank Investment Services is a premier provider of financial solutions, offering a comprehensive range of wealth management and investment services to its clients. With a team of experienced professionals and a commitment to personalized advice, Liberty Bank has established itself as a trusted partner for individuals seeking financial guidance.

Whether you’re a seasoned investor or just starting your financial journey, Liberty Bank’s comprehensive portfolio of investment services can cater to your unique needs. From tailored investment strategies to comprehensive financial planning, the bank’s advisors are dedicated to helping you achieve your financial goals.

Investment Research and Analysis

At the heart of Liberty Bank’s investment services lies a robust research and analysis framework. The bank’s team of highly skilled investment professionals is committed to providing clients with informed investment recommendations based on in-depth research and market insights.

Their comprehensive analysis encompasses a wide range of factors, including market trends, industry dynamics, economic indicators, and company fundamentals. Through rigorous due diligence and meticulous evaluation, Liberty Bank’s analysts uncover potential investment opportunities that align with their clients’ risk tolerance and financial objectives.

By leveraging cutting-edge research tools and proprietary data, the team at Liberty Bank provides clients with timely and actionable insights into the financial markets. They regularly publish research reports, host webinars, and conduct one-on-one consultations to empower their clients with the knowledge and confidence necessary to make informed investment decisions.

Personalized Portfolio Management

Liberty Bank’s personalized portfolio management services are designed to align with each client’s unique circumstances, risk appetite, and financial goals. The bank’s advisors take a holistic approach to wealth management, considering all aspects of their clients’ financial lives.

After thoroughly understanding their clients’ investment objectives, Liberty Bank’s advisors develop customized portfolios tailored to their individual needs. They carefully select investments from a diverse range of asset classes, including stocks, bonds, real estate, and alternative investments, to create portfolios that are both well-diversified and aligned with their clients’ risk tolerance.

The bank’s advisors are constantly monitoring market conditions and adjusting portfolios as needed to ensure that their clients’ investments remain on track towards their financial goals. They provide regular performance updates and conduct ongoing reviews to ensure that each portfolio remains aligned with the client’s objectives.

Comprehensive Financial Planning

Beyond investment management, Liberty Bank offers a comprehensive suite of financial planning services to help clients achieve their financial aspirations. Their team of experienced financial planners work closely with clients to assess their financial situation, identify their goals, and develop personalized strategies to help them achieve those goals.

Liberty Bank’s financial planning services encompass a wide range of topics, including retirement planning, estate planning, tax planning, and insurance. Their advisors provide guidance on managing debt, saving for education expenses, and planning for long-term care needs.

By taking a holistic approach to financial planning, Liberty Bank’s advisors help clients make informed decisions about their financial future. They provide ongoing support and guidance, ensuring that their clients remain on track towards their long-term financial goals.

Retirement Planning

Liberty Bank’s retirement planning services are designed to help clients navigate the complexities of saving for and managing their retirement income. Their team of financial professionals works closely with clients to assess their individual needs and develop personalized retirement plans.

Liberty Bank’s retirement planning services encompass a wide range of topics, including retirement savings strategies, investment management, tax planning, and estate planning. Their advisors provide personalized guidance on choosing the right retirement accounts, investing wisely, and managing retirement income efficiently to ensure a comfortable and secure retirement.

The bank’s financial advisors take a comprehensive approach to retirement planning, considering all aspects of their clients’ financial situations. They help clients manage their retirement savings, reduce their tax burden, and plan for unexpected events to ensure that their clients are well-prepared for retirement.

Trust and Estate Planning

Liberty Bank’s trust and estate planning services are designed to protect and manage their clients’ assets throughout their life and beyond. The bank’s team of experienced attorneys and financial advisors works closely with clients to create comprehensive estate plans that reflect their wishes and protect their legacy.

Liberty Bank’s trust and estate planning services encompass a wide range of topics, including trust administration, estate planning, probate, and legacy planning. Their advisors provide personalized guidance on establishing trusts, drafting wills, and structuring their estates to minimize taxes and ensure the smooth transfer of assets after their death.

By taking a proactive approach to estate planning, Liberty Bank’s advisors help clients protect their assets, provide for their loved ones, and ensure that their wishes are carried out in accordance with their intentions.

Conclusion: Partnering with Liberty Bank for Financial Success

Liberty Bank Investment Services is the ideal partner for individuals seeking a comprehensive and personalized approach to financial planning and investment management. With a team of experienced professionals dedicated to delivering customized solutions, Liberty Bank empowers their clients with the knowledge and guidance necessary to achieve their financial goals.

Whether you’re looking to invest for your future, plan for your retirement, or preserve your wealth, Liberty Bank offers a full spectrum of financial services tailored to your unique needs. Their commitment to personalized advice and thorough research ensures that their clients are well-positioned to navigate the complexities of the financial world and achieve lasting financial success.

Liberty Bank Investment Services: A Comprehensive Guide to Managing Your Wealth

In today’s fast-paced financial landscape, finding a reliable and comprehensive investment solution is of paramount importance. Liberty Bank’s Investment Services emerge as a formidable contender, catering to the diverse financial needs of discerning investors. Backed by years of experience and a deep understanding of the markets, Liberty Bank offers a full suite of services tailored to help you achieve your unique financial goals. From personalized investment advice to online banking convenience, Liberty Bank empowers you to take control of your financial future.

Online Banking and Mobile App

In an era defined by technological advancements, Liberty Bank seamlessly integrates online banking and mobile app capabilities into its investment services platform. Clients can effortlessly access their investment accounts, view performance data, and make transactions from the comfort of their own homes or on the go. The secure online banking platform and user-friendly mobile app provide real-time insights into your portfolio, empowering you to make informed decisions and stay abreast of market fluctuations.

Personalized Investment Advice

Liberty Bank’s team of experienced financial advisors is dedicated to providing personalized investment advice tailored to your specific financial objectives. Whether you’re a seasoned investor with a comprehensive portfolio or just starting your investment journey, our advisors will work closely with you to understand your risk tolerance, investment goals, and time horizon. This collaborative approach ensures that your investment strategy aligns seamlessly with your financial aspirations.

Diversified Investment Options

With Liberty Bank’s comprehensive range of investment options, you can diversify your portfolio and spread your risk across a variety of asset classes. From traditional stocks and bonds to alternative investments such as real estate and private equity, our advisors will guide you in selecting investments that complement your financial goals and risk appetite. This prudent diversification strategy mitigates volatility and enhances the potential for long-term wealth accumulation.

Retirement Planning and Estate Planning

Liberty Bank’s investment services extend beyond wealth management to encompass holistic financial planning. Our advisors specialize in retirement planning, helping you navigate the complexities of saving for the future and ensuring a comfortable retirement lifestyle. Additionally, we offer estate planning services, guiding you in preserving and distributing your assets according to your wishes, ensuring a legacy that reflects your values and provides for your loved ones.

Education and Resources

Liberty Bank recognizes that financial literacy is essential for informed investment decisions. We offer a wealth of educational resources and insights to help you stay abreast of market trends, investment strategies, and financial planning best practices. Our commitment to client education empowers you to make confident financial choices and navigate the ever-changing investment landscape with knowledge and confidence.

Unwavering Commitment to Excellence

At Liberty Bank, our unwavering commitment to excellence is reflected in every aspect of our investment services. We adhere to the highest ethical standards, ensuring that our advice and recommendations are always in the best interests of our clients. Our team of dedicated professionals is passionate about providing exceptional service, going the extra mile to exceed your expectations and help you achieve your financial aspirations.

Conclusion

Liberty Bank’s Investment Services stand as a testament to our deep-rooted commitment to helping individuals and families achieve their financial dreams. By combining personalized advice, diversified investment options, and cutting-edge technology, we empower you to take control of your financial future and build a legacy that will endure for generations to come. Whether you’re starting your investment journey or seeking to refine your existing portfolio, Liberty Bank’s Investment Services are tailored to meet your unique needs and aspirations.

Liberty Bank Investment Services: Empowering Investors with Knowledge and Expertise

Liberty Bank Investment Services is a trusted financial partner for individuals and businesses seeking guidance and support in navigating the complexities of the investment landscape. With a team of experienced professionals and a comprehensive suite of services, Liberty Bank empowers investors to make informed decisions and achieve their financial goals.

Educational Resources

Liberty Bank recognizes the importance of financial literacy and offers a wide array of educational resources to help clients stay informed about investment strategies and market trends. These resources include:

-

Webinars and seminars: Liberty Bank hosts regular webinars and seminars led by experts in the field. These events provide insights into current market conditions, investment strategies, and economic forecasts.

-

Online learning center: The Liberty Bank online learning center offers a comprehensive library of articles, videos, and interactive courses covering a wide range of investment topics.

-

One-on-one consultations: Liberty Bank financial advisors offer personalized consultations to help clients understand their investment options and develop tailored strategies based on their individual needs and goals.

Investment Strategies

Liberty Bank offers a diverse range of investment strategies to meet the unique needs of its clients. These strategies include:

-

Asset allocation: Liberty Bank helps clients allocate their investments across different asset classes, such as stocks, bonds, and real estate, to optimize returns and mitigate risk.

-

Portfolio management: Liberty Bank provides ongoing portfolio management services to monitor and adjust investments based on market conditions and client objectives.

-

Tax-advantaged investing: Liberty Bank offers tax-advantaged investment options, such as IRAs and 401(k) plans, to help clients minimize taxes and maximize the growth of their investments.

Investment Products

Liberty Bank offers a comprehensive range of investment products, including:

-

Mutual funds: Liberty Bank provides access to a wide range of mutual funds from leading fund companies, offering diversified exposure to different markets and investment styles.

-

Exchange-traded funds (ETFs): Liberty Bank offers a variety of ETFs that track various market sectors, indices, and investment themes, providing investors with convenient and cost-effective access to these markets.

-

Individual stocks and bonds: Liberty Bank offers the ability to invest in individual stocks and bonds, allowing investors to customize their portfolios and gain exposure to specific companies or industries.

Financial Planning

Liberty Bank provides comprehensive financial planning services to help clients achieve their financial goals. These services include:

-

Retirement planning: Liberty Bank helps clients plan for a secure and comfortable retirement by developing personalized retirement savings and investment strategies.

-

Estate planning: Liberty Bank assists clients in creating estate plans to preserve and distribute their wealth according to their wishes, minimizing tax liabilities and ensuring the smooth transfer of assets to their heirs.

-

Education planning: Liberty Bank offers education planning services to help families save for their children’s college education and other educational expenses.

Why Choose Liberty Bank?

Liberty Bank stands out as a trusted investment partner for several key reasons:

-

Personalized service: Liberty Bank financial advisors take the time to understand each client’s unique needs and goals, providing tailored investment advice and guidance.

-

Experienced team: Liberty Bank’s team of experienced professionals has decades of combined experience in the financial industry, ensuring clients receive sound and up-to-date investment advice.

-

Comprehensive services: Liberty Bank offers a comprehensive suite of investment services, catering to a wide range of investor needs, from beginners to seasoned investors.

-

Commitment to education: Liberty Bank believes in empowering investors with knowledge and resources, offering a wide range of educational opportunities to help clients make informed investment decisions.

-

Financial strength and stability: Liberty Bank is a strong and stable financial institution with a long history of serving the needs of its clients.

Conclusion

Liberty Bank Investment Services provides a comprehensive and tailored approach to investment management, empowering individuals and businesses to make informed decisions and achieve their financial goals. With a team of experienced professionals, a wide range of investment products and services, and a commitment to financial education, Liberty Bank is the ideal partner for investors seeking guidance and support in navigating the complex world of investing.